Founded in 2012, AirDNA is a bootstrapped start-up that provides short term rental insights on AirBNB and VRBO properties.

The company is growing almost 100% per year doing $8.4 million in annual revenue across a customer base of 6,500.

6,000 customers are short term rental property owners and 500 Enterprise Customers.

Nathan sat down with founder and CEO Scott Shatford to better understand the history and metrics behind his success.

Specifically, will their 20% monthly churn kill them? (Check out this post on churn analysis)

What is AirDNA average revenue per customer?

Most of the 6,000 smaller customers are paying $60-$70 per month generating $420,000 in monthly recurring revenue.

In addition, Shatford shared that 500 Enterprise customers drive in an additional $300,000 per month in revenue.

Together, the company is doing $8.4 million in annual revenue (+$3.5m yoy) representing 87% YoY growth from our last interview in September of 2018.

2012: 0

2018: $4.9 million in annual revenues

2019: $8.4 million in annual revenues

Why do so many customers churn?

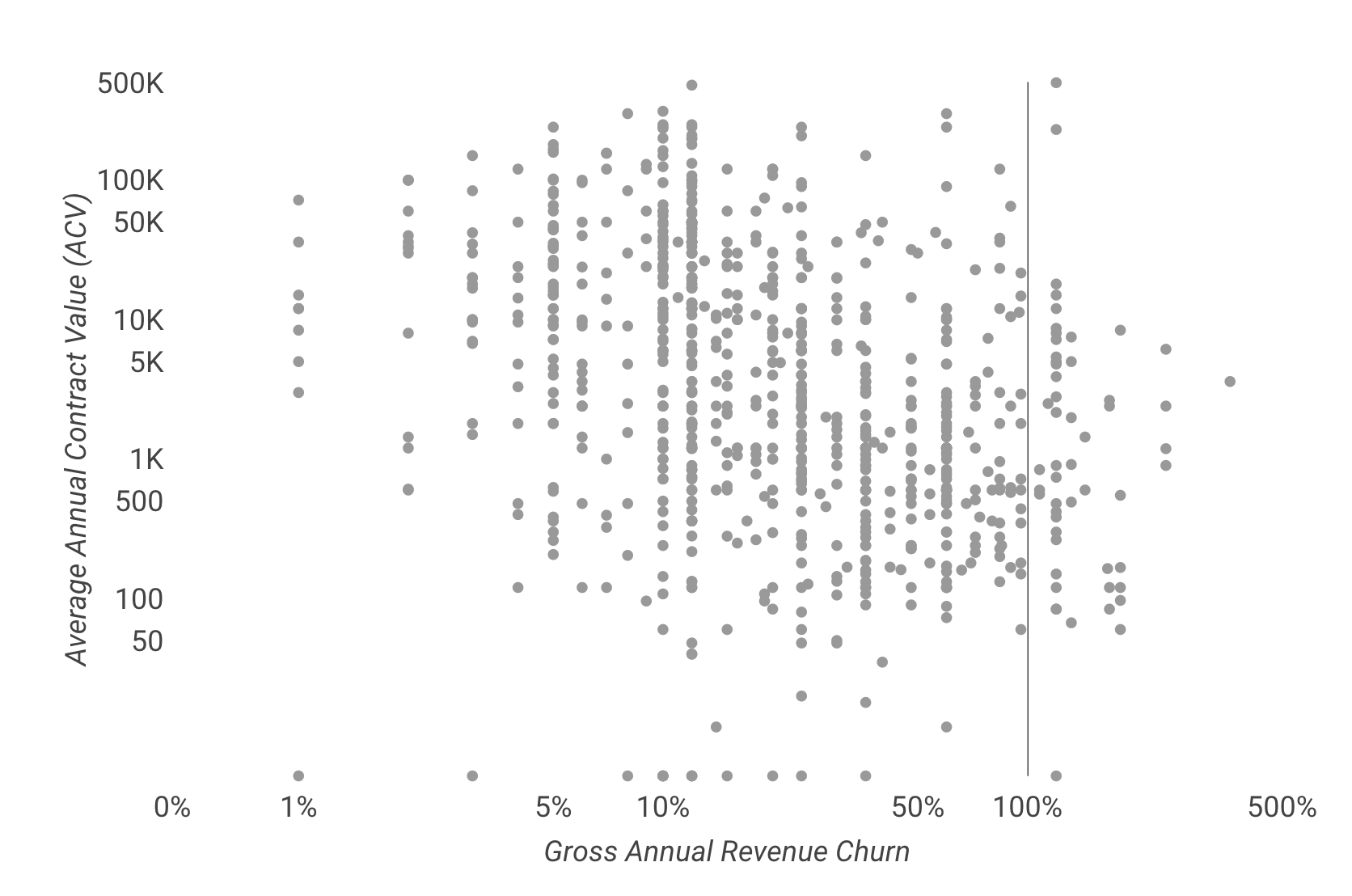

AirDNA is losing 20% of its monthly recurring revenue each month. Shatford shared that most customers view short term rental data and insights as a one time decision. This short term need leads to the high churn rate in the first month.

Churn is 40% in the first 30 days. Between days 31-60 churn reduces to 20%. After 90 days, the churn is 5%.

At the $60/mo price point, AIRDNA see’s higher churn than other similarly priced SaaS products:

AirDNA’s 500 Enterprise customers take a more holistic view on how to use the AirDNA data and insights. They are going beyond occupancy and charges, by adding additional data elements like set-up, price and performance.

How can AirDNA get more Enterprise customers?

The Number One Way AirDNA Gets New Customers?

Organic search is the primary customer acquisition channel, resulting in an average customer acquisition cost (CAC) of only $3.

With 80,000 unique monthly website visitors and 100 daily inbound inquiries, Scott had no concern replacing the 1,200 customers that churn every month.

To continue growing at 87% YoY, they will need to replace 1,200 monthly churning customers and add 500 new customer monthly. With a $3 CAC, this would not be that hard.

How can AirDNA increase the number of Enterprise customers and how would that impact churn and gross margin?

How Many Engineers and Sales People Are On the AirDNA Team?

The company has 12 Engineers, 7 quota carrying account executives and 5 outbound lead generation resources.

Scott mentioned a key differentiation they have are the deep data scientists and a killer technical SEO resource. For example, Scott shared that Data scientists are key to developing unique data insights,such as “why vacancies occur” and “when properties are booked”.

Will They Make a Big Acquisition?

AirDNA is bootstrapping and has no plans to raise external capital. Today, they are using cashflow to re-invest in the product to maintain competitive advantage.

The three founding partners, including his father had to absorb early losses, thus current profits are being used to make up for those earlier losses.

Companies like AirBNB are positioned as “free services” that do not provide a rich set of data. As a result, most competitors do no provide the granularity of data or robust API’s that Enterprise customers require.

An acquisition to expand services to other markets and providers has not been ruled out. Currently, casual courting is the extent of the inorganic growth strategy today.

Shatford shared that with a gluttony of 50+ small competitors. As a result, if a “Fire Sale” at less than 1X revenue presented itself, he would never say never to buying one of his smaller competitors.

What’s next for AirDNA?

We project the short term rental data and insights market will experience major consolidation as large hotel chains and REIT’s become more inquisitive.

AirDNA is well positioned to be a major player. However, enhanced customer acquisition techniques, enterprise level services and increased customer retention will be critical to be the market leader.

Ultimately, I see a cash heavy REIT paying a premium for AirDNA in the next downturn because AirDNA datapoints would tell an acquisitive REIT exactly what to go buy, for how much, and where.