The burden of managing commercial construction cash flow for subcontractors is a huge pain point that makes it difficult to grow and manage a business.

That’s why, in 2018, CEO Chris Doyle founded Billd, a construction payment and finance solution that helps contractors and suppliers grow with less risk.

In a fairly untapped industry, Billd doesn’t have a lot of competition, so it’s no surprise the company grew by 400% year-over-year in 2020, despite the disruption of COVID-19.

When subcontractors need materials for a project, they can take advantage of Billd’s short, 120-day financing terms, joining 350 customers who average $350,000 of purchases each.

“We’re doing $50,000, $100,000, $500,000 worth of material purchases for a single project,” Doyle told Latka in an interview. And with three opportunities per year to use Billd’s project-based financing, customers reuse the service, which results in a 0% annual churn rate.

Billd’s business model is unique — it began as a software company that served the construction space, then Doyle built the lending side to support the user group from his subscription products with an in-house vertical underwriting process that leads to faster loan processing and payouts.

The company partners with regional and national suppliers, so Billd pays them upfront on the behalf of its customers, adding the loans to its balance sheet for the duration of the financing term. However, Doyle characterizes his company as a SaaS. “We’ve become such a core part of [our customer’s] process and their purchasing process that the fundamental DNA is the same as a SaaS.”

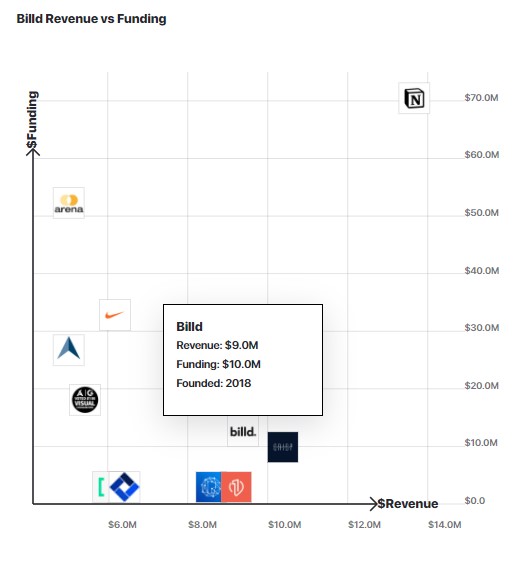

Source: GetLatka

In a few short years, Billd has grown steadily. Today, the company has 33 employees, and it processes $8 million in MRR through loan origination fees, earning the company a $100 million annual origination run rate — plus a $12 million yield in ARR.

Considering its annual run rate in 2019 was just shy of $25 million, this nearly $80 million increase in one year is significant.

To add to Billd’s revenue, Doyle says, “We have a debt facility to borrow 90% to 95% of the deal, then we basically make money on that spread.” Because of an existing relationship with another lender, the company raised $10 million in an equity/debt deal in 2018 that added $50 million to its balance sheet in combined senior and mezzanine debt.

Now, the company aims to raise $15 million in equity in the first quarter of 2021, and Doyle says he’s willing to sell 10% or more of the business to get it done.

What is Billd’s annual revenue?

In 2020, Billd generated $12 million in ARR.

What is Billd’s monthly revenue?

In 2020, Billd generated $1 million in MRR.

Who is the CEO of Billd?

Chris Doyle, age 39, is the CEO and founder of Billd.

Transcript Excerpts

Break down the barriers that prevent your customer’s success

“We do risk-based pricing, so let’s say as low as 20% annually, but that’s broken down. It’s a 120-day product, so the broader fundamental process is you need that $1,000 worth of lumber, right? So, you’re going to take the material plus labor and you’re going to install it. Now, you have a $3,000 receivable with a general contractor, with what generally has a 60-day timeline on getting paid, but you needed to buy 30 days in advance, and now you have a 90-day gap for when you needed the material versus when you get paid. So, we bridge that. You’re going to take four months’ worth of financing, and call it 20%. Four months is kind of the long end, so you’re going to get paid somewhere in this middle — call it 30 days to 120 days. Once you’re paid, you repay us.”

Learn your customer’s pain points to provide the best solution

“In construction, it’s just not that precise. There’s so much put into contingency, because you have to take a fourth trip, a fifth trip. It’s fairly manageable for our customers, especially when you’re growing and, quite frankly, you don’t have a lot of other options, because you’ve got to have a secure, reliable way to purchase your material.”

Get creative to reduce the costs of providing your service

“We have a net 10% [margin]. That’s very, very different than any kind of consumer lending and probably different than any kind of SMB lending. The way we make that work is our performance of these dramatically exceeds any other lender, because of the way we underwrite and the way we establish limits. We can give three times the limit, because we have a process that says it’s not about the person buying the lumber. It’s a little bit about the lumber, but more importantly, it’s where is the lumber going?”

Add value for your customers (and grow a loyal base!)

“There are some pretty cool success stories where we’ve saved $30,000 — a ridiculous amount of money — on what the customer [purchased. They] really had no clue, because look, they’re moving around fast. They’re driving job site to job site; they’re not going through and looking at it and marking it up and things like that. We also offer a value there, but we decided to pass [that savings] over to the customer.”

Full Transcript Nathan Latka: Hello everyone. My guest today is Chris Doyle. He’s an entrepreneur and business leader with extensive hands on and construction industry experience and a proven record of launching successful startups. He’s the founder, president and CEO of Billd, that’s B-I-L-L-D, a disruptive payment solution for the construction industry that helps contractors and suppliers grow their business with less hassle and less risk. Recognizing cashflow hurdles contractors face when purchasing materials, he launched Billd to make traditional Wall Street working capital accessible to the small business owners. Chris, you ready to take it to the top? Chris Doyle: Yep. Thanks for having me on, Nathan. Nathan Latka: What’s in your blood? Family construction business or financiers and ex Wall Street? Chris Doyle: Neither. Nathan Latka: Really? Chris Doyle: Yeah. I mean construction. I started construction, framing houses when I was 16 years old. It was a great summer job. I’d get a tan, a workout and paid cash every week. And then just like anyone else at that age, just kind of one foot in front of the other and said, “Oh, I guess I can do this.” So jumped into the broader residential construction, and then commercial, and before I knew it, I was like a construction guy. Then slowly converted finance guy. I don’t even know what I am now. Nathan Latka: So when did you launch Billd officially? What year? Chris Doyle: Just two years ago. Nathan Latka: Okay. So call it 2018. I mean, what was the first product? Was it the financing product right away? Chris Doyle: Yeah. Financing product. Yeah, yeah. You said cashflow [inaudible 00:01:26]. Commercial construction cashflow burden for subcontractors is just a ridiculous pain point and it makes it extremely difficult for subcontractors to grow and manage their business. This was very much recognized, and not a lot of folks are trying to challenge that problem and provide solutions for the subcontractor. I’d been in the space through other consumer finance products, things like that and said, “Hey, there is an appetite for this from a capital market standpoint to step in the middle of this.” Right? And then can we build a business around de-risking that by understanding construction, have a vertical underwriting process and go to market strategy to allow this to flow through and really solve this problem? When I say this, I mean, capital to flow through. Nathan Latka: In 2018, did you start off with a balance sheet business where you actually held these things while they were being paid off for 120 days? Or were you really a marketplace and you were taking a cut of the marketplace GMV. Chris Doyle: Yeah, yeah. A balance sheet business, but because it’s short-term, I don’t characterize our business’s balance sheet. Maybe it’s because we’re in capital raise mode, but I characterize it more as a SAS. That’s really what it is. Right? I mean, we’re not caring… To be a big boy in the lending space, really you’re talking about a billion or so an annual origination. You’re carrying 500, 700 million at any given time, this big portfolio and then different strategies on how to finance those longterm. For us, $500 million balance would be… We’d be a billion dollar company. So relative to other lenders, very, very low balance at any given time because we churn it three times a year. So in any kind of big, broader economic effect, we could just shut down origination. Three months later, we have zero balance. Nathan Latka: Yeah. Yeah. You said differently. You can recycle your capital three times a year. Chris Doyle: That’s right. Yeah. We’re recycling. Nathan Latka: To juice your yield. Chris Doyle: That’s right. Yeah. Nathan Latka: So let me get a sense of sort of scope for a second. There’s a marketplace, there’s capital, there’s a yield. Is that how you make revenue? It’s a spread on the yield, or is there a SaaS component of flat fixed rate, something there too? Chris Doyle: Yeah. Spread on the yield. I say SaaS because SaaS fundamentally is just a customer that latches onto a technology product, pays their annual or monthly fee, and they’re just a recurring user. Right? And they’re kind of, I wouldn’t say locked in, but they have a technology solution that’s incorporated into their process with very high stickiness. I own another business SiteCapture that is a SaaS product in construction. So I know it very well and what that churn looks like. So as a lender, we’re in this space… It’s the same thing though. Our customers use the product, then they use it again, then they use it again. There’s no like fixed, you must use this, but we’ve become such a core part of their process and their purchasing process that the fundamental DNA is the same as SAS. Again, this is a pretty rich coming from me going through the investment process. Nathan Latka: So you would say it’s usage-based. Right? It’s like Twilio. It’s like SendGrid. It’s number of emails. It’s usage based. Chris Doyle: 100%. Yeah. Nathan Latka: Interesting. Okay. And give me a general sense of size. So past 12 months, how many individual subcontractors took at least a dollar worth of, I guess, loans from you? Chris Doyle: Yeah. We’re probably about 350 right now. Nathan Latka: Okay. Smaller than I would have thought, but they probably do it many, many times over and over. Chris Doyle: Yeah, that’s right. Yeah. We’re probably doing around eight million a month right now, so- Nathan Latka: In originations? Chris Doyle: Mm-hmm (affirmative). Yeah. So it puts about a hundred million annual origination run rate. For two years is pretty, pretty remarkable. I mean, especially coming from where we started in January of this year and having to deal with COVID. But we take a slightly different approach on number of users because rather than like blanket and bring in pre-approved and approve thousands of contractors, we found that the underwriting cost of that from a conversion basis just didn’t make any sense. Wait until they have a purchase. So we’re focused on that because each customer really is probably… We don’t know because we don’t have a full lifetime cycle of data, but around 350,000 of purchases per customer, which is great. Right? And that’s from an annual standpoint. So we actually… Unfortunately only two years of data, we don’t know what that carries into year three, four and five. Nathan Latka: Yeah. So let’s just stick to the eight million in one month, just sort of break down this model. So how do you make money on this? Chris Doyle: Yeah, so we’re borrowing. We have a debt facility to borrow 90-95% of the deal, then we basically make money on that spread. Nathan Latka: And how were you able to get that first balance sheet capital to lend out with no history? Especially, it sounds like you just said you have a five or 10% participation rate, meaning you only have to put up five to 10% of your own equity. Was that always the case? Chris Doyle: Yeah. That’s right. Existing relationship with an investor from a previous company, another lender. ‘. Nathan Latka: Okay. Chris Doyle: Yeah. And they had gotten pretty comfortable in this space and comfortable in other alternative lending and construction like pace. It’s a lot easier with higher margins, and in the consumer space you’re duking it out over 30 bips. Whereas in the small business lending, especially in our space, a very vertically driven underwriting, customer acquisition, everything. And we understand the space very well. The margins are just broader than that. So there’s some room to play with from a risk perspective. Nathan Latka: Let’s just role-play for a second. I’m putting my construction hat on, my yellow vest. I’m one of your 350 subcontractors. I come in this month and I need, I’m just going to make up a simple example, I need a pallet of two by fours and it’s going to cost me a thousand dollars. I don’t have that cash right now. I use you guys to do it. Can we sort of break down the economics on a thousand? So you would loan me a thousand today at what interest rate over 120 days? Chris Doyle: Yeah, it depends. We do risk based pricing. So let’s say as low as 20% annually, but that’s broken down. I mean, it’s a 120 day product. So the broader kind of fundamental process is you need that thousand dollars worth of lumber, right? So you’re going to take the material plus labor and you’re going to install it. Right? So now you have a $3,000 receivable with a general contractor with what generally has a 60 day timeline on getting paid, but you needed to buy 30 days in advance. And now you have a 90 day gap for when you needed the material versus when you get paid. So we bridge that. So you’re going to take four months’ worth of financing, and call it a 20%, you’re going to get paid… So four months is kind of the long end. You’re going to get paid somewhere in this middle, call it 30 days to 120 days. Once you’re paid, you repay us. The 120 days is like the max. Chris Doyle: We generally represent this to our customers as… Because they’re fighting credit terms and who am I going to buy from, how we’re going to finance it, what credit limit do I have with this supplier? That just rolls up to about a percent and a half of the total project, right? The total project to their customer. Add one and a half percent to your bid, never have to worry about terms really for your material. Nathan Latka: So they’re really passing on the cost, which is nice. Chris Doyle: Yeah. They have to. And if they budget it in, they don’t use it, then it’s just excess margin. And in construction, it’s just not that precise. There’s so much put into contingency because you have to take a fourth trip, a fifth trip. It’s fairly manageable for our customers, especially when you’re growing and quite frankly, you don’t have a lot of other options because you’ve got to have a secure, reliable way to purchase your material. Nathan Latka: And the other side of the equation is how do you get the thousand dollars to lend out? So generally, what does it cost you to get a thousand dollars to lend out to me as a subcontractor? Chris Doyle: You mean our cost? Nathan Latka: Your cost. Yeah. Chris Doyle: Yeah. It’s our warehouse facility. So kind of fully baked in the low teens. So take that, let’s call it 10% cost, 20% income. We have a net 10, right? That’s very, very different than any kind of consumer lending and probably different than any kind of SMB lending. The way we make that work is our performance of these dramatically exceeds any other lender because of the way we underwrite and the way we establish limit. We can give three X the limit because we have a process that says it’s not about the person buying the lumber. It’s a little bit about the lumber, but more importantly, it’s where is the lumber going? Chris Doyle: And the way we look at this is our customer is actually remarkably reliable. The problem is if they get stuck on a project. So we look at it from a project standpoint of where is this going? Now for a thousand dollars in lumber, it never makes sense to do this kind of diligence, but most of our stuff is much, much larger, right? We’re doing 50,000, 100,000, $500,000 worth of material purchases for a single project. Nathan Latka: Yep. So to roll those economics out of my two by four pallet example up to your whole business, if you’re at a hundred million dollar origination or run rate today and you’re on average lending out at, let’s call it the 20% average cost, 10%, that spread is $10 million in gross revenue to you guys. However, I believe if I’m doing my math right, you should be able to recycle capital quickly and actually juice your returns up to like a 35 or 40, maybe higher than a 41% IRR. Chris Doyle: That’s right. Yeah, yeah. That’s right. Nathan Latka: Yeah. Chris Doyle: So we’re walking into this… It is higher than a 10. It’s probably closer to 12. Nathan Latka: Yep. Your cost or what you’re making, the spread? Chris Doyle: What we’re making on the spread. Nathan Latka: Okay. Okay. Chris Doyle: Yeah. The components of that are customer acquisition, right? Losses, which are fairly proven, but at the same time- Nathan Latka: Is that under 3%? Chris Doyle: It’s catch-22. What’s that? Nathan Latka: Under 3%? Chris Doyle: Under 3% annually? No, probably not that low, but pretty close to it. Nathan Latka: Okay. Chris Doyle: Yeah, yeah. Nathan Latka: Well, you can afford losses because you have enough yield. Chris Doyle: Right. That’s crazy low in any other kind of lending, right? Sub 3% in small business lending. You’re talking about 10 to 20% annual losses for some of these other lenders, but that’s what- Nathan Latka: You’re talking [inaudible 00:11:55] of the world, et cetera. Chris Doyle: That’s right. Yeah. But see, what we’re able to prove out and the blessing we have as a lender is we’ve gone through about four cycles of this now. So unlike any other kind of lending, we’re sitting around for… You’d have to sit around five years to go to the capital markets and say, “Hey, look what we’ve proven out. We’re ready to scale this.” We’re in our fourth [inaudible 00:12:14], which still we get some reluctancy. I mean, COVID is an impact here. It’s like, how has that affected? But it’s enough where people can get comfortable and say, “Okay, we’re ready to scale this.” Nathan Latka: So this year in 2020, I mean, it sounds like you’ll do what, about $10-11 million in total revenue? Something like that. Chris Doyle: Well, we actually take the whole thing as revenue, the whole origination. And the reason we do that is because it’s an installment sale. So we purchase the material and resell it to the contractor. But lending revenue, it’s going to be shy that because we started so low. Nathan Latka: Lower. Yeah. Chris Doyle: Right. And we’ve been growing like 15% month over month, which rolls up to about 400% annually. So that- Nathan Latka: You grew 400% over the last year. Chris Doyle: Mm-hmm (affirmative). Yeah. Nathan Latka: So you were doing… You were like at like a $24 million origination run rate at the end of 2019. Now you’re at a hundred million. Chris Doyle: That’s right. Nathan Latka: That’s great. Yeah. Okay. So then what? You went from like 1.5 million in your take on the originations to something closer to like nine or 10 today. Chris Doyle: That’s right. Nathan Latka: Yeah. Chris Doyle: Yeah. Nathan Latka: Interesting. Chris Doyle: And that includes purposeful stall in March, April with COVID and everyone’s like, “What the hell do we do?” We took the same approach. It’s like, “Okay, let’s stop. Chill out for a second. Let’s not take a lot of incremental risk here.” We did have some increased demand coming in because suppliers had locked up a little bit on their credit. So we had a little stagnant growth from March, April, May, but then we decided at that point, we’ve seen enough. Very strong performance. Actually our performance went up oddly when COVID had hit and then kind of went back into growth mode in May. Nathan Latka: Have you raised capital for this, not balance sheet, but equity capital? Chris Doyle: We raised 10 million to start with with the investor that we had an existing relationship with. Nathan Latka: Oh, got it. It was an equity debt deal, like 10 million on the equity side and whatever amount on the balance sheet. Chris Doyle: That’s right. Yep, exactly. Yeah. Nathan Latka: Okay. And I think- Chris Doyle: Which is kind of a unique process for a lender, but there’s a lot of value created there, right? If you can keep things tight between the equity and the debt. Nathan Latka: I mean, if you raised enough in that first year to cover your 10% participation rate, I mean he could have put up 30… Or she, 30, 40 million on the balance sheet side, 10 million on the equity [inaudible 00:14:31] side, five to cover participation, five for operation. Something like that. Chris Doyle: Yep. Yeah, yeah. We did 50 on the debt side, 10 on the equity. Nathan Latka: In the first year. Chris Doyle: Yeah. It’s what we call the equity drag, which is that remaining amount that we’re funding. It’s not super efficient use of our growth, our capital, but that’s the name of the game for… I guess we are a balance sheet business now. Nathan Latka: Well, not necessarily. I mean, look, I’ve talked to a lot of people in these spaces, not anyone in your niche, but it’s the same business generally speaking. I mean, with your loan tape history, I’m surprised you’re not able to go get cheaper capital at like, I mean, six or 7% to juice your spread. Chris Doyle: Potentially. A lot of that is bandwidth. Going out and raising debt is the same as equity. It’s not like… I’ve done this a few times with another company. To me, it’s actually more difficult and time consuming to go out and raise debt because you go through the whole to do, then it’s like, “Okay, we’re almost ready to start letting you use it.” And it’s like, “Ah, well, this other thing.” It’s like you keep on marching along. Then you get it and you’re like, “Damn, this isn’t even that good of stuff. I should’ve just used this other thing.” So it can be time consuming, and that’s where a lot of the value is created from the investor side to do both sides of the deal. Again, as long as things… It’s like being friends with people you work with. As long as you can separate the two and have discipline in that, it can work really well. Nathan Latka: Yeah. Talk to me about your team. Go ahead. Chris Doyle: Here’s what we’ll likely do. We’ll probably be raising some new equity in early 2021. The appetite we see is from their LPs that say, “Look, my GP is like in on your business. Let us deploy like 30 million in your mez slot. Right? That’s where we’re going to see the reduction of cost because our senior’s pretty cheap. It’s our mez that probably has a little extra on it that we could trim out. Nathan Latka: Oh, so you have senior that’s cheaper than 10% right now. Chris Doyle: Oh yeah, yeah, yeah. Yeah. Senior’s cheaper than the mez. It’s a fixed rate in the middle teens. Nathan Latka: That’s where the 50 million is. Chris Doyle: Mm-hmm (affirmative). Nathan Latka: How much did you raise- Chris Doyle: Oh, no, no, no. Our 50 is a combined senior in mez. Nathan Latka: Oh. Chris Doyle: Yeah, yeah. One provider. Nathan Latka: Oh, that’s interesting. Chris Doyle: Yeah, but we can draw whichever we want on either one. So we could just go get another mez alternative and still use the senior. Nathan Latka: Is there paper? Is this collateralized or do they really have to just trust your underwriting system? There’s not really actually collateral to go take over in an event of a loss. Chris Doyle: From a collateral standpoint, not in the asset backed since by any means, but there are some other components and requirements and covenants of our facility. There’s some secret sauce there on the way we do the transaction between the purchasing from the supplier and reselling that gives us some in construction vertical specifically, that gives us more rights than kind of unsecured here it is. Nathan Latka: Are you also able to get… Again on the two by four example I gave earlier, because you are the purchaser and you’re responsible for a lot of volume over a hundred million dollars worth of purchasing power. Can you drive down with suppliers, like the two by four supplier, your costs and actually make another spread on reselling it to the folks? Chris Doyle: We can’t, although we do something like that. We pass it all to the customer though. Nathan Latka: Okay. The same rates. Chris Doyle: Yeah. I mean, this goes back to my background, right? So I was in commercial construction for awhile and I would get… I had my projects about a third of what the company would do. So I would buy the material. I had to go get the cheapest bids for the material because I got to make money on this deal too. So I’d go bid out my material, a hundred thousand dollars of material, then it would come through and it would require my signature. Well, I stepped into this process. Business is fantastic. Southwest Construction Services would review every one of them and go, “Wait, this has got sales tax on it. This is a tax exempt project. Wait a second. This is shipping. We pick this one up. Wait.” And there’s lots of, I’m just going to say mistakes in the billing and nothing intentional from the supplier side, but there’s a lot of room there. It doesn’t take long to train somebody how to pick those up. Chris Doyle: So we do that and we train our team and they review these things. They go, “Wait a second, 2% cash discount. It says right here at the bottom of the invoice, we’re paying you up front.” Right? Nathan Latka: Discount please. Chris Doyle: “I’m going to pay you 2%.” That’s right. Guess what? We pass that straight to the customer. Nathan Latka: Oh, that’s great. Chris Doyle: Yeah. There’s some pretty cool success stories where we’ve saved like $30,000, like a ridiculous amount of money on what the customer really had no clue, because look, they’re moving around fast. They’re driving job site to job site. They’re not going through and looking at it and marking it up and things like that. We also offer a value there, but we decided to pass all of that over to the customer. Nathan Latka: What’s your team size today? Chris Doyle: Right at 30. Nathan Latka: And how many engineers? Chris Doyle: Everything? We only have one engineer on staff. We have about seven engineers that we use. Let’s see. Four or five of those overseas and then about three locally. Nathan Latka: Okay. Okay. Interesting. Chris Doyle: We manage three outsource dev shops and we balance the three on who we kind of want to use for whatever project. Nathan Latka: Yep. And looking forward to 2021, you mentioned raising. I mean, how much do you think you’ll target to raise? Chris Doyle: Probably 15. I think we could put more to work. We could also take as little as five. It’s like, what do we really want to do? But we don’t have a lot of competition in this space. So I think the business school whiteboard exercise says grow fast, take up market share, build technology that creates a moat around the customer. That’s what we’re doing mostly because there’s not a lot of folks in this space and especially going through the capital raise processes, word gets out about the model. Then we’ll likely see some other folks jump in the space, which we welcome because from a cost of customer acquisition, there is a ton of market education, right? Nathan Latka: Yeah. I was going to say, Chris, come on. Let’s call a spade a spade here. The real reason you can do what you do is because you have CAC arbitrage because you’re a software business. You can get these loans cheaper than anybody else. That’s very difficult to replicate. Chris Doyle: That’s right. Yep. Nathan Latka: Yeah. I’m surprised actually the equity investors in Billd didn’t require you to put your software company inside of this lending business. Chris Doyle: Oh, that’s different though. The other company I’m talking about is different. Nathan Latka: Okay. Chris Doyle: I could see that. Hopefully they’re not listening, but I could see that. Nathan Latka: Okay. So maybe 15 million on the equity side. I mean, usually this sort of stage you’re going to sell what, maybe something like 10% of the business for that much? Chris Doyle: Probably more. Nathan Latka: Okay. Chris Doyle: I would say. Yeah, probably a little bit more than that. Nathan Latka: Do you think you can tell a story that gets you over a hundred million dollar valuation? Chris Doyle: I’m not sure if we want it. Yeah. I mean, look, I can pitch this super sexy high margin, low CAC, very high customer retention. Put this little SaaS spin on it, but there’s question marks too. Right? And I would rather go… It’s like a relationship. You’d rather just go in and say, “Look, this is who I am.” We have a long road in front of us to really make this successful, and I’d rather go in it with like, “These are our flaws. This is what keeps us up at night. These are the question marks. Do you add value there?” We’re not just looking for capital. Find the right investor at a, call it a right size valuation. I think that’s really our motive. Nathan Latka: Yep. If I bring in- Chris Doyle: We’ve really felt the value of having the right investor with our existing. That can do a lot for the business and that’s our main focus. Nathan Latka: Yeah. Yeah. Interesting. Yeah. I love the business. I think about this space a ton. It’s capital leverage. I’m trying to think what I can say that would convince you to let me get involved. If I can bring you something like a hundred million dollar debt facility at significantly cheaper than even your senior is right now. So your weighted costs goes down to like 6%, juice your yield. Would you let me write an equity check? I mean, the caveat here is you have a tight relationship with these folks that backed you. They probably wouldn’t be happy if you didn’t let them earn their 10% return. Chris Doyle: What drives it for us right now is more of the advance rate because that’s the bigger driver. If I can get debt at a higher advance rate- Nathan Latka: You’re already high though. 90-95. Most are 80-85. Chris Doyle: Yeah. Yeah. But we’ll call it a firm and flexible 95 would do a tremendous amount for us because I mean, we talk about some of the restrictions. We definitely have the balance sheets and stuff because it falls outside. But it’s strong performing stuff. It’s just not ready. And there’s like… To get every single new thing into the facility, we’ve got to go through the attorney stuff and having flexible… Especially if you’ve got this cross collateralization. Right? So flexible access to that. That allows us to be a lot more efficient with our equity cash. Nathan Latka: Yep. This all makes good sense. It’s going to be fun to watch you over the next 12 months to see what happens. In the meantime, let’s wrap up with the famous five. Number one. What’s your favorite business book? Chris Doyle: I think it’s going to be this new book, Bad Blood. I’ve felt so ignorant about this. Some new folks they told me about it. I’m really interested in it. It’s sitting right next to me. Nathan Latka: All my [inaudible 00:24:35] friends listening from Silicon Valley are going, “Oh my gosh, this is hysterical. Bad Blood was so a year and a half ago.” But you’re not in that world. Chris Doyle: I’m way behind. Nathan Latka: Your head’s down building a great business. You don’t care about a prick of blood and Theranos, and this lady named Elizabeth. But yeah, it’s a great book. Number two. Is there a CEO you’re following or studying? Chris Doyle: A CEO? Not really. I’m a part of YPO. So my peers are who I follow the most and really breaking things down with them and understanding the constraints they have and just how the hell do I do this, guys? What’s next? Someone give me a playbook please. Nathan Latka: Yeah, yeah. All right. Number three. What’s your favorite online tool for building a business? Chris Doyle: Online tool. I love all this new stuff coming out. It’s not all that new, but like the Hotjars of the world that let us really take a peak inside what our customer is doing online and understand and diagnose that behavior and really prove this is what we’re doing in the market. It takes our customer two minutes for a purchase. Whereas any other option is going to take 15. And their time is worth this, and we can do a transaction this quickly. And what does this really impact? Not just from a savings, a freeing up cashflow, but really making their lives meaningfully easier. Those are the kinds of things that I’m super interested in and spend time from like eight o’clock at night to 10 o’clock just watching people creep through the platform and ways we can improve it. Nathan Latka: Number four. How many hours of sleep are you getting every night? Chris Doyle: No, I’m a good sleeper. Seven. Nathan Latka: Seven. Okay. And what’s your situation? Married? Single? Kids? Chris Doyle: I am single with kids. Nathan Latka: Okay. How many kiddos? Chris Doyle: Two kids. Nathan Latka: Two kids? Chris Doyle: Yeah, 13 and 9. Yeah. Nathan Latka: Oh, wow. Okay. Chris Doyle: Nathan Latka: Primetime. How old are you? Chris Doyle: I’m 39. Nathan Latka: Chris Doyle: Golly. I wish I knew when I was 20. I’ll write a little pamphlet on how to be a dad, how to handle kids when you’re 26 years old maybe. Probably nothing really. It’s been a great ride so far and looking forward to the next 39. I don’t know. Maybe not that much. Nathan Latka: Guys, there you have it. Billd.com. They’re on an origination run rate right now of a hundred million bucks. They make, call it, nine to 12 million in terms of the yield on that. Their cost to capital is, call it, weighted 10%. They lend at 20%, a little north of that with recycling. That’s how they make their money. But really got into this because he was serving the construction space already via a software product and built this lending business to sort of support the same sort of user groups that he was already seeing in the subscription business. So 350 subcontractors that have taken some amount of loan from the platform over the past 12 days, looking to scale, hoping to raise potentially $15 million again here in Q1 of 2021. Chris, thanks for taking us to the top. Chris Doyle: Awesome. Thanks, Nathan. Nathan Latka: One more thing before you go. We have a brand new show every Thursday at 1:00 PM Central. It’s called Sharktank for SaaS. We call it Deal or Bust. One founder comes on, three hungry buyers. They try and do a deal live and the founder shares backend dashboards, their expenses, their revenue, ARPU, CAC, LTV, you name it. They share it. And the buyers try and make a deal alive. It is fun to watch. Every Thursday, 1:00 PM central. Nathan Latka: Additionally, remember these recorded founder interviews go live. We release them here on YouTube every day at 2:00 PM central. To make sure you don’t miss any of that, make sure you click the subscribe button below here on YouTube, the big red button, and then click the little bell notification to make sure you get notifications when we do go live. I wouldn’t want you to miss breaking news in the SaaS world, whether it’s an acquisition, a big fundraise, a big sale, a big profitability statement or something else. I don’t want you to miss it. Nathan Latka: Additionally, if you want to take this conversation deeper and further, we have by far the largest private Slack community for B2B SaaS founders. You want to get in there. We’ve probably talked about your tool if you’re running a company or your firm, if you’re investing. You can go in there and quickly search and see what people are saying. Sign up for that at nathanlatka.com/Slack. In the meantime, I’m hanging out with you here on YouTube. I’ll be in the comments for the next 30 minutes. Feel free to let me know what you thought about this episode. And if you enjoyed it, click the thumbs up. We get a lot of haters that are mad at how aggressive I am on these shows, but I do it so that we can all learn. We have to counter those people. We got to push them away. Click the thumbs up below to counter them and know that I appreciate your guys’ support. All right, I’ll be in the comments. See ya.