-

MedStack more than doubled revenue since July 2018 to $70,000 MRR

-

Balaji Gopalan, the CEO, spent $1.8M raise to rebuild the product

-

CEO looking to raise an extra $500,000 to pass $1M ARR

Any health tech startup—telemedicine, at-home patient monitoring, healthcare scheduling, even fitness trackers—is all too well familiar with the painful process of meeting legal requirements of partner healthcare institutions. In plain English, you need data to make your app work, but the hospital won’t give it to you unless you comply with a robust list of standards.

MedStack takes all of that pain out of the equation. Since their inception in 2015, the company has already signed partnerships with industry giant Sinai Healthcare, and they’re aggressively expanding outside of the US.

The platform acts as the middleman between health tech founders and healthcare institutions—the latter have already vetted legal compliance of the platform, while the former have access to all the patient data they need. Sounds like a billion dollar idea, and our host Nathan Latka sat down with Balaji Gopalan, the CEO, to learn more.

MedStack CEO: “Nothing Is Unhackable”

Covid-19 spells busy times for a healthcare middleman, with industries like telemedicine at peak capacity. Vaccine seekers who use AI to determine the winning anti-coronavirus genome have also become more active. Even at-home patient monitoring has been increasingly in demand lately, with patients reluctant to visit the doctor’s office in fear of the virus. All these use cases translate into additional demand for MedStack’s platform.

While Gopalan reminds us that “nothing is unhackable,” MedStack does provide a level of security to these sensitive data transactions. “We’re tracking who had access to the data, when they accessed it, how they accessed it,” the CEO explains. “We’re managing who has the rights to access the data, the backups, the infrastructure of data security and monitoring of security incidents.”

70 Customers Pay MedStack $800 Per Month

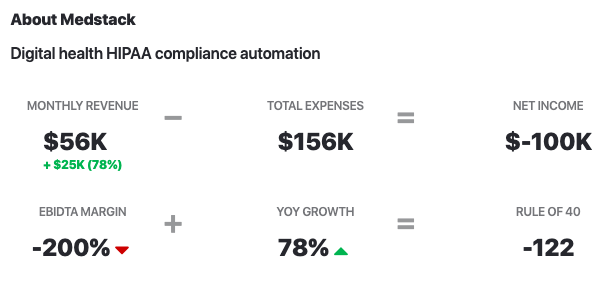

Back in July 2018, MedStack was serving 45 customers. As of April 2020, their customer count has almost doubled to 70. The revenue spike during the last few months, however, didn’t come from new customers, but rather from expansion revenue.

To this date MedStack has raised $2.3 million, with a hefty $1.8 million investment in early 2019—most of which was used to “completely rebuild the product from ground up.”

MedStack Control, the new product, offers “all of the security and legal commitments” of the previous platform, with the addition of robust automation in the self-serve domain. “Before, [the customers] would need to work with us in order to make any iterative changes,” Gopalan explains. “A bigger server, a different kind of framework running the server—all the security stuff we’re handling. […] MedStack Control is a completely self-serviced, machine-driven system.”

Customers pay MedStack $800 per month, or $9,600 a year, for the privilege. With 70 customers, this means that the company is bringing about $56,000 to their top line every month, or $672,000 a year.

MedStack Raising Extra $500,000 to Prepare for Series A

Gopalan spent most of the $1.8 million from the recent raise to build the product revamp, and he’s seeking a $500,000 seed extension right now. Money is expensive during a recession, but the CEO argues that investors still need to invest, and they don’t have a whole lot of options right now.

Gopalan says that MedStack is an attractive business opportunity for investors: with only 7 employees, they’re burning only about $100,000 a month, and their platform is both relevant and viable in the long run.

To justify the dilution, the CEO says MedStack needs a bit of cash to position themselves better for upcoming Series A. “We wanna cross the 100 customer mark, we wanna cross the $1 million annual recurring revenue mark, we wanna have a few companies of a larger size,” he explains.

Another thing Gopalan is eager to achieve before series A is getting important industry certifications—a necessary tool for a health-data middleman. The CEO is not looking eager to raise debt to finance his growth preparations.

Nathan Latka’s 5 Questions with MedStack Founder and CEO Balaji Gopalan

- Favorite business book? “Hard Thing About Hard Things by Ben Horowitz.”

- Is there a CEO Balaji is following or studying? “Tobias Lütke, CEO of Shopify.”

- Favorite tool to grow MedStack? “Slack.”

- How many hours of sleep? Married, single? Kids? Age? “5-6 hours. Married, two kids. I am 47.”

- What does Balaji wish his 20 year old self knew? “The importance of questioning your assumptions.”

Funding:

2015:

2016:

2017: $450k (angel round, 1)

2018:

2019: $1.8M (interview)

2020: $500k (CEO looking to raise, interview)

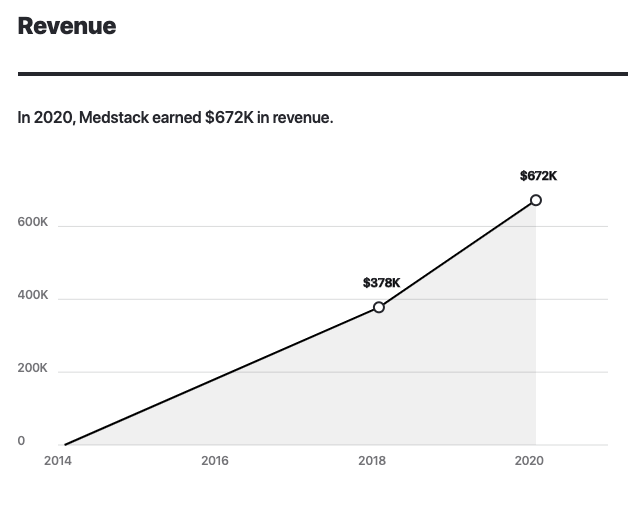

Revenue:

2015:

2016:

2017:

2018: $360k (old interview)

2019: $672k (interview)

2020: $1M (prediction—can the CEO accelerate growth due to coronavirus if he gets the cash?)

Customers:

2015:

2016:

2017:

2018: 45 (interview)

2019: 70 (interview)

2020:

Sources: