D2iQ, formally known as Mesosphere, earns more than $3 million in monthly revenue from big-name customers like NBC Universal and Royal Caribbean, which pay on average $200,000 annually for the company’s subscription service.

In addition to building technology infrastructure meant to help companies grow, D2iQ also helps large companies adapt to complex technology like machine learning and data analytics. As co-founder Florian Leibert describes it in our interview (August 2019), “we’re building something that’s very, very complicated.”

“We’re basically taking a number of open-source technologies and also work with some proprietary software vendors,” says Leibert, who now works as general partner at venture capital firm 468 Capital. “And we’re basically automating all of these software components to let our customers focus on what they’re best at, and that is usually building their products.”

Leibert launched the company in 2013 with his co-founders Tobias Knaup and Benjamin Hindman. But D2iQ’s origins really date back to 2008, when Hindman wrote his first line of code while pursuing his Ph.D. at the University of California at Berkeley.

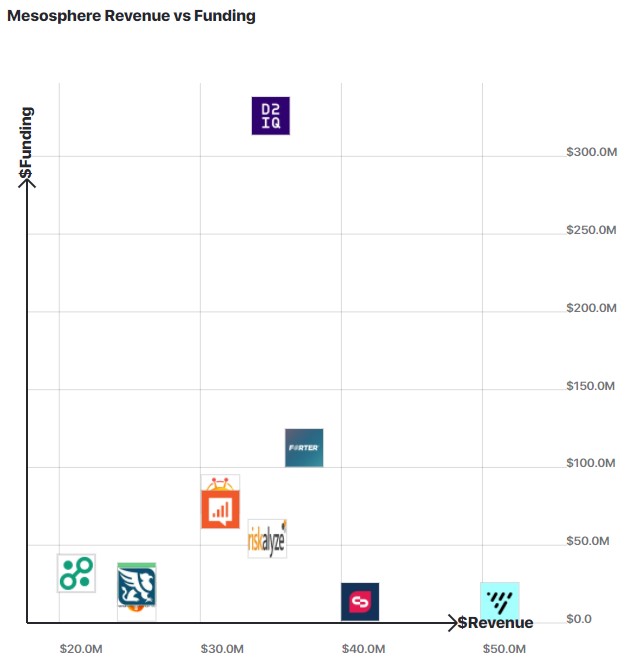

The company’s first project cost about $1 million, about half of then-called Mesosphere’s initial seed round of $2.2 million. D2iQ had raised $252 million at the time of this interview.

Source: https://getlatka.com/companies/mesosphere

Although the founders built D2iQ as open-source software, customers pay for a subscription license for the proprietary version of the product. Customers pay for their footprint, or the number of physical servers or virtual machines they use. Clients usually start with subscriptions worth between $50,000 and $100,000 per year, but they often add to their subscriptions over time.

Nearly 400 people work on the D2iQ team, including about 120 engineers. Although Leiber does not offer specific details about the company’s CAC, “right now the CAC is probably lower than the full 12 months” of a subscription, he says.

D2iQ has hit 140% net revenue retention in the past, but Leibert does not disclose whether this is still the case.

When it comes to raising cash, D2iQ keeps an unusually high runway of 36 months. This is largely due to the ever-changing complexity of their products and competitors. The company burns through an average of $3 million to $4 million per month, but Leibert emphasizes that D2iQ tries to make its money last as long as possible.

“We wanted to always have basically the room for error or room for a changing ecosystem … if Google comes out with a new technology, which they did three years ago, we really have to change gears and double down on this new technology,” Leibert says.

As of 2019, Leiber says the company remained focused on growing its leadership and developing new products before considering launching an IPO.

“We really want to see the value of these awesome products that we’re bringing out,” Leibert says. “And I think once we have those nailed and once we have all the reps … then I think we can have that conversation again.”

Get to Know Florian Leibert, CEO of D2iQ, formerly known as Mesosphere

Name: Florian Leibert, age 36, married with one child

Where to find him: LinkedIn | Twitter

Company: D2iQ, formally known as Mesosphere

Noteworthy: German-born Leibert’s advice to his 20-year-old self: “Come to the States sooner, come to Silicon Valley sooner.”

Favorite business book: “Crossing the Chasm”

CEO he respects: Mike Fey

Favorite online tool for building the business: G Suite

Average # of hours of sleep/night: 6.5-7

Transcript Excerpts

How working for major tech enterprises inspired the founders to launch D2iQ, formally known as Mesosphere

“We started the company because I used to work with my co-founders at Twitter and Airbnb, and we helped both of these companies actually build the next generation of infrastructure that helped the companies scale. And we took a lot of these learnings and figured out that we wanted to bring the same sort of technology to any company out there, not just the top engineering companies.”

The complexities and challenges of D2iQ’s engineering

“Think, for example, on a cruise ship. We’ve mentioned Royal Caribbean Cruise lines. They use our software on their cruise ships in order to power their mobile app and some other analytics that they’re running. And on the cruise ship, you don’t necessarily have software engineers right on board that can actually fix something if a server, for example, has an outage. So our software has to actually self-heal. And building that is actually very, very complex.”

How D2iQ stays in open-source users’ good graces (hint: working for free)

“So one of the things that we continue to do is to actually continue to contribute to the open-source project. Basically spending company resources on making sure that the free users of the software can continue to use it. And we never tried to hold back any major features or anything like that … We tried to provide additional value that the customers that were not naturally self-adopters and early adopters of technology would use.”

How D2iQ benefits form contributing to open-source projects free-of-charge

“It’s a little self-serving as well, because of course we don’t have to maintain necessarily a different code path and then have a lot of complicated logic to [reconcile] those two different projects … Think of plug-ins. That’s what we’re trying to do, add [valuable] things on top that leave the existing code base as it is.”

Full Transcript Speaker 1: Hello, everyone. My guest today is Florian Leibert. He’s the co-founder at Mesosphere, the hybrid cloud platform company, which helps companies like NBC Universal, Deutsche Telecom and Royal Caribbean adopt transformative technologies like machine learning and real-time analytics with ease. Florian, you ready to take us to the top? Florian Leibert: Yes. For sure. Speaker 1: All right. So I’m sure you’ve done this before. Try and simplify this idea for us, help us understand what you guys do and what the revenue model is. Are you pure play SaaS? Florian Leibert: No. We’re not a pure play SaaS company. So I’ll give you quick background. So we started the company because I used to work with my co-founders at Twitter and Airbnb, and we helped both of these companies actually built the next generation infrastructure that helped the company scale. And we took a lot of those learnings and figured out that we want to bring that same sort of technology to any company out there, not just the top engineering companies out there, but really any company. And the companies you mentioned, Royal Caribbean and so forth, they are all customers that are now employing our technology to actually build modern products. Speaker 1: And so how do they pay you though? Is it a licensing model? A SaaS model? Or something else? Florian Leibert: It’s a subscription-based pricing, but most of our customers run… Even if they run us in the cloud, they still pay us a subscription license for support and for the proprietary version. Speaker 1: Yeah. So, I mean, you are a SaaS based business then? Florian Leibert: Yeah, I mean, but it’s not self-serve. It’s not SaaS and it’s not just the, “Hey. Swipe your credit card and you’re ready to go.” It’s a little bit more [crosstalk 00:01:22]. Yes. Speaker 1: Oh, no, no. I don’t mean self-serve. No, no. I mean, I’ve had a lot of CEOs doing between a 100 and $400 million in ARR. They’re all selling enterprise. They’re all pure SaaS, but they’re definitely not swiping credit cards on an online portal. Florian Leibert: Exactly. Speaker 1: All right. Okay. Good. So that’s helpful to understand. So give me a general sense of kind of sweet spot for you then. What are companies paying on average per year to use this technology you’ve built? Florian Leibert: So our average pricing really varies depending on how big the customer’s footprint is [crosstalk 00:01:49] the cloud. Speaker 1: Measured by what? Speaker 1: Okay. Interesting. So you upsell based off number of physical servers or virtual machines. Do you do any seat-based or feature-based upselling? Florian Leibert: So the product that we’re actually launching pretty soon, it’s going to be seat-based and it’s going to be actually a mixed model between both nodes and seats. And I unfortunately can’t go into details about what their product is, but yes, we definitely have that. Speaker 1: Okay. But today you’re only upselling based off number of virtual machines, number of physical servers, nothing based off number of seats or number of nodes? Florian Leibert: Well, nodes is basically the number of physical servers or virtual machines. We have some customers that have very special hardware and for them, we’ve done pricing based on a core basis. So number of [crosstalk 00:02:39]- Speaker 1: Okay. I want to capture more of kind of the founding story here, how you realized this was a problem at your Twitter and Airbnb days. Before we do that, though, this is going to be painful for you, but we can’t talk about every customer cohort. What would you say a sweet spot is for you? Like a $100,000 a year? Or a million a year? 10 million a year? What’s a sweet spot? Florian Leibert: The sweet spot is a couple of 100,000 a year. Speaker 1: Okay. You feel like that’s fair. And let’s just role play for a second. If someone’s signing up, average customer $200,000 per year, how many virtual machines might they have? Florian Leibert: I mean, it really depends. We have a number of ways of packaging our product, but I’ll give you an example. So generally customers start with an accelerator package, which can start anywhere from 50,000 to a $100,000 or so. And then oftentimes, they get a lot of value out of the software and embed our technology into more and more of their products, because it really helps them develop their products faster. And that’s how we expand. So it’s really a land and expand strategy that our business is based on. Speaker 1: Okay. But generally speaking, it sounds like almost all customers spending now more than a 100 grand a year? Florian Leibert: Yeah. Exactly. Pretty much everybody starts somewhere and then as their application footprint grows, the needs to use more of our software subscriptions grows and that’s how we grow our footprint. Speaker 1: Yeah. That’s great. Okay. Let’s put this on a timeline. What year did you launch the company? Florian Leibert: We launched the company in 2013. So I think it was March, 2013. Speaker 1: 2013 and you’ve chosen to raise capital. Tell everyone how much you’ve raised and then articulate kind of why you had to raise, why’d you have to take the dilution. Florian Leibert: Yeah. So we raised a total of 252 million in funding and the reason is simple. We’re building something that’s very, very complicated. I mean, basically, we’re basically taking a number of open-source technologies and also work with some proprietary software vendors. And we’re basically automating all of these software components to let our customers focus on what they’re best at, and that is usually building their products. So that requires dealing with all of these software components and the complexity that these run on, different versions of operating systems, like different versions of Linux, different flavors of Linux. It’s very, very complex. We have to create a lot of software that automates these components. Florian Leibert: Think, for example, on a cruise ship. We’ve mentioned Royal Caribbean Cruise lines. They use our software on their cruise ships in order to power their mobile app and some other analytics that they’re running. And on the cruise ship, you don’t necessarily have software engineers right on board that can actually fix something if a server, for example, has an outage. So our software has to actually self-heal. And building that is actually very, very complex. We have a lot of really talented engineers who come from the likes of Twitter, Airbnb, [crosstalk 00:05:21] Google- Speaker 1: How many folks total are on the team? Florian Leibert: We have around 390 people right now. Speaker 1: And how many are engineers? Florian Leibert: I would say we have about 110, 120 engineers. Speaker 1: Okay. A good, fairly healthy engineering team there. Okay. So take me back here. So 2013 was when the first line of code was written? Florian Leibert: Well, I mean, really the first line of code that went into our technology was written well before then. It was written when my co-founder, Ben Hindman, was doing his PhD thesis at UC Berkeley. He was working on a piece of software that really automates the data center. And that software was the first product that we… Or the first open-source project that we productized. And later on, of course, many other technologies came into the mix, but really the first line of code was probably written in 2008. Speaker 1: Okay. 2008. And then I guess the reason I ask is I’m always curious how much money a company will sink into building their MVP before they they ask for their first dollar of revenue. So I imagine it’s probably a hefty amount. How much did you guys put into the MVP before you got your first dollar? Florian Leibert: So, I mean, the interesting thing is if you look at Twitter and Airbnb, for example, as actually contributing to this open-source software project that we were based up on, I mean, I think you can say 100s of millions. I mean, there were large engineering teams at both of these companies that were actually creating this open-source software. So 100s of millions, even before the MVP was written in Mesosphere. Speaker 1: If you just look at, again, literally dollars out of your bank account that you had to pay essentially engineers to kind of get this thing going before the first dollar of revenue, what would that actual amount be, do you know? Florian Leibert: I mean, let’s say we had the first product that we build from this open-source project and that probably cost us, I’d say, a million dollars, the first MVP that we built ever, as Mesosphere. Yeah. I’d say it was probably three quarters of a year and half of our seed round. I know our seed round was about 2.2 million. So… Speaker 1: 2.2? Okay. And did you raise that seed round right in 2013, right at the start? Florian Leibert: Yes. Exactly. We raised that right away and we, yeah, wanted to really get to know our investors- Speaker 1: And was that really based off the credibility of your background plus your partner’s PhD project? Florian Leibert: Yeah. Exactly. And the community that was actually behind the project. Speaker 1: Yep. Look. We had the Automatic folks on. Obviously, great story there. And I always asked these folks that launch company on top of an open-source platform how they managed literally PR. So when you go into open-source community and then you’re essentially going to profit on top of an open-source platform that other people contributed to, it’s a hard thing to balance. So how did you make sure you didn’t piss a lot of people off by essentially productizing something that was open-source, that everyone got value from free? Florian Leibert: Yeah. That was indeed our concern initially as well. So one of the things that we continue to do is to actually continue to contribute to the open-source project. Basically spending company resources on making sure that the free users of the software can continue to use it. And we never tried to hold back any major features or anything like that. What we tried to do is we tried to provide additional value that the customers that were not naturally self-adopters and early adopters of technology would use and find useful, and yeah, trying to just make complicated things much easier for less sophisticated customers. And we figured that we probably will never get Twitter to be a customer because they just had such a large engineering team already that they could build most of these or could actually implement most of what they needed on their own. Speaker 1: So today, how many lines of code are you contributing monthly to the open-source project for free? Florian Leibert: I don’t know. I really don’t have those stats. Speaker 1: Do you measure that stuff? Florian Leibert: I think the engineering team certainly measures their code contributions, but the complexity is that we actually contribute across a wide breadth of projects, not just a singular project, but really probably on the order of 20 to 30 open-source projects where we actively contribute, fix bugs and so forth. Speaker 1: I see. So that’s your way of staying in the good graces of the open-source community, why you build a big business on top of it? Florian Leibert: We hope to do so, yes. Speaker 1: Yeah. I think that’s probably a smart move. You don’t want that community revolting on you. Florian Leibert: Yeah. And I think it also helps us, because I mean, it’s a little self-serving as well, because of course we don’t have to maintain necessarily a different code path and then have a lot of complicated logic to reconciliate those two different projects. So what we try to do is we just… At least in theory. I don’t know if it’s in practice all the time like this. But we try to put… Think of plugins. That’s kind of like what we trying to do, value add things on top that leave the existing code base as it is. Speaker 1: Yeah. And that’s smart. Okay. So you’re doing all this to scale. You launched on top of that open-source platform. How many customers are you now serving today? Florian Leibert: So we have about 130, 140 customers. Speaker 1: Okay. Fair enough. Now, 130 customers. Take me back to kind of your team today. So do you have an inside sales team? I know you probably don’t like talking about sales because you’re an engineer. But do you have an inside sales motion? Florian Leibert: I had to actually get used to talking a lot about sales. I mean, it wasn’t until January… We haven’t had the role of the CEO until we hired Mike Fey, who is just a phenomenal guy, who came out of Symantec. He was the President, COO of Symantec. And the CMO of Symantec afterwards also joined. So phenomenal. But sales. Yeah, of course. We have an account development rep team or sales development rep team. So they basically find our leads and convert them into good prospects and… I’m sorry. They convert the leads. And we have a community team that goes to trade shows. We also have the sales reps that attend trade shows and conferences to collect leads. And yeah, so basically, initially of course, what we had was customers calling us because we were the only company at the time that was servicing the software, the open-source software. So companies initially called us when they had problems, but as we grew, and as of course there was more competition, we had to have an outbound sales team as well. Speaker 1: Yeah. So I mean, do you know how aggressive that team or you as a company are being in terms of if you see a company is going to be worth $250,000 to you in terms of their year one contract, will you spend that full amount upfront to get the customer? Are you happy with the 12 month payback? Florian Leibert: Look. I think we don’t really look at it that way right now. We are really in growth mode. I mean, I think we’re not like a super traditional business where you can say we can exactly attribute how much it costs to win that customer. There’s a certain amount of overhead, I already mentioned, the community team. It’s hard to measure the exact impact because you’re building up goodwill if you’re- Speaker 1: But to be fair though, Florian, I mean, your partner’s a PhD, you’re an engineer, which means you understand… I mean you’re metrics, you’re a rural kind of based guy. There are ways to calculate CAC. Some people take all their company expenses every month divided by new customer. Sometime it’s just sales and marketing. Sometimes it’s just paid spend. I mean, there are ways to measure this. Florian Leibert: I mean, you can slice and dice this in many different ways, of course. I mean, I think right now the CAC is probably lower than the full 12 months. I mean, I’m sure about that. I don’t know the exact number here and I don’t know that we’ve shared this before, but it’s certainly less than 12 months. Speaker 1: Yeah. And I mean, the reason I asked that is because many people would argue whoever wins a space, comes in the number one or number two spot, is actually the company that builds the healthiest economics, because then they can pay the most to get the customer. So that’s the reason I ask it how aggressive you’re willing to be on CAC. Florian Leibert: I mean, I think we’re a venture backed startup, so by the nature of it, I think we’re pretty aggressive. But I think we- Speaker 1: I’d argue actually six months is not aggressive at all. Most venture back startups that have raised between a 100 and 500 million bucks in revenue, I mean, you see payback periods in 18, 24 months kind of timeframes. Florian Leibert: Yeah. Again, I think it depends on what you add to your cost basis for… I think it’s probably longer if you add all of the community and we don’t really do that because it’s a little harder to attribute the leads that come into the community bucket [crosstalk 00:00:13:52]- Speaker 1: Well, and there’s no cash outlay for that, for you today really direct. Florian Leibert: For the community team? Speaker 1: Correct, right? Florian Leibert: Well, I mean, engineering [crosstalk 00:13:58]- Speaker 1: Besides salaries, Florian Leibert: Well, yeah, but I mean, those are pretty substantial, right? Yeah. Speaker 1: Yeah. You’re talking about engineering salaries that are contributing back code to these projects that bring you leads. Florian Leibert: Exactly. Exactly. Speaker 1: Yeah. Yeah. No, that makes sense. Okay. Let’s move on from that. It sounds like you have a pretty healthy expansion module where the cruise line installs you on one fleet and they love you so much, the next year they triple their account and they install you on the European fleet, et cetera. Do you know if you look at a past 12 months kind of what gross revenue churn is relative to expansion on that same cohort? Florian Leibert: Yeah. So, we of course know that and we measure that, but that’s unfortunately a metric I can’t share. Speaker 1: That’s okay. I guess what I’m asking is I think most companies at scale, world-class net revenue retention will be something like 140%. Have you hit that yet today? Florian Leibert: We’ve hit that before. Yes. Speaker 1: Okay. Okay. But you’re not there today? Florian Leibert: I don’t have the number in my head right now. I mean first quarterly sales in the enterprise business are a little lumpy. I mean, Q1 always looks different than Q2, Q3 and Q4. Yeah. I mean, there’s some fluctuation depending on what time of the year you look at it, and I can’t share the number for last year. Speaker 1: Yeah. No, no. That’s fine. That’s fine. Next question here. Folks at your scale, when you’re going out and doing a capital raise, how do you think about how much you want to raise for in terms of how much runway you want to by yourself? Do you raise for 12 months? 18? 24 months? What’s your theory? Florian Leibert: No. We’ve always tried to raise from 36 months. Speaker 1: Really? Okay. I’ve never heard the number that high before. Why 36 months? Florian Leibert: Well, because I think if you look at our business, it’s, first of all, I mentioned this very capital intense. The amount of time it takes to close these deals, the ramp, is pretty long. The ramp for the sales force is really long, because it’s a very complex product. And we wanted to always have basically the room for error or room for a changing ecosystem, because we are in a spot where in some ways, if Google comes out with a new technology, which they did three years ago, we really have to change gears and double down on this new technology. And that plus wanting to have the additional resources in case an opportunity comes up, always made us want to have 36 months of cash. Speaker 1: The last raise was back in May of 2018, 125 million bucks. If we divide that by 36 months, that would mean at that point, maybe you were burning between three and four million a month. Are you still being that aggressive? Are you still burning that amount per month? Florian Leibert: Unfortunately, I really can’t talk about the burn number. But I mean, ii we have a lot of head room in order to grow as a business. Speaker 1: Yeah. Well, Florian, by the way, I don’t want to put numbers in your mouth. Those are numbers you gave me. You said he raised for 36 months and your last raise was the 125, which mean burn would be about between three and five million a month. Florian Leibert: Yeah. But I think that’s the average case. I think that obviously you want to have it last even longer if possible by being more profitable or by, not profitable, but by burning less over time, right? Speaker 1: Yeah. Well, I mean, unless you’re in a kind of winner take all space that’s highly intensive. Being profitable at your board meeting would actually be a massive weakness because they’d go, “Oh, my gosh. Florian doesn’t know where to invest anymore.” Florian Leibert: I mean, I think businesses that are run as profitable businesses are always the best businesses, but I mean- Speaker 1: Florian, let me put it this way. I would be shocked if your company with your funding history was going to tell a story at a board meeting or pre-IPO saying, “We’re looking at being profitable right now.” With how much you’ve [inaudible 00:17:36], I think that is a story that’s not a story you’re going to tell. Florian Leibert: Well, no. I mean that’s [inaudible 00:17:40]. But I’m just saying. I mean, aspirationally of course, [crosstalk 00:17:44]. Speaker 1: Of course. We all want to be profitability, 60% of the bottom line every month, of course. Okay. Fair enough. What’s next on the roadmap? Again, now last raise was a little over a year ago. Are you raising now again? Or prepping for an IPO? What’s the next move? Florian Leibert: No. So, I mean, obviously we brought in Mike and the team because we wanted to set the company up for potentially an IPO or for a really high growth future and really shift the company around from being open-source only company or perceived as kind of an open-source company to being a real enterprise company. We want to be the folks that come in and help our customers bring really complicated software and turn their products into production products, not just… And Mike has a background of doing that. When he and his team came into BlueCode, they actually quadrupled, I think, the company valuation within two and a half, three years, and then they were acquired by Symantec and they did a phenomenal job there before leaving here. So obviously, we just did the shift about six months ago where we brought in that team. I’m super excited about that. And in about a month or so, we have some really exciting product news as well. I’m not going to share them right now because we take it as stealing the thunder basically. Speaker 1: No. That’s okay. But Florian, I mean, you bring in great talent. You have a big product release. This is a great storyline leading up to an [inaudible 00:19:14]. If you did decide that IPO was the right move for you, I mean, could you see that happening in the next, call it, two to five quarters? Florian Leibert: Two to five is a pretty broad spectrum. Speaker 1: That’s 18 months. Florian Leibert: I mean, I’d say definitely not within the next… Yeah. I think definitely not within the next year. Speaker 1: Okay. And why is that? Do you feel like you have to some revenue target before you actually file? Or why not definitely in the next 12 months? Florian Leibert: I mean, I just know that we are just launching this product and I already mentioned that the ramp period for reps is pretty high. In complex software, it takes about nine to… Yeah. Sometimes even longer than nine months to… Nine months to ramp a sales rep. So I think we really want to see the value of these awesome products that we’re bringing out. And so it’ll be awhile until we see the aggressive growth of that. And I think once we have those nailed and once we have all the reps, basically will be fluent with that new set of products, then I think we can have that conversation again. Speaker 1: That’s great. With the new product launch and some of the other changes you’re making, I mean, does it feel reasonable or uncomfortable to hit a 100 million bucks in ARR or run rate next year? Florian Leibert: I think it’s possible. Yeah. Speaker 1: But a little uncomfortable? Florian Leibert: I mean, there’s the possibility. I mean, [inaudible 00:20:38]- Speaker 1: Well, you never want a safe goal. Safe goals are boring. I’m just curious. Is that going to make you nervous? Or no, you guys feel pretty darn good about hitting it? Florian Leibert: So I think we brought in a really amazing executive team to take us to the next level. And I think anything is possible with this team. Speaker 1: That’s great. All right. Last set of questions here. You mentioned 140 customers. It sounds like everyone is north of a 100 grand, maybe even more than that, call it, 200 and 250 a year in terms of ACV. That would put you in north of 3 million bucks a month right now in revenue, potentially way north of that. Is that accurate? Florian Leibert: It’s north of that, for sure. Speaker 1: That’s great. And then if you go back a year ago today, I mean, was annual growth rate year over year in that kind of 30, 40% range? Or higher? Florian Leibert: Again, those numbers, we haven’t shared publicly yet, so- Speaker 1: What do you target? Florian Leibert: We haven’t shared our goals around exact numbers publicly. Speaker 1: Okay. If we don’t talk about you for a second, most companies, this kind of stage, you’re doing three X, three X, two, two, two, two, two X, basically to IPO. I mean, is it fair to say that kind of two X benchmark industry average is what you’re also targeting? Florian Leibert: I think yes. Definitely with new product revenue, that’s always the goal, at least two X. Speaker 1: Yep. All right. Very good. Let’s wrap up with the famous five. Number one, what’s your favorite business book? Florian Leibert: Favorite business book is probably… Well, it’s not a book. Well, Crossing The Chasm and that’s a book obviously by Geoffrey Moore. That’s amazing. But I think there’s a really cool research paper actually. I forgot which business school it came out of, but it’s called the Sales Learning Curve. That was one of the… By Mark Leslie. And I think that’s a really, really great paper to read for anyone who’s thinking about sales and sales operations. Speaker 1: Great. Number two, is there a CEO you’re following or studying? Florian Leibert: Well, I’m learning a ton from Mike Fey now, who’s our CEO here at Mesosphere. Speaker 1: Number three, what’s your favorite online tool to build your company? Florian Leibert: G suite. Speaker 1: All right. Number four, how many hours of sleep do you get every night? Florian Leibert: I try to get now more. I try to get six and a half, seven hours of sleep. Speaker 1: And how old are you? Florian Leibert: 36.. Speaker 1: Florian Leibert: Married with a kid on the way. Speaker 1: Oh! Oh. Congratulations. That’s exciting. Florian Leibert: Thank you. Speaker 1: All right. Last question. What do you wish your 20 year old self knew? Florian Leibert: I mean, back then I was still living for the most part in Germany and so I think I would have told myself, “Hey. Come to the States sooner, come to Silicon Valley sooner.” Speaker 1: Florian Leibert: Thank you so much.