Originally founded in 2015, Cognism was designed to be so much more than just another B2B sales solution. It’s an acceleration platform – one that helps make it easier for teams to generate high-quality sales and marketing leads by way of bringing together the major benefits of real-time company, people, and event data into a single, streamlined place.

As a platform, it’s also been hugely successful:

- Funding Secured: $129.1 million

- 2022 Revenue: $25 million

- Revenue as of April 1, 2023: $32 million

- Year-Over-Year Growth: 30.21%

- CEO shared 25+ slides on his growth at the SaaS CEO conference SaaSOpen

Cognism CEO James Isilay sat down with Nathan Latka to talk about the trajectory of the company to this point. GetLatka can also exclusively share that Cognism has term sheets for a $50 million equity raise on a $450 million post-money valuation.

Revenue: How Cognism Grew to $25 Million in Revenue

Cognism’s impressive revenue growth of $0 to $32m in the last 7 years can largely be attributed to its emphasis on modernization. As a platform, it offers users more than just another way to reach their next “best buyer.” It’s an invaluable opportunity to keep up with ever-changing buying behaviors.

The insight Cognism provides lets businesses form a real connection with their customers. This is all by way of the channels those people are already actively engaged in.

This all stems from the idea that modern buyers, in particular, are always focusing on businesses with the most relevant message to them. That is exactly what Cognism is trying to create – a chance for businesses to find out when those great-fit accounts are in-market, who should be contacted, and, more importantly, what they need to hear to close the deal at that moment.

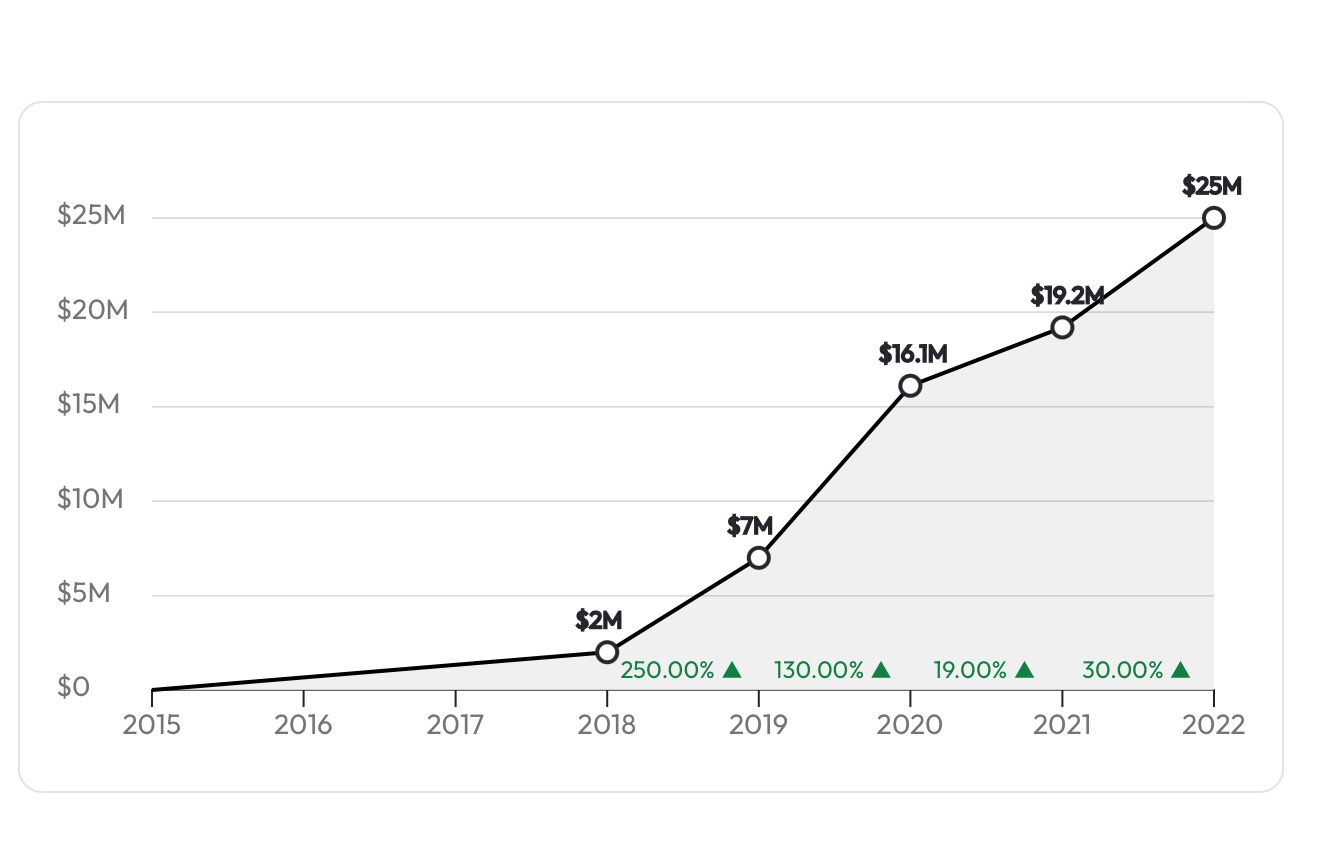

Founded in 2015, it took the company 3 years to hit $2m in revenue in 2019. A year later, it hit $7 million in revenue.

From that point, the company’s growth continued. It posted $16.1 million and $19.2 million in revenue in 2020 and 2021, respectively.

Despite all the uncertainty going on in the world, that trend continued. Cognism was able to hit $25 million in revenue as 2022 came to a close.

See revenue growth below:

Valuation: Cognism Valuation Hits $450 Million

Since its inception, Cognism has always made it a point to build features and partnerships designed to fully serve its end users – regardless of who they happen to be or what their needs are. The platform offers high-quality data coupled with the most useful features and an interface that virtually anyone can use.

All of these things have only grown more relevant over the last several years, which is why it makes sense that Cognism’s valuation trends closely resemble that of its revenue.

The company closed two seed rounds of funding in 2017 and 2018, both of which brought in $2.7 million. Also in 2018, the company completed Series A funding and raised an additional $3.8 million.

2019 Series B funding raised an impressive $10 million. 2020 Series B funding raised a further $12 million at an $80 million valuation. This was as of August of that year.

In 2021, Cognism raised a Series C of $10 million. Flash forward to January 2022, and Cognism raised a Series C of more than $87 million at a $436 million valuation.

Take a look at the valuation growth below:

Customers and Pricing: 1,000 Customers Paying $14,000 Annually on Average

As of 2022, Cognism serves over 1,000 customers on a monthly basis that are spread out across three continents. During the interview, James Isilay mentioned that their average annual contract value (ACV) came in at $14,000.

Given the metrics that he currently has access to, he is positive that they will have an even better 2023 than they did the previous year. He says that the aim is to keep the focus on their ACV, allowing it to double to $28,000.

He also indicated that they are aware of the product strategies that they need to emphasize to get them there.

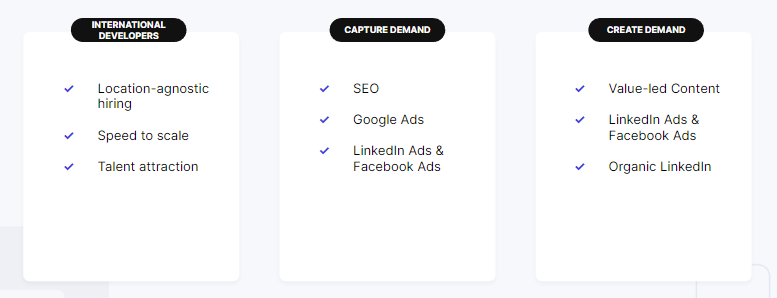

Growth Strategies: Efficiency

One unexpected source of growth for Cognism, according to James Isilay, was actually the COVID-19 pandemic. During this period, they were forced to become more efficient – much to their long-term benefit.

The company didn’t need a physical office anymore, for example. Overall, the pandemic made them much more efficient in terms of how they worked. More money can now be put into not only hiring additional employees (they currently have more than 400 in six countries) but marketing as well.

Both of these strategies will fuel growth moving forward.

CEO James Isilay Has Estimated Net Worth of $87 Million

Although CEO James Isilay’s net worth did not come up in any specific way during the interview with Latka, we can estimate the value of his equity.

By the time the company’s Series C funding rolled around in 2022, investors owned about 50% of the company, and the ESOP pool is estimated to be 10%. James Isilay confounded the company with Stjepan Buljat in 2015.

If equity was split 50/50 by the founders at the start, each would own roughly 20% of Cognism today. Based on the recent valuation of $436 million would put his net worth at approximately $87.2 million.

Obviously, paper valuations are just as good as paper net worths – not that great. The question is, can the Cognism team continue growing to drive towards a liquidity event in the form of a secondary, majority growth equity round or an IPO?

Get to Know CEO James Isilay

Favorite book: Isilay named The Hard Thing About Hard Things: Building a Business When There Are No Easy Answers by Ben Horowitz as his current favorite.

CEO he’s following: Henry Schuck of ZoomInfo.

Favorite online tools: Gong.

What does he wish he had known at 20? “Start earlier!”