There’s no denying that customer churn can seriously harm your business.

Besides losing customers and revenue, customer churn can also impact your brand reputation, making it more difficult to acquire new customers.

And, especially if you have a SaaS, growing your business is barely possible when you keep losing customers.

Luckily, tracking your customer churn can help you spot any sudden spikes in lost customers, which allows you to quickly take action to prevent more customers from leaving your business.

Despite the importance of this SaaS metric, however, many businesses still struggle to calculate their customer churn the right way.

So, in this article, we will cover everything about customer churn, including:

- What Is Customer Churn

- How to Calculate Customer Churn

- Why Should You Calculate Customer Churn Rate

- How to Reduce Customer Churn

- What Customer Churn Rate is Acceptable

- Customer Churn Rate Examples from Real SaaS Companies

What Is Customer Churn?

Customer churn, also known as customer attrition, is simply the loss of customers.

In other words, customer churn happens when your customers stop buying your products, services, or they simply stop interacting with your business.

Some of the most common causes of customer churn include:

- Your product doesn’t meet your customers’ expectations.

- Your competitors offer better deals and solutions for your customers.

- Your prices are too high.

- Your product or your market is seasonal.

- Your customer service isn’t up to par.

Besides causing revenue loss, customer churn can also hinder your business’ growth.

Not to mention, customer acquisition cost is typically larger than that of customer retention.

In fact, acquiring new customers can cost you from 5 to 25 times more than retaining your existing customers, so customer churn can take a heavy toll on your finances.

If worse comes to worst, customer churn can eventually lead your business to bankruptcy. For this reason, reducing customer churn is vital to your business’ success.

How to Calculate Customer Churn?

As a general rule, you want to calculate your customer churn every month.

This way, you will be able to track how many customers leave your business and, if necessary, make changes to reduce your customer churn before it’s too late.

The easiest way to calculate customer churn is by using the customer churn rate formula.

While there are many variations of this formula, overly complicated calculations can be time-consuming. When it comes to customer churn, though, you want to waste no time and handle the situation as quickly as possible.

For this reason, we will share a simple formula that will help you calculate your customer churn in seconds.

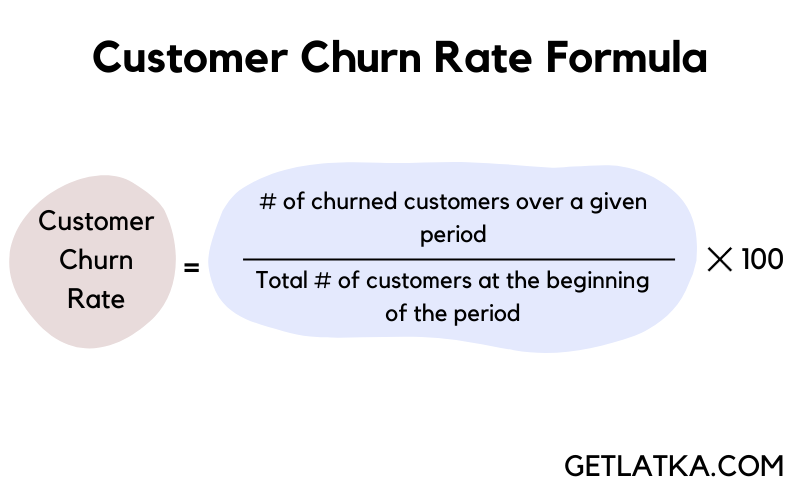

Customer Churn Rate Formula

Here’s a straightforward customer churn rate formula that allows you to quickly measure customer churn:

Customer Churn Rate = (number of churned customers over a given period / total number of customers at the beginning of the period) x 100

In this formula, you want to multiply the number you get by 100. This way, your customer churn rate will be expressed as a percentage, making it easy for you to compare the ratio between your total customers and lost customers.

Now, let’s see how you could put this formula into practice.

Let’s say you want to calculate your customer churn rate for the previous month.

If you had 80,000 customers in total in the beginning of the month and 7500 of them left your company over the course of the month, that leaves you with 72,500 customers.

Here’s how you would use the customer churn rate formula to calculate your company’s customer churn in this case:

(7500 / 80,000) x 100 = 9.4%

Based on the formula, your customer churn rate would be 9.4%.

Why Should You Calculate Customer Churn Rate?

Let’s be realistic – you can’t expect all of your customers to do business with you forever.

In other words, some customer churn is unavoidable, and most likely it won’t noticeably affect your business.

That said, if your customer churn is consistently high – and only getting higher each month – it can lead to some serious consequences, such as financial trouble and tarnished brand reputation.

So, let’s take a closer look at the 3 main reasons why calculating your customer churn rate is important for your business success.

#1. Manage Your SaaS Finances

More often than not, SaaS businesses use a recurring subscription revenue model. This means that, instead of receiving a full payment for the product upon selling it, such businesses generate smaller amounts of revenue each month.

Now, if your customer churn is significantly higher one month compared to the previous month, it’s very likely that your monthly recurring revenue (MRR) for that month will decrease.

In turn, this can impact your business plans as you might not have enough funds to reinvest into your business (e.g: you may not be able to introduce new products or features as planned).

Tracking your customer churn rate, however, can help you manage your recurring revenue loss.

Essentially, if you calculate your customer churn rate every month, you may notice a pattern that can help you predict and handle recurring revenue loss.

You may notice, for instance, that your customer churn rate tends to increase in the summer months. This information can help you plan your finances to prepare for an expected decrease in MRR months in advance.

#2. Increase Customer Retention

As mentioned above, customer acquisition is typically much more expensive than customer retention.

On top of that, your existing customers are more than 3 times more likely to buy your product than prospective customers.

So, needless to say, customer retention is critical to your SaaS business’ success.

As such, you want to regularly calculate your customer churn rate to help you spot sudden increases in churned customers.

While losing customers isn’t great, churned customers are a gold mine of information, so make sure to find out the reasons why they leave your business.

By gathering this information, you can improve your product, customer service, and get ideas on how to implement an effective customer retention plan.

#3. Improve Your Brand Reputation

Simply put, if your customers are leaving your business, they aren’t happy with your services.

Churned customers don’t just cause revenue loss – they can also damage your brand reputation.

In fact, unhappy customers tell up to 15 people about their negative experience, which can be detrimental to your brand and prevent you from attracting new customers.

For this reason, calculating your customer churn rate can actually help you maintain or improve your brand reputation.

By quickly spotting an increase in customer churn and taking action to improve your services, you can increase customer satisfaction, retention, and avoid a tarnished reputation. If you’re lucky, this can even help you regain lost customers.

How to Reduce Customer Churn?

Although reducing customer churn takes a lot of effort, it’s essential to keeping your business healthy and growing.

So, here are some tips that will help you effectively reduce customer churn:

- Collect customer feedback. Before you make any changes, it’s first important to gather customer feedback so you can focus on what really matters to your customers. You can also provide a questionnaire for customers that unsubscribe from your services to learn what exactly causes them to leave.

- Identify and retain the most valuable customers. You want to learn which customers bring the most value to your company and, of course, make sure they continue doing business with you. So, consider calculating your total contract value (TCV) to find out the most valuable customer groups and focus your customer retention efforts on them.

- Reward loyalty. Consider implementing a loyalty program to reduce customer churn and increase their retention. Providing your most loyal customers with incentives, such as discounts, might make your customers feel more appreciated. In turn, they may be less likely to leave.

- Ensure high-quality customer support. Your customers expect to get help as soon as they need it. As such, make sure your company provides exceptional customer support. Instead of just using email for customer support, for example, provide various real-time options, such as live chat and phone support.

- Provide education resources. Depending on your product, your customers may need some help learning how to use or navigate it. So, make sure to provide your customers with helpful guides, how-to videos, and other useful digital resources. This way, you can ensure that your customers won’t leave quickly after signing up.

- Improve your product. To make sure that your customers don’t switch over to your competitors, you want to constantly look for ways to improve your product and services.

What Customer Churn Rate is Acceptable?

Ideally, you want your customer churn rate to be as close to 0% as possible.

However, that’s fairly unrealistic as it’s impossible to retain 100% of your customers at all times.

As a general rule, B2C companies will usually have a higher customer churn rate than B2B companies.

That’s because compared to B2B companies, B2C companies typically have:

- A much larger customer base, which means that such businesses attract and lose customers much quicker.

- Cheaper subscription plans, which can lead customers to make impulsive decisions, such as buy and cancel plans without putting in much thought into it.

- More competition, which can make it more difficult to retain your customers.

As such, there’s no right answer as to what customer churn rate is acceptable since it depends on a variety of factors, including your business model, company size, price point, and more.

Nonetheless, the average customer churn rate for B2B companies is around 5%, while B2C companies have a customer churn rate of around 7% on average.

What Does My Customer Churn Rate Mean?

Generally speaking, the closer your customer churn rate is to 0%, the better, as that means you aren’t losing many customers.

However, even if you have a higher than average customer churn rate, your business can still be successful.

For example, if you have a 10% monthly customer churn rate, but your expansion MRR rate is 50%, you will still have a positive MRR growth and cash flow.

So, to get a clear picture of your business’ financial health, it’s important that you track other SaaS metrics alongside your customer churn rate, such as:

- Monthly recurring revenue (MRR)

- Total contract value (TCV)

- Annual contract value (ACV)

- Revenue churn rate

Want to learn how to manage your churn? Check out our churn management guide.

Customer Churn Rate Examples from Real SaaS Companies

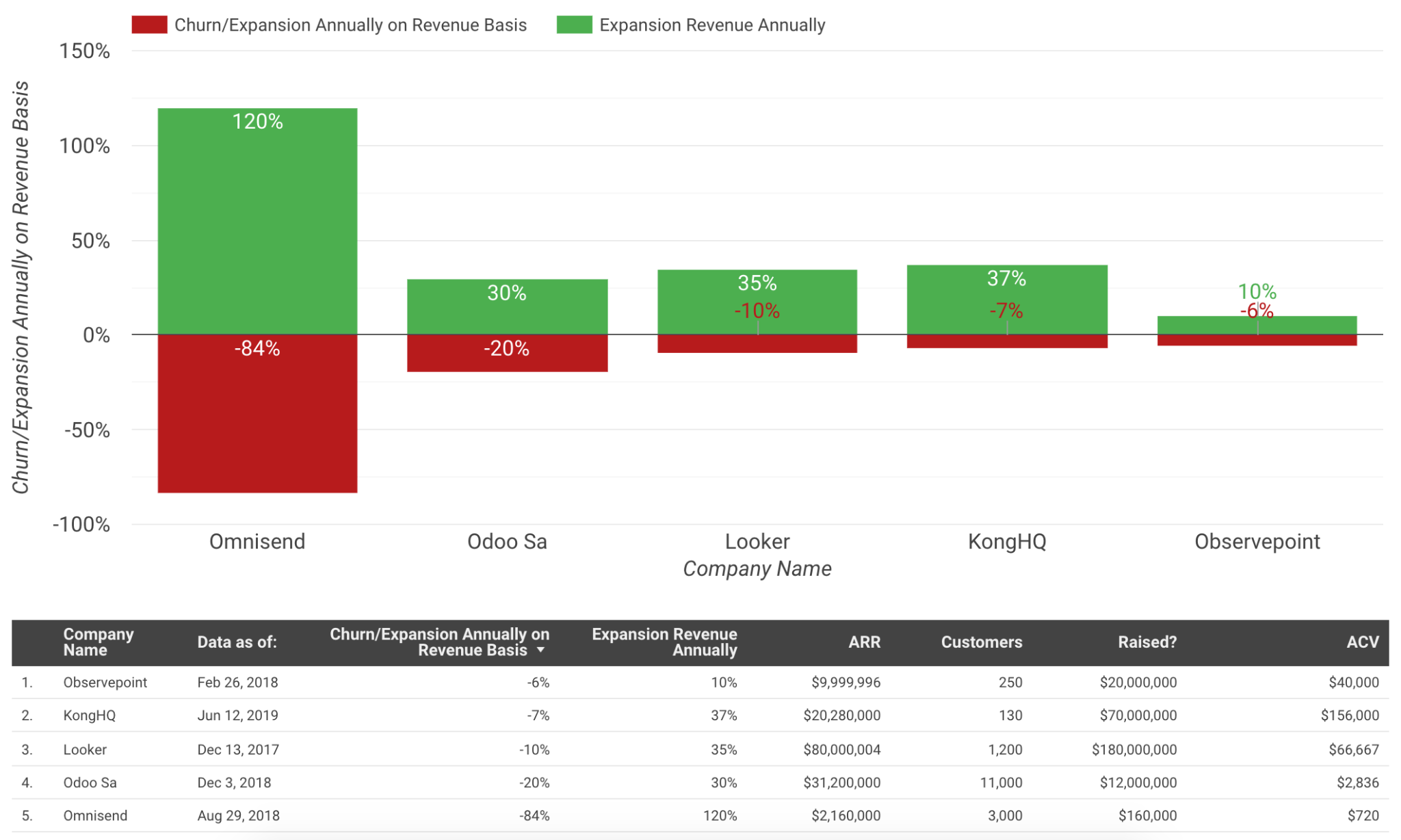

Now that you know what customer churn rate is acceptable, here are a few real-life examples of customer churn rates from different SaaS companies:

- Observepoint has a 6% customer churn rate and a $40,000 annual contract value (ACV).

- KongHQ has a 7% customer churn rate with a very high ACV of $156,000.

- Looker has a 10% customer churn rate, 35% annual expansion rate, and nearly $67,000 ACV.

- Odoo Sa has a 20% customer churn rate with 11,000 customers and a $2000+ ACV.

- Omnisend has a whopping 84% customer churn rate, 120% annual expansion rate, and an ACV of just over $700.

Key Takeaways

And there you have it – now you know just about everything you need to know about customer churn.

Before you go, here’s a quick recap of the key points of this article:

- Put simply, customer churn refers to the customers that no longer interact with your business.

- To calculate customer churn, you should deduct the total number of customers from the number of lost customers over a specific period and multiply it by 100.

- Calculating your customer churn can help you manage your budget, improve customer retention, and protect your brand reputation.

- You can reduce customer churn by implementing a loyalty program, identifying and rewarding your most valuable customers, and ensuring great customer service.