Article written and analysis by Micha Katz of Aream.co based of data from Latka.

Claudio Erba used to be a university professor in Italy. He needed a way to share handouts with students digitally, so he built an open source tool for that.

In 2005, corporate customers started ringing him to buy his software and Docebo was born.

Fast forward to 2019, Docebo has grown into a global cloud-based Learning Management System (LMS) helping the likes of Uber, Starbucks and Docusign increase employee performance and engagement.

“We’ve Passed $26m in Revenue and 1,400 Customers”

Claudio came on the show last year to talk about his journey: in mid-2018 Docebo was doing ~$26m in ARR from 1,400 customers. Average ACV was $20k and CAC payback was 12 months.

The business had grown efficiently taking only $10m of primary capital over the years, and was close to breakeven.

A few days ago, Docebo announced that it had filed a preliminary prospectus for an IPO in Canada. While we wait for the detailed prospectus, let’s take a guess at what we can expect from Docebo’s listing.

Back in mid-2018, Claudio was expecting a 68% top line growth for the year to come. Let’s assume 60%, which would bring current ARR north of $40m, and extrapolate that up to December 2019, at which point the business should hit $45m in ARR.

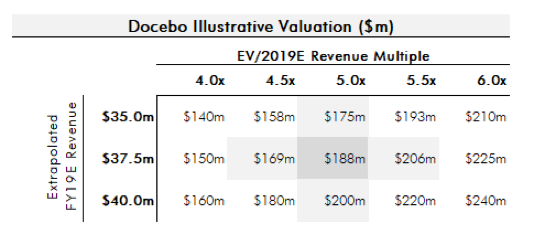

Given the growth rate, full year revenue for FY2019 should end up somewhere around $36-38m.

What can Docebo expect in terms of valuation at IPO?

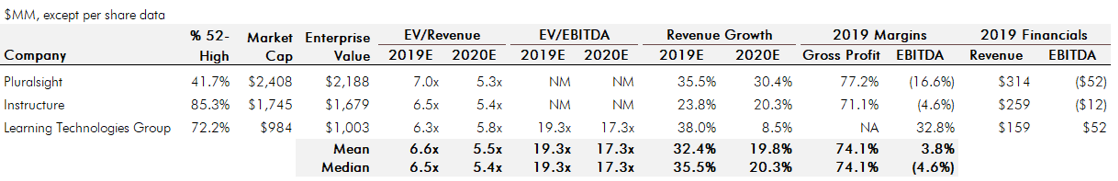

Listed Edtech / LMS SaaS peers such as Instructure, Learning Technologies Group and Pluralsight are trading between 6 and 7x 2019E revenue.

These are much larger businesses still showing solid growth as well as superior retention rates (120%+ net revenue retention for Pluralsight, vs. 97% for Docebo), which should justify a premium to Docebo’s future multiple.

Recent small cap M&A transactions in the space include acquisitions made by Learning Technologies Group (Breezy HR for 8x revenue and Rustici Software for 6x revenue) as well as Adtelem’s acquisition of OnCourse (4x revenue).

Who Gets Rich?

Docebo’s majority shareholder, Canadian private equity firm Klass Capital, certainly knows how to time an IPO on the Toronto Stock Exchange, having successfully listed restaurant chain Freshii two years ago. The broader public SaaS universe is currently trading at historic highs and 2019 has been a very strong year for software IPOs.

Docebo is clearly an attractive asset: the business has quickly gained market share in the $20bn+ global e-learning market. It has successfully scaled internationally while remaining capital efficient.

Lastly, its product is widely acclaimed and featured in the top right hand corner of G2 Crowd’s Corporate LMS software grid, comparing favorably with enterprise e-learning suites from Adobe, Paycom, SAP or Cornerstone OnDemand.

Docebo Likely IPO At 5x, $180m Enterprise Value Day 1

Still, with full year revenue most likely to be below $40m, Docebo will end up at the (very) small cap end of the market. This cohort consistently gets valued at a discount.

Based on where large cap LMS SaaS stocks are trading (6 to 7x), let’s guess that Docebo will IPO at 5x 2019e revenue, i.e. $180-200m Enterprise Value.

No doubt this will still be a fantastic outcome for Claudio Erba and Kass Capital.