After spending 17 years in sales and consulting, Kiran Menon, Tydy Co-founder and CEO, noticed the severe lack of effective onboarding processes in his enterprise network. In 2017, he and two school friends from years ago decided to explore fixing an overlooked problem in the marketplace. Tydy is an employee data and onboarding platform that found its blue ocean with enterprise accounts.

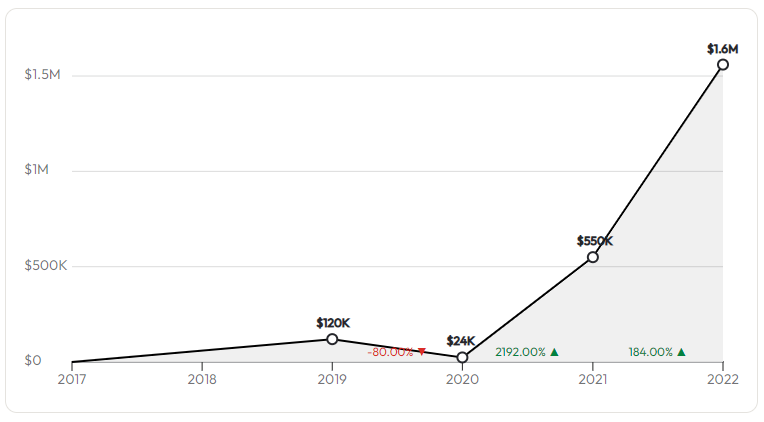

While the pandemic stifled many businesses, Tydy enjoyed explosive 12x growth in just 3 years with only $1m in outside VC support. Menon sat down with the GetLatka team to share why he could double his subscription ACV in one year, how he got customers to pay for his POC design, and what made him focus on enterprise customers.

- Team of 27, with 19 engineers in Bangalore and 2 quota-carrying sales reps

- 17 enterprise customers, up from 8 a year ago

- $1m over 2 pre-seed rounds

- $1.56m ARR

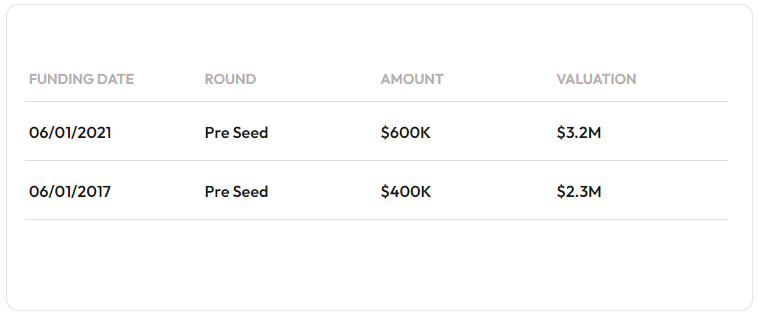

$400,000 pre-seed from multiple angel investors in 2017

To launch Tydy, Menon and his two co-founders raised $400,000 in pre-seed funding for 17.5% of the company in 2017. By 2019, they made their first dollar, hitting $120,000 in ARR. While this initial investment helped launch the company, the savvy co-founder shared with Latka that their first customers paid for the POC.

First 2 enterprise customers pay for POC with $5 per user fee, no platform charge

Impressively, Menon shared how he got two early customers to pay for the POC. “We built the POC with Unilever and Fidelity Investments. They helped us co-design the solution, so they only paid a per-user fee of $5,” he shared, adding, “My sales background helped to close those deals.” Manon added that they started with one geography and were able to show value in 6 months, which helped open new opportunities within the same accounts.

Tydy revenue model pivots to $40k subscription plus utility fee

During the development of the POC, Menon and his team realized that the revenue model needed to include a based annual fee for access to the platform (with an estimated number of employees), plus a “top up” fee for employees onboards over the estimated amount. Two years ago, Menon and his team set the annual subscription at $40k.

Pandemic led to sales growth: $275,000 ARR in 2020

As other businesses struggled, Menon explained how the pandemic accelerated the growth of their business. “In 2017 and 2018, I talked to many enterprise executives. The workplace was exploding, but onboarding tools were still considered a nicety before the pandemic,” Menon revealed. The pandemic moved Tydy into the must-have category, and business took off.

Platform subscription fee doubles to $80k

A year after setting the price at $40k, Menon doubled the price to $80k. “Once we saw the value of the platform, we were confident in doubling the ACV to $80k,” explained Menon. Tydy serves customers like Genpact, ABInBev, and Unilever by bringing together HR data and ID systems. “People now have a single place to go to orchestrate processes, onboard people faster and smarter, and retain them longer,” summarized the CEO.

ACV rises from $600,000 in 2021 to $1.56m in 2022; new customers sign 3-year contracts

A 3-year contract is now the standard as the number of enterprise customers grows to 17 (in 25 countries). Each customer continues to onboard an average of 2-5,000 new employees each month. During the last 12 months, revenue jumped from $600,000 to $1.56m ACV.

3X YOY growth as enterprise accounts doubled from 8 to 17 in one year

As Latka queried Menon about the source of revenue growth, the CEO attributes it predominantly to doubling the number of new enterprise accounts. “If you can show value with your solution, other enterprises want to latch on; their problems are similar,” Menon explained.

Second pre-seed round of $600k in 2021

Latka shared his admiration for the capital efficiency of Menon as his co-founders, sharing a familiar sentiment, “If you’ve raised less than you ARR, then you’re capital efficient and still bootstrapped.” However, Latka asked Menon why they needed to raise a second round at $600,000, given that they were already driving revenue. Menon explained it as a function of the enterprise deals, “We need cash flow to complete enterprise deployment. Contract to deployment is about 4 months,” he clarified.

2021 pre-seed cost 18.5% at $3.2m post-valuation

When asked why the second pre-seed post-valuation showed such a low multiple, the Co-founder lamented, “Traditional SaaS businesses sell to SMBs. Enterprise SaaS suffers from more questions from VCs, who are unsure about their future. As a result, our multiples are not as large.”

Team of 19 engineers in Bangalore

The entire Tydy engineering team works out of India. Says Menon, “My Co-founder is based in Bangalore. He finds our engineers for about $2m Indian rupees ($30,000 USD). He further explained, “It jumps to $60,000 USD if you want a seasoned pro with 7 years of experience.” Latka noted that a similar engineer in the US would cost $200,000 per year.

2023 GTM expansion in US HQ, sales rep paid $70k salary + $70k commission

While Tydy currently employs 2 quota-carrying sales reps, Menon explained that the GTM team would expand in the US to include SDRs, AEs, and account management. “We have huge upsell opportunities and need to build our customer relationships,” explained the CEO. He added that his current sales rep is paid a $70k base salary plus a 10% commission on a quota of $700,000. “He shadowed me for 2-3 years before doing sales on his own,” said Menon.

No real competitors

According to Menon, Tydy has no real direct competitors. “Internal teams are our biggest competition,” noted the Co-founder. He added that his enterprise customer work with companies like ServiceNow, ADP, and Okta, and Tydy brings all of those together into a single dataset. “The closest company doing what we do is Rippling, but they focus on SMBs,” he added.

Tydy founders split equity equally at 33%

Co-founder Menon confirmed that he and his two co-founders went to school together, then reconnected years later to start Tydy. They amicably agreed on splitting equity three ways from the beginning.

Famous 5

Favorite book: The Monk Who Sold His Ferrari, by Robin Sharma

CEO he’s following: Richard Branson. Kiran shared that he’s been a fan since college.

Favorite online tool: Slack. “I love using Slack; it’s so easy and quick.”

Balance: Kiran is 40, married with 2 children. “I have two kids and a startup. I get 6 hours of sleep a night if I am lucky,” quipped Kiran.

What does he wish he had known at 20? “I wish I had known that Tydy was a possibility.”