Justin Teague, CEO of SmartBear, breaks down the company’s expansion, retention and how it meets the software needs of 7,000 new customers annually.

Software testing and development company SmartBear is used by more than 24,000 organizations, including companies like Pfizer, Honda and Adidas.

In an interview with Latka, CEO Justin Teague says SmartBear serves clients like “the bank you use and the guys you order your pizza from.”

“As they build out their web applications or their mobile apps, we provide the lightweight, flexible quality tools, making sure that it runs and it runs as expected,” he says. “And when 10,000 people try to log in at once and order a pizza, it doesn’t crash.”

That means doing quality assurance pre-release and also working in a continuous deployment environment as well.

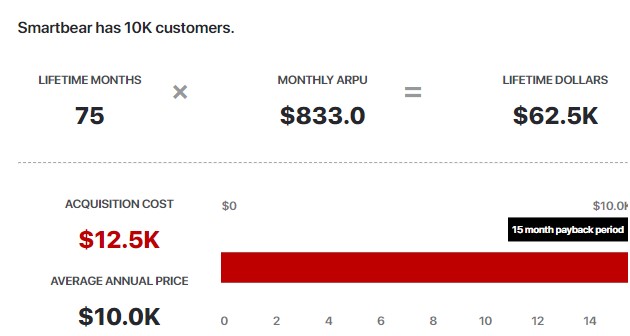

SmartBear offers multiple products and different subscription models — some starting around $100. But the average customer transaction is about $2,500 per year and Teague says the company will acquire around 7,000 users at that level annually. To get a sense of revenue growth, combine new revenue with expansion revenue and SmartBear has tracked itself to hit $100 million ARR.

Source: GetLatka

“Part of our disruption and how we’re being transformative is we run our entire business model off of a trial-and-buy concept — even all the way to the point where we have a couple of the leading open source tools in our market,” Teague says. “So we want to create a completely frictionless buying and using experience.”

Teague, who was SmartBear’s COO before becoming the CEO, says growth is almost evenly split between new revenue and expansion revenue. He says net retention — which includes churn, employee retention, as well as add ons — is at 115% to 120%.

But Teague says his preferred metric is gross dollar retention.

“It tells me if I wake up in the morning with 10 customers paying just $10, and I end the year, how many of those 10 customers are still paying that original $10?” Teague says. “They might have bought more stuff from us, but I want to make sure that they’re happy with what they originally were using.”

Teague says SmartBear has a gross dollar retention around 80%, but he hopes to get it up to 90%.

To track customer acquisition, SmartBear monitors the amount it takes to acquire a dollar of new revenue rather than a new customer. Teague says the aim is to stay below $1.25.

The company has about 400 employees globally with six offices, the biggest of which are in Boston and Tula, Russia. Soon after Teague became CEO, the company was purchased by the private equity firm Francisco Partners. Teague says public ownership can be a great option for companies, but he sees value in staying private for now.

Get to Know SmartBear CEO Justin Teague

Name: Justin Teague, age 45, married with three kids

Where to find him: LinkedIn

Company: SmartBear

Noteworthy: He wishes he had taken more risk. The time to take it, he says, is when you’re young. He says to accumulate as much experience as you can early.

Favorite business book: A biography of Benjamin Franklin

CEO he’s following: Jeff Bezos

Favorite online tool for building the business: professional Slack, personally Flipboard

Average # of hours of sleep/night: about 8

Transcript Excerpts

Attracting customers with a try-before-you-buy model

“That’s a pure monthly pay-as-you-go. You can take your application, and instead of having some sort of labs or a bunch of phones in the background, you can test it on as many configurations and devices you want. That’s a ticket to the game. And then if you have to have spike usage, you pay for spike usage. And then we have other tools that are traditional annual subscription payments.”

Differentiating metrics to calculate growth

“You have to cut it a couple of different ways. We do look at it by logo, then we look at it by product. And then we look at it by total spend. Because you’re right, it’s tough at a logo level because someone might spin up a mobile project, buy a bunch of our stuff, that mobile project goes away, but those same licenses might then be migrated to a new project. Is that a loss or not? So you have to look at it a couple of different ways. For us, it’s more the trend that’s more important than the industry benchmarks.”

Weighing the benefits of public ownership

“Do you want to be public? In today’s world, there’s a lot of investment around private equity, and that can be a great partnership opportunity for people … but it’s all just based on the economics at the time.”

Thinking about future growth

“We try not to focus on an outcome as much as building just a great company. Other CEOs, I’m sure would tell you there’s a dangerous trap to fall into, to think you’re going to architect your outcome as much as focus on growth, build a great company, make sure your customers are happy and satisfied, and they love what you do and what you provide. And you’ll get there. And for us, it’s a function of we’ve got these 20 million downloads, how can we create a more compelling product so that the customer is compelled to sign up and actually buy after they try a portion of it? And then, how can we continue to solve problems across the software development life cycle and expand our footprint?”

Full Transcript Interviewer: Hello, everyone. My guest today is Justin Teague. He’s responsible for SmartBear’s strategic direction and overall operation. Before his role as CEO, he served as SmartBear’s COO and president where he oversaw all sales, marketing product management and strategy functions, as well as execution for the company. He came to SmartBear from Bullhorn, where he was COO prior to that. Justin, are you ready to take us to the top? Justin Teague: Yeah, I love it. Let’s go. Interviewer: All right. Tell us what SmartBear does. And what’s the revenue model? How do you make money? Justin Teague: We focus on helping companies through the digital transformation, anybody that’s developing a software application today to accelerate their commerce or internal processes. And we’re the quality tools provider behind those applications. So our customers are the bank you use and the guys you order your pizza from. As they build out their web applications or their mobile apps, we provide the lightweight, flexible quality tools, making sure that it runs and it runs as expected. And when 10,000 people try to log in at once and order a pizza, it doesn’t crash. Interviewer: So is this like if someone’s pushing code on a continuous integration schedule, you are part of a testing process pre-release, or you’re the first test once it’s out in the public? Justin Teague: You got it. We want everybody to be doing quality pre-release, and the quality markets moved from traditional QA groups into now what you’re talking about, a dev ops, continuous deployment environment where testing is shifting left into the developer world. We serve both masters. Interviewer: Walk me through how people will pay for the product. Is it a pure play SaaS? Justin Teague: Yes. Part of our disruption and how we’re being transformative is we run our entire business model off of a trial-and-by concept, even all the way to the point where we have a couple of the leading open source tools in our market. So we want to create a completely frictionless buying and using experience let’s say, for our customers. Justin Teague: And as such, they’ll trial, they’ll buy, they’ll sign up. Our products can cost anywhere from $100 to a couple 1000, but it’s a pay-as-you-go subscription model. And some of them are pure cloud SaaS delivery. Others are on desktop. Interviewer: Wait, Justin. So break it down for me. Pay-as-you-go and SaaS are maybe I would say two very different business models. Is it like there are buckets of subscriptions monthly that get you a certain usage? And once you pass the usage threshold, you got to go to an upper bucket? Justin Teague: Yeah. It depends on the product, but yeah. So we have a product called cross-browser testing, for example. That’s a pure monthly pay-as-you-go. You can take your application, and instead of having some sort of labs or a bunch of phones in the background, you can test it on as many configurations and devices you want. That’s a ticket to the game. And then if you have to have spike usage, you pay for spike usage. And then we have other tools that are traditional annual subscription payments. Interviewer: I want to break more into your story and avoid going down every customer cohort. So if I forced you to pick an average, what’s the average customer paying you per month, would you say? Justin Teague: Well, I’ll give you a better one. Our average transaction is about $2,500. And so- Interviewer: Monthly or annual? Justin Teague: Annual. That’s an annual, yep. Interviewer: That’s helpful. Justin Teague: And we’ll acquire about 7,000 customers a year that way. Interviewer: Very interesting. That’s a great growth rate. So give us more of the backstory here. Well, were you there when the company launched, or did you join after? Justin Teague: I did join right after. The company was launched by an engineer that really wanted to solve problems for other software developers, and with this concept of frictionless and much easier way to go grab an application, deploy it and use it. And along- Interviewer: In what year did he or she do that? Justin Teague: It was about 2003. And that was a code collaboration product where engineers could together, keep track of the code and who was making changes and whatnot. Along the way, we found very similar companies, founder-led passionate software engineers that were developing tools to fix problems for other software engineers in the development environment, and embracing this idea that you should be able to download, try. Justin Teague: And if you’re getting value, then I want to buy it. I don’t want to go through days and weeks of evaluation. So we’ve accumulated over the time, a collection of products that serve this need with the same methodology and philosophy across the software tool … sorry, the quality tools market. Interviewer: Again, fast forwarding the story. How did you move from joined the company, then COO, then CEO? Justin Teague: I joined because essentially, we were hitting a point we’re great technologies, but the company really needed to scale. And so, how do we go take this … We have 20 million downloads a year, for example. We process about 400,000 leads, people that raise their hand and say, “Hey, I’m trialing. I’d like to buy.” Justin Teague: And so the operational efficiency of now trying to figure out how do we manage this and then expand, we’d like to add or build more tools to our portfolio to serve this need. And so I came in at the point where the investor said, “Great products, we love this try-and-buy high velocity concept, help us really optimize it and make it scalable.” Interviewer: What year was that? Justin Teague: Two years ago. Interviewer: So you joined in 2015 as COO, or directly as CEO? Justin Teague: I came in as COO and transferred to CEO. Interviewer: And was that part of a funding round? Were you in EIR somewhere and they said we’re not ready to putting the money in unless you bring on Justin? Justin Teague: Yeah. So we just sold to Francisco Partners in the spring. I had transitioned to CEO before that, but it was part of building SmartBear 2.0, the transition of our company. Interviewer: So the initial creators, I assume, cashed out and now you’re taking it under the private equity firm? Or is it a private equity firm? Justin Teague: It’s a private equity, yep. Interviewer: Right. So, how much capital had you have the company raise before the private equity firm took it over? Justin Teague: We acquired smaller companies along the way, founder-led. One of them, for example, was as small as a million dollars. It’s now about $45 million of our revenue. Many of those founders are still here, cross-browser testing that I mentioned earlier, in that company. And so we make them part of our innovation centers, which is why we have six locations around the globe. So that’s the genesis of how we got here. Interviewer: But it was all self-funded, or have you raised outside capital before the exit to a private equity firm? Justin Teague: Great question. Each of the companies had their own self-funding model or bootstrapped, and then the previous investor put some funding behind it in order to buy and roll up. Interviewer: So, how much had SmartBear raised? Just SmartBear. Not the companies you bought, just SmartBear. Justin Teague: I don’t have the exact figure on how much SmartBear has raised. Interviewer: More than what, definitely? Justin Teague: I think it was in the million and a half range. Interviewer: Oh, so not a lot? Justin Teague: No, no, not a lot. The company itself was in the couple of million dollar range when it was first put together with another company. Interviewer: Got it. So there’s a lot of mergers, M&A, sell that part, bring this part on stuff going on? Justin Teague: Yeah, yeah. We’re I would say entrepreneur friendly. You can build a million dollar company, get a payout to us and then become part of the company where we have innovation centers that are still driven by our founder-led owners. Interviewer: What are you at today now, in terms of total customers on the platform? Justin Teague: We are going to be at 10,000 customers. Many, many more users, of course, hundreds of thousands of users. And we’re approaching about a $100 million. Interviewer: I was going to say, so do you think you’ll break that? You have about 35, 40 more days left in the year. Will you break it? Justin Teague: This year, our target is just under. We’ll definitely break it next year. Interviewer: Now, I’m doing my math wrong here. So if I take 10,000 customers times that $2,500 ACV average you just gave me, obviously that’s 25 million annually. I’m missing 75 million bucks of revenue. Where is that? Justin Teague: So two answers. One, the beauty of recurring revenue. We have an existing customer base. That 2,500 transaction is our new software transaction, our new customer acquisition. And we have an expand model. So we have customers that, for example, we have developer tools. Five developers writing the next mobile application, download and like it, it spreads. And we might wake up one day, two years later and find out that there’s 200 users in the same account. Interviewer: Got it. So if I take the 100 million divided by 12, so call it 8.8 million ish or maybe eight point, whatever, eight million per month right now, and divide the 10,000 customers into that, they’re paying much closer to eight or nine or 10 grand a year versus 2,500 grand a year on average. Justin Teague: Yeah. Average customer pay, you’re right. Interviewer: Got it. What you were giving me was the average year one contract value is 2,500? Justin Teague: The average new, yeah. The av … sorry. Be super clear. The average first-time purchase. Interviewer: I see. Justin Teague: The average first transaction. Interviewer: I see. That makes complete sense. That makes sense. Now, help us understand the growth. So take us back 12 months. Where you at 60, 70, 80 million in AR? What’s the growth over the past 12 months? Justin Teague: Yes, we had been growing in the mid teens, so that’s organic. Inorganically, we had been able to grow faster than that. We’re now in the mid 20s. Interviewer: Got it. So you are, I call it 12 months ago, somewhere in the 78, 79? Justin Teague: Yeah, you got it. Interviewer: Very cool. Justin Teague: In the 70s, yeah. Interviewer: That’s great. And where is most of the growth coming from? If I forced you to credit more of the revenue to expansion versus new customers, which category is driving more growth? Justin Teague: We have a lot of customers. What we’re riding right now is it depends on the product. APIs, of course, we’re exploding in the world. We own and develop two of the leading open source tools, one called Swagger and one called SoapUI. And so the growth right now we’re seeing is as more and more of our customers and more of our new customers are facing the challenge of how do we deploy, build and test these API APIs, then we’re riding that wave. And it’s about 50-50 actually, revenue wise, in that park. Interviewer: Oh, wow. Well, I assume because of the large samples that you have of customers and the age of the company, you can pretty predictably forecast what a year one customer expands to in year two. What does that year one to year two expansion revenue look like, typically? Justin Teague: I wish it was that predictable. We have all of the fun retention metrics that hopefully, everyone out there is tracking. And one of them, of course, is net retention. And so net retention includes our churn and current employee retention, plus add-ons. And so our net retention is in the 115% to 120% range. Interviewer: Got it. Justin Teague: That’s the easy metric. But some of our customers are up to million-dollar customers, and they started off with $2,000 spend. Interviewer: Yep. Do you use logo churn at all as an indicator for you? Or is it not relevant because of the vastly different contract sizes? Justin Teague: No, we do. We look at logo churn. My favorite metric is gross dollar churn because it tells me if I wake up in the morning with 10 customers paying just $10, and I end the year, how many of those 10 customers are still paying that original $10? They might’ve bought more stuff from us, but I want to make sure that they’re happy with what they originally were using. Interviewer: What was that over the past 12 months, gross dollar term? Justin Teague: We’re in the right around high 80s. We’re trying to get to 90. Interviewer: And that’s retention, not churn, right? Justin Teague: Yes, sorry. Interviewer: Because if you’re churning 80 bucks on a 100, you’re screwed. All right. Justin Teague: We focus on the positives, not the negatives. Interviewer: Justin Teague: That’s right. Interviewer: So 80% dollar retention. That obviously doesn’t include expansion revenue or all the other juicy stuff you add on top, which gets you up to about 150% expansion year over year? Justin Teague: Right. You got it. Interviewer: Very cool. What do you spend to acquire customers? Justin Teague: We track our CAC on a dollar basis, rather than trying to acquire just the customer. So we think about acquisition in terms of, what does it take us to acquire a dollar of new revenue or new ARR, rather than a new customer? And our metric is we try to stay below a dollar 25. Interviewer: Got it. So basically, what I’m hearing you say is you’ll spend a dollar 25 to get a dollar of new ARR, which means you’re optimizing a payback period for about 12, 13, 14, 15 months? Justin Teague: That’s right. And we’re obviously at mid 90 … sorry, mid 80s retention, where the customer life cycle is a lot longer than that. Interviewer: Because of the huge differences, you probably do cohort analysis on this, I’m sure. But because of the huge difference in contract value sizes, how do you keep yourself honest on what lifetime value is of a customer? Justin Teague: You have to cut it a couple of different ways. We do look at it by logo, then we look at it by product. And then we look at it by total spend. Because you’re right, it’s tough at a logo level because someone might spin up a mobile project, buy a bunch of our stuff, that mobile project goes away, but those same licenses might then be migrated to a new project. Is that a loss or not? So you have to look at it a couple of different ways. For us, it’s more the trend that’s more important than the industry benchmarks. Interviewer: Yep. Interesting. Do you have many cohorts there? I can’t just ask you, so what’s your average lifetime bag because that’s really not indicative, because you have so many different plans. How do you measure it though, tactically? Justin Teague: As you’d expect, it’s based off of when someone buys and they deploy a product, how long do they actually keep that product in deployment? And how long can we count on that dollar of ARR? Interviewer: Got it. SendGrid just went public, the markets are generally feeling good. Tax cuts are coming, everyone is rosy dozy. You’ve got to get to the 110, 130 million ish ARR range to really start thinking, I think, thinking about IPOs based off other CEOs I’ve talked to in that range. How do you come up, and how do you guys think about that decision? Justin Teague: We try not to focus on an outcome as much as building just a great company. Other CEOs, I’m sure would tell you there’s a dangerous trap to fall into, to think you’re going to architect your outcome as much as focus on growth, build a great company, make sure your customers are happy and satisfied, and they love what you do and what you provide. Justin Teague: And you’ll get there. And for us, it’s a function of we’ve got these 20 million downloads, how can we create a more compelling product so that the customer is compelled to sign up the actual buy after they try a portion of it? And then, how can we continue to solve problems across the software development life cycle and expand our footprint? Interviewer: Let me ask this question differently, Justin. Justin Teague: Oh, sure. Interviewer: You know how to grow the company. It’s just a matter of cash, right? Justin Teague: Yeah. Interviewer: You’ve got to be predictable, you know how to do it. What’s the firm now that owns you guys now? What are they called? Justin Teague: A company called Francisco Partners. Interviewer: So Francisco Partners says, “Hey, we can either take this term sheet for 200 million from X, Y and Z investors or family offices, blah, blah, blah, or we can start looking at an IPO and trying to raise $200 million that way.” How do you make a decision which way to go on that? Which cost of capital is cheaper for you in terms of your energy? Justin Teague: Oh, man. I haven’t had to make that decision yet because we’ve been living in private equity, and private equity is great. I don’t know. Some of that decision, frankly, and I’m not trying to avoid the question is, do you want to be public? Interviewer: It’s them? Justin Teague: Do you want to be public? In today’s world, there’s a lot of investment around a private equity, and that can be a great partnership opportunity for people that wants you to get to scale, but it’s all just based on the economics at the time. Interviewer: Yep. That makes good sense. Where are you at today in terms of the team size? Justin Teague: We’re just going to hit about 400 employees globally, across six innovation sites. Interviewer: And where are your biggest offices? Justin Teague: Our biggest office is Boston. So right outside of Boston, Somerville, [Galway 00:17:07], where we have incredible talent and we have access to that talent, which isn’t always true in the competitive world of Boston. And then we have Tula, Russia, which is one of our offsite centers. Interviewer: Interesting. Justin Teague: Sorry, offshore. Interviewer: Boston and Russia. Very good. Last question here before we wrap up with the famous five. Over the past month, how much are you spending just on paid acquisition across all the channels, conferences, ad spend, all that jazz? Give me an order of magnitude. Justin Teague: Including headcount? Interviewer: No, not including headcount. Justin Teague: Just spend? And you’re saying in the last month? Interviewer: You can give me a year if it’s easier. Justin Teague: Or would you want the last quarter? We probably spend about $750,000 a quarter. Interviewer: And is that mostly AdWords or conferences or what? Justin Teague: We have a big inbound demand engine, so a lot of content based. The trial-and-buy high velocity motion for us demands us getting people to come to us. Our marketing team does an amazing job of navigating, how do you create demand throughout the ecosystem of the developer and test community? Interviewer: Good stuff, man. Let’s wrap up here, Justin, with the famous five. Number one, what’s your favorite business book? Justin Teague: Ironically, as I was thinking about this, my favorite business book is a bibliography of Ben Franklin. If you go back in time, just it doesn’t matter where you go, innovators happened. And Ben Franklin, you look back and you go, “It’s amazing what this guy invented from [crosstalk 00:18:44].” Interviewer: Are you talking about this one? Justin Teague: Ah, there you go. Interviewer: It’s a good one. Justin Teague: You find out that the guy invented the library. It’s like, wow. Interviewer: The Dewey Decimal System. Justin Teague: Right, right. Interviewer: All right. Number two. Is there a CEO you’re following or studying right now? Justin Teague: The book I’m actively reading right now is actually The Everything Store, the Amazon story. Interviewer: Jeff Bezos. Justin Teague: Yeah. You can’t do anything but admire what he’s done. But what I learned through that book is he has a maniacal focus on the customer, and that’s something that we’re trying to get closer and closer to. Interviewer: Number three. What’s your favorite online tool, besides your own? Justin Teague: I was thinking about that as an answer, but I’m sure you get that one all the time. I love Slack because frankly, we’re a big diverse, geographically dispersed company. Personally, my phone, I like this Flipboard product which just accumulates news and you get to subscribe to the things that you want to read, rather than a bunch of junk. Interviewer: Yep. Number three, or number four. How many hours of sleep do you get every night? Justin Teague: I’m pretty good about sleep. I sleep well at night. I don’t know if it’s eight, but I’m approaching eight. Interviewer: All right. And what’s your situation? Married? Single? You have kiddos? Justin Teague: I do. I have a couple of kids. Interviewer: How many? Justin Teague: I got three boys. Interviewer: Three? [crosstalk 00:20:03] Okay, wow. Three kiddos. And how old are you? Justin Teague: I’m 45. Interviewer: All right. Last question. Take us back 25 years. What do you wish your 20 year-old self knew, Justin? Justin Teague: I think my 25 year-old self, I don’t know that I’d change a lot, but of course, I wish I had taken more risk. Because the time to take it is when you’re young and the implications are not quite as let’s say, dramatic. But I accumulated a lot of experience going overseas, living in London, different types of software companies. And I think accumulate as much experience as you can early because you can always leverage it later. Interviewer: There you guys have it from Justin. Joined the SmartBear team many years after the launch. It was launched back in 2003. They’ve grown through a variety of ways, including acquisitions. Obviously, sold recently to a larger private equity firm, but growing rapidly, I think adding 7,000 new customers annually. Interviewer: They’re currently at about 10,000 customers. Grew from 78 million run rate in 2016, so about 12 months ago to over or approaching a 100 million here as we wrap up 2017. They’ve got a really healthy gross dollar retention annually, at about 80, a little over 80%. They’re spending about a dollar 25 to get a new dollar in ARR. Interviewer: Again, helping folks increase the quality of their software through a variety of different ways, including pre-release with their team of 400 folks between Boston and Russia. Justin, thank you for taking us to the top. Justin Teague: Great summary. Thanks, man.