Frequent GetLatka guest Pietari Suvanto, Co-founder and CEO of Vainu, shared how his company pivoted, shed half its clients, and increased Net Dollar Retention during his third interview with Nathan Latka between 2016 and 2023.

Vainu collects actionable firmographic data for customers to seamlessly integrate with CRMs, marketing automation tools, and data warehouses, similar to ZoomInfo, Cognism, and Clearbit. Since Suvanto’s last visit with Latka in 2019, the company has expanded its footprint from the Nordic countries to now offering a global presence.

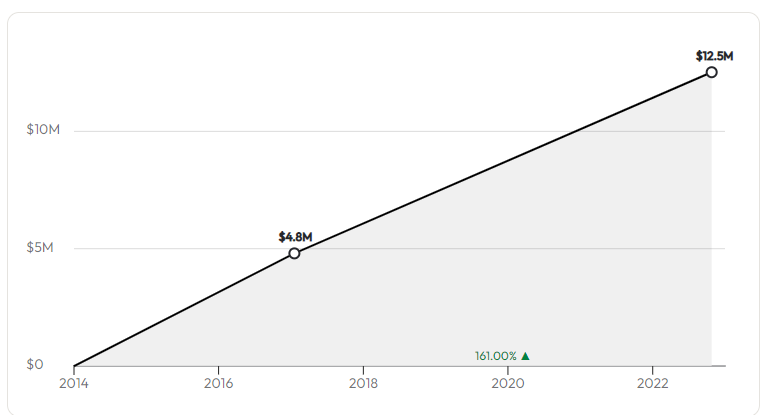

- $12.5m in annual recurring revenue (ARR)

- Team of 140 with 50 engineers, 15 quota-carrying reps

- $4m in VC funding after hitting $10m ARR

- Customer count drops from 2,500 to 1,200 while revenue grows (ACV expansion)

Since CEO Suvanto’s last interview with Latka in 2019, Vainu pivoted their business strategy, which purposely trimmed their customer count in half, from 2,500 to 1,200. And while the annual contract value jumped from $7,200 to $10,000, the real boost came from the value of their largest contracts. “Our largest customers pay several hundred thousand dollars per year now,” Suvanto shared.

Doubled down on 1,200 best customers

According to the CEO, Vainu shifted strategies, focusing specifically on the customers they wanted to keep. “We had a high churn on customers we didn’t want to keep, so they dropped out naturally,” explained Suvanto. The company now focuses its attention on RevOps teams instead of Sales. The product changes reflect the pivot, as Vainu leaned into creating strong integrations and connectors in the areas most important to RevOps teams.

Launched in Finland, Vainu now selling customers globally

With their 2014 launch roots in Finland, Vainu focused on firmographic data for Nordic countries. Since 2019, they have expanded globally, now offering secure, accurate firmographic data from around the world. “We now have a global firmographic data product; we excel at segmenting companies with firmographic data,” noted Co-founder Suvanto.

The big pricing change

Vainu’s pricing model charges customers a fee per account and per data point. Large customers use their data to send to Snowflake or AWS. “Common data points might be a business ID or segmentation data to model campaigns,” explained Suvanto. The CEO reiterated that Vainu is known for their powerful segmentation data. He added that customers are not charged for data updates, noting that they expect their data to be accurate, whether updated “once or 100 times a year.”

$4m VC raised after revenue hit $10m in 2021 and 2022

Since he last met with Latka in 2019, Suvanto raised a total of $4m in VC funding over two small rounds in 2021 and 2022. “We were at $10m ARR when we first raised,” reflected the CEO. “We are at $12.5 now,” he added. Latka chimed in, proclaiming, “If you’ve raised less than your ARR, I still consider you bootstrapped.”

10% equity to employees (ESOP Pool)

While Suvanto and his two co-founders retain the lion’s share of equity, he and his partners set aside roughly 10% for the employees in an Employee Stock Option Pool (ESOP) plan. Latka queried Suvanto about how they created the program. The Co-founder responded, “We came up with a number that felt right. We wanted to cover existing and future employees, so we developed a number for each and added them together.”

Moving 3rd co-founder out of the company

Latka noted that Vainu’s third Co-founder was no longer active in the company and asked Suvanto how he and his other partner dealt with that change. “For us, there was no drama. We all wanted what was best for the company. We discussed what everyone wanted and are now very happy where we are.” He added that their 3rd partner remains an investor but not an active participant.

VC’s own under 5%, $100m valuation

CEO Suvanto confirmed that the VCs owned less than 5% equity in Vainu. Latka estimated the company at a $100m valuation; Suvanto wouldn’t confirm but grinned and suggested that Latka run the math. Would they like to buy out their investors? Suvanto indicated it wasn’t a priority, noting that their focus today is on growing their now-global business.

M&A discussions open, but nothing imminent

Co-founder Suvanto indicated to Latka that he and his co-founders have had open discussions about potential acquisitions and mergers, “but nothing concrete.” He indicated they would look for companies that are a good fit with their advantages. “Our firmographic data and connections are our strength. We have connections that flow into well-known systems. IP data and contact data is what our customers ask for the most,” noted Suvanto.

Prioritizing SEO drives organic traffic for Vainu

As noted in previous interviews, Vainu prioritized SEO as a marketing strategy to drive free organic traffic. “We started out being sales focused. Now that we’re focused on revenue ops, we discuss the importance of good data and what makes good quality data. It seems to work; we get lots of good traffic by being a good leader,” Suvanto clarified. He added, “Aside from creating good quality content, we regularly attend events and talk to many people.”

Net dollar retention increases from 98% to 105% from 2019 to 2023

In 2019, Suvanto indicated that Vainu’s Net Dollar Retention stood at 98%: 12% gross annual churn and 10% expansion. Today’s numbers shifted as churn dropped to 10% and expansion increased to 15%, for a total NDR of $105%. Latka praised Suvanto for the movement from under to over 100%.

Famous 5

Favorite Book: Having recently finished the classic Moby Dick, Pietari named it his new favorite.

CEO he’s following: Pietari shared that he follows many CEOs, so Nathan asked him to name one of his favorite Finnish CEOs. He chose Supermetrics CEO Mikael Thunberg as his one to watch.

Favorite online tool: HubSpot is Pietari’s favorite tool, chosen without hesitation.

Balance: Pietari is 39, married, with no children. He sleeps 7 hours per night.

What does he wish he had known at 20? “I wish I could tell myself that things take time.”