When Lift AI founder and CEO Don Simpson launched his startup in March 2020, he could have had a very bad time. The widespread impact of COVID-19 was just reaching North America, and many businesses were tightening their belts.

Despite the challenges, Lift AI has thrived in 2020. In mere months, Lift AI has gone from bootstrapped with zero revenue to a $1 million run rate. That’s an accomplishment it can thank its highly targeted sales strategy for.

Lift AI is a data-driven, live chat integration that helps companies maximize revenue and conversions on their websites. By analyzing patterns in customer behavior on websites , Lift AI can help companies zero in on strong prospective customers and turn them into recurring revenue through AI, chatbots and live sales agents. The tool was originally spun out of MarketLinc, a live sales chat agency that Simpson launched in 1990 and which hit $10 million in ARR at its peak in 2018.

Less than a year after launching, Lift AI has eight customers who each bring in an average of $12,000 a month in recurring revenue. Customers’ pricing is based on their number of monthly site visitors, with a starting point of $5,500 a month for sites with up to 100,000 visitors a month.

Lift AI also has eight employees to its name, with one quota-carrying, outbound sales rep in charge of $1 million in yearly recurring revenue. That rep uses a razor-focused targeting approach to find the startup’s customers.

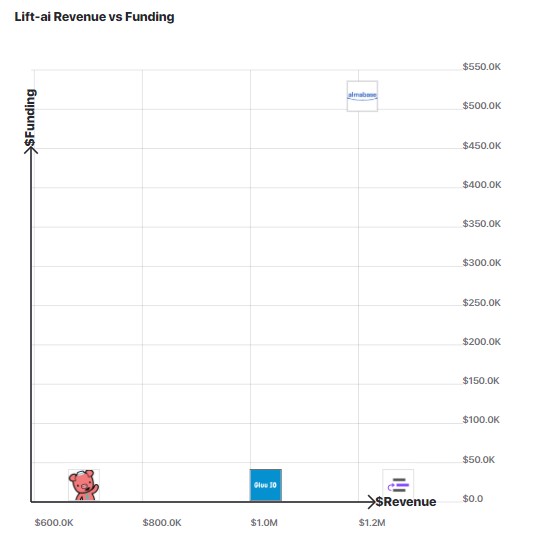

Source: GetLatka

“We should be able to go after the market we’re trying to serve with a pretty clear outbound approach,” Simpson says in an interview with Latka. “There are about 8,000 companies that we identify that have over 50,000 visitors a month in traffic.”

But Lift AI doesn’t stop there. The team uses technographic tools to see which chatbot the sites each utilize, and goes after those that integrate nicely with Lift AI.

“Because we’ve worked extensively in this chat space and work with companies like Drift and LivePerson, we really tried to hone in and narrow our focus from a go-to-market perspective on that group,” says Simpson.

It’s a strategy that’s gotten Lift AI to $1.2 million in ARR so far, and Simpson has no doubts that the team can scale the process.

“One iteration of our [MarketLinc] business used outbound, demand gen, and BDRs,” he says. “We have that in our DNA.”

What is Lift AI’s annual revenue?

In 2020, Lift AI was on track to generate $1.2 million in ARR.

What is Lift AI’s monthly revenue?

In 2020, Lift AI generated $120,000 in MRR.

Who is the CEO of Lift AI?

Don Simpson, age 54, is the CEO of Lift AI.

Transcript Excerpts

You don’t need every detail ironed out before launching

“We’re still playing with the pricing on it. We’ve got an entry point of $5,500 a month, up to 100,000 visitors a month, and then over 100,000 visitors it’s $8,500 a month. But we actually launched the business on the 1st of March, which was weird timing given COVID. So we’re working and still playing with that, but that’s where it’s at right now.”

Stay lean for as long as you can

“It took about four or five years to really make the technology work in Lift AI, and to be able to operationalize based on the scores that we were gleaning from the technology. It wasn’t like we just said, ‘Hey, we did this overnight.’ We had a fairly significant team in India. We outsourced a bunch of the development to a team in Russia. Over the years, as we iterated, we got to the point and said, ‘OK, this technology works and it’s good.’ Now, we’ve got a pretty small team internally, just to continue to fine tune while we try to find that product-market fit. Then we’ll look to scale.”

Scaling can require new tools

“I’ve been reinvesting everything [back into the business]. Now I’m just trying to go on that pretty much break-even line. So we’re bubbling up a little bit above, a little bit below every month, and as we grow, I’m just going to continue to invest and build. We’re now in the midst of actually looking to raise money because I think if we’re going to be really successful with this, it’s going to take a different kind of a war chest.”

Don’t get caught up on valuations

“The multiples with some of this stuff seem a little off for me. [People have valued us] as high as $30 million, but I don’t know. That seems a little nuts to me, to be honest with you — we’ve got lots of work to do and lots of building to do.”

Full Transcript Nathan Latka: Hello everyone. My guest today is Don Simpson. He has pioneered the use of customer engagement to drive revenue for global brands for three decades, first in building inside sales operations, then leading in the use of live sales chat. And now he’s pioneering AI to score website visitors conversion potential to trigger optimal customer engagement. Don, you ready to take us to the top? Don Simpson: Yeah, you bet. Thanks, Nathan. Nathan Latka: That’s a lot of buzz words. Break it down for me. The website is lift-ai.com. What are you guys doing? Don Simpson: So what we’re doing is we had a live chat service for the last 15 years where BPO companies would outsource to us to engage visitors on their website and convert those visitors into customers. And we worked on straight commission. So we’d start out and we’d go in and we’d look at their websites and we’d say, “Well, here’s how much potential revenue that we think we can create for you.” One Fortune 500 customer we worked for, they were doing $150,000 a year in revenue in live chat and we looked at their analytics and did a forecast. Said, “We think we can do 15 million,” and we did 16 and a half million in the first year. Don Simpson: When we started that business, there was probably four or five chat companies in the world, and now everybody and everywhere, this chat market has exploded. So over the years, as we’ve invested in building out that analytics and building out that technology, it became increasingly more powerful. And once we really started to figure it out, we thought, hey, you know what? This is something that we want to take, that experience and background that we have in building and using that technology for our own purposes, and deploy it so that customers can use it to themselves and get- Nathan Latka: So Don, it’s now pure SaaS. What do customers pay you on average to use the technology? Don Simpson: We’re still playing with the pricing on it. We’ve got, I think, an entry point of $5,500 a month. It’s kind of up to a 100,000 visitors a month, and then over a 100,000 visitors. So it’s an 8,500 a month. But we actually launched the business on the 1st of March, which was weird timing given COVID. So we’re working and still playing with that but that’s where it’s at right now. Nathan Latka: Are you pre-revenue, then, Don, today? Any customers or no? Don Simpson: Yeah, we’ve got eight clients in production. We were hoping to hit 100 in MRR at some point this year, and we’ve already hit that so we feel pretty good. But in part of COVID- Nathan Latka: So just to be clear, Don, you’re doing north of a $100,000 per month in revenue. Don Simpson: Yes. Nathan Latka: Okay. Got it. So that’s eight customers paying what, on average, 12,000 a month? Don Simpson: Yeah, yeah. In that range. Nathan Latka: To me, that’s super impressive. I mean, how do you basically launch from scratch and land a bunch of… I mean, these are $120,000 a year contracts you’re landing right off the bat for a chat AI tool. Don Simpson: Well, it’s really a revenue tool. So what we did historically is, with our BPO, we were looking at at a minimum entry point would be about $50,000 a month. So I guess we’re used to dealing in that world and in that space, and typically we would go, depending on what their volume and their ACV was, we would need somewhere between 15% and 40% of the revenue in order to make it viable. And now with this tool, we’re trying to figure out, well, how can we get in? [inaudible 00:03:24] it’s another piece of technology in their stack, somewhere around, 8%, 10%, 12% maximum. That’s where we’re trying to get to with the incremental revenue that we’re generating and what we get compensated for. Don Simpson: But that’s really… Because we work from here, we do it all as a BPO, to now, it’s a SaaS play kind of technology product. Nathan Latka: Totally separate businesses? Don Simpson: Yes. Nathan Latka: Walk me through how you [inaudible 00:03:47]. So just to be clear, you ran an… What was the agency name? Where you were doing the BPO stuff? Don Simpson: MarketLinc. Nathan Latka: Okay. MarketLinc.com? Don Simpson: Yeah. And that business we ran for almost 30 years and have been running for almost 30 years. And it’s still in existence today but this technology business, this Lift AI, is a new product company that we launched. Nathan Latka: Don, let’s stay on MarketLinc for a second. So launched in 1990, been around for almost 30 years. How much revenue did MarketLinc do in 2019? Don Simpson: 2019? I’m not sure. We peaked at about 10 million in revenue. Nathan Latka: In what year? Don Simpson: I would think that would be 2018, maybe 2019. Nathan Latka: Okay. Does MarketLinc own [crosstalk 00:04:30]. Nathan Latka: Do they own any portion of Lift AI? Don Simpson: No, they’re separate companies. Nathan Latka: Okay. Got it. So there wasn’t any conversation around, “Hey, we’re spinning Lift AI out of MarketLinc. MarketLinc should own a portion of Lift AI. They should should have equity.” Don Simpson: There’s a change and transfer of IP and so forth as a result. But it wasn’t- Nathan Latka: Functionally though, how does that work? I mean, there’s a lot of people that seem right now, they’re stuck inside of an agency. They use a little side piece of software to service customers. They’d love to spin it out, but they don’t know where to start. Walk me through how you actually did that economically. Don Simpson: Well, we took… Economically, because I started MarketLinc, and so I own MarketLinc. So for me to go and take and separate these two is relatively- Nathan Latka: Oh, oh, you own 100% of MarketLinc? Don Simpson: Yes. Nathan Latka: Oh, got it. It’s not like you have partners. Don Simpson: I bootstrapped that business. I started just out of university and I’ve been bootstrapping Lift AI. So it’s just me negotiating with me [inaudible 00:05:32] how am I going to set this up to move forward? Nathan Latka: Oh, that’s easy. Don Simpson: It makes it a little simpler. Nathan Latka: So you personally own 100% of Lift AI, the tech tool. Don Simpson: Yes. Nathan Latka: I see. I see. Okay. That makes way more sense. Got it. So, I mean, what’s the team look like today? How many people? Don Simpson: Well, we’ve got eight FTEs and, historically what we did is we had a team in India that was part of the MarketLinc business. We actually had a few iterations on this. It took us about four or five years to really figure this out and make it work- Nathan Latka: Make what work? Don Simpson: To the point… To make the technology work in Lift AI where it works and it’s accurate, and to be able to operationalize based on the scores that we’re gleaning from the technology. To really make it sing, it took quite a few years. It wasn’t like we just said, “Hey, we did this overnight.” And we had a fairly significant team in India. We outsourced a bunch of the development to a team in Russia. And then just kind of over the years as we iterate, we got to the point and say, “Okay, this technology works and it’s good,” but now we’ve got a pretty small team internally just to continue to fine tune while we see and try to find that product market fit. And then we’ll look to- Nathan Latka: So eight full-time folks. How many of those full-time folks are engineers? Don Simpson: Three. Nathan Latka: Okay. Three. Any quota carrying sales reps besides you? Don Simpson: Yeah, well actually, yeah, we have a one. Nathan Latka: Okay. Fair enough. How do you set their quota? Don Simpson: How do you set their quote? I guess that’s a good question. We’re looking for a million dollars a year in new revenue from them. Nathan Latka: Got it. And so do you fall to the ratio where if they hit a million dollars in new AR added, they’re making about one-fifth of that in terms of total earnings? Don Simpson: Yeah. And it costs a little more than that in the first year. You don’t get things off the ground, but that would definitely be [inaudible 00:07:20]. Nathan Latka: Yep. Yep. Yep. Interesting. Do you think you can hire 10 AEs and follow those same economics? Don Simpson: Well, I certainly hope so. One iteration of our business was outbound, demand gen, BDRs. We worked for companies like Xerox in the ’90s doing that kind of work. We worked for Microsoft in the ’90s doing that kind of work. So we have that in our DNA. So my thinking and focus is, is we should be able to go after the market we’re trying to serve with a pretty clear outbound approach. There was about 8,000 companies that we identify that have 50,000 plus visitors a month in the traffic on their website. Nathan Latka: Wait, say that again. You’re targeting how many? Targeting 5,000? 8,000. Don Simpson: 8,000 companies. Yeah. Nathan Latka: With how many hits? Don Simpson: With 50,000 visitors plus a month. Plus we know what their chat tool is. Because we’ve worked extensively in this chat space and working with companies like Drift and LivePerson, And so we really tried to hone in and narrow our focus from a go-to-market perspective on that group. Nathan Latka: That’s compelling. Do you use tools like BuiltWith, or firmographic and technographic tools to find that list where the JavaScript code from Drift has been installed or Intercom has been installed? Don Simpson: Yeah. Yeah. That’s exactly what we did. Nathan Latka: That’s super smart. That’s really smart. Don Simpson: Yeah. Nathan Latka: So you find me, I’m your target. You call me up, you go, “Nathan, screw Intercom. Try Lift AI.” I mean, how do you convince me to switch off my current JavaScript install to you? Don Simpson: Well, we don’t. So you continue to use whatever you’re using. We’re just going to enhance it. So, one of the companies, the initial companies that we’ve launched and got a testimony… We’ve got quite a few good testimonials, actually from short period of time. But one of them, a company called PointClickCare that we increased their lead conversions or number of conversions on their website by 168% in the first month. Don Simpson: And that might be a little high, but I think the lowest one we’ve got so far, I think it’s 63%. Because we’re used to working from that mindset in that model of, “Hey, we can use our technology to help and define who is a good prospective customer on your site.” And bots don’t work for everybody. I mean, bots don’t sell like salespeople do. Maybe one day they will, but they don’t today. So what we do, we go in, we look at their website traffic, and then we say, “Based on the scores, we would suggest that people who fit this profile,” and it works with anonymous visitors, it’s- Nathan Latka: And how are you scoring them? Are you reverse engineering an IP address, and then an employee account at that IP address company or something? Or how are you scoring? Don Simpson: It’s all based on behavior. Over the course of the 15 years with the BPO, we profiled about a billion visitors and we had 14 million live sales interactions. And looking at all of that conversion data, we can go and we can say, “Well, based on the behavior of that visitor on the website, even if they’re anonymous,” and that’s where there’s a lot of companies out there that are doing that IP reveal. But ours works with anonymous visitor data based on the behavior and what they’re consuming on the website. So we can identify and predict the conversion potential and intent, and then reach out and engage those people, commensurate with that score. So if it’s a really high scoring visitor, we can say, “Well, let’s get them to a sales person [crosstalk 00:10:44]

Nathan Latka: Sure, sure, sure. Yeah. That makes complete sense. [crosstalk 00:10:49] Do you pay for it? Don Simpson: If it’s low-scoring visitor-driven, you could still use bots, but you just have to be, I don’t know, more calculated in the way you engage the visitors [inaudible 00:10:55]. Nathan Latka: It has to be lower touch. The economics don’t work as nicely. Do you pay for Bombora data or ZoomInfo data or FullContact data to enrich the data that you’re tracking? Don Simpson: Not yet. Nathan Latka: Okay. So really, you don’t pay anything out any other data providers? Don Simpson: No. Nathan Latka: Huh. Fascinating. Don Simpson: Trying to position it as, you can use all of those things, but you still have a lot of anonymous visitors on your website that you have no idea who they are and what they do. They may have very high purchase intent. Or there may be somebody on your site that doesn’t necessarily reveal themselves. If you do have an IP reveal, you could say, “Based on our score, based on looking at the behavior of this visitor, we think this is a great opportunity and potential that you could do a BDR outreach for somebody who’s been on your site, but didn’t necessarily engage you.” Nathan Latka: Yep. Are you profitable today or are you reinvesting everything back in growth? Don Simpson: I’ve been reinvesting everything. Now I’m just trying to go on that pretty much break even line. So we’re bubbling up, a little bit above, a little bit below every month, and as we grow, I’m just going to continue to invest and build. Nathan Latka: Don, what would you value the company at today? Don Simpson: That’s a very good question. I don’t know. I’ve heard some crazy numbers. Nathan Latka: What’s the craziest? Don Simpson: Well, the multiples with some of this stuff seem a little off for me, maybe as high as 30 million, but I don’t know. That seems a little nuts to me, to be honest with you. Nathan Latka: So that’s 25X on your current run rate? Don Simpson: Yeah. Nathan Latka: Yeah, yeah. Don Simpson: I mean, we’ve got lots of work to do and lots of building to do and- Nathan Latka: Let me ask the question more directly, make it real. David Cancel approaches you, wants to buy Lift AI to enrich Drift’s tool. He offers you a 7X multiple on your current revenue. He offers you eight or nine million bucks, all cash up front, no earn-out. Do you take the deal? Don Simpson: I don’t know. I don’t know if I’d want to answer that. I actually met David Cancel. I can’t tell you how much respect I have for him and I don’t think that’s a question that I want to answer. Nathan Latka: Have you signed any LOIs to sell the company in the past year? Don Simpson: No. Nathan Latka: Very good. Building, building, building. I love that. Last question here. Churn. Any gross turn? Don Simpson: None yet. Nathan Latka: None yet. Very cool. All right. Yeah. I mean, again, this is what’s impressed me. You launched this thing in March and it sounds like you reached out to some folks that you already had relationships with via your BPO business. You closed them. You went from zero to a million dollar run rate in under basically six months, which is really impressive. So congratulations. Nathan Latka: Let’s wrap up here with the famous five. Number one, favorite business book. Don Simpson: I like that Made in America. I read it three times back to back to back actually about 20 years ago. It was amazing. Nathan Latka: Number two is… Sam Walton, right? Don Simpson: Yeah. Nathan Latka: Yeah. Number two, is there a CEO you’re following or studying? Don Simpson: It’s funny you say David Cancel, but there’s a few like that in our space. It’s actually crazy how many good CEOs there are, but he’s certainly one. Nathan Latka: You should go buy Olark and then compete with David. Enrich Olark’s basic chat tool with your AI and machine learning, and then go head to head. Don Simpson: Yeah. Yeah. I actually said this to a guy on my advisory board. [inaudible 00:13:49] David as well. He was on their advisory board and I said, “I always say I wanted to play on the tour, but I just never knew Tiger was that good.” You start playing at that level and you’re going, “Wow, this guy is good.” Nathan Latka: Would you ever go and raise some capital to go buy… Olark is doing 12 million in terms of run rate right now, but they have no interest in scaling. You clearly have this other thing you can add to a live chat. Would you ever go buy a company like Olark and then scale? Don Simpson: Possibly. Nathan Latka: Yeah. And where would you get the capital to do that? I mean, it sounds like you’re personally wealthy, but you’d probably use some other finances too? Don Simpson: We’re in the midst of actually looking to raise money because I think if we’re going to be really successful with this, it’s going to take a different kind of a war chest. Nathan Latka: How do I get in on that deal? Don Simpson: I might talk to you soon, Nathan. Nathan Latka: Okay, good. Don Simpson: I’ve been following you for a while as well. Nathan Latka: I want in. Don, I want in. I’m not publishing this episode unless I get in. Nathan Latka: I’m kidding. It’ll go live, no matter what. I love your story, but I’d love to be in. Nathan Latka: All right. Number three, talk to me about your favorite online tool for building your company, besides your own. Don Simpson: I don’t know. Twitter is pretty amazing. I mean, just even following a guy like… I would say once a week, Jason Lemkin says something on Twitter that I follow that I find wow. I wish I would’ve known that 20 years ago. So- Nathan Latka: Great guy. Don Simpson: I’ll say Twitter. Nathan Latka: Number four. How many hours of sleep, Don, do you get every night? Don Simpson: About six and a half. Nathan Latka: Not bad. And situation, married, single, kids? Don Simpson: I’m married, three kids. Nathan Latka: Three kiddos. Wow. How old are you? Don Simpson: I’m 54. Nathan Latka: Don Simpson: I was swinging for the fences. Nathan Latka: Guys, there you have it. MarketLinc was his first company launched in 1990. It was a marketing agency. Did about 10 million at its peak in 2018. Then realized, you know what? I’ve got to spin out this Lift AI product, which is essentially using conversational marketing in a real revenue attribution way. Nathan Latka: He launched it just a couple months ago in March 2020. Already has eight customers, paying on average $13,000 per month. So six-figure ACBs right off the bat, broke a million dollar run rate doing about 1.2 in terms of ARR run rate right now. Team of eight people [Inaudible 00:15:52] three engineers. First quota-carrying sales rep just joined with a million-dollar quota. We’ll see how that goes. Bootstrapped, which we love, Don, we’re rooting for you. Thanks for taking us to the top. Don Simpson: Thank you Nathan. I appreciate it. Nathan Latka: One more thing before you go. We have a brand new show every Thursday at 1:00 PM Central. It’s called SharkTank for SaaS. We call it Deal or Bust. One founder comes on, three hungry buyers. They try and do a deal live. And the founder shares backend dashboards, their expenses, their revenue, ARPU, CAC, LTV, you name it, they share it. And the buyers try and make a deal live. It is fun to watch. Every Thursday, 1:00 PM Central. Nathan Latka: Additionally, remember these recorded founder interviews go live. We release them here on YouTube every day at 2:00 PM Central. To make sure you don’t miss any of that, make sure you click the subscribe button below here on YouTube, the big red button, and then click the little bell notification to make sure you get notifications when we do go live. I wouldn’t want you to miss breaking news in the SaaS world, whether it’s an acquisition, a big fundraise, a big sale, a big profitability statement or something else. I don’t want you to miss it. Nathan Latka: Additionally, if you want to take this conversation deeper and further, we have by far the largest private Slack community for B2B SaaS founders. You want to get in there. We’ve probably talked about your tool, if you’re running a company, or your firm, if you’re investing. You can go in there and quickly search and see what people are saying. Sign up for that at nathanlatka.com/slack. Nathan Latka: In the meantime, I’m hanging out with you here on YouTube. I’ll be in the comments for the next 30 minutes. Feel free to let me know what you thought about this episode. And if you enjoyed it, click the thumbs up. We get a lot of haters that are mad at how aggressive I am on these shows, but I do it so that we can all learn. We have to counter those people. We’ve got to push them away. Click the thumbs up below to counter them and know that I appreciate your guys’ support. All right, I’ll be in the comments. See you.