Making sure that you’re spending the right amount of money on customer acquisition is critical for any SaaS business.

If you spend too much on acquiring new customers, your business won’t be profitable and eventually, you’ll burn through your funds.

On the other hand, if you aren’t investing enough into customer acquisition, you may hold back your company’s growth.

For this reason, you want to calculate your customer lifetime value (LTV) to customer acquisition cost (CAC) ratio. This way, you can quickly determine if your business makes more than it spends on acquiring customers.

In this article, we will cover everything you need to know about the LTV:CAC ratio, including:

- Customer Acquisition Cost (CAC) Vs Lifetime Value (LTV)

- CAC: LTV Ratio: Why Does It Matter for Your Company?

- Calculating CAC-LTV Ratio

- CAC: LTV Ratio Example

- What Is a Good CAC: LTV Ratio?

- How to Optimize the CAC: LTV Ratio for Your Company

- 5 Other Important Marketing Metrics

Customer Acquisition Cost (CAC) Vs Lifetime Value (LTV)

To fully understand what LTV:CAC ratio is, it’s important to first break down the two elements that it compares, which are the customer lifetime value (LTV) and the customer acquisition cost (CAC).

What Is CAC?

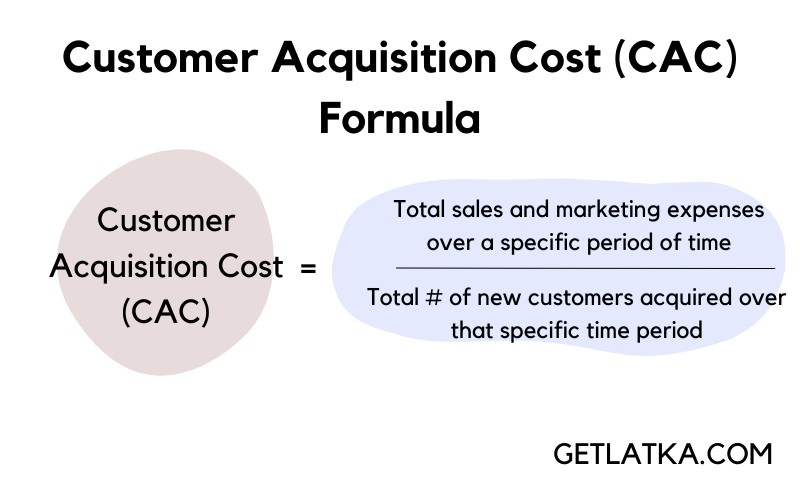

Essentially, customer acquisition cost (CAC) calculates your company’s total expenses for acquiring a new customer.

In other words, CAC measures the total amount of money your company spends on sales and marketing to convert a prospect into a buying customer.

You can easily calculate your company’s CAC with this formula:

Customer acquisition cost (CAC) = Total sales and marketing expenses over a specific period of time / Total number of new customers acquired over that specific time period

For example, if your company spent $5,000 on sales and marketing expenses last month and acquired 400 new customers by the end of the month, your CAC would be $5,000 / 400 = $12.5. This means that last month, acquiring each new customer cost you $12.5.

What Is LTV?

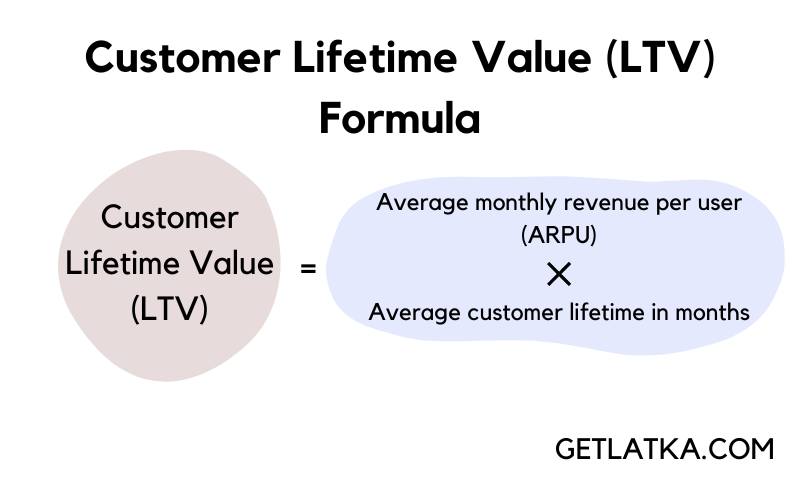

Customer lifetime value (LTV, CLTV, or CLV) calculates the average amount of revenue your company generates from one customer throughout their entire relationship with your company.

You can calculate your LTV in several ways. If you’re looking to avoid complicated calculations, consider using your average monthly revenue per user (ARPU) to calculate your LTV with this simple formula:

Customer lifetime value (LTV) = Average monthly revenue per user (ARPU) x Average customer lifetime in months

For example, if your ARPU is $200 and your average customer lifetime is 3 years, your LTV is $200 x 36 months = $7,200.

What Is CAC: LTV Ratio?

Simply put, LTV:CAC ratio is a SaaS metric that compares your customer lifetime value to the cost of acquiring a new customer.

A low LTV:CAC ratio can indicate that you are spending too much on acquiring new customers, although they don’t bring profit to your business, whereas a high LTV:CAC ratio indicates that you can afford to spend more on advertising and sales to boost your business and revenue growth.

Most commonly, startups and growth-stage SaaS businesses use LTV:CAC ratio to evaluate their business financial health and project their future growth.

Nonetheless, the LTV:CAC ratio can be a valuable metric to any business with repeat purchases.

CAC: LTV Ratio: Why Does It Matter for Your Company?

Now that you have a better understanding of what LTV:CAC ratio is, let’s discuss the advantages of calculating your LTV:CAC ratio.

Your LTV:CAC ratio is critical to your business success as it allows you to:

- Optimize your sales and marketing strategy. Calculating your LTV:CAC ratio can help you figure out whether your sales and marketing efforts are paying off. In turn, it can also help you determine growth opportunities. For example, companies with a very high LTV:CAC ratio may be underinvesting in sales and marketing. In this case, consider increasing your customer acquisition budget to grow your business.

- Project your company’s profitability. Your LTV:CAC ratio can help you determine your company’s financial health. A low LTV:CAC ratio, for example, might indicate that you’re losing customers before they start generating value for your company. Essentially, this means that you’re losing money in the long run, so you might want to allocate more of your budget to increasing customer retention.

- Attract investors. Your LTV:CAC ratio can also be a determining factor for investors. A high LTV:CAC ratio shows that your company is profitable and has a lot of growth potential. If your LTV:CAC ratio is low, on the other hand, you may have a harder time securing investment and funding despite needing more capital to sustain your business growth.

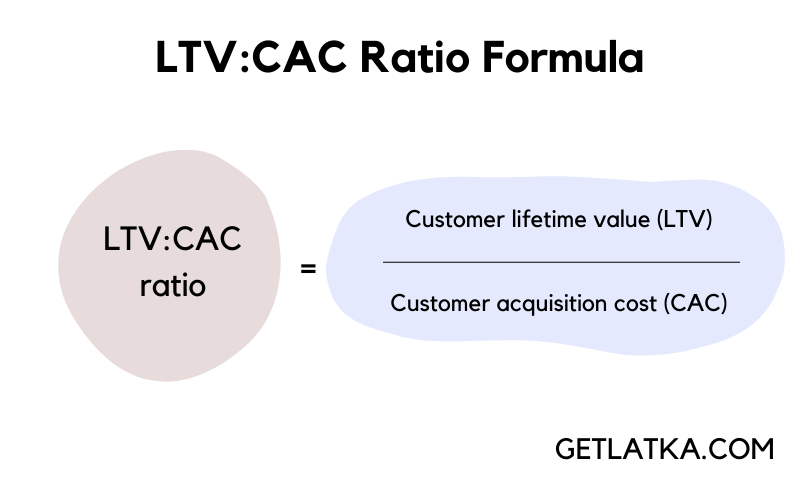

Calculating CAC-LTV Ratio

Once you know your CAC and LTV, calculating your LTV to CAC ratio is easy. All you have to do is determine the calculation period (a year, a month, etc.) and use a LTV:CAC ratio formula.

Here’s a simple formula to calculate your LTV:CAC ratio:

LTV:CAC ratio = Customer lifetime value (LTV) / Customer acquisition cost (CAC)

CAC: LTV Ratio Example

Now, let’s see how you could use the formula above to calculate your LTV:CAC ratio.

Let’s say that your company uses the recurring subscription revenue model. Your average revenue per user is $100 per month, and users typically subscribe for an average of 5 years.

Based on these numbers, your LTV would be $100 x 60 months = $6,000.

Now, let’s say that your company spent $300,000 in total on sales and marketing over the year, and acquired 200 new customers by the end of the year.

This means that your CAC would be $300,000 / 200 = $1,500.

Now that we know the LTV and the CAC, we can easily calculate the LTV:CAC ratio:

LTV:CAC ratio = $6,000 / $1,500 = 4:1.

So, in this case, your LTV:CAC ratio would be 4:1.

What Is a Good CAC: LTV Ratio?

Generally speaking, the ideal LTV:CAC ratio is 3:1.

In other words, you want your company to generate 3x more money than you spend on acquiring new customers.

What Does My CAC: LTV Ratio Mean?

Calculating your LTV:CAC ratio won’t be useful unless you understand exactly what it means to your business.

So, here’s what your LTV:CAC ratio can tell you about your business:

- LTV is lower than CAC. If your LTV is lower than CAC (e.g. 1:1.25), you’re essentially burning more money on customer acquisition than you’ll ever make from your customers. As such, it’s important that you optimize your LTV:CAC ratio to sustain your business.

- Even LTV and CAC ratio. If your LTV:CAC ratio is 1:1, it means that you spend the same amount of money on acquiring a customer as they bring to your business. In some industries, this might also mean that you’re losing money (e.g. LTV:CAC ratio doesn’t calculate shipping costs, product returns, etc… so eCommerce companies might be losing money with a 1:1 LTV:CAC ratio).

- LTV is higher than CAC. In this case, your company generates more revenue than it spends on customer acquisition, which typically means that your business is profitable. That said, if your LTV:CAC ratio is high (4:1 or higher), you may be underspending on sales and marketing.

How to Optimize the CAC: LTV Ratio for Your Company

There are several ways you can improve a less than ideal LTV:CAC ratio.

If your LTV is much higher than your CAC, you can simply optimize your LTV:CAC ratio by investing more into sales and marketing to promote your business growth.

Now, if your LTV is lower or equal to your CAC, you can optimize your LTV:CAC ratio either by reducing your CAC or increasing your LTV.

So, here’s how to do it:

#1. Update Your Marketing Strategy

One way to effectively reduce your spend on customer acquisition is to optimize your marketing strategy.

If you’re using paid ads, for example, you may want to look into more sustainable marketing options. While paid ads are great for building brand awareness and attracting customers, their cost can quickly add up.

Instead, consider adopting a more cost-effective marketing strategy, such as launching a referral program. Referral programs allow you to get more leads with little to no impact on your budget. Not to mention, on average, referred customers have a 16% higher LTV and an 18% lower churn rate than non-referred customers.

On top of that, you may want to calculate your LTV:CAC ratio for different customer segments to identify your most valuable customers. This allows you to determine on which customers you should focus your marketing efforts.

#2. Adjust Your Pricing Strategy

Besides optimizing your marketing strategy, consider adjusting your pricing strategy to decrease your CAC.

A freemium pricing model, for example, can help you attract new users and lower your CAC. In reality, though, this model only works well if you have a strong strategy for converting free users to paid users.

Rather than using a freemium model to decrease your CAC, consider offering a free trial to new users. By giving new users complete access to your product for a limited amount of time, you can encourage them to buy your product once the trial period is over.

To get the best results, make sure to collect their credit card information before they sign up for the free trial. This can significantly improve your conversion rate, leading nearly every second user to convert to a paid customer after the end of the free trial.

Besides that, you may also want to adjust your pricing. Underselling your product can decrease your LTV, so make sure that your product price matches the value you provide for your customers.

#3. Improve Customer Retention

Increasing customer retention is the most effective way to improve your LTV, especially if you have a high churn rate.

Here are some tips that can help you retain your customers:

- Optimize your onboarding process so that your customers don’t leave soon after making their purchase.

- Collect feedback from churned customers to learn why they leave your business and use it to enhance your business.

- Regularly improve your products and services to make sure they meet your customers’ needs and requirements.

- Make sure you offer high-quality customer support.

- Offer competitive pricing.

- Encourage your current customers to support your brand by creating a reward system or a loyalty program.

5 Other Important Marketing Metrics

To gain a better understanding of your business growth and financial health, consider tracking the following metrics alongside your LTV:CAC ratio:

- Annual recurring revenue (ARR), which measures the revenue your business expects to generate over the year.

- Annual contract value (ACV), which calculates the average recurring revenue your company generates per year from one contract.

- Run rate, which helps you predict your business’ future performance based on its current performance.

- Total contract value (TCV), which refers to the total revenue generated from one contract.

- Burn rate, which estimates the amount of money your company uses to cover its monthly expenses.