-

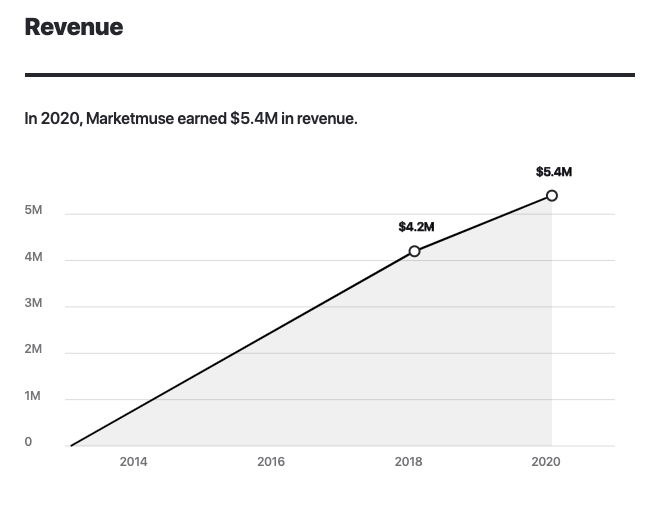

Since its inception in 2017, MarketMuse has been steadily doubling its revenue to $5.4 million in 2019

-

$2.5m in debt is extremely favorable for company

-

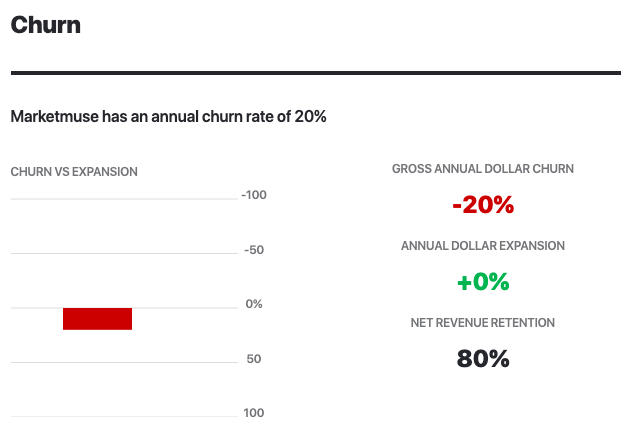

Churn is double from 2018, CEO happy to stay at 25% with Covid-19 developments

If you’ve ever tried writing an article, you know how labor-intensive it is. And if you’ve ever tried to ship a healthy content marketing campaign, you know how difficult it is to optimize that labor.

Aki Balogh’s MarketMuse promises content marketers and writers to do everything for them, except the actual writing. The AI-based platform will scour the internet for profitable keyword opportunities, create content plans with specific headlines and even give writers outlines on how their articles should be structured. Our host Nathan Latka went to see whether Balogh’s product is really as good as it sounds.

Source: https://getlatka.com/companies/marketmuse

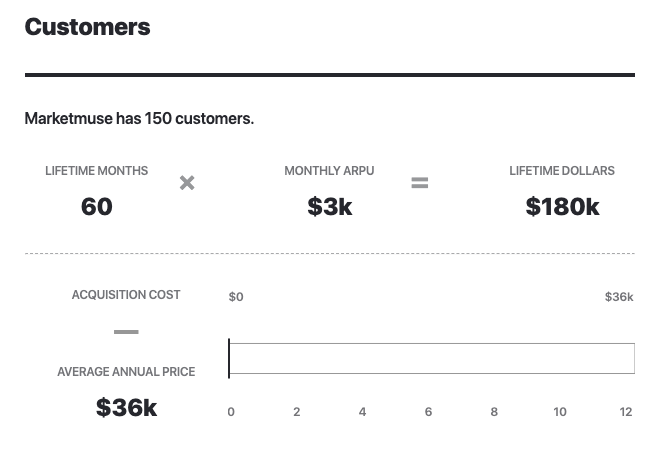

MarketMuse’s 150 Customers Generate $5.4 Million Annual Revenue

MarketMuse offers two products: a $399/mo self-serve lightweight version which will create 7 article outlines from 7 inputted keywords, and a $60,000-$80,000 a year platform that will go deep into your website structure and produce the optimal content plan.

The company has 35 fully automated $399/mo SaaS customers, accounting for nearly half of MarketMuse’s revenue. Bologh reports current (April 2020) annual recurring revenue at about $5.4 million.

Source: https://getlatka.com/companies/marketmuse

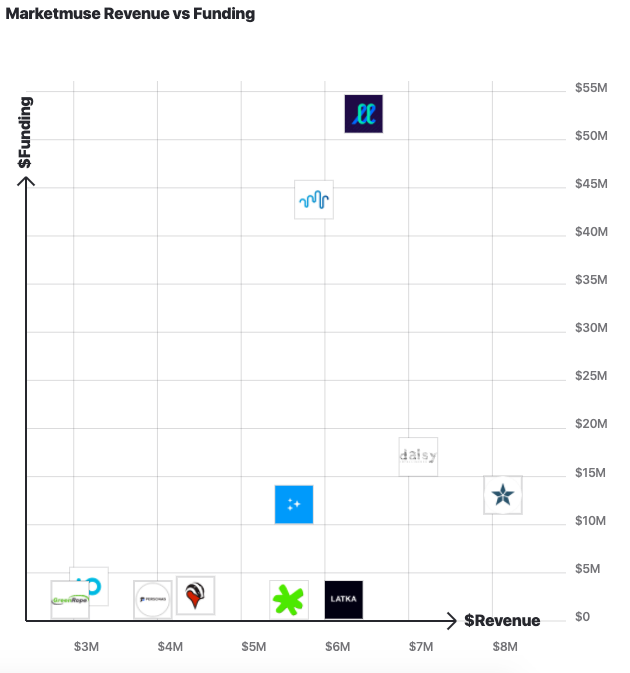

MarketMuse Raised $2.75 Million Debt to Repay 2x in 5 Years

MarketMuse raised $3.7 million in early 2018 to move away from professional services and towards the SaaS platform. As of April 2020, the company has raised $10 million in total on their $4 million annual recurring revenue.

But it wasn’t all equity: Balogh raised $2.75 million in venture debt. The biggest challenge for a startup with debt, the CEO says, is to avoid big fixed rates. What MarketMuse did is called revenue-based financing: “they basically charge you a royalty on your top line revenue,” Balogh explains.

Source: https://getlatka.com/companies/marketmuse

While the percentage rate can depend, the CEO estimates 4% to 7% of monthly revenue to be the norm for debt payments. In Bologh’s case, MarketMuse will have to give the money back over the course of 5 years, but there’s also a hard cap on top possible amount of repayments.

“The easy way to think about it,” Bologh explains. “If we pull $3 million, we pay $6 million over 5 years. […] These are not our exact numbers, but roughly in that neighborhood.”

Since most of the borrowed money goes into customer acquisition, the CEO believes raising debt this way is a lot cheaper than raising equity.

MarketMuse’s Suspiciously Favorable Debt Term Sheet Doesn’t Bother CEO

Debt raising is all good and games while the numbers are going up, but many lenders will protect their downside via term sheets that spell full repayment of any interest that didn’t reach the cap. Bologh says their term sheet is different. “I can assure you that there’s no balloon payment at the end,” the CEO says.

Source: https://getlatka.com/companies/marketmuse

“The way it works in our contract with Riverside is it’s either 5 years or you hit that repayment cap of 2x,” Bologh argues. “If we pay them back in either of those scenarios we’re done, if we don’t pay them back then they’re done.”

Back in 2018, there were 22 people on MarketMuse’s team. As of April 2020, that number is up to 40, with 12 engineers and 8 quota-carrying sales representatives.

Churn is up from 12% in 2018 to over 20% in 2020. With Covid-19 developments and an accelerating recession, Bologh is happy to keep gross annual churn at 25% for the year.

Nathan Latka’s 5 Questions With MarketMuse CEO Aki Balogh

- Favorite business book? “The Inner Game of Tennis by Timothy Gallwey.”

- Is there a CEO Aki is following or studying? “Eric Yuan.”

- Favorite tool to build MarketMuse? “We love Zoom.”

- How many hours of sleep does Aki get? Married, single? Kids? Age? “5 hours. Single. I’m 34.”

- What does Aki wish his 20 y/o self knew? “I started in management consulting but I should’ve gone right to SaaS.”

Funding:

Up until 2017: $3.55 (he said $10 total, interview)

2018: $3.7M (interview)

2019: $2.75M (debt, interview)

2020:

Revenue:

2017: $1m (interview)

2018: $2m (interview)

2019: $4m (interview)

2020:

Customers:

2017:

2018: 100 (old interview)

2019: 150 (Getlatka)

2020: