Serial entrepreneur and startup community member Harshit Agarwal, Co-founder and CEO of Appknox, recently sat down with the GetLatka team to discuss how his mobile security testing app company grew 100% YOY through organic growth. Agarwal shared what changes he made to save Appknox when his back was against the wall with 30 days of cash left in the bank, his stance on raising more capital, and what he does for one of the largest FMCG (fast-moving consumer goods) companies in the world.

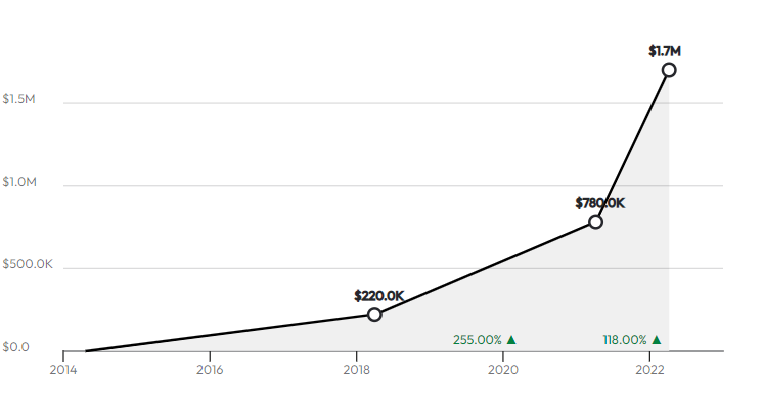

Agarwal used his years of tech and startup experience to co-found Appknox in 2013. He and his team built the application over two years and officially launched it in 2016. After nearly shutting down in 2018, he realized he was focused on the wrong customer segment. Pivoting led to immediate success, which resulted in 100% growth from early 2021 to today.

- 76 enterprise-level customers

- Team of 42, including 11 engineers, 9 security techs, 6 quota reps, 5 marketing

- $750,000 Pre-Seed Round in 2014

Targeting Enterprise Customers with 50+ Mobile Apps, $20,000 ARR

Appknox is known as the world’s most powerful plug-and-play mobile app security testing solution. While CEO Agarwal initially focused on SMBs as the ICP (ideal customer persona), he realized within two years of launch that he wasn’t focused on the right customer segment. Once he pivoted from SMBs to enterprise clients, his business took off. Today, the average enterprise client pays Appknox quarterly to provide ongoing security testing for 20-100 mobile apps at $20,000 ARR.

Mobile Security Testing 600+ Apps for FMCG Giant Unilever

Unilever is currently Appknox’s largest customer, according to Agarwal. The worldwide FMCG enterprise giant actively maintains over 600 apps across multiple regions and represents approximately 10% of Appknox’s current $1.7m ARR. Agarwal explained that app security testing is challenging without Appknox because app update release cycles are getting shorter and shorter, and apps cannot be used without security testing. By automating the process, enterprise clients like Unilever can be confident that their apps in the field are secure as soon as updates drop.

Client ARR Ranges from $7,500 to $100,000

Because Appknox charges per mobile app, clients pay between $7,500 and $100,000 in ARR. Agarwal explained that some enterprise customers only manage 5-10 apps while others need to secure 100+ apps.

Raised $750,000 in Early Pre-Seed Round in 2014 at $4.3m Post-Money Valuation

Agarwal noted that Appknox raised an early Pre-Seed round of $750,000 in 2014 to fund the initial build of the software. In hindsight, he believes that he raised funds too early and could have done it cheaper and easier if he had waited. Appknox has not needed to raise funds since.

Appknox nearly shuts down with $30k left in 2018

After focusing on SMBs for two years, Agarwal and his 22-member team realized that they weren’t getting traction in the marketplace because they weren’t focused on the right customer segment. At the time, he had about one month of overhead left in the bank. He went back to the drawing board and rethought the Appknox strategy. Agarwal also had to make some hard decisions about his team to lower costs. Once sorted, Appknox began to grow organically and consistently without any additional capital.

2018 Revenue Hits $220,000, $19,000 MRR

Co-Founder Agarwal shared that by the end of 2018, with a new focus on enterprise customers, Appknox survived and hit $220,000 in revenue. To do so, he focused on key metrics and began releasing features that mattered to customers. Agarwal explained that his team discovered that SMBs are “fighting their own struggle” and couldn’t justify the spend on Appknox. When he pivoted to enterprise, Agarwal focused on an ICP that placed a premium on security. At that point, he focused on better understanding what the customer wanted and built features to accommodate their needs. The team learned to give customers what they wanted.

98% Client Retention, 103% Net Dollar Retention

Agarwal explained that customer retention is key with enterprise clients, which is why his current team of 42 includes 4 customer support and customer success members. As a result, his client retention sits at a healthy 98%, with an impressive 103% net dollar retention.

$7,000 CAC, 9-month Payback Period

“We were miserly in marketing,” admits Agarwal. When the company pivoted in 2018, he realized the importance of marketing to attract and land his prospective clients. Currently, Appknox spends marketing dollars on SEO and content to attract F500s. He says their best leads come from inbound traffic as a result of organic SEO and Google Ad Words. Lakta confirmed that the $7,000 CAC is inclusive of sales commissions.

Starting Quarterly Quota of $50,000

The current sales team at Appknox consists of 3 channel salespeople and 4 direct salespeople. All 7 operate on a quota. Agarwal explained that each salesperson starts with a quota of $50,000 per quarter, as it takes 1-2 quarters for new people to get up to speed. The quota scales up to $150-200k per quarter within a year. According to Agarwal, salespeople hit approximately 60-70% of their quota as they scale, and it’s not a good fit if any salesperson cannot hit $50,000 in a quarter.

2 Sales Funnel Challenges, Even with a Successful $65,000 MRR YAG

Agarwal sees two current challenges with their sales funnel. First, he believes they need to drive more TOFU (top-of-the-funnel) inbound leads for sales to nurture and close. He noted that he’s working on opening new channels to address this challenge. Secondly, because the platform is so technical, he sees that it can be difficult to convince a prospect to take action at times. Even with these challenges, Appknox ended last year with $65,000 MRR.

MRR 2X to $140,000

Appknox doubled MRR to $140,000 vs. $65,000 a year ago. They currently sit at $1.7m ARR as they continue to grow organically. Agarwal currently enjoys an operating profit of $10,000 per month.

Expanding Staff to 50 by End of Quarter

CEO Agarwal plans to expand the staff from 42 to 50 by the end of the quarter as Appknox continues to grow organically. He is still evaluating whether or not to raise additional capital. “In our world, the challenge is the upsell. We might need to add funds to build additional verticals for our product,” he explained.

Fast Five

One of Co-Founder and CEO Harshit Agarwal’s favorite CEOs to follow is Girish Mathrubootham of Freshworks. His favorite online tool to help build his business is Hubspot. Harshit explains how much he loves the product and the ecosystem they’ve built. Harshit enjoys a full 7 hours of sleep per night. He is 32 years old, married with no children. He wishes at 20, he had better appreciated the value of learning and experience. “We did it the hard way. It could’ve been faster and easier if I had known,” he lamented.