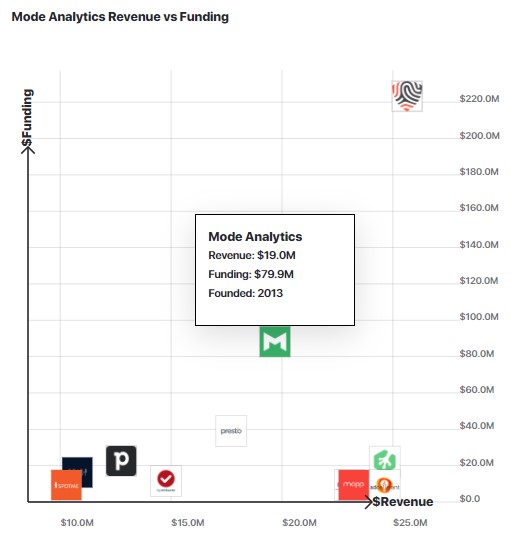

Data analytics company Mode, whose 600 customers include over half of the Fortune 500 companies, hit $19 million ARR in 2020.

Mode offers data analytics solutions within the business intelligence space. The framework for Mode began when CEO and co-founder Derek Steer worked as an analyst at Yammer.

“My Mode co-founder Josh [Ferguson] eventually split out to start a data engineering team that was responsible both for building out data pipelines and managing the quality of our data. And also for building internal software that looked a lot like Mode for us to do our jobs,” Steer says in an interview with Latka.

Mode is “in the range” of 100% year-over-year growth, Steer says, although that number was a little lower in 2020. The company plans on growing through a land-and-expand strategy.

While Mode began as an analyst-centric company, its services have since become valuable for many people: “The value is not in providing some groundbreaking new way to do analysis,” Steer explains.” What we provide is great collaboration around that analysis.”

Source: GetLatka

That means Mode doesn’t just offer services to analysts. It also equips analysts to empower their own customers.

Because its services are ultimately spread across a large audience, Mode prices based on scale. The company originally started with clients like Twitch and Lyft, charging them a few thousand dollars for a seat. But that changed when they realized this pricing wouldn’t scale for major companies with 4,000 to 6,000 seats.

“The way that we do it now is we have a platform fee and then a per seat fee,” Steer explains. “The list price on the seat fee is $25 per person per month, and it works like any kind of SaaS product where we batch it. So the first 500 might be a certain price and the next 500, another one.”

About 120 people work for Mode now, including 40 engineers and eight quota-carrying sales reps. The company hired its first sales rep before it hit $50,000 revenue; Mode’s first sales leader took the company from $500,000 to $10 million.

If Mode were to do anything differently, Steer says they would bootstrap for a longer period before raising money.

“You can just go get $100K and AWS or Google credits, and you can run your business pretty much for free for a pretty long time,” Steer says. “I wish we had done that. I wish we had gone super, super lean in the early days, because I think we would have found the market faster. We would have been focused.”

What is Mode’s annual revenue?

In 2020, Mode generated about $19 million in ARR.

What is Mode’s monthly revenue?

In 2020, Mode generated about $1.6 million in MRR.

Who is the CEO of Mode?

Derek Steer, age 36, is the CEO of Mode.

Transcript Excerpts

Founding a company is hard; make sure you’re obsessed with it

“The decision to go and start a company really had to do with the fact that I was waking up every morning thinking about this particular problem and going to bed every night. And when I talked to other would-be founders, the advice that I give them is: Make sure you’re obsessed, because it’s pretty hard. And I think that obsession with making the lives of analysts and data scientists better is what has gotten me through some of the challenges of just starting and running a business.”

Buying your list risks losing authenticity

“For our audience, authenticity is critically important. I think that’s true for technical audiences in general, people just smell sales and that kind of thing. And nothing feels worse to me than buying a community. I think that our customers in the market would view that as too corporate.”

A large valuation right off the bat isn’t always a blessing

“I got a really great piece of advice … from Yammer’s then-CFO, Mark Woolway. A different Yammer group had split off and raised immediately, like day one, [about] a $20 million valuation on a business that Mode has surpassed. [Woolway’s] take was that a $20 million valuation is not good for anybody. And what I saw was that they made hires right off the bat that probably didn’t make sense. They weren’t the necessary people to find product market fit. Now, I don’t want to be too critical, because startups are hard and I don’t know what’s going on there. But what I can say is that a certain amount of hunger sharpens the senses and really focuses you in.”

Publishing content as the key to building a brand

“We spent a lot of time writing blog posts, building content and essentially just making sure that the Mode brand was associated with good analysis. And I think that’s the thing we’re really good at. Our DNA is not to have a super thriving Slack channel … What we can do really well is make the best analyst and data scientists-focused content, the type of thing that helps businesses understand the value of good analysis.”

Full Transcript Nathan Latka: Hello everyone. My guest today is Derek Steer. He’s a CEO and co-founder of Mode. Prior to co-founding Mode in 2013, he was an early member of the Yammer’s Analytics team. There he led sales and marketing analytics drawing upon his experience on the monetization analytics team at Facebook and his background in anti-trust economics. Derek, you ready to take us to the top? Derek Steer: Let’s do it. Nathan Latka: All right. So I want to jump right in with the Yammer. How many people, when you were building out these tools at Yammer, how many data scientists was Yammer employing to work on this problem? Derek Steer: So we had, when I arrived, the company was probably like 140, 150 people. We had team of maybe five analysts. And then there was, I forget whether it was right when I started, but my Mode co-founder Josh eventually split out to start a data engineering team that was responsible, both for building out data pipelines and managing the quality of our data. And also for building internal software that looked a lot like Mode for us to do our jobs. Nathan Latka: Interesting. Derek Steer: And that was something that a lot of folks were doing at the time. It was like they were hiring up teams of developers to work on these sorts of internal tools. Nathan Latka: What I want to get to now is I imagine you probably had a cushy salary at Yammer. When did you build up the confidence to say, you know what, I’m taking a risk? We’re going out, we’re going to build this and we’re going to build it for everybody. Derek Steer: Well, the cushy salary only came after the acquisition by Microsoft. Nathan Latka: Okay. Derek Steer: The decision to go and start a company really had to do with the fact that I was waking up every morning, thinking about this particular problem and going to bed every night. And when I talked to other would be founders, the advice that I give them is make sure you’re obsessed because it’s pretty hard. And I think that obsession with making the lives of analysts and data scientists better is what has gotten me through some of the challenges of just starting and running a business. Nathan Latka: And so, actually, can you share, I always like to measure opportunity cost and those sorts of things. I mean, can you share what salary you gave up when you left? Derek Steer: Well, it’s, I’d have to go do some stock math because my Microsoft shares at that time were the fraction of what they would be now. Nathan Latka: They’re better now. Yeah. Derek Steer: Yeah. Yeah. If you look at the price now, it was a seven figure annual type of amount, but I had no way of knowing that. It was less than that. I was surely getting paid really well at Microsoft. Nathan Latka: You leave and some of your early investors are your Yammer bosses. So walk me through, I think he raised 500,000 from them. How much of the company did you sell? Derek Steer: Well, I don’t remember. So, I guess it was about 10%, that the evaluation was like in the range of 5 million, which we were just triangulating around like kind of standard YC evaluations at the time. It was a pretty straightforward negotiation. In fact, we wanted to do everything really above board. And so we told our boss that we were going to leave and we declared our intention to leave. And then after leaving, went back to David Sacks and said, “Hey, we got this thing that we’re going to go do. Here’s what it is.” We brought him a deck. And on the second slide, he was like, “Okay, yeah, I’m in, let’s do it.” Derek Steer: It’s funny, the second slide was, it was GitHub for data, which was like a … In 2013, that was like an awesome pitch. But more importantly, he had seen our work and understood the value of what we did at Yammer and that we could go in and do it on a bigger scale. And so he was in, and then it was just a very quick, like maybe quicker than I was even prepared for conversation around like, okay, how are we going to do the deal? Like, what are the terms, et cetera. Nathan Latka: Yep. Branching off a totally different direction. Some of your earlier customers you talked about were folks like Twitch and Lyft, and you said in other interviews, you started off at sort of a $3,000 per seat license, but then quickly realized you’re going to have teams signing up for massive amounts of users on three grand a seat wouldn’t scale. What are customers paying you today on average per seat? Derek Steer: Oh, the way that we do it is based on scale. And we have folks who are buying four or five, 6,000 seats. And we also have a piece of technology now called helix where we do some data processing on our end and that costs us money. And so we have a cost that’s associated with that. So the way that we do it now is we have a platform fee and then a per seat fee. The list price on the seat fee is $25 per person per month. And it works like any kind of SaaS product where we batch it. So the first 500 might be a certain price and the next 500, another one. Nathan Latka: Yeah. Yep. That’s great. And so walk me through how you learn from sort of like when you discount your pricing, did you let Twitch come off a 3000 per month seat down to your new, cheaper pricing? How do you handle grandfather accounts and pricing experiments? Derek Steer: Oh boy. Grandfather accounts. So I think we’ve been through probably like seven different models that vary a little bit. I mean, we introduced freemium, not initially, but later, and that threw a wrench into some things. So we had some people who decided they wanted to go freemium. And some people, we kind of grandfathered into pricing on a business tier. In general, we try to do right by our customers. That’s really it. And if you made an early commitment to Mode and you want to keep doing it, then we’re going to try and accommodate you. And I think I’m really proud of how we supported some of our early customers to grow to be very big. And I try to do right by them has been a part of that. Nathan Latka: And how many customers are you serving now today? Just logos, not seats? Derek Steer: Yeah. It’s around 600, this is the most recent thing that we published. Nathan Latka: Yeah. That’s great. And one of the things you have on your website is 52% of the fortune 500 folks are using you guys. I mean, obviously there’s probably a significant expansion opportunity there to add more value to that cohort, but eventually you’ve got to open top of funnel, move back downstream to get more customers and add more products and drive more ARPU. How do you think about that transition? Has it already started? Derek Steer: I think that Mode is land and expand business. And the important thing to understand about Mode is that we started off as a very analyst centric company. That’s my background and my co-founders background. And that’s something that we knew how to solve. And maybe most importantly, that was the hole in the BI space, right? BI generally as a category decides that the technical person’s job is to specify the system. They build out a menu of metrics and then the actual analysis or dashboard building or whatever is going to happen by people who aren’t professional analysts or aren’t necessarily super technical. Mode is about supporting the people who are technical. Like that’s where we started at day one, where we’ve evolved and I think pricing is tied into this. So the notion of paying 3000 per seat per year is focused on delivering a certain value to analysts only. Derek Steer: Like that’s a price you can command as a very critical workflow tool for one person. But when the value is actually distributed across many people, like in Mode’s case, the value is not in providing some groundbreaking new way to do analysis. What we provide is great collaboration around that analysis. So the value is experienced by lots and lots of people. So a lower price spread across an entire audience makes more sense. When we think about the way that we expand that was a part of it, was shifting from that pricing model to one that again is now like 25 per seat per month, as opposed to 250 per seat per month. When I look at the way that we expand in the future, it is about going wall to wall, like you were saying, okay, well what’s with 50% of the fortune 500, how do we allocate resources between existing and new customers? Derek Steer: The answer is we’ve always got to be bringing people into top of the funnel, but price isn’t necessarily the most important thing for us there. The most important thing is landing, because we have a product that’s sort of naturally like just through the natural analytical workflow starts to expand. The sort of path that we’re on now and what we’ve talked about with our customers and a little bit publicly is, once we expand, once as an analyst or data scientist, once you’ve shared your work with lots of other people at the company, those people need to be served well too. Derek Steer: As an analyst, your reputation lies in the thing that you produce and that you hand off to them. You are doing a good job only if you produce a good product and Mode has to do that. Part of a good product is something that they can expand upon, work further from. And so what you’re going to see from Mode in the coming year is a lot more that’s geared toward making the analyst look like a superhero by empowering their own customers. Previously, like when we started, all about empowering the analysts now empowering analyst to empower their customers. Nathan Latka: Analyst is a superhero. I want to come back to that in a second. But first with this approach where you’re sort of trying to democratize this sort of technology means a lower price point, more people. You started doing this, I think more than 12 months ago, what is your company growth rate look like over the past 12 months on a percent basis with this sort of strategy? Derek Steer: Well, you picked it interesting year to ask that question. Nathan Latka: Yep. Derek Steer: I think we tend to keep the high level revenue and the growth stuff generally within the company, but that continues to grow pretty fast and be an exciting business to be a part of. We are in the tens of millions revenue range. I know that’s- Nathan Latka: I was going to say, Derek, you know I listen to the show. So you know I’m going to push you on this. I won’t pin you down exactly. Derek Steer: Yeah, yeah. I know the show. Nathan Latka: I mean, can we put you in sort of the a 100 percent year over year growth club? I mean, is that a fair statement? Derek Steer: Yeah. Yeah. I think so. It’s been a little bit lower than that this year. I think in some very interesting ways, but it is, yeah, I think that’s like the right range to put us. Nathan Latka: Okay. Well, I mean, look it’s a hot space. I mean, we had Frank Bean on seven months before the acquisition happened and I straight looked at him on that call and said, are you on acquisition talks with Google right now for billions of dollars? And he said, no. And then smirked at the same time. I’m like, something’s happening here. So you’re in a very, very hot space. And on the flip side, folks like you get all the attention where people don’t spend a lot of attention are the folks that try to do what you do, but then they fail for some reason. Nathan Latka: And I talked a lot of those folks and usually the reason they fail is they fail to identify a utility value for the data they’re surfing. Like they don’t enable their customers to actually deliver and become a superhero internally. Let’s now go to that sort of a business. You know, a lot of SaaS companies that are in your space at your scale are building communities to drive stickiness and expansion. Do you have sort of a analyst superhero community you’re building somehow? Derek Steer: The company that does this really well as Fishtown the makers of dbt. Nathan Latka: I’ve never heard of them. Derek Steer: Oh man. Company to watch for sure. They did a series A with Andressen pretty recently. They live between Fivetran and Mode. So Fivetran brings all your data into a database. You need to then transform it to make it really effective for analysis. Dbt is kind of the product. That’s going to be the next thing. And if we were going to build it, we would do it the way that they did it. And the name of the company is Fishtown. So they’ve built a really excellent community, I think they’re really good at that. We’ve been talking a lot about like what the future of this is going to look like. And we’ve done some things in the past that have been really effective. Derek Steer: The founding team for Mode is three people, myself, Benn Stancil and Josh Ferguson. Of the three of us, Josh was the only engineer. Benn and I can do analysis. We can write some code, but like it’s different from building production software. So in the early days, what we did is we very quickly hired some other extremely capable engineers. And then they worked with Josh on actually making the product. And what Ben and I did we did some amount of customer development and understanding what the product should become, though we also had an intuitive sense for that because we had done it ourselves internally at Mode already, or sorry, at Yammer. Derek Steer: We knew kind of what it should look like. So we spent a lot of time writing blog posts, building content, and essentially just making sure that the Mode brand was associated with good analysis. And I think that’s the thing we’re really good at. Our DNA is not to have like the super thriving Slack channel that Fishtown has. They’re going to do that better than we are. And they are doing an awesome job of it right now. What we can do really well is make the best analyst and data scientists focused content, the type of thing that helps businesses understand the value of good analysis. One of those things that has been, honestly, I on essentially a whim in early 2014, wrote this SQL tutorial. And I had taught SQL at basically every business I’ve been at. The big problem with SQL, as it was taught. Derek Steer: Like if you were to go buy a SQL book at that time, and maybe even still today, it’s focused on software development, which means that the first chapters are going to be about setting up your database, getting data into it and doing all this other stuff that doesn’t matter at all if you’re an analyst, like if you get hired as an analyst, you’re going to come into a situation where that already exists. And what you need to do is write the world’s best select statement. Like you need to be able to get data from a database and transform it and do stuff with it. You don’t need to do the other stuff. So I wrote this tutorial that we call SQL school and it lives on Mode’s website. You can go to it. And there’s a little resources tab, Mode.com, resources. It is one of the most popular tutorials on the internet. Derek Steer: And I think the reason for that is it approaches the user as though their only knowledge is Excel. It’s like, we’re going to assume you’re not a programmer. You know some concepts from Excel like what a spreadsheet looks like, but maybe you haven’t worked with databases before, and we’re going to teach you all the basics of that stuff without forcing you to create a database and do all this other heavy lifting. And that’s been tremendously … I mean, this thing gets hundreds of thousands of uniques a month. Nathan Latka: Yeah I’m seeing that. Derek Steer: It has for a while. That’s the place when you think about community and of analysts, I think the place where it will be really great in the future is around continued education, making great content, that kind of thing. Nathan Latka: So let me just ask you something, I mean, you just raised 33 million bucks, I believe, right? Derek Steer: Mm-hmm (affirmative). Nathan Latka: I mean, do you ever say, you know what, let’s pull off 5 million of this and go buy a community like codewars.com where developers are competing on quizzes. I mean, you’re already doing a bunch of these quiz sort of things on this resources page, you get a list of a million engineers by doing that. I mean, would you ever go by community like that? Derek Steer: Oh, I think it’s hard. I mean, so for our audience, authenticity is critically important. I think that’s true for technical audiences in general, people just smell sales and that kind of thing. And nothing feels worse to me than buying a community. I think that our customers in the market would view that as too corporate maybe. Nathan Latka: Yep. Yep. No, it makes good sense. It makes good sense. So contents is strategy, not build your own community, just put out great content that allows these analysts to become superheroes internally. Derek Steer: Look, community forms around that too. Like it’s not a deliberate effort for us right now to like, have a conversation going in a forum or on our Slack channel or anything like that. It’s not an explicit effort that we have, but it probably will be at some point. Nathan Latka: Yep. Talk to me about your team today. You mentioned the founding team. How many folks are on the team today total? Derek Steer: About 120. Nathan Latka: Okay. How many engineers? Derek Steer: 40 ish, plus some more for product and design. Nathan Latka: Okay. And how many quota carrying reps do you have? Do you know? Derek Steer: Seven, eight [inaudible 00:16:06] business? Yeah. Nathan Latka: When did you hire your first out of curiosity? What revenue were you doing when you hired your first quota carrying rep? Derek Steer: Okay. So, the first rep, so we were a little more than a year old as a company. We had been in public open beta. We had some folks who were using the product. This is October, 2014. Okay. Nathan Latka: Were you at half a million run rate already or no. Derek Steer: Not even close. Nathan Latka: Not even close, okay. Derek Steer: We were somewhere North of zero and South of 50K. Nathan Latka: An ARR. Derek Steer: Yeah. Nathan Latka: Oh, wow. Good, good. Derek Steer: Look, and so what the composition of this founding team is a bunch of people who are like pretty analytically sound and have done analysis on larger businesses in plenty of different areas. There’s an understanding of how products should work and how go to market should work from running the numbers at bigger companies. But it’s very different. And certainly you have to learn this the hard way. It’s very different to sell than to analyze sales. And had I known that a Yammer, I probably would have done some parts of my job differently, but anyway, we realized pretty quickly that we wanted someone who was going to be a more of a sales expert. And then in the process of interviewing people, found someone who coincidentally worked at Yammer, but we didn’t know him super well. Derek Steer: His name’s Chris Davis, he was our first sales hire. He was kind of fresh into AE land. He had come out of being a very successful BDR at Yammer. Had done a couple of deals, but didn’t really have a ton of skill closing yet. Eventually we ended up hiring an advisor to help him. So someone to come in and do deal review. She came to our office every Monday, went through our CRM acted like a sales pitcher. Nathan Latka: Who is she? Derek Steer: Sorry. Nathan Latka: Who is she? Derek Steer: Her name is [Analiese Husman 00:18:01] . She was at Yammer briefly as well. I mean, we were hiring the people we knew who were good and she had gone to AdRoll. So while she was at AdRoll, she would, after her day job at AdRoll, she would show up at our office on Monday. Our office was like three blocks away at the time. And so she would walk over from AdRoll, do our deal review Monday afternoons. And then eventually we hired her as our first sales leader. She took the company from like ballpark 500K to 10 million. Nathan Latka: Yep. And that was that 10 million, I think you hit about October last year? 2019. Derek Steer: Yeah, I think that’s right. Nathan Latka: Somewhere in there. Yeah, that’s great. Hey, last question I want to ask there’s a lot of folks earlier stage SaaS company is able to access debt these days, probably on much better terms than what you raised the 375. I think you raised 375 back in 2015. Is that number accurate? And if so, why’d you do it? And do you regret it or was it powerful? Derek Steer: I heard you like bootstrapping. Nathan Latka: I love bootstrapping. Derek Steer: Oh, you love bootstrap. Nathan Latka: I love it. Derek Steer: Here’s what I’d say. So I got a really great piece of advice in the early days but I didn’t actually realize it was advice at the time. From Yammer’s then CFO, Mark Woolway who said … Because a different Yammer group had split off and raised immediately like day one like a $20 million valuation on a business that Mode has surpassed. His take was that $20 million valuation is not good for anybody. And what I saw was that they made hires right off the bat that probably didn’t make sense. They weren’t like the necessary people to find product market fit. Now I don’t want to be too critical because like, startups are hard and I don’t know what’s going on there. But what I can say is that a certain amount of hunger sharpens the senses and really focuses you in. Derek Steer: And, and I think, look, we had it easier than most. Like we raised basically on day one from David Sacks and from some other Yammer execs. And then we went out to people that they knew and raised another round that I think 375 I think is right. Or actually I think it was more like 1.2 million. Then we added 375 to that or something. I don’t remember the exact order, but we raised a bunch more money from Formation 8 and from some other folks at that time. And we just had money. Like we had money to spend even from the earliest days. And if I were to do it differently, I would bootstrap longer. The resources are also different today. Like you can just go get a 100K and AWS or Google credits and you can run your business pretty much for free for a pretty long time. Derek Steer: I wish we had done that. I wish we had gone super, super lean in the early days because I think we would have found the market faster. We would have been focused. I mean, you can hear me on other podcasts talk about some of the experiments that we ran with GitHub, like an open-source community, all on GitHub for data. There are other places where I’ve explored that more, but I think we would’ve just gotten much faster to the core elements of value with less money. Nathan Latka: That’s great. Well, Hey, you’re, you’re on a tear. It sounds like almost 4% year over year growth in a really tough year for everybody. If you’re in the tens of millions of 10 million and at 25 bucks a seat and 600 customers, you’ve got to be getting close to a million seats here soon. Well hopefully, maybe we’ll hit that next year. We’re all rooting for a man. You’re not in any acquisition talks with Google, are you? Derek Steer: Me and Frank? No. We’re not in acquisition talks with Google. Nathan Latka: Fair enough. And did you guys talk about, you just raised a 33 million. I mean, usually at that stage, you’re probably signing somewhere between five and 10% of the business. Were you sort of in that range? Derek Steer: Again, those are the sorts of things. We don’t talk about the valuation publicly, so sorry. Maybe years down the road, we can go back and talk about that. Nathan Latka: Okay. Very good. I will hold you to that. You’ll get an email from me exactly every year from this point forward and we’ll keep following up Derek. Let’s wrap up here with the famous five. Number one. What’s your favorite business book? Derek Steer: Hard thing about hard things. There are some chapters that I still go back to on a regular basis. Nathan Latka: Number two, is there a CEO you’re following or studying? Derek Steer: You know, I have a guy that I connect with on a regular basis and we met just through kind of Silicon Valley stuff, a guy named Jim Benson who’s now the CEO of [Chorus 00:22:11]. And I think he’s just like clearly excellent at what he does and always has something really insightful to share with me. And because he’s running a business of similar scale, super, super helpful. I think that’s important to find mentors who are the types of people you aspire to be and who are running businesses or have run businesses that look kind of like yours. Nathan Latka: Number three, Derek, besides Mode. What’s your favorite online tool for building the company? Derek Steer: Besides Mode, Mode was going to be my answer. Nathan Latka: You use it a lot I bet. Derek Steer: I think Coda honestly like the ability to structure documents. Nathan Latka: Can they beat Notion? Derek Steer: Can they beat notion? Nathan Latka: I just think these went through very different paths. You know, he raised 60 million bucks basically on day one pre-revenue. Notion was basically bootstrapped ended a massive round. They both basically do the same thing. You like Coda though. Derek Steer: I like both products. Coda happens to be a thing. Code does a customer of ours. So is Notion and I like working with both teams, I use notion personally, we just happen to use Coda in Mode. That’s just the way it evolved. Like someone on a product team, I think started using it. And that’s the way it went. Nathan Latka: When you have both- Derek Steer: You can embed Mode into Coda, but not Notion. That is one critical thing is today Mode embeds work in Coda. Nathan Latka: Very good. That is the most diplomatic answer I’ve gotten from a CEO who has two customers and has to give an answer that caters to both of them. But also I felt like it was very honest. There’s reasons [crosstalk 00:23:44]. Number four, Derek, how many hours of sleep they get every night? Derek Steer: It depends on the night. I have toddler. So that’s been decreasing. So it’s yeah. In the range of like six to seven. Nathan Latka: Okay. And just one kid or multiple? Derek Steer: Just one. Yeah. I have a one and a half year old. Nathan Latka: Married with a kiddo. And how old are you? Derek Steer: How old am I? I am, depending on when you air this 35 or 36. Nathan Latka: When’s your birthday? Derek Steer: January 7th. Nathan Latka: Oh, happy early birthday. That’s great. Derek Steer: Thank you. Nathan Latka: Okay. Take us back 15 years. What’s something you wish you knew when you were 20? Derek Steer: I, this is such a cop out answer, I know, but, I am very happy to have generally done the things that I have been passionate about and I have found great success in that. And I don’t think I knew it explicitly, but it’s just what I happened to do. Like, I’ve been the type of person my whole life who gets extremely motivated about certain things and I really succeed where I am motivated and when I’m not motivated, I don’t succeed quite to the same degree. There’s my other diplomatic answer for you. I think this was really important. And as I reflect it’s not something that I really thought about, but it has been probably the most important lesson of my life is to always make sure that I’m doing stuff that I’m passionate about. Derek Steer: And when you asked me earlier about opportunity, cost and salary, it doesn’t even factor in for me really. I just was so passionate about starting this particular business with those two co-founders that there was nothing that was going to get in the way of that. Nathan Latka: Guys Mode.com, making analysts superheroes, internally, externally, everywhere. Launched in 2013 with again, three co-founders altogether. Raised 500K at a $5 million valuation, right on day one and scaled since then. Finally have passed 600 customers, hundreds of thousands of seats on the platform. Passed a $10 million run rate last year. And almost up to that a 100 percent year over year mark, obviously in a tough year for everyone, but hot space. We’ll see what they do next, Derek. Thanks for taking us to the top. Derek Steer: All right, thanks so much for having me. Nathan Latka: One more thing before you go, we have a brand new show every Thursday at 1:00 PM, central it’s called Shark Tank For SaaS. We call it Deal or Bust. One founder comes on, three hungry buyers. They try and do a deal live. And the founder shares backend dashboards, their expenses, their revenue, ARPU, CAC, LTV, you name it, they share it. And the buyers try and make a deal live. It is fun to watch every Thursday, 1:00 PM central. Additionally, remember these recorded founder interviews go live. We release them here on YouTube every day at 2:00 PM central. To make sure you don’t miss any of that. Make sure you click the subscribe button below here on YouTube, the big red button, and then click the little bell notification to make sure you get notifications when we do go live. Nathan Latka: I wouldn’t want you to miss breaking news in the SaaS world, whether it’s an acquisition, a big fundraise, a big sale, a big profitability statement or something else. I don’t want you to miss it. Additionally, if you want to take this conversation deeper and further, we have by far the largest private Slack community for B2B SaaS founders, you want to get in there. We’ve probably talked about your tool if you’re running a company or your firm, if you’re investing. You can go in there and quickly search and see what people are saying. Nathan Latka: Sign up for that at Nathanlatka.com/Slack. In the meantime, I’m hanging out with you here on YouTube. I’ll be in the comments for the next 30 minutes. Feel free to let me know what you thought about this episode. And if you enjoyed it, click the thumbs up. We get a lot of haters that are mad at how aggressive I am on these shows, but I do it so that we can all learn. We have to counter those people. We got to push them away, click the thumbs up below to counter them and know that I appreciate your guys’ support. All right, I’ll be in the comments. See ya.