How does a SaaS founder make over $100m in profits in the last 12 years, yet very few people know of him? Netcore Cloud CEO Rajesh Jain, the marketing automation innovator, sat down with the GetLatka team as the company he founded celebrates its 25th anniversary.

Netcore Cloud, a global full-stack MarTech platform, offers AI-powered marketing automation and analytics solutions for B2C companies.

Now, after 25 years in emerging markets, this MarTech icon is aggressively eyeing the US and Europe for expansion. In Jain’s conversation with Latka, the bootstrapped legend revealed the details of his recent acquisition (including where he got the $100m cash for the deal), his catchphrase for similar debt-free, 9-figure companies, and how he has grown while remaining profitable and debt-free.

- $110m in annual recurring revenue (ARR)

- Team of 750 at Netcore with 175 engineers, 70 sales reps with a quota

- Bought Unbxd for $100m, all cash

$115m sale of IndiaWorld funds Netcore Cloud

Before Jain became the leader of marketing automation, he was an Indian internet leader: he set up the first Internet portal in India in 1995, around the same time Yahoo and eBay launched. By 1999, IndiaWorld had grown to a family of internet portals, which he sold for $115m (nearly all cash) just before the bubble burst

“If I waited 3 more weeks, my life would have been very different.”

Revenue: How Netcore Cloud grew to $110m

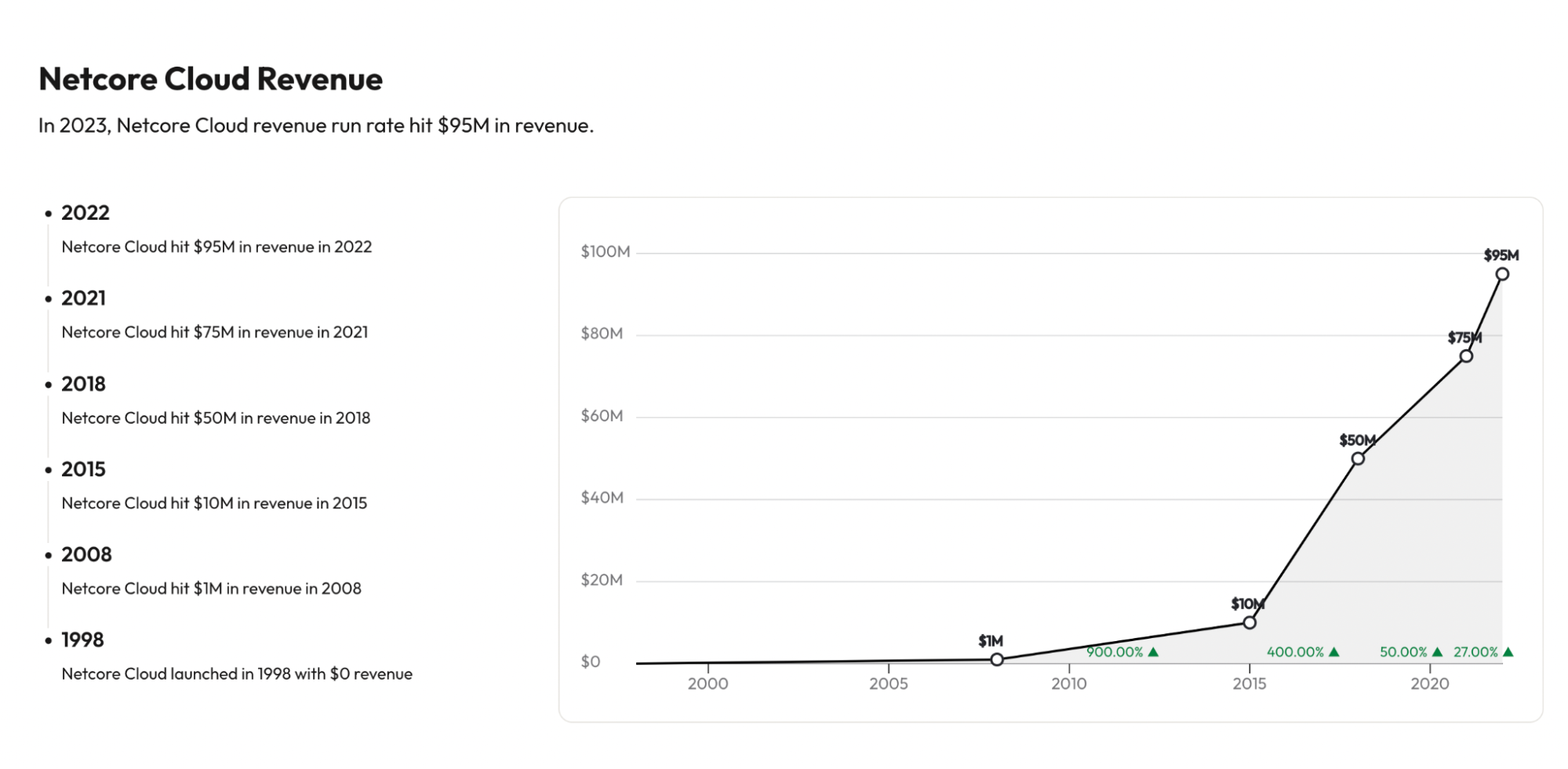

Jain shared that he used that cash from IndiaWorld to build and launch Netcore Cloud 25 years ago. Latka queried Jain about when he hit his milestone targets. Together they compiled an approximate revenue history:

2008 $1mm

2015 $10m+

2018 $50m

2021 $75m

In 2022, Netcore revenue was tracking at $85m, plus they added $10m from the Unbxd acquisition to flirt with $100m total ($95m). CEO Jain anticipates hitting a revenue run rate of $150m in 2024. Latka quipped that it looked like they would easily eclipse that figure.

2 businesses, 1 new iconic term

Founder Jain introduced a new word into Latka’s vernacular by dropping the catchphrase “proficorn” into the interview. Jain describes a proficorn as a “profitable unicorn”; specifically, a profitable, private, promoter-bootstrapped company valued at $100m+. Jain proudly described Netcore as his second Proficorn and encouraged Latka to use the new term. As a bootstrapping believer, Latka embraced the phrase.

Netcore Cloud valuation breaks $1 Billion

CEO Jain revealed that he is planning an IPO in India in 12-24 months, noting that he owns 75% of the business and employees own the remaining 25%. “It’s time for some value creation for the employees,” he explained, adding, “An IPO gives us cash and resources for consolidation.” Like many industry pundits, Jain believes that the MarTech space is headed for more consolidation, as customers want to cull the number of vendors they manage. That’s why Jain used $100m of Netcore’s cash on hand to acquire Unbxd. “It’s a great asset. It tells a fuller story. It adds to the stack and provides a global presence,” he explained.

Jain estimates the Netcore valuation multiplier at 6-10X, perhaps with a bonus for profitability. He clarifies that he’s not as interested in the intermediate valuation; after being around for 25 years, he wants the company to be around for another 100.

Latka calculates that Netcore currently sits at a valuation of $800-900m, with a $1.5B-2B valuation likely at IPO.

15 years of profits, $100m cash in bank

Netcore currently generates a profit of $1m per month, maintaining an overall profit margin of 17-18%. The purchase of Unbxd required Netcore to invest nearly all its available cash, but Jain is convinced the move is right for both organizations.

Customers: Netcore has 5000 B2C customers

CEO Jain explained that Netcore maintains 2 distinct revenue streams. Their high-margin business is the email and MarTech platform they sell globally. Netcore also manages a low-margin SMS business, all in India. Netcore manages 75% of India’s email traffic and half of Asia’s, to the tune of 18 Billion emails per month. They are one of the last independent email companies in the world. Their customer base has been increasing by 20% annually.

Growth strategies: Netcore expands through acquisition and geographic footprint

In 2022, Netcore purchased 90% of Unbxd, with the founder retaining the other 10%. Jain explained that the acquisition gave Unbxd the advantages of both access to additional capital and capabilities while providing their existing customers with a more complete solution. For Netcore, it provided a pathway into the US and Europe and boosted their net dollar retention. With the acquisition, now their net dollar retention is 140% (45% from expansion, 5% churn).

CEO Net Worth: Rajesh Jain has net worth of $600m

With an estimated current valuation of $800m and a 75% ownership stake (the other 25% belongs to the employees), founder Jain’s net worth is estimated at $600m.

Famous 5

Favorite Book: Rajesh Jain named Jim Collins, author of Beyond Entrepreneurship 2.0, his favorite read today.

CEO he’s following: The two CEOs he follows are a pair of his competitors at Twilio and Salesforce. Jain complemented their work, noting, “Both the CEOS have a lot to teach us about how to build very big SaaS companies.”

Favorite online tools: Rajesh named both Salesforce and Freshworks as his favorite online tools.

Balance: He sleeps 6.5-7 hours each night, adding, “I wake up at 4 AM and then go to bed early.” Rajesh is 55, has been married for 29 years, and has a 17-year-old child.

What does he wish he had known at 20? “I wish someone had told me how important things other than engineering would’ve been, especially economics, psychology, all these disciplines. I think I realized the value of liberal arts pretty late in life.”