COVID-19 negatively impacted many companies across the globe, yet Proposify SaaS in Halifax, Nova Scotia, Canada, saw 20% year-over-year growth in 2020, ending the year with $564,000 USD in MRR.

After raising $3.5 million in 2016 and 2019, Proposify added an additional $3 million of operating capital to its balance sheet in March 2020 — this time, in a funding round where the Canadian Business Growth Fund also did a full buyout of the company’s existing investors.

Because Proposify was fresh out of a round at the same time an unpredictable pandemic hit, CEO Kyle Racki says investors preferred to save the capital for a rainy day rather than invest in any growth strategies.

Even though growth slowed overall, Racki says the modest growth it saw “[exceeded] our investors’ expectations, so we were able to allocate some of that capital into growing the team, investing in product and sales.”

Proposify has 100 employees, including 40 engineers and a 12-person marketing team that helped the company rank for nearly 30,000 organic keywords and garner 37,000+ organic clicks per month.

Proposify creates a consistent user and buying experience and offers insights into how prospects interact with documents to give leaders who scale SaaS sales teams more control and visibility into their sales documents. That way, teams don’t have to navigate the chaos of proposals, contracts and quotes being sent out across a range of tools by multiple sales reps.

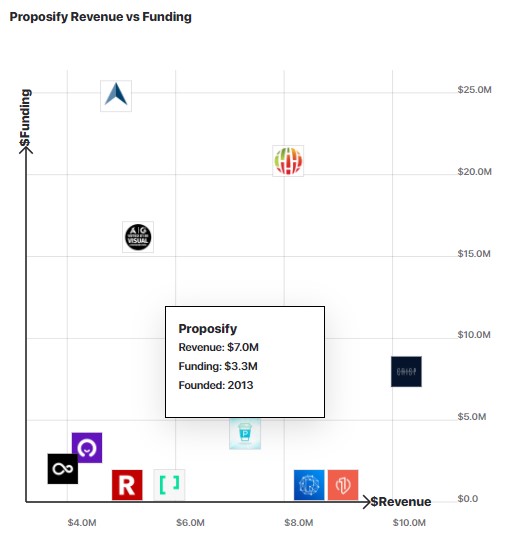

Source: GetLakta

Since its launch in 2013, the SaaS has grown steadily, especially in the last year, where it grew to a $7 million run rate in 2020 from $4.5 million in 2019. One key to this increase? Expanding its engineering team and hiring quota-carrying sales reps to target high-touch customers.

Proposify splits its 10,000 customers into two segments: large and larger enterprise, which Racki describes as the anything-under-$300-per-account MRR group and the $300+ MRR group.

The 228 accounts in the company’s larger segment have an ARPA of $789 and an ACV of $10,000+ — although they account for only 2% of Proposify’s logo retention, they make up 20% of its ARR.

“We’re focusing more on the high-touch segment, because that actually doubled last year,” says Racki. “If you look at the ARR to MRR from that high-touch group, that grew 98% in 2020, whereas the self-serve segment grew about 7.2%.”

To reach more of its target market, Proposify plans to invest in product and engineering teams to release more products and refine the tools target customers gravitate to most — at the moment, Racki says that’s its Salesforce integration.

What is Proposify’s annual revenue?

In 2020, Proposify generated $7 million in ARR.

What is Proposify’s monthly revenue?

In 2020, Proposify generated $564,000 in MRR.

Who is the CEO of Proposify?

Kyle Racki, age 37, is the co-founder and CEO of Proposify.

Transcript Excerpts

Acknowledge hiring mistakes, then forge a path forward

“This has been an evolutionary process for about two, three years now. The first time we had raised the round, we kind of did the classic mistake where you go and hire a VP of sales with big company experience. They go and hire 10, 20 reps very quickly, without much of our go-to-market or our positioning figured out. So, I think we’d already made that mistake and taken the team back to a very small size.”

Rule #1: Incentivize the drivers of your growth

“In terms of setting a [sales] quota, we’re always adjusting that process. We’re even going into 2021 with a new comp plan for the reps. But essentially, what it looks like now moving into 2021 is, as opposed to resetting the commissions and the quotas every month, it’s more of looking at annual targets and then accelerators, once they surpass the baseline target for the year. So, everything after that point becomes much more lucrative for the reps.”

Know what it takes to land, then upsell target customers

“The way we get the logos in the door is with the Salesforce integration. That’s the starting point for that $7,000 ACV. Essentially, if you’re a sales team that [has] any kind of growth happening in it, you’re using Salesforce and you need tight integration with a management package or whatnot. Plus, the service component of professional services, onboarding, configuration and getting your account set up — that’s where we’re starting to find those larger high-touch customers, what they want and what they’re willing to pay for. As far as expansion, it’s typically seat sizes. So, one of those accounts might come in with about 10 or 20 seats they want to start with. And then, throughout the year, [customer success] will expand or even go into other divisions or other parts of the company where they can resell Proposify into it.”

Align your organization around key objectives

“The whole company is aligned around this higher-touch segment. We don’t break out engineering teams or product teams to say, ‘Well, you guys go after the low segment and you go after the high one.’ Everybody is building for the high segment, and if some of those improvements to the product also lead down and help the smaller customers, that’s great. But every team is essentially aligned around our target customer and the market we’re going after.”

Full Transcript Nathan: Hello everyone. My guest today is Kyle Racki. He’s the co-founder and CEO of Proposify, a software as a service company based in Halifax, Nova Scotia, Canada, which currently serves more than 10,000 customers worldwide. He started his first business, a web design company, at age 24 and sold it after five years. He’s blogged extensively about his journey through the ups and downs of entrepreneurship and is the author of Free Trials (and Tribulations): How to Build a Business While Getting Punched in the Mouth. Kyle, you ready to take us to the top? Kyle Racki: I’m ready. Nathan: Just speaking about getting punched in the mouth, I remember before COVID hit, we were in person at an event and you were mentioning, “Hey, we’re going to try and get a round done.” And then COVID hits. Give us an update. What happened? Did get a deal done? Kyle Racki: We got a deal done. Nathan: That’s great. And so, what were you looking for? And for people that are not familiar with Proposify, from your last episodes, give a quick overview on the product. Kyle Racki: Sure. So our products essentially helps sales leaders in scaling SAS teams, SAS sales teams get more control and visibility into their sales documents. So what we typically do is we help sales teams that are growing, who it’s sort of chaos, and every rep is sending proposals and quotes and contracts through PDF and Word and all these different tools. We basically tighten that up, create a more consistent user experience and buying experience and offer insights and analytics into how prospects are interacting with the documents. So that’s what we do as a company. Kyle Racki: Now you asked about the round. So, we had previous investors who essentially, we got in touch with CBGF, which is the Canadian Business Growth Fund who their LPs are like TD Bank and large national banks. And we were going through the process of them doing a full buyout of the existing investors and putting some capital on the balance sheet. So we were able to get that deal done in March of last year. Finally closed around May. Nathan: Yeah, that’s great. So, explain to me the strategy there. So there’s a lot of people listening that have raised a little capital and they’re going, “Some investors want out, how do I recap them?” You did this, it sounds like. Sort of give me the extra context there. Kyle Racki: Sure. Yeah. I mean, I have to be a bit careful about how much information I can give out just out of respect to the investors. But I mean, essentially we had a group of investors who, for one reason or another, wanted out and they wanted their money back. CBGF came to the table with essentially a proposition that would enable them to be bought out 100%, get out completely and put almost … oh geez, I almost forget now three million on the balance sheet. Nathan: So what was the total round side? Three to the balance sheet and how much to early folks? Kyle Racki: I had agreed I would not disclose that information. I have to keep that close to my chest. Nathan: That’s fine. That’s fine. Okay. Got it. So prior to that round though, you had raised about 3.5 million, correct? Kyle Racki: Yeah, about. Nathan: In 2019 and 2016. Okay, great. And so moving forward, you have three million in extra of operating capital on the balance sheet. Now it’s March 2020. Where are you investing that capital last year to grow the business? Kyle Racki: So I think, obviously for everybody, there was a lot of unknowns around March and moving forward in last year. People just didn’t know what was going to happen. So, I think the initial strategy and what our investors wanted was essentially just sit on the cash, don’t spend it, keep it in the bank in case everything goes to shit and we need the money. Kyle Racki: But what we actually found was that even though growth was slowed overall, there was modest growth and it was actually exceeding our investors expectations. So we were able to allocate some of that capital into growing the team, investing in product and sales. But overall we did not spend even close to the amount of capital that we raised. So now that we’re heading into 2021 where we’re looking to really invest is mainly in the product and engineering team. Nathan: Flush that out for me today. How many engineers are on the team? Kyle Racki: We have about a 40 probably split between dev ops [inaudible 00:04:17]. Nathan: And what’s the total team size, Kyle? Kyle Racki: Company just past 100 or so employees. Nathan: Oh, got it. Okay. So that’s up about 25 since I interviewed you back in late 2019. Sounds like most of that growth came from engineering. Do you have any quota carrying sales rep these days? Kyle Racki: We do. We actually have three quota-carrying reps and then sort of the BDRs and support team around them. And so, one thing that we hope to do as we get in further into this year and see how things are going is essentially looking to scale up that sales team. Nathan: So three quota carrying. And then the whole sales organization together is how many? Kyle Racki: It’s about 10. Nathan: Kyle Racki: So we ended the year at 564,000 in MRR USD. Nathan: Got it. Okay. Got it. Kyle Racki: Nathan: That’s healthy. So the story of this podcast is really how you went from about four and a half million in terms of run rate up to about a $7 million run rate by adding 10 engineers, bringing on some quota carrying sales reps. Let’s talk about the reps for a second. That first sales hire is always tricky. How’d you decide what to set their initial quota at? Kyle Racki: Yeah, I mean, this has been an evolutionary process for about two, three years now. The first time we had raised the round, we kind of did the classic mistake where you go and hire a VP of sales with big company experience. They go and hire 10, 20 reps very quickly, without much of our go to market or our positioning figured out. So I think we’d already made that mistake and taken the team back to a very small size. Kyle Racki: The team has been led for the last year and a half by Daniel [Hebert 00:06:11]. And really in terms of setting quota, we’re always adjusting that process. We’re even going into 2021 with essentially a new comp plan for the reps. But essentially, what it looks like now moving into 2021 is like, as opposed to resetting the commissions and the quotas every month, it’s more of looking at annual targets and then accelerators once they surpass the baseline target for the year. So essentially everything after that point becomes much more lucrative for the reps. Nathan: So if I was joining today and I was on this new comp plan you’ve put together, what are you going to tell me that my quota and my annual quota is? Kyle Racki: Some of the numbers I did not quite prepare for. Nathan: That’s okay. Kyle Racki: Off the top of my head, if you were joining today … So one of the things that we’ve adjusted is there’s actually a bit of a variation from rep to rep. So some reps who want a bit more of their percentage in salary and others that want a little bit more in commission, depending on where they’re at in life and family commitments and whatnot. So we’ve actually provided a little bit of flexibility. So it’s not just complete boiler plate from rep to rep. But essentially you’re looking at a … this is a little bit talking out my you know what, but 10% roughly of the gross sales within accelerators that get closer to the 20% mark after you’ve hit a certain amount of quota. Nathan: Okay. So is that quote amount, like they need to land … there’s three of them. So if you wanted to add three million in ARR and they would each have an average of them, a million dollar quota. Is this sort of the range you’re looking at? Kyle Racki: Sure. Yeah. What we could do is if you wanted to cut this out of the interview when you launch it, I can just look up the numbers really quickly. Nathan: Yeah, no, that’s okay. Yeah. Take your time doing that. I mean, the reason I’m asking is because when you came on last year, you talked to us about average price point. You’re not yet, at least from what I can tell, at enterprise motion. Your average is like a 45 to $50 a month sort of deal. And sure, you might sell a lot of seats. But walk me through that. How do you manage the low ACV, but still be able to have enough deal flow and volume to comp a sales rep appropriately. Kyle Racki: Right. So maybe what I’ll do is I’ll kind of dig into our two segments because I think this will answer a lot of your questions, maybe even more so than the compensation part of it. Which is that we’ve been in the process of moving up market now for a couple of years. And last year we’ve seen a large amount of growth on the larger segment. So when you look at our total numbers as a company of it all blended in, it looks a certain way, but once you start breaking it out into two segments, which is the 300+ MRR group and the anything under 300 MRR, which usually typically would equate to self-serve customers, those two groups look drastically different. And so what we’re doing is we’re focusing more on the high touch segment because that actually doubled last year. So if you look at the ARR to MRR from that high touch group, that grew 98% in 2020, whereas the self-serve segment grew about 7.2%. Nathan: In terms of net new revenue? Kyle Racki: In terms of total MRR, including expansion. Nathan: Yeah. Yeah. Okay. Yeah. So net new revenue. Yeah, yeah, yeah. So, just to be clear, you’re talking about $300,000 a month plan. So you’re talking like minimum, these are like $4,000 ACV accounts and higher is where you’re focused on incentivizing the sales team to go close more deals. Kyle Racki: Well, actually when I say 300 plus, all I mean is that is sort of the starting point of where we start breaking up that segment. But the actual ARPA from that group is 789. Nathan: Oh, wow. Okay. Kyle Racki: So we’re looking at about a 10K-ish deal size. We’ve got a handful of customers that are above 20K in ACV, one in particular closer to the 50 mark. But that’s where we’ve been going as a company, as far as sales targeting those accounts, bringing them on board and CS expanding them. That healthy segment, it only makes up 20% of our total ARR, but it’s actually 2% of our logos. So we’re finding- Nathan: Wow. Kyle Racki: Yeah, I mean the logo churn on is under 1% a month. The net MRR churn is negative 2.3%. The LTV is 85K. So, that segment is the one that we’re essentially putting all of our effort towards. Nathan: And just to be clear, when you say 2% logos on your 10,000, so you’ve got about 200 of these enterprise-like accounts with around a $10,000 ACV or higher. And that’s where your three sales reps are focused on driving growth. Kyle Racki: Absolutely. 228 customers in that segment. Versus 10K total, right? Nathan: Yeah. That’s interesting. Okay. And walk me through a little bit the experimentation you’ve done about how to add more value to that very tight segment. Are you upselling just number of seats. If not, is there a product based upsell that’s working really well? What’s working? Kyle Racki: Yeah. So the way that we get the logos in the door essentially is with the Salesforce integration. That’s the starting point for that 7K ACV. Essentially, if you’re a sales team that’s of any kind of growth happening in it, you’re using Salesforce and you need a tight integration with like a manage package or whatnot. Plus the service component of professional services, onboarding, configuration, getting your account set up. That’s where we’re starting to find those larger high touch customers, what they want and what they’re willing to pay for. As far as expansion, it typically is seat sizes. So one of those accounts might come in with about 10 or 20 seats that they want to start with. And then throughout the year, CS will expand or even go into other divisions or other parts of the company where they can resell Proposify into it. Nathan: Interesting. So, I’m looking at your pricing page right now. You’ve got the user limits. You’ve got what else? Workspace. So talk to me about workspaces. Kyle Racki: Workspaces is, it’s not actually as big a draw as you might think. It’s very dependent on the account. Like one of our largest accounts is a cleaning franchise. So, they actually need several accounts or I think they’re at 40 or 50 separate accounts. That’s kind of where we get into workspaces, but it’s not a huge driver as much as roles and permissions, Salesforce, complex approval, products and price books, all those kinds of features, single sign on, security and so forth. Those get more on the enterprise plan. Nathan: When do you start dedicating engineering resources to developing new enterprise products so that you can add to your current seat based upselling, your current feature based upselling with Salesforce integration? I feel like there’s a missing third there, which is your ability to sell them another $10,000 ACV contract for another product you know they need tangential to proposals. Kyle Racki: So if I understand your question correctly, how do we assign engineering resources? Essentially, we’ve changed our pricing, our positioning over the last couple of years. In particular last year, nailed down our positioning. So essentially, the whole company is aligned around this higher touch segment. We don’t break out engineering teams or product teams to say, “Well, you guys go after the low segment and you go after the high one.” Everybody is building for the high segment. And if some of those improvements to the product also lead down and help the smaller customers, that’s great. But every team is essentially aligned around our target customer and the market that we’re going after. Nathan: What’s the next big product release you guys are working on? Kyle Racki: So the big thing that’s going on right now is a complete redesign of our pricing tables. The sort of limitations customers have run into, especially when they get into complex pricing has been like being able to add multiple columns, being able to use formulas and whatnot, sort of like in Excel and be able to import that from Salesforce and feed it back. So if the customer select certain products or services, that gets fed back into the Salesforce reports for the financial teams. So that whole workflow of building pricing, how it gets displayed to customers, how it feeds into your pricing catalog, that’s probably one of the biggest ones that’s coming this year. Nathan: And then talking about again, growth and aggressiveness moving forward, I would argue you guys have been pretty darn capital efficient with about call it a one-to-one ratio of equity raised to ARR that you’ve been able to generate. So you guys, I would look at you and say you’re great capital allocators. Last time you came on in 2019, you said you were burning about a $100,000 per month in terms of your bank decreasing that much. Are you guys profitable today or break even, or where are you? Kyle Racki: I’d say depending on the month, we’re around the break even mark. Some months we’re cashflow positive. We essentially have the same amount in the bank that we did when we raised the money. So we’ve kind of gone down periodically and then gone back up depending on the month. Nathan: Yep. Okay. Interesting. Any acquisitions you’re looking at doing? Kyle Racki: Not currently, no. Nathan: Interesting. And if someone came to you and made an offer, buy you at a healthy evaluation, how would you guys think about an acquisition offer on your table? Kyle Racki: We would look at anything that made sense for the business. I think what we really want to do as a company is this segment that we’re going after, where we’re seeing the high growth, the huge need in the market, the traction that we’re starting to build around our positioning, that’s really exciting to us. And I think Kevin and I and my co-founder, we want to see that through. We want to get to the point where we’re doubling ARR total in a year’s time. So I think when that happens, let’s say one to two years out, we’d probably be in a better position to look at acquisition offers. Today, I’d say it would have to be pretty healthy for us to want to look at it. Nathan: Last question before we wrap up with a famous five. Your SEO game is very strong. You rank for over 29,400 organic keywords. You’re getting over 37,300 organic clicks per month according to the AH refs. Which firm are you guys working with on the SEO side? Or is it in-house? Kyle Racki: We do it all in house. Nathan: Oh, wow. How many people are dedicated to that? Kyle Racki: We don’t really have anyone dedicated to SEO, but our marketing team sort of factors SEO work into all the work that they’re doing. It’s about a 12 person marketing team. Nathan: Wow. Okay. Let’s wrap up here with the famous five. Number one, favorite business book? Kyle Racki: I just finished reading Inspired by Marty Cagan about how to create high-tech products customers love. And it’s a fantastic. Nathan: Number two, is there a CEO you’re following or studying? Kyle Racki: CEO? I don’t want to go with a cliched answer here. You know who I really like as Nathan Barry. Nathan: Yep. I agree. Just had him on and the way that he does profit sharing with employees is remarkable. We’ve got the interview coming out actually. It’ll be probably a day or two after yours, Kyle. So it’ll be close together. Number three, what’s your favorite online tool for building Proposify? Kyle Racki: I’m currently in the process of falling in love with Gainsight PX. Nathan: Number four, how many hours of sleep to get every night? Kyle Racki: I’d say seven to eight. Nathan: And situation? Married, single, kids? Kyle Racki: Married. Second time for both of us. And three kids. We just had our first together a year ago so he’s about 13 months. Nathan: Congrats, that’s exciting. And how old are you, Kyle? Kyle Racki: I’m sorry? Nathan: How old are you? Kyle Racki: I will be 38 in September this year. Nathan: Kyle Racki: Pretty much everything that I’ve learned in the last 17 years. Man, that’s a hard question. I think … I don’t know. You got me stuck on this one. Nathan: Well, think about where were you when you were 20? What were you working on? What’s something you wish you knew back then? Kyle Racki: I had no idea that I had been wanting to be an entrepreneur. I didn’t think I did. And I’ve been doing it now 13 years or something like that. So I mean, people is the biggest thing. It’s sort of a cliche. But it’s all about people, finding the right people, coaching them. You can’t build a company by yourself and that’s something everybody takes a long time to figure out. Nathan: Guys, there you have it. Proposify helps you get your proposals done. They’ve got a larger and larger enterprise segment. It makes up just 2% of their logos, but over 20% of their revenue, which topped $564,000 a month last month. That’s up almost 20% year over year. Very capital efficient. They’ve raised about total of seven million bucks recently [inaudible 00:19:17] March of 2020, where three million went to the balance sheet and some other amount went to buying out earlier investors. They’re scaling their team up to 100 people, 40 engineers, 10 sales employees, three quota carrying reps. Net revenue retention is above 100%. Again, a lot of the healthy economics you see from the high-growth SAS companies, Kyle is starting to see at Proposify. We’re rooting for you, man. Thanks for taking us to the top. Kyle Racki: Thanks, Nathan. Nathan: One ore thing before you go, we have a brand new show every Thursday at 1:00 PM central. It’s called Shark Tank for SAS. We call it Deal or Bust. One founder comes on, three hungry buyers. They try and do a deal live. And the founder shares backend dashboards, their expenses, their revenue, ARPU, CAC, LTV. You name it, they share it. And the buyers try and make a deal live. It is fun to watch. Every Thursday, 1:00 PM central. Nathan: Additionally, remember these recorded founder interviews go live. We release them here on YouTube every day at 2:00 PM central. To make sure you don’t miss any of that, make sure you click the subscribe button below here on YouTube. The big red button. And then click the little bell notification to make sure you get notifications when we do go live. I wouldn’t want you to miss breaking news in the SAS world, whether it’s an acquisition, a big fundraise, a big sale, a big profitability statement, or something else. I don’t want you to miss it. Nathan: Additionally, if you want to take this conversation deeper and further, we have by far the largest private Slack community for B2B SAS founders. You want to get in there. We’ve probably talked about your tool if you’re running a company, or your firm, if you’re investing. You can go in there and quickly search and see what people are saying. Sign up for that at nathanlatka.com/slack. Nathan: In the meantime, I’m hanging out with you here on YouTube. I’ll be in the comments for the next 30 minutes. Feel free to let me know what you thought about this episode. And if you enjoyed it, click the thumbs up. We get a lot of haters that are mad at how aggressive I am on these shows, but I do it so that we can all learn. We have to counter those people. We’ve got to push them away. Click the thumbs up below to counter them and know that I appreciate you guys as support. All right, I’ll be in the comments. See ya.