-

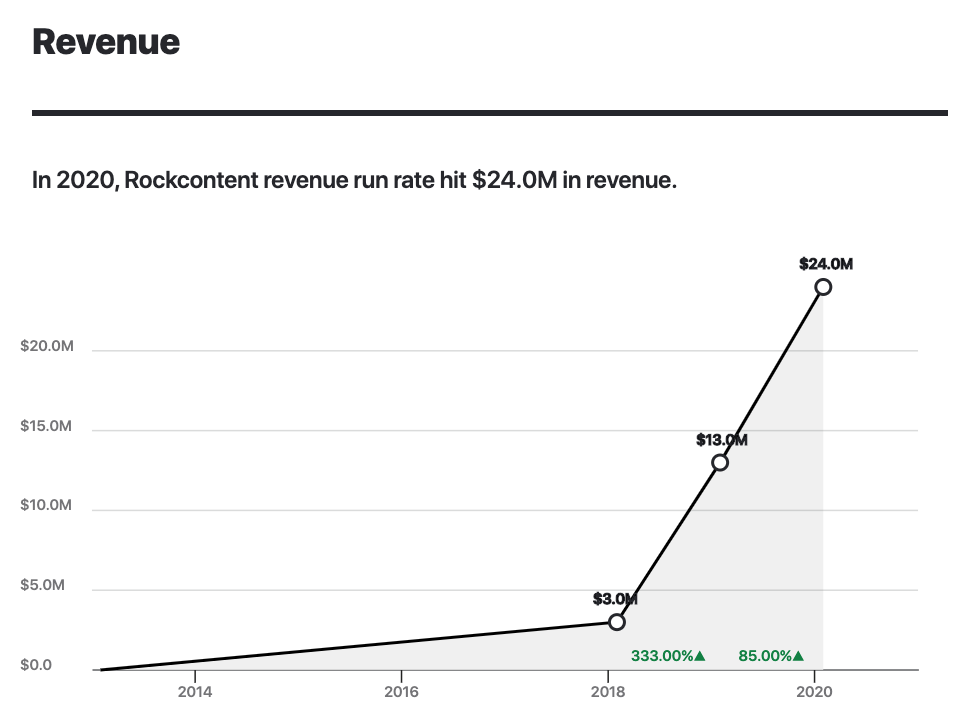

Rock Content had $8m in revenue in 2018, It grew to $13m in 2019, and as of August 2020, it is at a $24m run rate with eyes on $26m by the end of the year, profitably.

-

The company raised $10m to pursue Scribble Live acquisition in late 2019, as a pivotal movement to accelerate its global expansion.

-

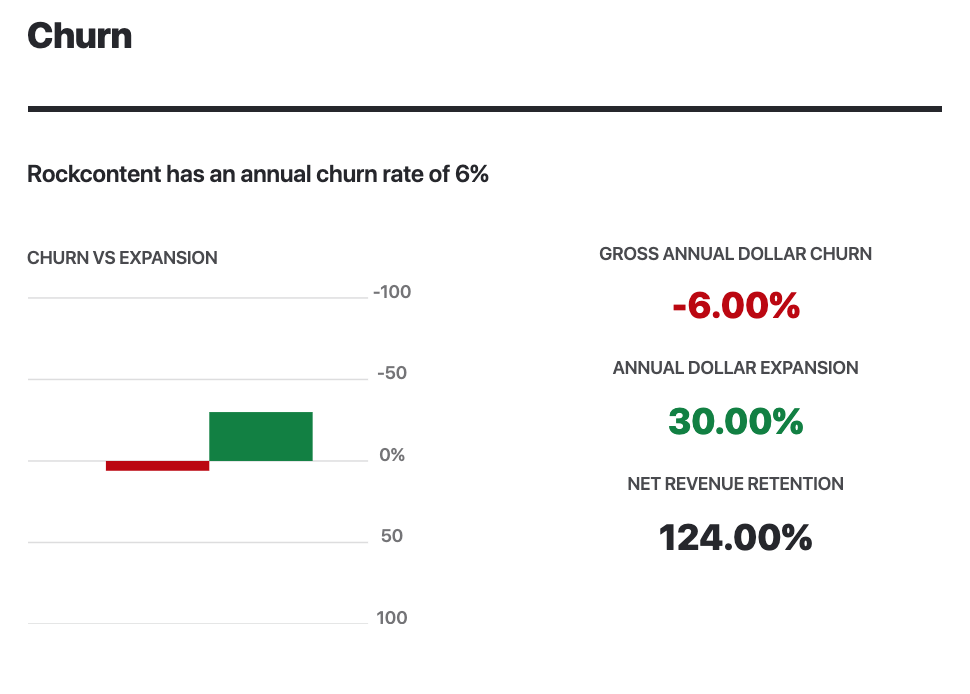

Net Revenue Retention broke 100% for the first time in July due to product cross-selling, even during COVID.

With advisors such as Mark Organ, the founder of Eloqua, Lincoln Murphy, the customer success guru from 16 Ventures and Mark Roberge, former Chief Revenue Officer at Hubspot, Rock Content is seen as a content marketing upshot with potential to lead the category globally, starting from Latin America.

Could Rock Content be the next $1b unicorn in the content marketing space?

Diego Gomes (CEO) founded the company in 2013 with his two co-founders Vitor Peçanha and Edmar Ferreira. They focused mainly on services and marketplace revenue related to helping companies with their SaaS content marketing strategy.

Source: https://getlatka.com/companies/rockcontent

Soon after that, the trio brought in Matt Doyon, a former sales executive from Hubspot, to join and accelerate growth.

Today, the company gets 80% of its revenue from an enterprise cohort of customers paying for a suite of 4 different products.

50% of last month’s revenue, approximately $1m, was pure SaaS, 40% came from their creative talent marketplace, and 10% came from professional services.

In this interview, Nathan Latka sat down with Rock Content CEO, Gomes, to discuss its metrics and fast growth trajectory.

Rock Content Has 2,000 Customers That Pay for These 4 Products

The company started as a tech-enabled creative services provider, leveraging a talent marketplace full of 80,000 freelancers to help their customers to create infographics, videos, and ebooks. Check out Visual.ly to see what this marketplace looks like today.

This marketplace does approximately $10m in revenues annually (40% of Rock Content revenue).

The company sells “creative wallets,” to help customers always have content ready to go, at scale. This generated predictable revenue for Rock given that today “brands have to become publishers to succeed”, according to Gomes.

In addition to Visually, the company sells 3 other SaaS products designed for Content Marketers and CMOS, called Studio, Stage, and Ion.

Studio is a Content Marketing Platform (CMP) that helps marketers, plan, create, schedule, distribute, and analyze their content marketing results.

Stage is a WordPress based Digital Experience Platform used by brands to build high performing websites, conversion-oriented content hubs, and exceptional customer experiences.

Ion is an Interactive Content Platform for marketers to build landing pages, quizzes, assessments, and solution finders. Its focus is to help marketers collect first-party/declared data, important in a world where everyone must comply with GDPR and privacy regulations.

Studio, Stage, and Ion are sold on a pure SaaS basis and do $12m in revenue (50% of Rock Content total revenue).

How Much Does Rock Content Cost?

Over the years, Rock Content has moved upmarket from the SMB segment to focus more on large enterprises. With this transition, average annual contract values have increased by 7x over the past two years, going from $3k to $20k.

It was a bold transition: In 2018, 60% of their revenues came from small businesses. As of January of 2020, SMB’s only made up 20% of Rock Content revenue.

As COVID gripped the world, Rock Content small business customers faced several challenges and shrank by almost 50%. Today they make up just 10% of the company’s revenues.

How Rock Content Onboards Brands Paying $200,000+ Annually

While the SMB customer cohort shrank, Rock Content was intentional about scaling their presence in enterprise accounts. They are executing well, showing significant improvements in revenue retention (100%+), gross margins (70%), and growth (2x you revenue growth).

Their sales team targeted new enterprise accounts focused on a natural customer expansion strategy based on product upsell and cross-sell. The goal was to get customers investing more and more each year as they used more of Rock Content’s product suite.

At the same time, the motion for the SMB segment shifted from sales-led to product-led, driving a lower-touch, fast-paced customer acquisition machine, supported by the land and expand strategy.

Today, their average customer pays $20,000 per year to use their SaaS platforms. Their enterprise customers often pay more than $200,000 per year. Oracle, Microsoft, Cisco, the NFL, and several other big logos use Rock for content marketing today.

The company has executed this strategic shift by segmenting its sales and marketing initiatives in two main two groups: Velocity and Solution Sales.

The Velocity teams focus on shorter sales cycles and a lower touch acquisition motion, while the solutions teams focus on more complex, multi-product deals, often selling to big enterprises.

The company also has a Named accounts segment, which works closely with its most prominent logos to ensure customer satisfaction and expansion.

Today, Rock Content employs 50 sales reps that carry a quota, 10% of the company’s total headcount.

So what does it cost Rock Content to onboard a new $20k ACV account?

Rock Content Spends $12k To Acquire $20k ACV Customers.

Given its global presence, some markets, such as Latam, might see a lower CAC than North America. On average, their payback is between 3-4 months because 70% of contracts are paid upfront with an immediate payback.

CAC is typically between $12k-$14k on a blended global average basis to get a new $20k per year account, giving the company excellent an LTV/CAC, above 5 across all segments, and getting close to 10x in the enterprise segment.

Did Rock Content Valuation Suffer From 50% Non-SaaS Revenue?

Investors in SaaS companies usually discourage lower margin professional services revenue as they tend to prefer a focus on 85%+ margins and SaaS only product lines. Rock Content is a SaaS enabled Marketplace and has 70%+ margins today.

In some cases, company valuation will take a hit if a significant portion of revenue is not SaaS. Still, given that comparable marketplaces such as Fiverr and Upwork trade at high multiples that are close to SaaS business, it wasn’t a problem.

Gomes says that didn’t happen in Rock Content’s $10m fundraise last year (the company has raised a total of $13m). According to him, they had to educate investors about SaaS Enabled marketplaces. Still, investors liked that content is a recurring need for brands and that the company was able to grow in a very capital-efficient way.

Diego also says that is because he could point to his continually improving net revenue retention numbers, which upped from 75% to 94% in less than 18 months.

“What matters in our business is lifetime value and continuous investment in our SaaS products and our talent marketplace. The marketplace behaves a lot like SaaS, given the fact that brands will always need to create more content to succeed in digital marketing.”

Rock Content Retained 94% of Revenue in 2019 (Gross)

The company is now working to improve this by going upmarket with a strong focus on NPS, their global average is 51, with a 70 score for the named accounts segment.

For the first time in the company’s history, in July 2020, the company hit 100% net revenue retention across all their customer segments, including small business. Diego believes this is a trend that will endure. “Our new go-to-market motion helped accomplish this.”

He continued, “Today, most customers start using our Stage product to assemble their website, host their content hubs and blogs, and upgrade to Studio or Ion. It’s a motion that aligns better with the customer journey, and we can help our customers find out what is their next logical step for success.”

In July, the team cross-sold and minimized churn so much so that they hit the holy grail of SaaS: -3% net negative revenue churn (or greater than 100% net revenue retention).

6% of this expansion came from LATAM customers, and US-based customers expanded 2% on average.

Source: https://getlatka.com/companies/rockcontent

Rock Content Would Not Sell Right Now, No Talks

Contently, Newscred, and Skyword all compete in the content marketing space space as well.

When asked if Gomes would consider being acquired by a big public company or any of his competitors, he responded:

“I don’t see a clear path to any consolidation with any competitors in the short term (18-24 months). We’re here for the long term and would not consider selling. Our big dream is to lead the category.”

Should Rock Content start thinking about exiting, Hubspot has to be high on the list with former Hubspot CRO Roberge listed as a company advisor:

“Whether you’re in Boston, Boca Raton, or Belo Horizonte, Brazil applying the proven fundamentals of a sales methodology: the buyer journey, the sales process, and the qualifying matrix to a world-class team is a recipe for success. Adding that to a business whose mission is firmly grounded in custom success as its top priority, Rock is charting a course for scaleable success in a content-first world.”

Is Rock Content Acquiring Other Companies?

Gomes likes M&A in a strategic instance, and he is a believer in showing both organic and inorganic growth. Rock Content is looking for businesses with strong cross-sell potential to their current customers or consolidation opportunities in spaces they are already in.

To date, the company has acquired 2 companies: iClips and Scribblelive. The first one was a “bootstrapped acquisition”, while Scribble required an additional $10m in funding to pursue. The final deal was a mix of cash and stock.

Rock Content likes to monitor spaces adjacent to content marketing closely. They have no specific niche focus right now, but hosting, content distribution, and planning are the ones they watch closely.

Their strategy is to own the customer for everything related to content marketing. They have plans to consolidate vertical marketplaces that help their customers create more diversified content formats.

Would you Acquire more Creative Marketplaces?

Yes, says Gomes. Visual.ly was acquired for this reason; the goal was to build our North American talent network. If we had to enter the market organically, it would have taken a lot more time and had cost us more.

The company would look at niche specific marketplaces that add new skills to their talent community or accelerate go-to-market for new geographies, like bringing new languages.

Today Rock operates in English, Spanish and Portuguese.

Getting to Know Rock Content CEO Diego Gomes

Favorite business book: The Outsiders by William Thorndike.

CEO he’s studying: Warren Buffet

Favorite Online Tool: Fireflies.ai to transcribe meetings and make them searchable.

Hours of sleep: 5-6 each night, married with no kids. 35 years old.

What he wishes he knew when he was 20: How to better lead and communicate by inspiring people and setting a great example. I’m working hard on my communication skills right now.

Nathan latka:

Hello everyone. My guest today is Diego Gomes. He is the Chairman, Chief Executive Officer and Founder of Rock Content, a SaaS blogger, Researcher and Evangelist. Rock is among the fastest growing SaaS companies and a global leader in content marketing solutions. Diego is an also an Endeavor entrepreneur, Angel investor and in his spare time he blogs at SaaSholic.com. Diego, you ready to take us to the top?

Diego Gomes:

I’m ready. I’m excited to be back.

Nathan latka:

All right, let’s not bury the lead here. We’re going to get into product in a second, but first you said fastest growing SaaS company. So what are you at today in terms of revenue and where were you a year ago?

Diego Gomes:

So Rock has been in a trajectory to really lead the content marketing category, and we’ve seen really fast growth over the last few years. Last year we closed at around 13 million. This year. We’re expecting to close between 25, 26.

Nathan latka:

And where are you today in terms of run rate?

Diego Gomes:

Around $24m and something.

Nathan latka:

Wow. So it’s because of COVID, you’re only planning to add about a million dollars in new ARR between now and the end of the year?

Diego Gomes:

Yeah. We’re expecting one to two million, and we slowed down a little bit in sales in Q2.

Nathan latka:

Okay, there we go. So there you guys have it. Fastest growing, we just quantified it. And Diego, let’s back into the product here for a second. You have four critical components to the business. Tell me about the products and the product lines and how you help customers.

Diego Gomes:

Perfect. So content marketing is a complex and challenging process for several companies. We have four main offers to help marketers tackle that with a complete suite. So we have a talent marketplace where we have 80,000 freelance creators, it’s called Visual.ly. Visual.ly. There you can find talent to create infographics, videos, PDF, eBooks. It’s a very important piece of our ecosystem.

Diego Gomes:

We also have Rock Studio, which is our content marketing platform. It helps you plan your strategy, schedule your content distribution, measure your results. We have a digital experience platform based on WordPress. It’s called Stage. It’s for helping customers build high performance websites and content hubs. And lastly we have Ion, which is an interactive content platform which helps customers with lead generation and really reach data-driven experiences for their lead generation processes.

Nathan latka:

And what do customers pay on average for the suite?

Diego Gomes:

So not all customer buys all products. Our average SaaS ACV is around $20,000 a year.

Nathan latka:

Okay. So something-

Diego Gomes:

There are a few hundreds of thousands, but the average is around 20,000.

Nathan latka:

Okay. That’s very different than when you came on back in, I think it was July of 2018, your ACV then was just about $2,000. So have you guys really moved significantly at market?

Diego Gomes:

Significantly. We really shifted the organization focus to scale an enterprise sales team. Today, we have two sales teams. The velocity team, which focuses on smaller businesses and mid-market and the enterprise, we call it solution sales team, which is the fastest growing right now.

Nathan latka:

Okay. And how many sales reps do you have that are full-time and carry a quota?

Diego Gomes:

I would say around 40, 50. I don’t have the exact number, but it’s in that range.

Nathan latka:

And what’s the total team size today, everybody?

Diego Gomes:

We are around 400 people spread in four countries.

Nathan latka:

Wow, okay so four-

Diego Gomes:

Actually, 10 countries.

Nathan latka:

400 people, 10 countries, 45 sales folks. How many engineers?

Diego Gomes:

Around 100 people in product.

Nathan latka:

Okay, got it. So 100 are actually writing code.

Diego Gomes:

Yes. I’m also accounting for product designers. This is the whole product and engineering organization. It’s around one-fourth of our head count to date.

Nathan latka:

I see. Interesting. So this is not a easy transition, right? Again, about 25 months ago, you had an average ACV of 2000. Today you have an average ACV of 20,000. Does that mean that you let a bunch of your customers from two years ago churn? You had 1500 customers two years ago. Did you let the cheaper ones paying smaller amounts churn off?

Diego Gomes:

Yes. We actually evolved for a self-service model and a kind of self-selecting on the smaller business segments. COVID was a big accelerator. So if we look at January 2018, we were around 60% of our revenues were coming from small business. If you look at January this year, around 20%. And COVID actually increased our churn in the smaller business segment, which we were able to replace it for enterprise customers. So COVID brought the small business segment to around 10% and we replaced that with enterprise customers.

Nathan latka:

So how many total paying customers do you have today?

Diego Gomes:

A little north of 2000.

Nathan latka:

- Okay. Got it. Fascinating. So can I take 2000 times a $20,000 ACV? That puts you at a $40 million run rate. So your ACV is closer then to 10 or 15,000 on average.

Diego Gomes:

Oh, it’s because I have a lot of customers that are not SaaS subscribers. They use only the marketplace and our business has the SaaS component and the marketplace component, which is transactional. So people buy an infographic, an article. And I would say when it comes to SaaS customers, the number is significantly below that. I don’t have the exact number in front of me.

Nathan latka:

So you finished 2019, I think you said 13 million in terms of run rate. What percent for your last 12 months revenue was marketplace or transactional versus pure SaaS, would you say?

Diego Gomes:

It’s slowly decreasing, but it’s still around 40% of the total revenues. So we have around 50% SaaS out of 25 million, we have around 12 to 13 million in SaaS, we have around a 40% of that which would be around 10 in marketplace and a little 10% approximately in professional services.

Nathan latka:

Sorry break that down again. 50% SaaS, 10% marketplace and 40% like someone buying one infographic?

Diego Gomes:

No, 40% marketplace and 10% professional services.

Nathan latka:

I see. Got it. And what professional services do you offer?

Diego Gomes:

Mostly content hub development, interactive content experiences creation. We have expert advisory services for large enterprises that want to create a content marketing program from the ground up. We have a very strong professional services team taking a very consultative approach.

Nathan latka:

Interesting. Okay. Do you get hit from your investors on “stop doing this professional services do more SaaS”

Diego Gomes:

No. It never happened with us because we started in the early days doing more services than anything else. I think the first one year and a half we were doing the services in the marketplace space, and we started building upsize revenues in the middle of the journey. I actually see professional services as a great R&D tool to evolve the product. And I love the services team and the services revenues, and the investors are super aligned with us in that.

Nathan latka:

How much have you raised to-

Diego Gomes:

It enables us to be super capital efficient and increase retention services? Drive retention up. It’s been a meaningful component of our offers.

Nathan latka:

Let’s go to churn in a second, but first, how much have you raised to date?

Diego Gomes:

Around 11, $12 million.

Nathan latka:

12 million. Okay. And can we look at other companies sort of in this space that have also raised, what are these companies, like Contently? Would you put them in the same category as you?

Diego Gomes:

I would say yes, there are intersections with Contently, NewsCred, Skyward, these are companies that they raised a lot more capital, but they are on the same space.

Nathan latka:

Contently’s raised 20 million, Skyward I think is 60 and NewsCred is over a 100 million. They’ve got cash to play with, are you in any acquisition talks with any of them?

Diego Gomes:

No, not at all. I see these companies they hyperscale to early, my personal take, and that comes with a cost. They didn’t have the efficiency we always valued. I don’t see a clear path for any consolidation with any of them in the short term, maybe in the future, but we are not pursuing a direct competitor move in the next, let’s say 18 to 24 months.

Nathan latka:

Many people would say you’re like the HubSpot of Brazil, but you’re also now getting really good at content. Mark Roberge is also an advisor to you, so you have strong DNA ties to HubSpot. Would you sell to HubSpot if they gave you the right price?

Diego Gomes:

No. We are really committed for the long term. Actually, Mark Roberge is a mentor for Matt Doyon. Our CRO came from HubSpot, so we are very inspired. We have a deep admiration for what they’ve built. Our sales and marketing machines are similar to theirs. So I think that’s one of the… We are a key partner. We really like to work together with customers.

Nathan latka:

Yeah. In prep for this, I reached out to Mark and said “Mark what do you think about these guys?” And he said, “Nathan, look, whether you’re in Boston, Boca Raton, or Brazil, applying these sort of fundamentals of a sales methodology is really important, the buyer journey, the sales process, qualifying matrix to a world class team as a recipe for success.” And he goes on and said, “adding that to a business whose mission, you guys, is firmly grounded in customer success. Rock is on a course for super interesting success in this content first world.” So he’s clearly a big fan of what you guys are building.

Diego Gomes:

Yeah, I’m a big fan of his book. The Sales Acceleration Formula is one of my favorites. Our CRO Matt was coached by him and worked directly with him. So he’s a big inspiration. When we spoke last week… He’s always provided advice and helping us with strategy and direction.

Nathan latka:

You were talking about churn earlier and how you like professional services as an R&D tool, but also to retain customers. Your net retention is higher when you put professional services on an account, what is your revenue churn annually today?

Diego Gomes:

So last quarter we closed at annualized 94%. So that’s around half a percentage point mostly, is significantly-

Nathan latka:

Sorry 94% retention.

Diego Gomes:

Yes, annualized. So around a half a percentage point monthly. We are working very hard to improve that, driving NPS up, going up market. It’s a combination of different initiatives that we are being able to… This month by the way was our first month with 100% revenue retention across all our SaaS products. We actually got negative a few points. It was pretty exciting and-

Nathan latka:

Wait how did you do that any day, we’re in the middle of a crisis, you’re telling me not one single of your 2000 customers paid you less. They did no downgrades or anything. You lost no dollars of revenue?

Diego Gomes:

No, I’m saying net revenue retention. So not gross, in terms of we had a lot of expansion in cross-selling. Because our business has a suite of offers, the journey is the customer’s typically start in one product more often than not the cheaper product, like Stage, which is a simple website and content hub hosting platform. And then they go to Studio to Ion and gradually… The cross-sell machine is picking up fast, I’m really excited about that. That’s my main-

Nathan latka:

Can you quantify that? Do you know what your expansion is on an annualized basis?

Diego Gomes:

I do. I don’t have this in front of me right now, but I can bring it up in one minute from now. Loading here-

Nathan latka:

It sounds like if you have 0.5%, right, monthly revenue churn your expansion is at least 0.5%, if you hit a 100% net revenue retention last month.

Diego Gomes:

Yes, last month was a massive cross-sell move for us. So I think we were negative 3%, mostly through cross-selling our interactive content platform to all customers. Let me see if I can find expansion rate.

Nathan latka:

While you’re looking for that, 3% expansion last month and 0.5% churn gives you basically net revenue retention of 102.5%. So obviously if you do that annually and do that every month, that’s basically 125% net revenue retention on an annualized basis.

Diego Gomes:

Yeah. But the last month… Because we are introducing this new product, Ion across the board to our customers. It’s accelerating faster now. I don’t expect to sustain 125. My personal targets is to close the next year closer to 110, which is the medium for public traded SaaS companies. My expansion rate last month… where is the consolidated numbers here?… was around 6% in LATAM and 2% in the U.S.

Nathan latka:

That’s great, we’re running out of time here. Let’s talk top of funnel for a second. What are you spending fully weighted to get a new $20,000 a year customer?

Diego Gomes:

Today it’s very dependent on the geography. We have lower CAC in Latin America than we have in North America, but we are having a payback of three to four months considering that a significant number of deals are up front around 70% of our contracts are up front. The CAC is typically between 12 to 14K U.S., this is blended global average.

Nathan latka:

Got it. So $12,000 to get a new $20,000 a year account on a blended global average. That’s about a six month payback period. Again, talking averages here, is that right?

Diego Gomes:

Yeah, I would say it’s closer to seven, but because we have a significant number of upfront deals with immediate payback, this number goes down to closer to three months.

Nathan latka:

Very cool. Let’s touch on acquisitions real quick. You’ve acquired two companies. Are you looking at acquiring additional companies in the future?

Diego Gomes:

Yeah. I think acquisitions are told that most entrepreneurs in SaaS companies do not leverage often. I believe if you find the right strategic partner, you should pursue that. Both the acquisitions we did to date were very successful. We see ourselves as a company who will pursue both organic and inorganic growth strategy. We are looking for business that have a strong cross-sell opportunity to our customers or consolidations in some of the spaces that we are acting.

Nathan latka:

So you bought ScribbleLive. Did they have real revenue when you bought them? Or was that more of a tech acquisition?

Diego Gomes:

They had real revenue. They had around… Ion the interactive platform came from them. Ion product has around $6 million in annual revenues. I think a significant more than that, but that was back then and-

Nathan latka:

So when you bought the company, they were doing 6 million a year in revenue.

Diego Gomes:

They also had Visual.ly, which was a ScribbleLive product doing around 2 million if I recall correctly.

Nathan latka:

So that company together was doing 8 million in total revenue. How did you come up with the money to go buy that company? Or was it like an all stock deal?

Diego Gomes:

That’s why we raised $10 million to pursue this acquisition. The consideration was a mix of cash and stock. Unfortunately, I can’t disclose the specifics, but we raised for pursuing this deal.

Nathan latka:

Yes. So I’m saying, anyone doing the math, if the company was doing 8 million in revenue, and you’re saying you went and raised 10 million to do the deal. There’s no way they sold for a little more than one X revenue. What you’re saying is there’s also some stock options in play as well that juiced the deal for them.

Diego Gomes:

Yes. We had some dilution and specially for team members that remained with us. We had a very strong team joining us.

Nathan latka:

Very good. Okay. And so if someone’s listening right now and they’re going, I wonder if Diego would be interested in acquiring my company, what’s the perfect fit or is there a specific sector you’re looking to acquire in right now?

Diego Gomes:

We really like any space that is adjacent to content marketing. So there’s not a specific focus right now, but all the pieces that touch the content creation, distribution analysis in hosting are interesting to us. I cannot give you a little more color on that, but we get a lot of opportunities in the pipeline and we’re always observing what’s out there. Our strategy is to own the customer, in a sense that we want to provide every need that they have when it comes to content marketing. So we want to consolidate a few categories like vertical marketplaces that tie so let’s say audio, other skills that we don’t have on our talent network today and products that could match the same customers leads.

Nathan latka:

Would you ever go buy one of these networks you can go hire writers to create content for you or no, you want to stick to pure SaaS acquisitions?

Diego Gomes:

I would consider it definitely, Visual.ly for instance, which was one of the ScribbleLives’ products was acquired because we didn’t have a talent network in the North America back then. Now we have the skill and we have a large pool of talent. We would consider looking at other marketplaces like that, that would add new skills. By new skills I mean, let’s say an audio marketplace or a specific language, a Spanish marketplace or German, but we are mostly focused on SaaS.

Nathan latka:

Guys there you have it. Diego let’s wrap up here with the famous five, number one favorite business book.

Diego Gomes:

I would say, The Outsiders.

Nathan latka:

The Outsiders, that is a good one. Number two, is there a CEO you’re following or studying?

Diego Gomes:

I am in a Warren Buffet phase.

Nathan latka:

Number three. Is there a favorite online tool that you use to grow your company?

Diego Gomes:

I would say that’s a hard one. I would say Gmail is where I live, but it’s not a favorite tool it’s pretty much an obligation-

Nathan latka:

Very original answer there, Diego. All right. Number four. How many-

Diego Gomes:

Fireflies.ai, transcribing my meetings. I’m loving this tool.

Nathan latka:

There you go. Number four. How many hours of sleep do you get every night?

Diego Gomes:

Five, six when I sleep a lot.

Nathan latka:

And what’s your situation? Married? Single? Kids?

Diego Gomes:

Married, no kids.

Nathan latka:

No kids, and how old are you?

Diego Gomes:

I’m 34.

Nathan latka:

- Last question. What do you wish you knew when you were 20?

Diego Gomes:

That’s a hard one for me. I wish I knew how to better lead and communicate by inspiring people and by setting the example and tone. I am an introvert, so I’m working a lot on my personal communication skills and leadership skills. That’s something I think it’s an ongoing journey forever, but I wish I started studying that earlier on.

Nathan latka:

Guys, rockcontent.com growing fast, 2018 four or $5 million run rate, in 2019 they finished at $13 million run rate. And this year they’re hoping to close at a 24 or $25 million run rate. Currently already at 23, 24 million in terms of run rate. Healthy customer rates of 2000 customers. A portion of that are also paying for professional services. They’re scaling nicely, 12 million raised a lot of that was to fuel two acquisitions they did. He’s still looking for great acquisitions, 400 people on the team, 100 engineers, 45 quota carrying sales reps, never any retention last month was above a hundred percent for the first time as we look to continue to scale and drive growth a lot through expansion and cross-sell opportunities. Diego, thanks for taking us to the top.

Diego Gomes:

Thanks a lot.