-

Segmint’s 100 customers pay up to $180,000 a year for transaction cleanup

-

With $30 million raised, CEO reports “steady growth” and “low burn”

-

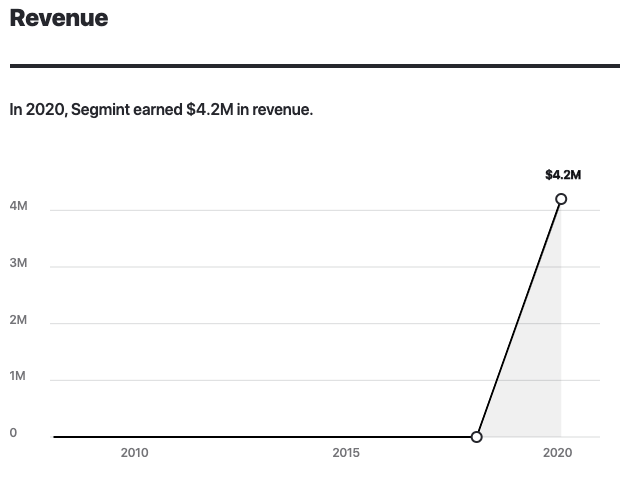

The company already doubled 2019 bookings in revenue

Segmint’s CEO Rob Heiser started off our interview smiling calmly, almost sleepily. His startup helps companies make sense of their transactions, and it’s not in any danger related to Covid-19. Our host Nathan Latka had the chance to pick this man’s brains for 11 minutes.

Bank statements, according to Heiser, are full of “hieroglyphics,” and companies often have to deal with a lot of those. The CEO calls Segmint “a group of library scientists” who help financial companies sort all the numbers and data in their transactions. Mid-market FinTech companies are Segmint’s bread and butter cohort.

“We take all that transaction data, and we do research against them,” Heiser explains. “We have a huge rules engine that’s based on machine learning, AI and human intelligence. That creates a really high quality and high match rate of every transaction that runs through a banking system.”

For example, an accountant or a FinTech executive may open a transaction document and see a line like WDW_CRO_RF. Most companies, Heiser says, won’t know what that means. “What we know is that he is a customer of Walt Disney World and actually a vacation club buyer.”

Segmint’s 100+ Customers Pay Between $72,000 and $180,000 a Year

Back in October 2018, Segmint had 12 paying customers. As of April 2020, the number of customers is “over 100.” The company charges customers on a per-user basis (FinTech customer, credit union member, etc.) Customers get charged only for active users.

Segmint’s average customers has 120,000 active users—depositors—on average, and the company charges between $0.06 and $0.20 per depositor. This means Segmint’s 100+ customers pay from $72,000 to $180,000 a year on average.

The different pricing points come from Segmint’s selection of products—not all customers buy all of Segmint’s features. One of such features is called Merchant Cleansing, which turns a “dirty, uncategorized stream” of transaction data into a nicely organized sheet with proper company names and logos in it.

Lifestyle analytics, automated messaging and communication to the customer are among Segmint’s other features.

Segmint To Hit Profitability in April, CEO Expects Up to 200% Growth Based on New Bookings

Segmint had raised $30 million up to October 2018, and they raised “a little bit more” after that. However, as Heiser points out, steady growth and low burn means there’s no pressure to raise more. The CEO adds Segmint “should be cash flow positive in April.”

Heiser doesn’t seem to be hindered by the Covid-19 pandemic. While he does see “some deals slide,” the CEO also sees a tremendous opportunity to build tighter relationships with Segmint’s customers during this time. Financial companies need insight more than ever, and Segmint is happy to deliver.

“We created a report on what’s happening in the world, and we’re giving it for free, it was called Financial Health Vital Signs Report,” Heiser adds. The report specifies 5 crucial areas which financial companies should be discussing with their customers.

Segmint currently employs 40 employees, 20 of whom are in the product and data teams. Overall, Heiser doesn’t “think their pipeline is going to slip too much,” and expects his company to grow 150% to 200% this year. Segmint already doubled new bookings revenue compared to 2019. “We’re not seeing a whole lot of softness around our business,” Heiser reassures.

Nathan Latka’s 5 Questions With Segmint Co-founder and Vice Chairman Rob Heiser

- Rob’s favorite business book? “Sensemaking by Christian Madsbjerg.”

- Is there a CEO Rob is following or studying? “I like Dan Collins.”

- Favorite tool to grow Segmint? “We use Monday a lot but Linkedin is my favorite.”

- How many hours of sleep does Rob get? Married? Single? Kids? “Probably get six to seven hours of sleep. Married, three kids. I’m 44.”

- What does Rob wish his 20 year old self knew? “That everything takes longer and all you have to have is patience and relentlessness to get through the challenging times.’

Funding:

2007:

2008:

2009:

2010:

2011: +$2.7M (1)

2012:

2013: +$3.3M (1)

2014: +$23.5M (1)

2015:

2016:

2017:

2018:

2019:

2020:

Revenue:

2007:

2008:

2009:

2010:

2011:

2012:

2013:

2014:

2015:

2016:

2017:

2018:

2019: $4.2M (Getlatka)

2020:

Customers:

2007:

2008:

2009:

2010:

2011:

2012:

2013:

2014:

2015:

2016:

2017:

2018: 12 (Getlatka)

2019: 100 (Getlatka)

2020:

Sources: