Ajesh Kapoor, Founder, and CEO, recently sat down with the GetLatka team to chat about SemiCab, a transportation logistics SaaS headquartered in Atlanta that’s turning trucking into a competitive advantage. Kapoor, who’s obsessed with finding better ways to solve significant challenges, shared with Latka how his SaaS platform differs from other trucking marketplaces, what he’s been able to accomplish with eight customers in less than 12 months, how scaling affects his business model, and what he’s looking for in a lead investor.

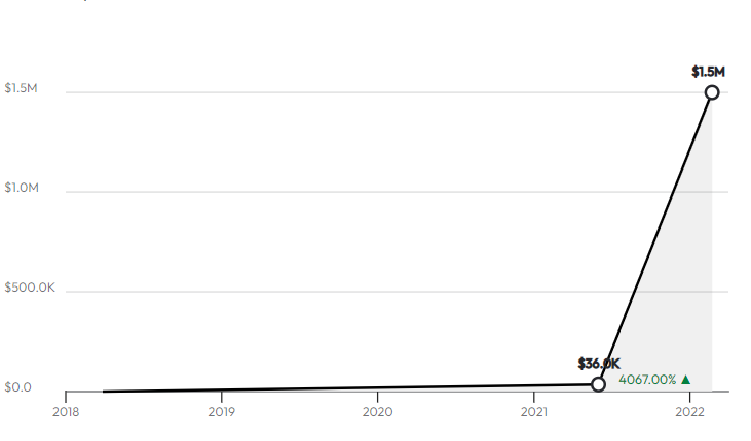

Kapoor launched SemiCab in 2018. He spent most of two years building his marketplace platform and testing its predictive modeling on actual datasets. The company received funding from interested parties in the supply chain, technology, and financial space. They finally began to bring on customers at the end of 2020 and managed their first loads in April 2021, with a project value of $400,000. Less than a year later, they’re handling $1m in loads per month and are continuing to scale rapidly.

- 1,200 Carrier partners

- 8 Enterprise customers

- Team of 16, with 10 engineers/product managers

8 Enterprise Customers in 12 Months

In late 2020, SemiCab began to close their first enterprise-level customers, managing their first loads in April 2021. Their customer list is already impressive, spanning many different business verticals. Their current customers include retailer Staples, consumer packaged goods giants Pepsi and Colgate, and computer electronics icon HP.

Enterprise Logistics is a Billion-Dollar Line Item

Kapoor explained that large enterprises might spend $1 billion on logistics, aiming to move goods in full truckloads. SemiCab is building a marketplace that optimizes these loads by connecting with the fragmented trucking market.

600,000 Small US Carriers in the Fragment Trucking Market

The US is dominated by owner-operator entities carrying trucking loads. This marketplace fragmentation makes optimization challenging when such massive amounts of goods need to be moved regularly across multiple routes. SemiCab is creating long-term relationships in this industry by offering carriers a way to make their business revenue more consistent and reliable.

1,200 Carriers at 99% Acceptance Rate

SemiCab vets each carrier on their platform, according to Kapoor. This vetting process ensures that their insurance is current and their safety record is clear. Once on the platform, the carriers can choose to accept loads. In traditional scenarios, truckers accept 50-70% of the loads offered, but on SemiCab, 99% of the loads are accepted, and they are coming back for more.

Actively using 700 Core Carriers, Attracting Mid-size Shippers

Kapoor’s goal was to start with a core, predictable group of carriers with which SemiCab could build ongoing relationships. With that core in place, the organization is focused on attracting small to mid-size shippers with trucking fleets. The bigger footprint would allow for a greater ability to optimize load miles for shippers and customers.

Optimizing by adding 100’s of Full-load Miles

Trucking miles with empty loads is Kapoor’s focus. SemiCab generates revenue from the platform based on the value of those incremental miles that carriers can go with full loads along their scheduled route. Kapoor explains that the current model is fraught with inefficiencies as carriers complete hauls with empty or partially empty trailers.

Where those 5-10 Loads per Week are Currently Going

Using January’s loads as an example, it’s clear that there is no such thing as a “typical load.” SemiCab helped move goods from the busy Southern California ports across the country to Dallas, New England, Chicago, and Atlanta. SemiCab also saw goods move from the Northeast to the Midwest. Goods in Texas, Atlanta, and other points in the Southeast moved to the Midwest and Northeast. Plus, Kapoor notes, they moved some goods to the Rockies, which he described as logistically sketching with road closures due to weather conditions during the winter months.

12-15% of the Efficiencies

SaaS SemiCab makes its money by creating efficiencies. Their marketplace platform manages loads from enterprise customers and offers them to drivers looking to optimize their existing carrier routes. In short, they sell trucking services to enterprise companies and buy trucking services in the form of available space from carriers. Kapoor’s model helps carriers generate incremental, predictable income and smooth out the wild fluctuations in the logistics industry.

On track for $12m in 2022 Contract Value

Kapoor explains that due to the market fluctuations and that the platform will be most consistent as they hit 50 million, 100 million, 500 million in contracts, he consistently looks at his 12-month targets and not a month-over-month growth rate. This year, their first full launch year, they’re expecting to hit at least $12m in contract value, bringing over $1m in revenue to SemiCab.

$1m ARR from Unique Business Model

In 2022, Kapoor expects to optimize 400 total loads worth $2,700 each to the company. While SemiCab’s competitors use transactional and dynamic pricing models, Kapoor’s model stands alone. “We are focused on building relationships and reliability that gets 99% carrier acceptance,” he reiterated. So, while Convoy Seattle, Uber Freight, Transfix, and Loadsmart are in the business, Kapoor notes that SemiCab approached the problem differently. Their focus is getting supply from owner-operators and mid-size carriers who can use their existing transportation space more efficiently. According to Kapoor, no one else in the space talks about optimization.

Optimizing $100B of Empty Miles

SaaS SemiCab’s mission is to create efficiencies that optimize the currently $100B in yearly lost value. These new efficiencies are also seen as environmentally positive, as they reduce carbon emissions and create economic value for carriers and customers. SemiCab has already been recognized by Gartner, Fast Company and Food Logistics as a world-changing vendor in the supply chain industry.

Initial Investment Round Placed Valuation at $15m

Kapoor has raised $5m to date, but not in the traditional funding round process. He raised $2.1m on converted notes at the end of 2020. A year later, he raised $3m as a safe note. When Latka asked why not do a traditional equity round with a valuation, Kapoor indicated that this approach was quick and didn’t rely on negotiations based on the current broad range of SaaS valuation multiples. Kapoor indicated that he expects to move forward with a more traditional funding round and that he is planning to be very selective about his lead investor.

Fast Five with Ajesh Kapoor

Founder and CEO Ajesh Kapoor’s favorite business book is “anything from Peter Drucker.” The CEO that Kapoor most closely follows is Brad Jacobs, CEO of XPO Logistics. When asked about his favorite online tool, Kapoor lit up with various choices he and his team use daily, including the AWS suite, Gusto for HR, and Hubspot and Webflow for marketing. He quipped, “The tools around today make it so much easier to build a business than before.” Kapoor’s sleep ranges from 4 to 8 hours per night, depending on the day’s responsibilities. He is 55 years old and married with one child. When he was 20, he wished he knew how it takes a village to create a venture.