-

Tyler Tringas has invested in 17 B2B SaaS companies out of his $3.1m Fund I raised in late 2018 from 40 LP’s

-

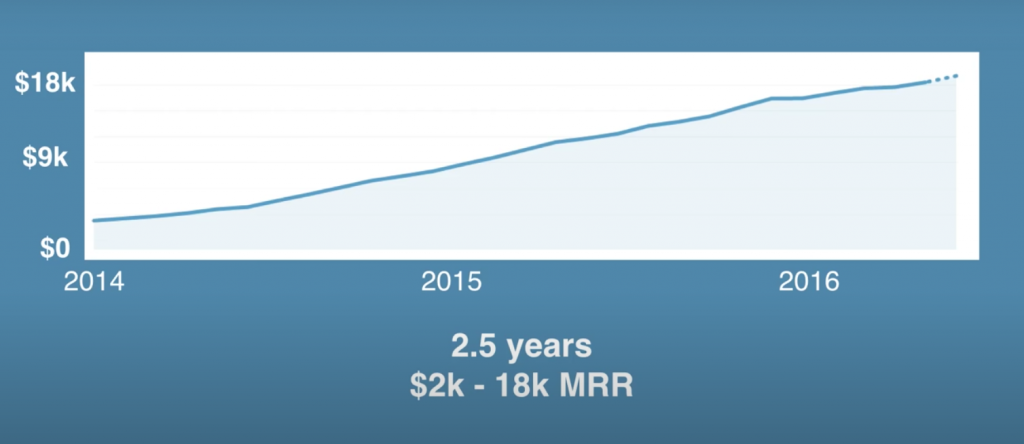

In 2016 he was taking $250k in profits from his SaaS startup doing well north of $18k in MRR. He sold the company in 2017.

-

Earnest Capital gives founders $150k for 10% on average. Founders can use company profits over time to pay back $450k (3x cap) to get 7% of the equity back.

In 2007 Tyler Tringas of Earnest Capital was a senior in college interning at a renewable tech company.

When he graduated in 2008 he joined New Energy Finance where he spent his time compiling a levelised cost of energy outlook report. The startup consulting firm was then acquired by Bloomberg.

Would Tringas survive at the more bureaucratic Bloomberg? Hard no. He left in 2010 to launch his own company, SolarList.

First Startup: Craigslist for Solar

The company was a “craigslist for solar”, a quick way for anyone to educate themselves on the cost benefit analysis of renewable energy projects.

Tringas and his Bulgarian co-founder, with fresh copies of Lean Startup in hand, did countless customer interviews but couldn’t get enough customer revenue early on to fund growth.

In a foreshadowing event, Tringas turned to Venture Capital. He pitched 400 VC’s and ended up raising $400k from friends, family, and advisors.

Things never worked out. CAC was too high and go to market failed. He shut the company down near his 23 birthday in 2013.

Riches in the Shopify Fiverr Niches

At this point, Tringas was living in NYC burning $3k/mo. Rent was $1,500 by itself.

To make ends meet, he started doing freelance gigs for shopify ecommerce brands. He listed himself on Fiverr as a shopify developer and began taking jobs.

During this time, he found himself writing code around the same idea, over and over: Mapping store locations

He also found himself in love with his future wife, Anne.

The Plane Ride of Love and MVP

The couple ended up in San Francisco for Anne’s state department work. When the department asked Anne if she’d relocate to Buenos Aires, Tringas agreed to join.

On that plane ride from SF to Buenos Aires, Tringas wrote the code for his next startup MVP: Storemapper.

To launch, he emailed his freelancer customers. 5 signed up at $20/mo ($5 per location). In 2013 Tringas grew the company from $200/mo to $2k/mo.

By 2014, revenue had more than tripled to $7k/mo and Tringas was enjoying the “travel and work on the beach” sort of lifestyle.

In 2016 that lifestyle paid nicely: Tringas was pulling $250k/yr out of the business as owner salary and revenues had passed well north of $18k/mo.

The Magic of MicroConf: Bootstrapped (and buyers?) Galore

Around 2016, Tringas attended the conference put on by Rob Walling of Tiny Seed (ex Drip) called MicroConf.

There, he met Kevin McArdle of SureSwift Capital. The two hit it off and eventually agreed to terms for SureSwift to acquire StoreMapper.

Tringas wouldn’t comment on the deal terms other than sharing that revenue was “well north of $18k/mo” or $216k in ARR.

Pen Hits Paper for Earnest Capital

After Tringas sold, he traveled the world for about a year with Anne. They enjoyed hiking through Torres Del Paine National Park in Southern Chile, Rockclimbing in Parque Nacional da Tijuca in Brazil, and the Louisiana Museum of Modern Art in Sweden.

At about this time, Tringas started thinking about the difference between his two startups: SolarList and Storemapper.

One VC backed and failed. One highly profitable and exited.

After traveling the world and realizing that true freedom came from profitability, he started writing about a new way to fund entrepreneurs to give them maximum flexibility.

40 Investors Like Tringas Idea, Invest $3.1m In Fund I

Tringas thesis for Earnest Capital was to invest $100-$250k into B2B SaaS entrepreneurs and let them decide how to treat the money.

Each deal would have a valuation cap (say $1m) so a $100k investment would mean Earnest owned 10% of the company: Earnest Shared Income Agreement

If the company grew over time and became profitable, the founders could decide to stay that way. A highly profitable lifestyle business. Every time the founders paid out dividends above a threshold, Earnest would get 10% of the payout and the founder could buy back 6-8% of the equity. Earnest would always keep a floor of 2%.

If the company decided they were sitting on a billion dollar unicorn, they could go the VC route, invest all profits in the business, and let Earnest keep the full 10%.

Earnest Capital Portfolio Companies

So far Tringas has invested in 15 companies and used most of the $3.1m in capital to do so.

- Yac is voice messaging for remote teams.

- Hostifi has grown from $2k in MRR to over $24k in MRR after taking a $100k investment from Earnest Capital.

- EndCrawl makes movie credits easy.

- 1 Second everyday builds a movie of your life based off daily 1 second clips.

- ManyRequests is an all in one platform to sell productized services.

- Cachix is nix binary cache hosting.

- Callingly is lead response and phone sales automation.

- DocSpring lets you fill out pdf forms with an API request.

- FirstBase helps remote teams get set up fast.

- JetBoost is no code search for webflow.

- JungleBee is a booking system for tours and activities.

- MakerPad helps you build and operate your business without using code.

- MemberSpace helps you turn any part of your website into a membership site.

- Newslit next generation news monitoring for PR.

- Wholesale Gorilla helps you sell wholesale on your shopify store.

- Yeluchi by UnRuly is an at home hair styling service.

How Will Earnest Capital Make Investors Money?

This is sort of a hot button issue. These new asset classes for Limited Partners (LP’s) are a bit unknown.

As a result, most of the LP’s are SaaS founders that like to be on the cutting edge of new ideas.

When push comes to shove, any fund is measured on IRR. Especially if the fund wants to scale past friends and advisors, a compelling IRR story is what enables scale/spreading of the fund thesis.

Tringas believes most of the funds IRR will be generated through exits. Not paid out dividends.

I wonder if entrepreneurs who want to build a lifestyle, profitable business, would ever actually want to sell.

They might think: “I’m making $250k/yr in cash from my micro-saas, why would I sell?”.

Tringas knows if the price is right, folks will sell as he did with StoreMapper.

A New LP Model: Quarterly Subscriptions

To avoid the pressure of raising massive funds, then deploying over 3 years, Tringas is changing how he raises from LP’s.

Beginning this month, July 2020, LP’s can commit to quarterly investments, like a SaaS subscription. You can start and stop whenever you want as long as you commit to year long contracts (4 quarters of investments).

Moving forward, Tringas hopes to build an LP base that is diverse instead of the traditional fund model which is reliant on an anchor LP (usually a pension fund, family office, of very wealthy individual).

To learn more about Tringas model, visit EarnestCapital.com