Matt Kilmartin, CEO and Co-Founder of Habu, sat down with the GetLatka team to talk about the global data clean room SaaS company he joined as the pandemic hit in March 2020. He explains how and why his roster is filled with aspirational A-list clients like Disney, Roku, and L’Oreal, how he was able to close six-figure deals during a lockdown, and why their direct competitor is also a key partner.

Kilmartin launched Habu in venture studio super{set} in March 2020 to fill an obvious need in the marketplace. As more and more companies see the value of collaborations, are seeking consumer insights within their own datasets and others, and have clear legal concerns about data privacy, they need a solution to share value without sharing data. Habu fills that need as the industry’s first marketing data operating system that helps brands harness first-party data to deliver multi-channel personalization in a privacy-first world.

- Team of 50, with 25 engineers and 6 salespeople with quotas

- 50 enterprise-level clients

- Closed $25m in Series B late 2021

$350,000 ACV From a Single Side of the Partnership

As Kilmartin explained, only one partner needs a Habu license to use the data clean rooms. Instead of seat licenses, enterprise companies pay for slots, where they can collaborate with a specific partner to share data to glean insights. When a company like Disney (along with their Hulu, ESPN, ABC media units) wants to collaborate with L’Oreal, they don’t want to share actual data. Instead, they want to know more about the customer base to deliver more personalized marketing messaging and offers within the context of the collaboration.

Single Partner License Acts as Sales Tool, as Habu Eyes Growth from 50 to 100 Customers

Another significant use case for SaaS Habu, as detailed by Co-Founder Kilmartin, is grocers and consumer packaged goods manufacturers (CPGs). Latka gave the example that if HEB were a licensee, they could use a slot to share insights with P&G.

After seeing the value of the SaaS data cleanroom, P&G could pursue their own license for collaboration with other partners. Kilmartin acknowledged that Latka’s example was correct and noted that many of their first 50 enterprise customers closed through this route, adding that they have several RFPs in the pipeline. “It’s a hot category,” Kilmartin added.

Launched with 8-10 POC Deals During the Pandemic

Kilmartin explained that when Habu launched, they were uncertain of their ICP, so they began with 8-10 POC deals. He explained that these deals were flexible in that they allowed shorter-term, 6-month deals focused on first value engagement. Because these new deals couldn’t be closed in person, but rather over Zoom, he and his team offered unique 90-120 day trial windows, where the prospect could realize the value of the engagement. It worked, and Kilmartin proudly noted that every POC deal turned into a full-value paying customer.

One Rockstar Sales Leader, 75% Female Sales Team

Habu launched with a “rockstar sales leader,” according to Kilmartin. She helped the company hit the ground running, along with the team’s existing contacts. They now have a CRO with domain experience and six salespeople on quotas and are looking to add more as they rapidly expand. 75% of their sales team is female, a rarity in the SaaS world, noted Kilmartin to an impressed Latka.

Kilmartin Part of $700m Krux Acquisition by Salesforce

Before joining the Habu team at super{set}, Kilmartin held a variety of executive leadership roles at Salesforce, Krux, and Akamai. While acting as CRO at Krux, the organization was acquired by Salesforce for $700m; Salesforce was looking to beef up its marketing and adtech footprint. Krux is a cloud-based data management platform that helps companies deliver personalized commerce, media, and marketing experiences to people across devices, browsers, and operating systems. Kilmartin remained at Salesforce after Krux was acquired in 2016.

Added to the Habu team with the $13m Series A Funding Round

Kilmartin explained that he joined the Habu team as they closed their $13m Series A funding round in February 2020. He was eager to do something new and knew he needed a co-founder who could act as a technical engineer. “Salesforce is awesome, but where there’s rapid change in a chaotic market, you need innovation. Sometimes it’s easier to innovate when you are a small company starting with a clean slate,” he pointed out.

10 Companies in 3 Years

Habu was launched in a venture studio by super{set}, an organization that funds startups, run by Kilmartin’s mentor, Tom Chavez. Chavez and the team mutually agreed to make Kilmartin the CEO and co-founder when he joined. According to Kilmartin, super{set} is different than Y Combinator in that they play operational roles in the company and take active roles early on. Now, super{set} has taken a backseat role as the company grows. Habu remains a part of the super{set} portfolio of companies.

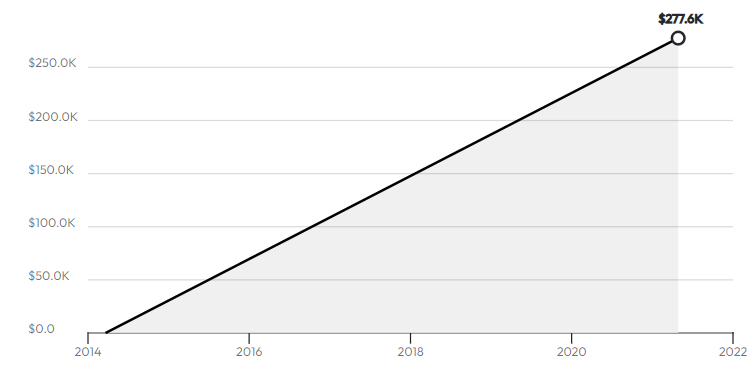

$25m Series B Support, Led by Snowflake Ventures, offered 10-15% Equity

Latka noted that the Series B funding seemed to put their multiple at 20X, which is at the lower end of the SaaS multiple range for this kind of company. Kilmartin explained that this deal had less to do with the valuation and more to do with the partnership. He and his team saw significant value in Snowflake as a partner, so it made sense to make the deal. “I saw the power of distribution at Salesforce, so it was worth it to dilute,” clarified Kilmartin. He reiterated, “This market (SaaS clean room data) is hot.”

Quota Model at $600K per 6 months

Asked about Habu’s quota model, Kilmartin explained that his team is still trying to figure out quotas at this stage. He did reveal that he prefers 6-month quotas so that they can set the bar appropriately as they advance. The company is leaning toward a unique territory model: by business vertical because vertical expertise is so valuable selling in their space. Kilmartin added that they’re currently working on defining their selling motion and creating a repeatable process.

$1.2m ARPU, But “Lean too Long” on Sales and Marketing

Kilmartin laments that Habu didn’t invest earlier in sales and marketing, as they just hired their first CMO. He noted that his competitors are more prominent and are growing by investing in marketing. Yet, he says, “We benefit from the competitors educating the market. A rising tide raises all boats.” One of his partners, a public company, is a competitor, but Kilmartin embraces the relationship because of the value they bring. Asked who else competes in the space, Kilmartin named LiveRamp.

120% NDR through Slot Expansion

Upsell growth is coming from consumption, as existing customers add slots to the contract, explained Kilmartin. He also enthusiastically shared that Habu is preparing to add different modules to their service offerings. While the current slots are typically used for collaborations, Habu is developing advanced model slots where machine learning can be applied to datasets for deeper, practical, and actionable insights.

Fast Five with Matt Kilmartin

The Habu CEO and Co-Founder noted that his most recent favorite business book was Amp It Up, by Frank Slootman, Chairman and CEO of Snowflake, Inc. His favorite CEO to follow is his mentor Tom Chavez, Chairman and CEO of super{set}. His favorite online tool is the telephone, which he considers to be an underutilized business tool today. Kilmartin says he gets a solid 7-8 hours of sleep every night. He is 47, married, and has four children. Asked what he wishes he knew at 20, he responded, “It’s a marathon, not a sprint.”