Last year, end-of-life documents company Willful raised $1.1 million CDN — or about $850,000 USD — just as the COVID-19 pandemic spread worldwide. The virus caused more people to consider their legal end-of-life preparations, which helped Willful prove to investors that their $6 million valuation was pandemic-proof.

“At the same time that that investment was jeopardized, we saw our sales and traffic go through the roof because, unfortunately, the pandemic made people think about their own mortality and contemplate and prioritize emergency planning,” says CEO Erin Bury, who co-founded the company with her husband Kevin Oulds.

Based in Toronto, Willful allows people to create online wills and access power-of-attorney privileges. Prices range from $99 to $149 CDN as a one-time fee. So far, the company has sold over 40,000 plans to at least 10,000 customers.

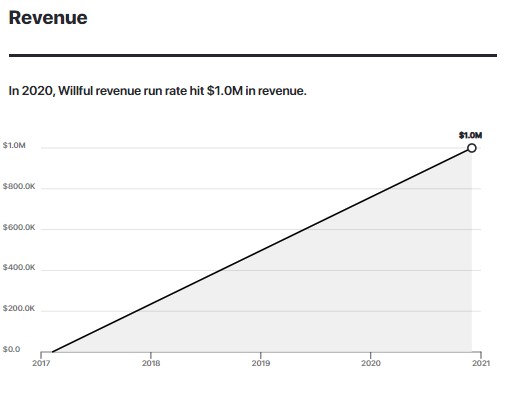

After launching in October 2017, Willful made “a couple of hundred thousand dollars” in revenue in its first year. This has increased four five times year over year; although Bury doesn’t share revenue numbers, she says the company has met a $1 million run rate. In 2020, Bury and her husband were able to start giving themselves salaries.

Willful sells a one-time transactional product instead of a recurring service, but the company has a considerable customer base.

Source: GetLatka

“The sad truth is … people are woefully unprepared for their own passing,” Bury says. “About 60% of adults don’t have the simple legal documents. So there’s a really big pool of potential customers, more of whom are turning to online tools because of COVID.”

The company has focused on SEO and PR marketing strategies to bring potential customers to its site. Willful targets potential customers by honing in on specific groups, like Parent Life Network, WealthSimple and Facebook groups for new parents. It also finds clients through partnerships with mortgage brokers and financial advisors, because individuals are more willing to think about end-of-life preparation after major life milestones.

About 15 people work on the Willful team, including four engineers, a B2B salesperson, affiliates manager, and product and delivery team. The company also contracts with lawyers in every province in Canada, and a conversion manager focuses on converting one-time clients to lifelong customers.

Bury says the most likely outcome for Willful is an exit, and it maintains good relationships with similar companies who could be potential acquirers. But for now, Willful is focused on building other products to help customers with end-of-life planning and making customers stay long-term.

“That’s kind of the next phase is, ‘OK. Now someone’s in our ecosystem. What are we actually doing to turn them into a long-term ambassador?‘” Bury says.

Who is the CEO of Willful?

Erin Bury, age 35, is the CEO of Willful.

What is Willful’s valuation?

Willful’s valuation is $6 million.

Transcript Excerpts

Being intentional with SEO and content marketing strategy

“A lot of the things we do are not intentional, but this one is. For us, we always think about the behavior of our users. You really start your search for estate planning and wills by hitting up Google. And so we’ve long known that PR content marketing and methodical SEO is going to be the way that we win.”

Building upon a one-time transactional product to increase revenue

“I don’t know that we can get up to a $10 million run rate with only the current existing product, because it is a bit of a lower price product. But as we start to look at things with more lucrative price points like estate administration tools [and] insurance, I absolutely think that those one-time transactions could get us up to that run rate or that the commission could be on the B2B side. For example, launching a version of Willful where a financial advisor could pay a monthly fee to offer it to their clients, and so the recurring actually comes from the B2B side of the business.”

Getting along with peers in your market

“[Re: Trust and Will], I think that we’re both trying to achieve the same goal, but it’s actually nice that we’re both doing it in different ways. So for example, we have a family plan where you can buy multiple plans, they don’t. So it’s a way for them to validate that. They all have subscriptions. We don’t, so it’s a way to kind of validate that. So it’s actually nice. To your point early in the conversation, it’s not a sexy topic and so, estate planning CEOs tend to be a pretty tight-knit club and to share learnings, and it’s nice to have these peers in other markets who are sharing those learnings.”

Structuring affiliate arrangements with clicks and signups

“We have to find other ways to incentivize partners to promote us over a bank insurance company, where they might be making thousands of dollars in commission. So we’ve started to expand from those learnings into earnings per click and for signups instead of just for conversions and I think that’s something that others in this space are moving to, as well.”

Full Transcript Nathan: Hello everyone. My guest today is Erin Bury. She is an entrepreneur speaker startup advisor and former technology journalist. She’s a co-founder and CEO today of a company called Willful, an online estate planning platform. She’s appeared in publications, including the New York Times, Forbes, and CNN. And she was named on a marketing magazine’s top 30 under 30 marketers. Erin, you ready to take us to the top? All right. Estate planning is not like a sexy hot topic. How’d you find yourself in that world? Erin Bury: Yeah, it’s a great question. As a journalism grad, I did not expect to be the CEO of an estate planning company, but every entrepreneur starts a company because of a personal experience. And so we had a family member pass away unexpectedly and trying to wrap up their life when going through all the unanswered questions made us realize that there really isn’t an easy way to record those wishes and take care of end of life planning. So here we are. And now it’s something I’m very passionate about. Nathan: So when was that? What year did you launch the company? Erin Bury: So it was 2017. It’s actually my husband and I who founded it together, which is always fun working with your spouse. And yeah, so we’ve since created about 40,000 documents for people across Canada. We’re a Canadian company based in Toronto and we’re currently working on building out other products that can help people with their end of life planning. Nathan: Let me understand that from a SAS perspective. On average, what’s the customer paying you per month to use your technology? Erin Bury: So it’s actually not a recurring product, it’s more of a one-time transactional product. So you’re paying us at anywhere from 99 to $149 for your documents, your will and power of attorney documents, and we offer free unlimited updates, which is a competitive advantage. And the idea is that we’ll build out other products and services that help you along that end of life journey, either you or your family, and be able to increase our lifetime value through that. Nathan: Mm-hmm (affirmative). It’s hard to plan. You have to do a certain number of these POAs and $900 sales per month for you to have some revenue base to feel confident, to go out and make hiring decisions on to build the business, invest more in engineering. I mean, how do you get to a product where you can add value to these folks even after they filed the initial documents? Erin Bury: Yeah, it’s a great question Nathan. I feel like the sad truth is, and this is true in Canada as well as the US, people are woefully unprepared for their own passing. And about 60% of adults don’t have just the simple legal documents. So there’s a really big pool of potential customers, more of whom are turning to online tools because of COVID and in terms of how we actually create that predictability, it’s through marketing around life moments. We know that having a child and the death of a loved one are the two major life events that cause you to think about these things. And once we have you in the door, then we become a trusted source for other products in the future. Nathan: Mm-hmm (affirmative). Okay. Interesting. So back in your first year in 2017, how much revenue did you guys do? Do you remember? Erin Bury: Well, we launched in the end of October, so I’m assuming a couple thousand dollars by the end of that calendar year, but really my husband started it initially. I was running a marketing agency at the time that worked with consumer tech companies, so I joined full-time after about a year. I think in the first year we probably did a couple of hundred thousand dollars of revenue, so we felt like we had some good product market fit in that there were people paying from day one, but we didn’t truly achieve some of that scale until I’d say the last 12 months. Nathan: Okay. So 2018, you feel like you did two, $300,000 in sales, something like that. Erin Bury: I’d have to look back at the numbers because our fiscal is June 30th. So for us, I’m always thinking in fiscal. Nathan: Yep. Yep. Okay. This makes sense. So I guess the reason I’m asking the revenue questions is it’s a big risk for you and your husband put all your eggs in the Willful basket per se, so he had to sort of de-risk it early for you guys to agree that you should leave your agency job and do this full time. What sort of moment was that? Walk me through that conversation. Erin Bury: Yeah. I mean, actually, it’s funny because now it sounds like it was all planned out in the stars to join Willful, but initially I left the agency for other reasons. I was just not feeling challenged, wanted to move on. And as I actually looked around at all of the options and what to do next, Willful just was the obvious choice to learn. I’d never run a venture backed company before. I’d only run a service business, so I was really looking for that challenge of how to get a VC to buy into your idea and scale a product team. So it became the natural option, but yeah, at the time it was scary to have both of us taking no salaries, but I do some paid speaking and other things on the side. And luckily Nathan, we were able to start paying ourselves earlier in 2020. Nathan: Oh, that’s great. That’s a big moment. Congratulations. Erin Bury: Thank you. Nathan: In your venture back, when did you raise capital? Erin Bury: We raised it right smack dab in the middle of COVID and it was quite a rollercoaster because we actually had a signed term sheet on February 27th. And then a couple of short weeks later, the world’s went crazy and our investor raises from high net worth individuals into special purpose vehicles, so it’s not a traditional fund model. So there was a couple of weeks there where we thought there’s no way this is going through because all of these high networks are… their liquidity is being compromised. And really at the same time that that investment was jeopardized, we saw our sales and traffic go through the roof because unfortunately, the pandemic made people think about their own mortality and contemplate and prioritize emergency planning. So it just so happened that we were able to say, “Hey, look, we are actually a pandemic proof business and a business that has actually seen our numbers go up,” and so they were able to rally the investors and we closed in the end of May. Nathan: Okay. Closed in the end of May. And how much did you close on? Erin Bury: 1.1 million Canadian, which I think is like $4 US. Nathan: Okay. 1.1 Canadian. What is it actually US? Erin Bury: I think it’s probably around 800k. Nathan: Yeah. Depending on what day you look at the exchange rate. I’m curious about SPD model. Did you do that on a note, like a safe or did you have a price round? Erin Bury: No, we did it as a price round with a post-money valuation of 6 million. We had done some convertible debt earlier on from mostly Shopify executives. In Toronto, there’s a lot of Shopify executives who are angel investors now. So those all converted along with the price round, but it was priced. Nathan: And walk me through that valuation conversation because this isn’t obviously a typical SAS movement, but there’s a clear path to launching a recurring product. So how do you justify the valuation with really one-time sales? Erin Bury: Yeah, that’s a great question. I mean, we always do try to position ourselves more as an e-commerce model versus a traditional SAS with recurring revenue and the investors who want SAS are never going to see the valuation there, but luckily our investors had been executors themselves. They really understand the space and they had also invested in other companies like Mocha who are more e-commerce based fintechs. So really, I mean, it’s always a dance. Nathan, I’m sure everyone tells you this. It’s like negotiating anything. They come in low, you go high, you try to justify it. They say no. That’s crazy. And then you meet somewhere in the middle. So luckily we found great investors who saw the value in the business and who understand that you’re getting into bed for a decade potentially and so you have to both be happy walking away from the deal. Nathan: And talk to me about your guys’s content marketing strategy and if it’s your primary user acquisition channel. You ranked very high according to AHrefs for competitive terms like online will. Even just the word will, you guys are in the six position for it, gets you caught 300, 400 clicks per month organically. Is that an intentional strategy? Erin Bury: It is Nathan. A lot of the things we do are not intentional, but this one is. For us, we always think about the behavior of our users. You really start your search for estate planning and wills by hitting up Google. And so we’ve long known that PR content marketing and methodical SEO is going to be the way that we win. And the other big user acquisition channel for us is partnerships. So being able to target people through new mom groups or mortgage brokers, financial advisers, anyone who’s already having the conversation with folks around those major life moments that tend to be inflection points to create your will. Nathan: Okay. So community groups like mom groups, I mean, can you name one? Is it like a Facebook group? What’s the title of it? Erin Bury: Some of them are Facebook groups, but the more official ones would be Parent Life Network is a big one in Canada that new moms are a part of, but even just other kind of fintech, so we’re partnered up with Wealthsimple and some of the other folks who are offering investing, saving tools, and then the B2B community is big, so financial advisors, insurance brokers, mortgage brokers, et cetera. Nathan: And when you look at your last full fiscal year of revenue history, what did that come in at? Erin Bury: So that I am not going to disclose just because I know our competitors are always watching, but I can say that it was about… we’ve seen like a four to five increase year over year. So it’s definitely gone up a lot. Nathan: I’m going to push further with a more generic question. Have you broken a million dollar run rate yet? And if not, do you think you can do that in the next couple months? Erin Bury: Yes. We’ve broken a million dollar run rate. Yes. Nathan: That’s great. The next goal, I assume it’s probably getting up to five or 10 million. Do you think you can get to like a five or $10 million run rate still selling just a lot of one-time products or do you have to launch a recurring product to do that you think? Erin Bury: I think to answer your question, I don’t know that we can get up to a $10 million run rate with only the current existing product because it is a bit of a lower price product. But as we start to look at things with more lucrative price points like estate administration tools, insurance, things like that, I absolutely think that those one-time transactions could get us up to that run rate or that the commission could be on the B2B side. So for example, launching a version of Willful where a financial advisor could pay a monthly fee to offer it to their clients, and so the recurring actually comes from the B2B side of the business. Nathan: Yeah. I mean, the company that comes to mind when I’m interviewing you, because I do so many of these interviews, I’ve touched a couple on the space, but like Trust and Will comes to mind. And I’m going a bit off memory here, but I think that they were only doing like 25 grand a month in revenue, so $300,000 a year, but they’d raised like $8 million at a ridiculous valuation. You’re doing, it sounds like more revenue than they’re doing, but it’s not true SAS, so you’re maybe not getting the premium that they got, but you’re maybe making more money. Erin Bury: I don’t know. I mean, I think Cody and I are very close. We’re partnered with them and we do a lot of work together and I definitely would not say that we’re making more revenue than them. I don’t know that for sure, but the market in the US is just so much bigger, and they’ve obviously seen a COVID bump as well. I think that we’re both trying to achieve the same goal, but it’s actually nice that we’re both doing it in different ways. So for example, we have a family plan where you can buy multiple plans, they don’t. So it’s a way for them to validate that. They all have subscription. We don’t, so it’s a way to kind of validate that. So it’s actually nice. To your point early in the conversation, it’s not a sexy topic and so, estate planning CEOs tend to be a pretty tight-knit club and to share learnings, and it’s nice to have these peers in other markets who are sharing those learnings. Nathan: Yeah. And sorry, I have to add a correction there. That’s just their SAS revenue. Like you, they have a much larger business, which is sort of the one-time sort of sales, but they’re trying to build that recurring revenue. That’s super interesting. Wait, so is there a path where in four years I’m interviewing you and Cody and you guys are all part of the big same company? Erin Bury: You know what? I always say if I had a chance to move down to San Diego, which is where they’re based instead of staying here all winter in Toronto and trudging through the snow, absolutely. I mean, obviously there’s a few paths for any company. There’s IPO, exit, or staying profitable long-term and I think we’re very much on an exit path. And when we think about ideal acquirers, we want it to be somewhere where we want to work. I’m going to have to spend years of my life at the acquirer, and so of course we really admire their culture and their mission. Nathan: Mm-hmm (affirmative). And Erin, when you look at 40,000 documents process so far, how many customers have paid you at least a dollar and a one-time fee to generate those 40,000 documents? Erin Bury: Yeah, I think I’d have to again, check, but between 10 and 15,000 kind of paid customers to generate that 40,000 documents. Nathan: Do you have any relationship with those 10,000 folks like today if they used you three years ago or is it really sort of one-time and then you’re not around it anymore? Erin Bury: So they’re coming back and making updates to their document. We offered that for free as a kind of competitive advantage in the market, but really that building out that kind of longer-term relationship is the priority for us for 2021. Nathan: Yeah. I mean, that’s a huge advantage if you can get these folks that paid one time a long time ago to still be addicted to your platform, come in once a year and update it before their new year celebration for example. What’s the activation metric you’re tracking each year to say, You know what? We love this. They’re still active on the platform”? Erin Bury: Yeah. That’s a good question. I’d have to ask our conversion manager, but I don’t know that we’re really tracking a lot of that right now. And that’s kind of the next phase is, “Okay. Now someone’s in our ecosystem. What are we actually doing to turn them into a long-term ambassador”. Nathan: What is your team size today? How many folks? Erin Bury: We’re at 15. Nathan: 15? Okay. How many engineers? Erin Bury: Four. Nathan: Four. Okay, great. And then everyone else is sort of a mix. Any quota carrying sales reps? Erin Bury: Yeah, we have a B2B sales person. We have an affiliates manager. We have a great product and delivery team and then some marketing folks as well, that kind of blend between paid acquisition and the more content SEO side of it. And then we also have estate lawyers in each province on contracts with us, but they’re not full-time in place. Nathan: Does the BDR or the business person, they have like a sales quota they have to hit, or they’re just more handling all the relationships and partnerships? Erin Bury: It’s a mix of both. They do have a quota that they’re aiming for, but they also do a lot of fulfillment of those partnerships as well. So actually working with partners on the account management side, and then also doing a lot of the outbound. Nathan: How do you structure maybe with a company like Cody and Trust and Well? How do you structure your affiliate arrangement and how has it changed from the first deal you did to now in terms of what you’ve learned? Erin Bury: Yeah. So for us, it’s really kind of… we always have offered a percentage of revenue, but again, we’re not a huge price point product, so we have to find other ways to incentivize partners to promote us over a bank insurance company, where they might be making thousands of dollars in commission. So we’ve started to expand from those learnings into earnings per click and for signups instead of just for conversions and I think that’s something that others in this space are moving to as well. Nathan: So just to put this out because EPC earnings per click used to be only something you would see on like Warrior forum. These like very deep like websites for affiliate marketers, but it’s creeping into B2B and B2B SAS exclusive. So what you’re saying is there are partners that you would pay just because you know the quality of their base is so high, you’re comfortable taking the risk. And if they say, “Yes Erin, we’ll send an email blast out to our list of a million people. We’re going to generate a thousand clicks.” You’re comfortable saying we’ll pay $3 a click because you know what they’re probably going to convert at. Erin Bury: 100%. And also because we have a conversion manager whose job it is to create great journeys once they get there and to also be tweaking the product continually to know that we can actually service them. The hardest challenge for any startup is getting someone’s eyeballs on you. So for us, we’re happy to pay, especially as you said, a very targeted marke, like can do parents, new homeowners, et cetera, and to pay for that versus a conversion. Nathan: Super interesting. What a great story. Let’s wrap up here Erin with your famous five. Number one favorite business book. Erin Bury: The Power of Habit by Charles Duhigg. Nathan: Number two, is there a CEO you’re following or studying? Erin Bury: Great question. I mean, I guess Cody from Trust and Well. I really admire his leadership style and what he’s been able to achieve in the business. Nathan: Number three. What’s your favorite online tool for building Willful? Erin Bury: Asana. It’s my Bible for project management. Nathan: Number four. How many hours of sleep do get every night? Erin Bury: Oh, I sleep a lot. Eight hours every night. Nathan: Love that. And what’s your situation? Obviously, married. Kids? Erin Bury: No kids yet, but you know what? Stay tuned, Nathan and you might see some in the future. Nathan: I was going to say, you mentioned Parent Life Network and these mom groups, I’m going, “Oh, maybe there’s some kiddos on the way here. We’ll have to see.” All right. So married, no kids yet. And Erin, do you mind me asking how old you are? Erin Bury: I am 35. Nathan: Okay. Last question. Take us back 15 years. What’s something you wish you knew when you were 20? Erin Bury: That entrepreneurship was a career path. Nathan: Guys, there you have it. She started off as an agency. Now teamed up with her husband, launched willful.co helping with power of attorney and wills and end of life planning. They’ve done over 40,000 of these documents filed spanned across over 10,000 customers that have paid them something to do this. It is a one-time fee model right now, but they did raise capital, $800,000 at a $6 million valuation. We’ll have to watch closely and see if a SAS product is in the works. Right now, they’re just focused on driving free engagement and free updates for their user base as they want to keep updating those wills and documents over time. Erin, thanks for taking us to the top. Erin Bury: Nathan, thanks for having me. Appreciate it. Nathan: One more thing before you go, we have a brand new show every Thursday at 1:00 PM central. It’s called Shark Tank for SAS. We call it deal or bust. One founder comes on, three hungry buyers. They try and do a deal live. And the founder shares backend dashboards, their expenses, their revenue, ARPU, CAC LTV. You name it, they share it. And the buyers try and make a deal alive. It is fun to watch every Thursday, 1:00 PM central. Additionally, remember these recorded founder interviews go live. We release them here on YouTube every day at 2:00 PM central. To make sure you don’t miss any of that, make sure you click the subscribe button below here on YouTube, the big red button and then the little bell notification to make sure you get notifications when we do go live. Nathan: I wouldn’t want you to miss breaking news in the SAS world, whether it’s an acquisition, a big fundraise, a big sale, a big profitability statement or something else. I don’t want you to miss it. Additionally, if you want to take this conversation deeper and further, we have by far the largest private Slack community for B2B SAS founders. You want to get in there. We’ve probably talked about your tool if you’re running a company or your firm if you’re investing. You can go in there and quickly search and see what people are saying. Sign up for that at nathanlacquer.com/slack. In the meantime, I’m hanging out with you here on YouTube. I’ll be in the comments for the next 30 minutes. Feel free to let me know what you thought about this episode. If you enjoyed it, click the thumbs up. We get a lot of haters that are mad at how aggressive I am on these shows, but I do it so that we can all learn. We have to counter those people. We got to push them away. Click the thumbs up below to counter them and know that I appreciate your guys’ support. All right, I’ll be in the comments. See ya.