SEO monitoring platform SEMrush has somewhere between 30,000 and 60,000 paying customers and just hit 6,000,000 registered users. Latka interviewed SEMRush COO Eugene Levin to get more metrics and details.

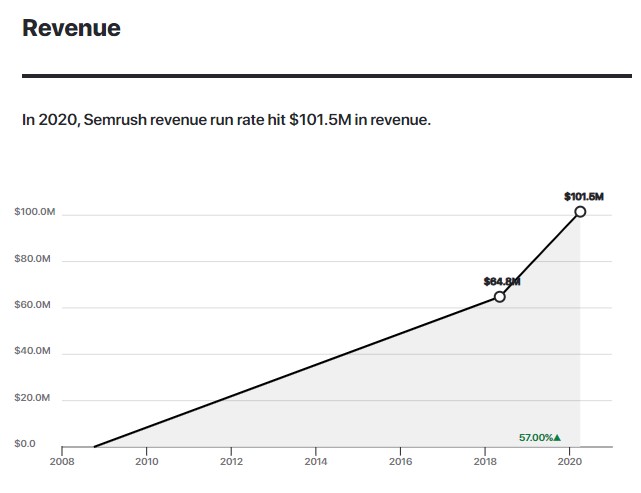

The company, which launched in 2008, broke $100 million in ARR in 2019. Now the focus needs to be on something else: churn rate.

New customer revenue is subject to higher churn, says SEMrush Chief Strategy and Corporate Development Officer Eugene Levin. “If a sales rep sells to an existing customer who’s loyal, very unlikely to churn, then $1 of expansion is going to stay with us forever. And then what we’ve noticed is that if people expanded, they are more likely to continue expanding. So, that’s where we now try to focus our sales teams.”

Those sales reps are part of a more than 800-person team of full-time employees who would be working from the company’s Boston office if the COVID-19 pandemic hadn’t caused them to go remote. Of those 800, approximately170 people are writing code and around 60 are quota-carrying sales reps.

Currently, reps are selling over 40 products and working with more than 15 funnels, and Levin says there is no minimum that a rep must sell. The company previously had a requirement to close at least a certain number of annual subscriptions, but right now they’re focused on “things that are more profitable,” especially expansion (as stated earlier).

Levin says SEMrush doesn’t have a single customer paying more than $1 million per year, and that’s the way he likes it. He says he prefers 10 million marketers paying a dollar a month than 10 enterprise clients paying a million a month.

Source: https://getlatka.com/companies/semrush

He also says that currently, SEMrush is cash flow profitable, is hoping to continue to drive solid double-digit growth, and has no plans to raise capital, especially when most of the $40 million of capital Levin helped raise in his first two years on the job is still sitting in the bank.

“We have been a bootstrapped company from the very beginning with very healthy economics,” Levin says. “And we didn’t really need extra capital. We use it more as a safety net to allow us to run more experiments. However, most of those experiments proved to be successful. So we didn’t need the safety net at any point.”

Essentially, that money is for four or five months of cash runway if a catastrophe hit and there was no revenue coming in. According to the contractual commitment with investors the capital could be sent to SEMRush in four time-based tranches every six months because there wasn’t a dire need for it.

As for the growth experiments, Levin says most of them have involved trying new marketing channels such as YouTube, as well as expanding the company’s global footprint. But more recently, SEMrush is focusing on its products — Levin says some of the best technology that’s taken the longest to develop, such as its traffic analytics product, has paid off the most.

Getting To Know SEMRush COO Eugene Levin

Name: Eugene Levin, age 32, married with one child.

Where to find him: Twitter | LinkedIn

Company: SEMrush

Noteworthy: Since joining the company as a chief strategy officer, Levin helped to more than quadruple company revenue and raised more than $40 million from Tier One Investors.

Favorite business book: “The Intelligent Investor”

CEO he respects: Satya Nadella

Favorite online tool for building the business: Zoom

Average # of hours of sleep/night: 8

Transcript Excerpts

Using SEO to help companies with everything top-of-the-funnel

“We help companies to improve their online visibility from search engine optimization, where we became a household name over the last 10 years, to things like pay-per-click digital advertising, social media, digital PR, and so on. So technically we try to help people with everything related to all top of the funnel.”

Experimenting with new marketing channels vs. investing in product

“We started doing more YouTube, and we dramatically expanded our global footprint, so we started hiring people to run marketing for European markets such as Germany, Italy, Spain and France. Those were the first things that we tried, but then we started investing more in product. Product takes more time to show results, and some of the things that we started doing in ’16, they actually started paying off only in ’18 or ’19. Things like our traffic analytics product. We’ve been building it for two, three years, so it’s extremely complicated technology. It took us quite a while to get everything running, but now it’s actually one of the fastest-growing product lines that we ever had. In a nutshell, that’s what we started doing once we had more flexibility and could take more risks.”

Churn rate is largely determined by how much the customer is paying

“Another factor is that your low paying customers churn faster than your best customers who pay more. So I think average check in general is a combination of those factors. If you do nothing, if you stop acquiring new customers, over time your average check goes out. What was the point? Right. So I think you need to think about this on a cohort basis.”

Leading a SaaS during COVID-19 requires a focus on new business vs. existing

“The big question is what’s going to happen with new business and what’s going to happen with existing business in terms of churn. So in terms of churn, we see that certain categories to follow customers will be impacted materially and certain categories will not be impacted pretty much at all. … from what we see, in some categories we will have 25% higher churn, and in some categories we’ll have no changes at all. And those categories seem to be relatively small for us … our most vulnerable categories, like very small agencies, freelancers and small local businesses. So we see them being impacted, but they’re historically not the biggest part of our audience by any means. We usually work more with online businesses.”

Full Transcript Speaker 1: You’re going to love this interview. Just got done editing it. I’m glad I got it live for you. I’ll be in the comments for the next 30 minutes, hanging out, answering any questions you have. In fact, leave a comment below about data points or what you think is going to happen to the company and I will respond to every comment. Additionally, if you’re just loving the content, click the thumbs up and I will go and check out your profile as well and give your videos some love as well. In the meantime, enjoy the interview. Speaker 1: Hello everyone. My guest today is Eugene Levin. He was one of the first investors to spot a company called SEMrush. After joining the company as a chief strategy officer, he helped to more than quadruple company revenue and raised over $40 million from Tier One Investors. Before that he was a partner at Target Global, a pan-European venture fund and invest in the consumer internet space. All right Eugene, are you ready to take it to the top? Eugene Levin: Yeah, absolutely happy to do that. Speaker 1: All right. So for folks that don’t know what SEMrush does, what’s the product do? Eugene Levin: Oh, we help companies to improve their online visibility from search engine optimization, where we became a household name over the last 10 years to things like pay-per-click digital advertising, social media, digital PR, and so on. So technically we try to help people with everything related to all top of the funnel. Speaker 1: Okay. And when you came on back in May of 2018, you shared the company was founded in 2008. When did you join? Eugene Levin: I joined in ’16. Speaker 1: Okay. 2016. Okay. Got it. You’ve been there obviously three, four years now at this point. And you also shared at that point that the company had raised about 40 million bucks. Have you guys been able to grow with just that money or did you raise additional capital? Eugene Levin: We raised some money, but frankly speaking, we didn’t because there’s this [inaudible 00:01:45]. It’s pretty much all on the balance sheet. We have been bootstrapped company from the very beginning, very healthy economics. And we didn’t really need extra capital. We use it more as safety net to allow us run more experiments. However, most of those experiments proved to be successful. So we didn’t need the safety net at any point. Speaker 1: Sure. I mean, more than 30 million bucks of that 40 million is still sitting in the bank doing nothing, Eugene Levin: Not doing nothing. I think in times like this, it’s actually very comforting to have additional 34 million. Speaker 1: But it’s sitting there in the bank basically for you to do whatever you want to do with. You haven’t spent it or you spent it in early returned money? Eugene Levin: Yes. Sometimes you invest and they just give back very fast. So, we had a couple of those experiments when we started investing in new products or writing new types of marketing campaigns, but they paid back very fast, so. Speaker 1: Okay, so let’s go back to kind of pre-virus, right? When founders come on the show and say like, “We raised a bunch of capital, but we didn’t touch it.” They say that and I can tell when they say it, they’re saying it as a sign of strength, but in my mind, I can’t help think, “Well, that’s pretty stupid. You just got diluted for nothing.” Right? So how do you balance the fact that you don’t need money, but you still got diluted your next VC. Eugene Levin: Yeah. So, the math is very simple. As company gets bigger, technically you want to have certain amount of money on the balance sheet, comparable to your revenue, like monthly revenue, or better say monthly expenses. In case things happen, you want to be able to, to run the business for a while. So I think when I joined, we were in a situation where we had money in the bank and we were profitable, but that was not comparable to our revenue and expenses. So that gives you very low room for any sort of errors. So, I think when people think about their cash position in the world where you’re a VC funded company and the reality is you have 18 months of runway and nothing going to change that, this reality is very different comparing to bootstrap business where you put all your life, you’ve built over years and you don’t want to take those types of risks. So you’ll want to have little bit more on a balance sheet in case hard times come, to be prepared. Speaker 1: So you joined in 2016. You guys raised the 40 million two years later in 2018. I assume you played a critical role in figuring out how much to raise, what was the right amount? What was that actual runway number for you? Were you targeting 18 months of runway to cover burn? 24 months? What was it? Eugene Levin: No, I mean, we thought about this in a way that we will have couple months off of our runway on a balance sheet if we have zero revenue. If there is no revenue, we still can do this for a couple months, at least, but without this money would be less than a month. So, we actually had very, very good cash management, but amount of cash that we had on the balance sheet was not comparable to monthly revenue and monthly expenses. Speaker 1: I’m just trying to… I’m digging here to try and understand exactly what you’re saying. So what I’m hearing you say is, you went out and raised 40 million bucks to assume a catastrophe hit. You had no new, no revenue at all coming in, not no new revenue, no revenue at all, coming in for several months. You’d be able to pay all your expenses for five to eight months. Is that accurate? Eugene Levin: Yeah, kind of like that. Speaker 1: Okay. I mean, so 40 million divided by like five or six months that, I mean, basically I’m hearing you say, your guys were burning like eight, nine million bucks a month with no revenue. Eugene Levin: I mean, no, probably less, probably less than that, but I mean, I don’t remember from the top of my head. Back in the day, I came in 16, it took us one year to close everything. We also didn’t take all the money in one sort of transfers. So I would say four or five months. Yeah. That would give us four or five months. Speaker 1: Of runway without any revenue. Eugene Levin: Yes. Mm-hmm (affirmative). Speaker 1: Okay. I mean, so can I take 40 million divided by four or five months? I mean, you’re basically saying, [crosstalk 00:06:21] yeah, go ahead. Eugene Levin: No, no, that, I mean, if you think about that, there are also… Is it cash where it’s not the same way as revenue that comes in. And there are different revenue recognition policy. The right expenses that you already paid for there are expenses that you pay over time, but yeah. I mean, and as I said, we didn’t raise 14 million from the very beginning. So we renounced that later, but it was actually multiple different transactions with more or less the same group of investors. So, it’s not- Speaker 1: And just to explain to me how that works. So you don’t hear about that often. So how much was the first traunche and why’d you guys decide to go kind of the step approach? Eugene Levin: So, yeah, I mean, definitely we just wanted to be super friendly with investors because we knew we would not spend money. So, they had an obligation to fund in certain point, but there was no big difference if money sits on their balance sheet or… not even balance sheet or on our balance sheet or is with them in this case, they can optimize their IRR, which is one of their main metrics and we don’t really care, so we could negotiate a better moderation because we are nice. You see, the point for investors- Speaker 1: How much [crosstalk 00:07:48] was the first traunche? Eugene Levin: Yeah, I mean, I think we cannot disclose it publicly. Speaker 1: Okay. But okay, how many traunches were there total to get up to the total 40 million? Eugene Levin: So, through the whole thing, probably three or four. Speaker 1: And what were they tied to? Revenue targets or just a time based approach? Eugene Levin: No, just stop. Speaker 1: Okay. Got it. Okay. Fair enough. So, yeah, so you’ve got- Eugene Levin: Just to clarify, it’s not conditional. It’s just we allowed them to send money later because we knew we would not need them. Speaker 1: Yeah. That’s what I was trying to get at. Okay. So 40 million total raised. It wasn’t for traunches. You didn’t need all the capital, but you wanted that contractual commitment and you said, “Hey, it’s totally cool if you send us it in four tranches, every six months, not conditioned on revenue targets, just time-based.” Eugene Levin: Yep. Speaker 1: I see. Okay. Very good. So talk to me about some of these experiments you guys ran that panned out super quickly and returned a lot of cash. What were some of the first experiments you ran in 2018 when you closed? Eugene Levin: We started experimenting with new marketing channels. We started doing more YouTube. We dramatically expanded our global footprint. So we started hiring people to run marketing for European markets, such as Germany, Italy, Spain, France and so on. So those were the first things that we tried, but then we started investing more in product. Product takes more time to kind of show results. And some of the things that we started doing in ’16, they actually started paying off only ’18 or ’19. Things like our traffic analytics product. We’ve been building it for two, three years, so extremely complicated technology. So it took us quite a while to get everything running, but now it’s actually one of the fastest growing product lines that we ever had. So yeah, I mean, that’s kind of in a nutshell, what we started doing once we had more flexibility and could take more risks. Speaker 1: And now that some of these product lines have matured it’s that they obviously attract new and different sorts of customers, how many total customers are you serving now today? Eugene Levin: Yeah, I mean, I don’t think we disclose this number ever, but we have over 5 million registered users. And then, yeah. I mean, paying customers would be relatively small percentage of total registered users, but it’s obviously, tens of thousands. Speaker 1: Got it. So the reason I’m asking, last time you came on, you said you had about 30,000 paid customers. So how many more than 30,000 do you now have? Eugene Levin: It’s a little more. Speaker 1: Like more than double? Eugene Levin: Probably not. No, probably not. Probably not more than double. Speaker 1: Okay. So I won’t push you harder here, but fair to say today, somewhere between 30,000 and 60,000 paying customers on 5 million registered users. Eugene Levin: Yep. Speaker 1: Okay. How do you convert a registered… What’s the critical moment that you know a registered user has to hit to drastically increase the likelihood they convert to paid? Eugene Levin: It really depends. We have multiple different funnels. It depends on what problems users had commented with. So for things like keyword research, we will give certain functionality for free, certain amount of data for free. And then as people hit the limit, they will either upgrade or sometimes wait another day. We limit number off searches that you can make on a free plan per day. Or we also limit number of results that we show. For example, for free, we’ll show you 10 results. If you want more than 10, you have to upgrade. So, that would be sort of funnel for keyword research, but for [inaudible 00:00:11:53] it will be different for [inaudible 00:11:55] did, for example, we will allow you to crawl 20 pages for free. So if your website is less than 20 pages, you can use it for free pretty much forever. But if your website is bigger, then you’ll hit the limit and either upgrade or don’t crawl your whole website and just limit your site only to some sections. So yeah, I mean, we have more than 15 different funnels, Speaker 1: 15 different products or funnels? Eugene Levin: Yeah. Funnels. I mean, funnels can include multiple products. Speaker 1: How many products do you guys have? Eugene Levin: Over 40 right now. Speaker 1: Over 40? Eugene Levin: Yes. Speaker 1: Holy crap. So with all these additional products, obviously you’re launching them to hopefully cross sell and also bring in new customers. Has the average price that your average customer has paid increased drastically over the past couple of years? Eugene Levin: Yeah, I think if you look back to 2008, I think comparing to the first version of the product that we had, our revenue stream per customer increased more than six times, probably closer to seven times. After I joined… I want to say almost doubled. Speaker 1: Okay. Yeah. Back back in May again, when you came on, you said you put a target and said, “Hey, the average customer pays somewhere around $180 on average per month.” I’m sure there’s some way bigger. There’s probably some that are smaller, but 180 on average. Has that 180 increased drastically or no? Eugene Levin: So, yeah, it depends on cohorts, so there are two factors here. So people come in and then over time they upgrade another factor is that your low paying customers churn faster than your best customers who pay more. So I think average check in general is a combination of those factors. If you do nothing, if you stop acquiring new customers, over time your average check goes out. What was the point? Right. So I think you need to think about this on a cohort basis. But yeah, I think those cohorts that were at, let’s say for example, 180, they continue to grow. So when you go cohorts, they’re probably still climbing to this number. Speaker 1: Well, so the reason I’m asking is one of the things that drives a lot of a HubSpot’s earning calls is their ARPU, right? Average revenue per user. And they have way more cohorts than you, but they don’t obviously go into detail on every single cohort. The quick way to measure that is just ARPU across all cohorts. So total customers into total revenue. Is that about 180 today? Eugene Levin: No, probably not. [crosstalk 00:14:48] By the way. I don’t know why you have 180. I don’t think I told this number. Speaker 1: No, you did. I can pull a quote for you. Do you feel like it’s higher or lower than that now? Eugene Levin: Would depend on the stagnant. But I think over 180 is quite a high number. I mean, if you look at our price page, then we have a plan for $100, plan for $200, and plan for $400. You can make some assumptions about distribution, but it’s hard to see average being 180, right? Speaker 1: Why is 180 a hard average when your plans go from 100 to 200 to 400? 180, it seems like it’d be… That makes complete logical sense to me that’d be 180. Eugene Levin: Yeah. Okay. Then why not? Yeah. I mean, you don’t usually have everyone on the [inaudible 00:15:44]. Speaker 1: Sorry, Eugene, come on. You know how these numbers work. You’re an ex-VC. ARPU is total customer base divided into your total revenue. Obviously I know there’s different cohorts. That’s like obvious SaaS 101 stuff. It’s important you’re measuring it. I’m just trying to get a general ARPU number. The reason I’m asking is because some firms like you sometimes will intentionally turn lower paying customers and go way enterprise four, five, six thousand dollar a month kind of plans. Others will go and go way freemium and decrease their price significantly. I’m trying to get a general trend. Eugene Levin: Yeah. Listen. This I think, if you’re looking for trends, this number is absolutely in the range. Yeah. Speaker 1: Okay. That doesn’t answer my [crosstalk 00:16:23] question. So the average… you have between 30,000 and 60,000 customers. Do you feel like the… If you take all those customers divided by whatever your revenue is right now, it’s about $180 per month? Eugene Levin: It is. It’s within range, yeah. Speaker 1: Okay. And are you, from a strategic perspective, do you feel like SEMrush has more growth opportunities serving less customers at a higher price point in the future or more customers at a lower price point? Eugene Levin: So I think the goal of the business is to help as many marketers as possible in general. That’s always have been the goal. Even if we, at some point say, “Hey, it would make a lot of sense to hike prices.” We would not do this because the goal is to have very, very broad presence to have as many marketers as possible. Speaker 1: So, you prefer 10 million marketers paying a dollar a month, then 10 enterprise clients paying a million a month? Eugene Levin: That’s in a nutshell, yeah, the philosophy. But for some of them they need special features and they’re willing to pay for those features. So would we have been built something special for enterprise clients and sell it only to them because only they need this? Yeah. At some point. Speaker 1: Sure. Eugene Levin: Not necessarily our focus right now. Speaker 1: Let’s talk more about- Eugene Levin: Right now- Speaker 1: Let’s talk more about the teams. So how many folks on the team today? Eugene Levin: So we have over 800 people. Speaker 1: Okay. And are those all full time? Eugene Levin: Yep. Speaker 1: And remote? Eugene Levin: Right now, yes. Speaker 1: Sorry, pre-virus? Are you remote company? Eugene Levin: No. Speaker 1: Okay. Got it. So you have offices. All right. And break that down for me. How many of those folks are engineers? Eugene Levin: Yeah, so we don’t call people just engineers. We think about this as a product department. And then if your role is engineer- Speaker 1: How many people are writing code? Eugene Levin: So, that’s what I’m trying to say. Code is not the only important thing in the product. So in product department overall would have more than 200 people. Now out of them, how many write code? Probably 75%. Speaker 1: Okay. So call it 170-ish people writing code. Do you have quota-carrying reps at this price point or is it too cheap to pay a commission? Eugene Levin: We do. We have, as I said, some segments of customers pay a lot of money to have customers prepay more than a 100,000 per year. Speaker 1: Yeah, you don’t have any customers paying more than a million per year though, right? Eugene Levin: No. Speaker 1: But close? [crosstalk 00:19:04] Maybe in the next couple of years? Eugene Levin: Not yet. Not yet. Speaker 1: All right. So how many quota-carrying reps do you have? Eugene Levin: So we have, I think, roughly around 60, I’d say. Speaker 1: Okay, cool. And what’s the minimum ACD sizes you want them focused on closing? Eugene Levin: We don’t have minimums. We had previously requirement to close at least annual subscription. Right now we don’t have this. Whatever they sell is good. Speaker 1: One of those sales rep, so if they spend three hours selling someone on a $200 a month plan, that is not profitable use of their time. Eugene Levin: Right. So, their incentive plan is focused on things that are more profitable, especially expansion. So, we find that if customer sells new revenue, does good, but new revenue is subject to final churn. If sales rep sells to existing customer who’s loyal, very unlikely to churn, then $1 of expansion is going to stay with us forever. And then what we’ve noticed is that if people expanded, they are more likely to continue to expanding. So, that’s where we now try to focus our sales teams. Speaker 1: Eugene Levin: I’m not sure I understand. Can you- Speaker 1: Sure, so net revenue retention in any company is made up from two components, gross revenue churn and expansion. Eugene Levin: Right. So, we measure kind of one number net for having your retention. And then the question is what do you include, what would you don’t include? And we have roughly six, seven different ways to calculate it. There are also different definitions of what you call user. For example, if you have company like Microsoft and they buy six different subscriptions for their six offices, is it one customer or- Speaker 1: No, but you’re talking about logo churn on a customer basis. This is why people measure revenue churn. It’s way simpler. You take total revenue from a cohort last year and that same cohort this year, how much churn and how much expanded? Eugene Levin: Exactly what I’m trying to say. It depends on how you define customer, because if you say Microsoft is one customer- Speaker 1: Eugene, doesn’t it matter… When you’re calculating revenue churn it doesn’t matter how many logos are on. You’re measuring it purely on a revenue basis. So it doesn’t matter that it’s one Microsoft logo. It means that it’s a million dollar a year contract. Eugene Levin: So, hear me out. There is actual difference. Let’s say someone from Microsoft, Japan, let’s say signs up and by subscription, they have separate billing entities. So, if you combine this into one account and you say, have expansion for Microsoft, if you do not combine you say, I have you guy in Japan, which is bought, and his email is microsoft.com, but this is new guy because this is new billing address. So it depends on definitions actually but, and as I said, we have six, seven, but in general we have all 100%. And then we also do segmentation like of if customers work in a company with more than 50 employees, then it will be way, way higher than 100%. But if they, let’s say, individual freelancers with Gmail account and some they will have, on the average, probably lower than 100%. So, it really depends. But on average we have 100% when [crosstalk 00:22:55]. Speaker 1: Yep. Interesting. Okay. And then, so from the respective of the virus, right, obviously everyone’s just trying to get to profitability as quickly as possible. And actually they can have a long runway here. Are you guys profitable today? Eugene Levin: Cashflow is positive. Speaker 1: Okay. Why do you say it so specifically? Is there some other metric you measure where you’re not profitable? Eugene Levin: Sure. Yeah. I mean, as many other SaaS companies, if you build people up from when you sell annual subscriptions, then you get money, but you can not recognize it as revenue. As a result, your bottom line might be in red, but your cash flow might be positive, if you want to feel balanced it’s accurate. Speaker 1: If you took a payment today for a thousand dollars for the year, which is actually $83 per month for a customer, you’re saying you’ll count the thousand today in this month. And when you do that on a cash basis, you’re profitable, but if you divide the thousand by 12 months and only recognize it over the next 12 months, you might be burning a little capital. Eugene Levin: That’s the difference between gap and cashflow- Speaker 1: You’re cashflow profitable? Eugene Levin: Yep. Speaker 1: What will you guys grow out this year, do you think? Eugene Levin: What? Speaker 1: What will you guys grow at this year, do you think? Eugene Levin: I had a number before this crisis? Speaker 1: Which was what? Eugene Levin: So reasonably good double digit. I would say high double digit for a company- Speaker 1: What is that? 70, 80%? Eugene Levin: No, not that high, but- Speaker 1: Okay. So somewhere between 20% and 60%, right? Eugene Levin: Right. I mean, we have 800 people and we are cashflow positive. If we grew 80%- Speaker 1: That’d be- Eugene Levin: That would be awesome. But yeah. Speaker 1: Yeah. When do you guys, I mean, so look, I don’t know what your actual obviously ARR is, but I mean, can you break a million, sorry, 100 million dollars in ARR this year, do you think, or you have to wait until next year? Eugene Levin: I mean, we talked about this. We did this long time ago. Speaker 1: You broke 100 million dollars in ARR. Recognized ARR how long ago? What year? Eugene Levin: Last year. Speaker 1: Okay. So that’s not a long time ago. You haven’t been on in over a year and a half, so, okay. So you broke that last year. That’s on a recognized ARR basis. Not on a cash basis. Eugene Levin: Yeah. Speaker 1: Okay. So how… So walk… Last question… [crosstalk 00:25:12] Before we wrap up. Go ahead. Eugene Levin: I mean, the difference is not that huge. It’s maybe one quarter or so, maybe more than one quarter. Speaker 1: The last question I want to finish with, because I think this is valuable, you had obviously a growth target pre-virus. You have to now re-engineer with your team. What is the new target? What are those conversations sounded like? How are you planning for the next six months? Eugene Levin: I think, reality is that if someone tells you they know exactly what’s going to happen and how it’s going to impact that revenue, they’re probably not very honest, so. Speaker 1: But everyone has to take a guess. You can’t just say, “I don’t know, so we’re not going to plan.” I want to know your guys’ best shot, your best estimate. Eugene Levin: Yeah. So, right now we are looking at a different salvation [inaudible 00:25:58] and the big question is what’s going to happen with you, business and what’s going to happen with existing business in terms of churn. So in terms of churn, we see that certain categories to follow customers will be impacted materially and certain categories will not be impacted pretty much at all. And we’ll look at percentage of customers in those categories and apply certain multiples like additional 25% of them will churn versus what we would see naturally organically. And from what we see is that in some categories we will have 25% higher churn, in some categories no changes at all. And those categories seem to be relatively small for us. So we are talking about now most vulnerable categories, like very small agencies, freelancers and small local businesses. So we see them being impacted, but they’re historically not the biggest part of our audience by any means. We usually work more with online businesses. Speaker 1: Very good. All right. By the way, have you been approached by any bigger, maybe public folks like HubSpot and said, “Hey, we’d love to buy you guys now. We feel like we could get you cheaper because everything’s cheap right now.” Eugene Levin: So, yeah, I think that brings us to the beginning of the conversation. We can wait this one out. And we don’t have to do any irrational moves. There’s there is, there is no need for this. We we’re still business that largely owned by founders, managed by founders and you know, team off people who they assembled all over. Over time. We don’t have to do anything irrational. We can wait this one out. Speaker 1: Any plans to [crosstalk 00:28:01] raise capital? Eugene Levin: Not in this environment probably. I don’t think it’s a good idea. Speaker 1: All right. Let’s wrap up with the famous five number one, favorite business book. Eugene Levin: Intelligent Investor. Speaker 1: Number two, is there a CEO you’re following or studying? Eugene Levin: Yeah. So right now I’m actually looking at Satya Nadella. Speaker 1: Yep. Number three. What’s your favorite online tool besides SCM Russia to build a company? Eugene Levin: So right now Zoom is everyone’s favorite. Right? Speaker 1: Original answer there, Eugene. Good stuff. Number four, how many hours of sleep do you get every night? Eugene Levin: So I changed my mind recently. Now I’m sleeping full eight hours mandatory. Speaker 1: That’s great. And what’s your situation? Married? Single, kids? Eugene Levin: Still married, but you know if coronavirus continuous, I don’t know. Speaker 1: Any kids- Eugene Levin: I’m sure. Speaker 1: Any kids? Eugene Levin: Yeah. I have one. Speaker 1: One kiddo. And how old are you? Eugene Levin: Me? I’m 32. Speaker 1: Eugene Levin: I would say don’t waste your time with stupid things. Speaker 1: Guys. There you have an SEMrush launched in 2008 and now have over 40 products between 30 and 60,000 paying customers over 5 million registered users, broke over a 100 million dollars in revenue last year, hoping to continue to drive solid double digit growth this year, even in the face of the virus. They’re profitable on a cash basis. So have plenty of runaway. They can afford to ride it out. Raised 40 million bucks many years ago, but didn’t need the capital used on some experiments. Now with 800 people on the team, obviously all remote right now, looking to continue to scale. Eugene, thanks for taking us to the top. Eugene Levin: Thank you. Speaker 1: You guys know I fight like heck to get these data points for you from the CEO’s that rarely do these kinds of shows. If you want more shows like this, make sure you subscribe right now. We’re trying to get 10,000 YouTube subscribers by the end of September here 2019. And it would mean the world to me if you clicked now to subscribe. Additionally, I’ve got two more great interviews for you. If you want more data points from the world’s leading SaaS CEOs, click and watch one of them right now.