Crowdsource competitive intelligence platform Owler has more than three million business professionals using its platform on a daily basis. That includes about 100 customers paying up to $100,000 per year. Latka interviewed Owler founder Jim Fowler to get the details.

The company, which launched in 2011, was founded by Fowler after he sold his previous company, Jigsaw, to Salesforce for more than $100 million. Fowler has since moved out of the CEO role and is Owler’s executive chairman. He says the company’s freemium model and crowdsourcing approach to company data collection — information that is exceedingly hard to get — is working and helping the company attract customers.

“It’s a freemium model in a way like LinkedIn,” Fowler says, adding that Owler gives information about acquisitions, CEO performance, etc. “The idea is that you’re getting news in particular, but we also give a lot of other insights about companies. … Jigsaw really brought the concept of data-as-a-service to market. Now many people do it. Dun & Bradstreet copied that model. I’m quite proud of that.”

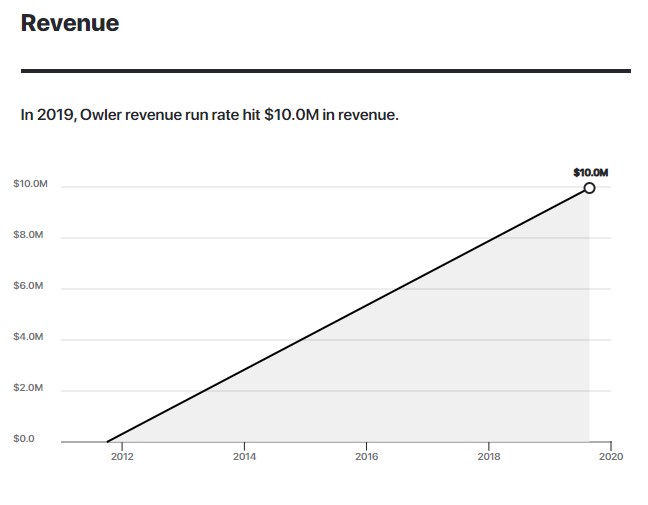

Over the last 12 months that Fowler was CEO, he estimates gross revenue churn was below 5%. At the time of this interview, the goal was a $10 million run rate. The company has 40 employees, which includes 12 engineers, and with around 30% expansion year over year on its historical cohorts. Fowler says the company is around 130% in terms of net revenue retention.

Source: https://getlatka.com/companies/owler

Owler’s average contract size is around $100,000, but Fowler says the company continues to chase $1 million deals with clients, such as hedge funds. Wall Street customers will pay top dollar for hard-to-get data .

Fowler says the company did end up taking on $3 million in debt with Silicon Valley Bank, which took warrants as part of the deal.

“It’s a small amount of warrants, really,” Fowler says. “At the high level, it’s just a mechanism for taking capital into your business to grow without giving up so much equity. So it’s far less dilutive than equity. Warrants are just a model to do that.”

To attract new customers, the company isn’t spending money on direct paid ads, but instead focuses on sales.

“We’re very specific and targeted on our marketing,” he says. “Luckily we use our own database. We have over three million growing quickly. I think we’ll certainly be over four [million] by the end of the year … But we use our own database a lot.”

Get to Know Owler Founder Jim Fowler

Name: Jim Fowler, age 54, single with one teenaged son.

Where to find him: Twitter | LinkedIn

Company: Owler

Noteworthy: Fowler stepped down from his position as CEO to take a more relaxed position as executive chairman, which he likes because it allows him to “step aside and stay super engaged in the business from a strategic perspective, but no longer carry that heavy operational burden.”

Favorite business book: “The Innovator’s Dilemma”

CEO he respects: Jeff Bezos

Favorite online tool for building the business: HubSpot

Average # of hours of sleep/night: 7

Transcript Excerpts

How he knew Mattermark wasn’t going to be a big competitor for Owler

“Because they were all over the map on their business model. I could tell. I don’t know, you just start getting a smell about these companies … what it’s all about is how do you get market separation? Right. I get up on stage all the time and preach that there’s no new ideas. There’s just new execution. … I just knew that the way that their model, they just didn’t have a clear concept. They kept jumping around and you have to kind of stick to it and really figure out that repeatable sales model.”

Mechanisms used to drive contract values in year one to doubling the next two years

“From a SaaS perspective, I’m sure your readers have all read Byron Deeter’s ‘10 Laws for Being “SaaS-y’ … I’ll just stand on the shoulders of giants here when it comes to how to do this kind of stuff in SaaS. … Year one is all about making sure they understand the value. There’s a big upfront investment for most SaaS or DaaS, data as a service customer, which is what we are, and it takes a long time to actually implement it. Even though you say, ‘Hey, it’s out in the cloud, we don’t have to install anything,’ the dirty little secret of SaaS is that it’s much more difficult to install and use, especially when you’re trying to figure out the data side of it. For us, it’s really about making sure they understand the value of the data and having a customer success or renewals person on from the beginning. That’s critical.”

When customer acquisition takes up to a year (for a $100,000 ACV)

“The good news is that SaaS model is now well understood. I mean, it’s been over a decade or two getting on. SaaS is still used, but Marc Benioff, the positioning genius out there, I’ve had many conversations with him personally. No one positions better than Marc. … Really kind of taking the whole conversation more about cloud, right? But we still use this term SaaS as you will. The metrics for this are all now well-known. I mean, everyone understands if you’re not getting there. Customer acquisition is always very expensive in SaaS because you’re not getting that huge upfront. That’s why SaaS models usually have to raise a lot of capital.”

Customer growth fueled by a useful product

“What we just believed from the very beginning is if you create a great product, people talk about it, and what’s driving us surprisingly is news. Really, I think the number one use case on this thing is it’s just a really great replacement for Google Alerts. And Google Alerts is just really messy. This just gives you a really clean interface and there’s a lot more data input on it. … I was surprised because I really felt like when we founded the company that news was such a commodity, but it turns out really well-curated news … And we spent a lot of time on our engineering team and we have a team in India that actually hand-curates parts of it for the really important companies.”

Full Transcript Nathan Latka: Hello everyone. My guest today is Jim Fowler. He is the founder of a company called Owler, the crowdsource competitive intelligence platform that business professionals use to outsmart their competition, gain insights, and uncover the latest industry news and alerts. Before Owler, he founded Jigsaw in 2003 and was CEO until it was acquired by Salesforce in 2010 for 175 million bucks. Jim, you ready to take us to the top? Jim Fowler: Yes, sir. Nathan Latka: All right. Owler. So first off, I love the platform. In fact, I paid to put a promo through you guys and it did fairly well. You’ve built a massive network of business professionals. Why are they using Owler? Give us the overview. Jim Fowler: We’ve got over three million business professionals using us now on a daily basis. It’s a crowdsource platform where you get information about companies that you care about, whether you’re a sales person, a CEO, a product person. When you give information about it, you get a lot more information back, which is the beauty of a crowdsource model. Business professionals use us to stay on top of companies that they care about either from a competitive perspective because they’re customers or because they’re potentially an investment company as well. A lot of investors use us as well. Nathan Latka: And explain to me with any kind of data platform like this, source of truth and how you get data is obviously critical for folks to understand. So explain how you capture data. Jim Fowler: Sure. So many of our users use it for free. It’s a freemium model in a way like LinkedIn. The idea is that you’re getting news in particular, but we also give a lot of other insights about companies. For instance, we might say that, “Hey, this company just acquired another company.” And at that time, we’ll ask them to do something like perhaps rate the CEO of the company, or, “Hey, for a private company, estimate the revenue of that company.” So we kind of use a wisdom of crowds model to get information about these companies. That’s very difficult to get. Revenue of the employee is one of the most important ones. Nathan Latka: So obviously if someone is on the Inc. 5000, you see the revenue, someone will report that an hour. You’ll have really accurate numbers on those kinds of companies. There are a lot of companies though that are pretty private. And the knock I’ve seen on Owler is that there are some where you might or your crowd might say the revenue is two million, but the CEO is like, “Nathan, just so you know, we’re doing like 30 million.” Right? So how do you make sure you don’t lose the trust of these kind of three million daily users? Jim Fowler: Right. We actually had to deal with this at Jigsaw as well. Because what people want when they deal with business information or any kind of database is they want perfection, and they want it for free usually. The reality is is that all we have to do is be a lot better than Dun & Bradstreet, and we blow those guys away. Every year, one of our critical benchmarks is how good is our data comparative to Dun & Bradstreet? And we blow them away in terms of accuracy. Unfortunately, it’s not perfect. So what we’re trying to do is just provide the best possible that we can get. Nathan Latka: Yep. These people that are… I early on when you launched, because you came back on September 2016, I became a user of Owler. So occasionally when I get an email, I would actually go in and rate a CEO or I talked to a CEO and then saw it wasn’t accurate on Owler, so I put in the accurate information. Whether it was revenue or employee counts or things like that. Who are typically the ones that are providing that feedback? Is it usually investors or CEOs wanting their profile to be accurate so they update it themselves? Who is it usually? Jim Fowler: That’s a great question. It was the same with Jigsaw, which is of course also a crowdsource database. It’s really interesting because I’ve always gone in and really tried to get a handle on who are these, I call them data geeks? And you’re clearly one of them, and we love you. We worship you. The reality is there’s no rhyme or reason to it. Humans are kind of like answer bees. We are workers and we like to build things and make them right. It’s that gene that gets triggered and it can be from everywhere. Sometimes it’s salespeople. Sometimes it’s product people. We love, by the way, investors because they have a very good view. So we really look hard. Our algorithms weight different votes differently, by the way. There’s a lot behind the scenes in our algorithms. Nathan Latka: Yeah. An investor who’s sitting on the board who gives a revenue update, you know you can probably trust. Right? Jim Fowler: What we have found is that people tell the truth far more often than they lie. Because what we try to do is go out and say, “Okay, we know this answer. Now, how do we figure out who’s giving us correct?” One of the things we thought at the beginning was if you competed with a company, you would go and give inaccurate information about that company. We’ve actually seen that does happen, but it’s not the norm. There’s always really crazy interesting things you learn from crowds. Nathan Latka: Yeah. Okay. This is interesting. Again, I love the motto. We geeked out there a little bit, but tell me the revenue model. How do you guys make money? Jim Fowler: We have just launched a freemium model now and that’s doing really well, but we also do huge data deals. It actually follows a lot what we did with Jigsaw, where we go out… We’ve actually now closed a couple of deals above a million dollars a year with customers because of course everyone builds this database. It’s a corpus of information that really doesn’t have a mirror anywhere else in the market. And so we’re able to go out there in a data as a service or a SaaS model, do these deals where we get multiple year contracts [inaudible 00:05:41] large scale. Nathan Latka: Explain to me what’s in one of these million dollar kind of deals. If I’m paying you a million bucks per year, are you feeding into like, I now have a direct API connection to Salesforce and the outlier information updates on my Salesforce record? Or what typically is included in that? Jim Fowler: That’s actually our pro where we actually pump a lot of the news alerts about companies into Salesforce. It’s all API deals with these big million dollar deals. They’ll want different fields in our database. Jigsaw really brought the concept of data as a service to market. Now many people do it. Dun & Bradstreet copied that model. I’m quite proud of that. But the whole point is that it’s all about just taking whatever of our fields, and we have many fields in our database. Some people want them all, some people just want some of them. Nathan Latka: What’s the most popular field that people want? Jim Fowler: For sure, it would be a revenue. Private company revenue. It’s just a difficult one to get. And number of employees. Because if you think about it, every company uses those two fields to set sales territories. Nathan Latka: Now, will you do things like analyze all of the Nordic government reports and then use that, because they have to report certain things, then use that as a sample cohort to project upon similar US companies and projector or guess their revenue? Jim Fowler: That’s a hell of an idea, Nathan. No, we don’t do that yet. Right now, we’re really focusing on getting the US market because they don’t have to report. I think a lot of US listeners may not be aware as you are that most of the European companies require private companies to report their revenue. Something that we would certainly not like here in the United States. But no, we don’t do that yet. As we get larger, we will. Nathan Latka: Yep. Okay. Good. I remember, I think you said you launched in 2011, is that right? Jim Fowler: Yes, we did. Yes, we did. Nathan Latka: Jim Fowler: We had. Yes. Correct. Nathan Latka: How much to date? Jim Fowler: Yeah. 19 million. Nathan Latka: Yeah. Any more since then, or still 19 million total? Jim Fowler: We just took some debt, which is very common. So once you start having a regular revenue stream, we took some debt and then we took a strategic investment last summer. But that was small. Nathan Latka: Who was the strategic? Was it public? Jim Fowler: Yeah. Well actually, I think it’s public. For sure. Nathan Latka: Well, let’s make it public. Who was it? Jim Fowler: It was the founder who’s no longer CEO of Morningstar. So you would probably know him well. Nathan Latka: Well, look, this is an interesting add on to a pitch book kind of hub and spoke MNA roll-up in the data space kind of model, right? I mean, are you in acquisition talks right now with Morningstar? Jim Fowler: Oh, well. First of all, I couldn’t comment on that if we were. But no, we’re not. I’ll say that no, that’s not… Morningstar isn’t exactly where we go. Although there’s a lot of really interesting… We have several hedge fund customers that use us to get our data. Obviously, as you well know on Wall Street, having any sort of edge on any sort of data about companies that you might invest in is huge. So we have a lot of customers there, but no, Morningstar is not in the… Nathan Latka: Yep. Okay. So total in the company then at this point is what, 20, 21, 22? How much debt did you end up taking? Jim Fowler: Three. Total would be if you include debt, 25. Nathan Latka: Jim Fowler: We actually worked with Silicon Valley Bank. Nathan Latka: Okay. This was very much like a 3, 4, 5% term loan kind of thing. Jim Fowler: Exactly. Exactly. Nathan Latka: Did they take warrants? Jim Fowler: Yes. Nathan Latka: Jim. Jim’s given up warrants now. I would never have expected this. Why’d you do that? Jim Fowler: That’s just the model. It’s a small amount of warrants, really. I mean, at the high level, it’s just a mechanism for taking capital into your business to grow without giving up so much equity. So it’s far less dilutive than equity. Warrants are just a model to do that. Nathan Latka: Yep. Very good. Okay. So it launched in 2011. Your first line of code was then… I know you were building this freemium model and you could afford to do it because you were able to tell your Jigsaw story and raise a lot of capital upfront. How much total capital? Do you remember this? This is probably going to be painful. How much total capital did you spend before your first dollar of revenue? Do you remember? Jim Fowler: Oh boy, that’d be tough. We pushed off revenue for a long time to grow our user base over a million. So I would say… What was it? 2014. We had raised certainly that 19 before first dollar of revenue. Nathan Latka: Yeah. That’s what I’m saying. You’ve potentially spent many millions between 2011 and 2014, correct? Jim Fowler: Yes. Nathan Latka: Yeah. Jim Fowler: But no way do you do that without having a prior… Jigsaw was a great outcome. No way does that happen without that. Nathan Latka: All right. Very good. Build the MVP. First dollar of revenue was in 2014. What was that first deal size? Was it like a hundred grand, or you went right for a million bucks a year up front? Jim Fowler: I remember our first deal, it was six figures. I remember going, we’re going to set… I wanted to set the mindset of our whole team that, “Hey, this is worth six figures.” That was fun to do. We do deals that are much smaller than that as well, but that was our first deal. Nathan Latka: Well, it’s interesting that’s what you lead with because there’s so many companies in the space. Let’s look at Mattermark for example, right? They had a lot of data, but ultimately it just failed. I mean, flash sale for 500 grand. Probably your friend at… I don’t know if you know Bart, but you probably do, at FullContact. That model where you’re trying to sell a million salespeople at 50 bucks a month just didn’t work with data, but I doubt they tried anything like what you’re doing, which is just sell the hedge funds for a million bucks a year. Jim Fowler: Right, right. Yeah. No, I remember Mattermark at the time, because I think it was Danielle was the CEO, I can’t remember the founder. Nathan Latka: Yeah. Jim Fowler: She was really good at getting PR. I mean, she was great about that. I remember there was a few people on our team and I had a board member that in particular was worried about Mattermark. I remember going, “Mm-mm. This one’s not going to work. You wait and see.” Nathan Latka: Why’d you know so clearly? Jim Fowler: Because they were all over the map on their business model. I could tell. I don’t know, you just start getting a smell about these companies now where, to me, what it’s all about is how do you get market separation? Right. I get up on stage all the time and there’s no new ideas. There’s just new execution. I think I was reading some of the bullet points on your book. Nathan Latka: Yeah. I was going to say, Jim, I see the exact same thing. Jim Fowler: Exactly. I saw something about how to copy without being [inaudible 00:12:44]. My main point is it’s all copying. I mean, it really is. I mean, Leonardo da Vinci thought of the helicopter, right. He just didn’t have the ability to execute on it. Right? So my main point is that to me, business information companies have taken lots and lots of funding and some have been very successful. I just knew that the way that their model, they just didn’t have a clear concept. They kept jumping around and you have to kind of stick to it and really figure out that repeatable sales model. Nathan Latka: Yep. No, I mean, you’re exactly right. They pivot all over the place. Okay, good. That’s good to understand. Again, 2011 was your date. 2014 first dollar of revenue. How many customers now serving today? Jim Fowler: Boy. Well, as you well know, or we haven’t talked about yet, I’m now executive chairman. One of the things that’s really fun is when you step aside and stay super engaged in the business from a strategic perspective, but no longer carry that heavy operational burden. I don’t know the exact number, but we have certainly over a hundred customers. I’m not sure the exact number. Nathan Latka: Hundred. What was the day? When did you walk away from CEO role and switch to chairman? Jim Fowler: Two summers ago. Exactly. But it had really been in the works for a year before that. In fact, I’ve been grooming our current CEO, Tim Harsh, who’s awesome and hopefully one day will be on this podcast with you and running a much larger company than I ever did i.e. Owler becomes much bigger than Jigsaw ever was, but I had kind of groomed him from the beginning. Funny enough. He started just out of Dartmouth. He was my super intern. We had a whole string of Dartmouth interns at Jigsaw because one of my investors, Jeff Crowe from Norwest Ventures went to Dartmouth and he would always funnel us these awesome college kids who were interns. Tim was the best of them all. I told him after he was an intern at Jigsaw, “The good news is you’re the best intern I’ve ever had. The bad news is if you don’t come work for me, I’m going to tell everyone you suck.” Jim Fowler: So he ended up coming and working for Owler, our first employee. I was grooming him from the beginning because I knew he had the skills to become CEO one day. Nathan Latka: No family connection there. Right? Jim Fowler: Tim Harsh? Nathan Latka: Yeah. Jim Fowler: No, no way. Nathan Latka: For some reason, my research team had said to ask you about it. Was there a family connection with the pass off to the current CEO? So no family relations there. Jim Fowler: Oh no, no. Not at all. Not at all. I mean, if you look at Tim, Tim’s a super handsome guy. He looks like a Ken doll is from what I heard [inaudible 00:15:26]. Nathan Latka: That’s a perfect kind of guy to potentially run this kind of company. Right? Jim Fowler: Oh, yeah. He’s got that perfect UI. Nathan Latka: The Mad Men kind of deal things going down. Jim Fowler: Oh, for sure. For sure. Nathan Latka: Jim. All right. There’s some other questions here, especially because you learned all this at Jigsaw, I have to ask about these because we’re going to learn a bunch. Expansion revenue is critical in a SaaS company, right? What mechanisms are you using to drive contract values in year one to doubling in year two and three? Jim Fowler: From a SaaS perspective, I’m sure your readers have all read Byron Deeter’s 10 Laws for Being “SaaS-y” that I think he wrote back in ’06 and then just re did 10 years later or 12 years later. I know Byron, he’s a close personal friend. I’ll just stand on the shoulders of giants here when it comes to how to do this kind of stuff in SaaS. But for us, it’s really about, you’ve got to… Year one is all about making sure they understand the value. There’s a big upfront investment for most SaaS or DaaS, data as a service customer, which is what we are and it takes a long time to actually implement it. Even though you say, “Hey, it’s out in the cloud, we don’t have to install anything.” The dirty little secret of SaaS is that it’s much more difficult to install and use, especially when you’re trying to figure out the data side of it. For us, it’s really about making sure they understand the value of the data and having a customer success or renewals person on from the beginning. That’s critical. Nathan Latka: So a couple of questions around that. So first off, if you look at gross revenue churn, so before expansion, over the past 12 months or the last 12 months that you were there, the last 12 months that you remember. What was gross revenue churn? Jim Fowler: Boy, again, because it’s been two years, these are the details. What I know is that if your churn is anywhere above 10%, your host [crosstalk 00:00:17:23]. Nathan Latka: So you are below 10% annually. Jim Fowler: Oh, for sure. I’m guessing. And again, Tim, would have to ask. It’s below five. Of course that’s just… Well, okay. It depends on how you look at churn. Is that new or old, right? Because then you have growth of year one deals. Nathan Latka: Ignore the growth for a second. Yeah. Just gross revenue churn on the historical cohorts that signed up a year ago. It sounds like less than 5%. The next question is, how much do you that same cohort or the first 12 months? I assume it’s going to be more than 5%. Jim Fowler: Oh, for sure. If not, again, you’re dead meat in a SaaS model. You just can’t- Nathan Latka: Are you above 140 net? Is your expansion more than 40 or 50% year over year on those historical cohorts? Jim Fowler: Good question. I don’t know the exact answer, but I’m guessing that we are not that high, but I’d say we’re probably more in the 30% growth. Nathan Latka: If it’s 30% in five churn, you’re talking like 125 net. Jim Fowler: I’d say it’s probably more like 130 net. 130 or above. That’s what sticks to me from last year. But again, remember, we’re still relatively early in on this and these first couple of years, it’s kind of [crosstalk 00:18:36]. It’s hard to predict. Nathan Latka: Your average contract size though, obviously you have some that are a million, but would you say your average is more like a hundred thousand dollars across all your customers? Is that a fair average? Jim Fowler: Yeah, sure. I think directionally correct. Yeah. Nathan Latka: Yeah. Then look, I mean, that’s helpful to understand like expansion and churn metrics there. Now the second question I have for you there is obviously you raised a bunch of capital upfront, right? How aggressive were you willing to be with user acquisition? Were you happy with a 12 month payback on a hundred thousand dollars year one ACV? Jim Fowler: Oh, for sure. I mean, the good news is that SaaS model is now well understood. I mean, it’s been over a decade or two getting on, if you will. I mean, obviously, SaaS is still used, but Marc Benioff, the positioning genius out there, I’ve had many conversations with him personally. No one positions better than Marc. I mean, he is the animal of it. Really kind of taking the whole conversation more about cloud, right? But we still use this term SaaS as you will. The metrics for this are all now well-known. I mean, everyone understands if you’re not getting there… Customer acquisition is always very expensive in SaaS because you’re not getting that huge upfront. That’s why SaaS models usually have to raise a lot of capital. Nathan Latka: Where are you? Let’s say you spend a hundred grand to get it for a hundred thousand dollars and contract value year one. Where are you spending that hundred grand typically? Is it sales commissions, direct paid spend? Jim Fowler: Yeah. For us, because we’re very specific about how we go, we aren’t big enough yet to go do a lot of the advertising and do like a big, huge dream force. Obviously, Salesforce is kind of a one of a kind, I mean, Marc just went, “Go big, go home,” from the very beginning and got a tip the cap to the guy. He’s just created an amazing company. Although I’m not going to lie, I’ve been predicting ever since they bought us that this thing’s got to slow down at some point and it just keeps rolling. Nathan Latka: It just keeps going. Where are you spending that money though then if it’s not on direct paid? Jim Fowler: We spend our money mostly on sales. A bit on marketing. We’re very specific and targeted on our marketing. Of course for us, luckily we use our own database. I mean, we have over three million growing quickly. I think we’ll certainly be over four by the end of the year and maybe even five. But we use our own database a lot. Nathan Latka: Yep. What’s growing so many new of these free signups so quickly? Because there’s not really like a invite your team member. I mean, I obviously use the tool. I can’t spot any kind of bio coefficient flywheel or anything. Jim Fowler: Yeah. No. What we just believe from the very beginning is create a great product and people talk about it and what’s driving us surprisingly is news. Really, I think the number one use case on this thing is it’s just a really great replacement for Google Alerts. And Google Alerts is just really messy. This just gives you a really clean interface and there’s a lot more data input on it. So I really think it’s the news that drives it. People just need that news. I was surprised because I really felt like when we founded the company that news was such a commodity, but it turns out really well curated news… And we spent a lot of time on our engineering team and we have a team in India that actually hand curates parts of it for the really important companies. Nathan Latka: How many engineers total? Jim Fowler: We have data folks that I’m not going to leave in this, right? Those are just folks that actually look at the data from a human perspective and then give feedback to the algorithm. But our engineering team is now 12. Nathan Latka: And total team? Do you know? Jim Fowler: Total team is… Oh gosh. 40. Nathan Latka: 40 folks. Okay. Very good. All right, good. Then look, growth. I’m curious. Growth year over year revenue wise. You got 100% hopefully, 200%, something like that or what’s growth at? Jim Fowler: Oh, for sure. I mean, but again, it’s easy to do 100% growth. Nathan Latka: Small number of- Jim Fowler: … when you’re small. Right. But the reality is any company. In fact, Jeff Crowe who’s now rockstar VC, who was on my board at Jigsaw. Jigsaw was his first. Nathan Latka: His win. Jim Fowler: … investment as a VC back in the day. And now he’s doing huge deals. He did Lending Club. Anyway, Jeff said, “Hey, any company that is doubling its revenue year over year is doing great.” Now granted it’s much easier to do when that number is small. But yeah, for the last couple of years we’ve doubled our revenue. But it’s going to be harder to do this year. Nathan Latka: Obviously. Yeah. It gets bigger numbers. Well, I mean, what’s the big revenue target this year? The uncomfortable one where if you hit it, you’re celebrating. If you miss it, it’s like, we’ll get it next year. Jim Fowler: Oh boy. Boy. I’m not sure. This is one, Nathan, I want to be careful about. Tim’s the CEO, and I think I’d be stepping on his stuff a little bit. It’s not that I’m trying to avoid your question [crosstalk 00:23:27]. Nathan Latka: We actually have Tim on hold on my column right now. Give me one second. No, Jim I’m totally kidding. I’m kidding. No, no, no. Jim, the reason I ask is, so you said a hundred customers, kind of average ACV of a hundred thousand bucks, right? I mean, if those numbers are directionally correct, that would put you at about $830,000 a month right now in revenue or about a 10 million run rate. Without pushing you harder, is it fair to say you’re about a $10 million run rate today? Jim Fowler: I’d say that might be a little bit higher than we actually really are. Nathan Latka: You have a couple of months left in the year. I mean, do you think you can pass that this year or you’re going to need another couple of quarters? Jim Fowler: You need to be like an investigator on a… You can solve a lot of crimes. Nathan Latka: I’m just asking the right questions. Only based off numbers. The only numbers you gave me. You said a hundred customers, a hundred thousand dollar ACV average. Jim Fowler: Yeah, yeah. If we hit 10 million in revenue this year, I would do cartwheels. I’d be so thrilled. Nathan Latka: Good answer. That’s a fine answer. I’m good with that. All right, Jim, let’s wrap up with the famous five. Number one. What’s your favorite business book? Jim Fowler: I think it’s changed from the last one. I was looking at my answers from the last time, which was Good to Great. I’m going to argue now, The Innovator’s Dilemma by Clayton Christianson. I just read that. And it’s just like this work of art, I think. Both The Innovator’s Dilemma and a follow on The Innovator’s Solution, which really, in some ways is almost one book. I just think it’s so fascinating and the way that it talks about innovation. So that’s my number one now. Nathan Latka: Number two. Besides your own obviously, is there a CEO you’re following or studying? Jim Fowler: Yeah, I’ve been… Obviously Bezos since we’ve talked has really emerged. I just find him so fascinating. Yes, I’m really paying close attention to him, but so is everyone. That’s boring, I know. I wish I had something more esoteric for you, but he just fascinates me. Nathan Latka: No problem. All right. Number three. What’s your favorite online tool for building your company besides your own? Jim Fowler: Boy. HubSpot is just crushing it for us. We’re watching those guys just go bananas, and we use them and they’re fantastic. Nathan Latka: Number four. How many hours of sleep are you getting? Jim Fowler: More now that I’m executive chair. I’m not going to lie. It was probably certainly six or at best… I’d say I’m more getting seven. Sevenish now. Maybe even a little tiny [inaudible 00:00:25:51]. I’m enjoying it. I’m not going to lie. I’m not as much [inaudible 00:25:54]. Nathan Latka: That’s good. [inaudible 00:25:55] everyone’s situation. Married, single, kids. Jim Fowler: I’m single. Nathan Latka: No kiddos running around? Jim Fowler: I do. My son is 18 and just graduated from high school. He’s got long blonde hair, by the way, if any of you are actually looking at me. Nathan Latka: There you go. Jim Fowler: My son better enjoy that. He’s doing awesome. Nathan Latka: That’s good. One kiddo. And how old are you, Jim? Jim Fowler: I’m 54. Nathan Latka: Take us home. Last question. What do you wish your 20 year old self knew? Jim Fowler: Oh boy. How to breathe. Just don’t be in such a hurry. Take more time to breathe, and it’ll come a little easier for you. Nathan Latka: Guys, Jim Fowler. Founded owler.com. Raised 19 million bucks to get it going after he sold his last company Jigsaw to Salesforce for well over a hundred million dollars. Now serving over a hundred customers paying caught between 50 and 100 thousand dollars a year on average with eyes on that caught $10 million run rate in the next couple quarters. We’ll see if they do it. In the meantime, again, team is 40 people, growing, 12 engineers, 5% gross revenue churn annually, but 35% expansion puts them up in the 130 ish percent range in terms of net revenue retention. Totally comfortable economics wise with his 12 month payback period as they chase additional million-dollar data deals with folks like hedge funds. Jim, thanks for taking us to the top. Jim Fowler: Pleasure, Nathan.