-

Workfront combines business communications, project/task management and content management into one platform

-

Their unique selling point is the seamless integration of those three elements

-

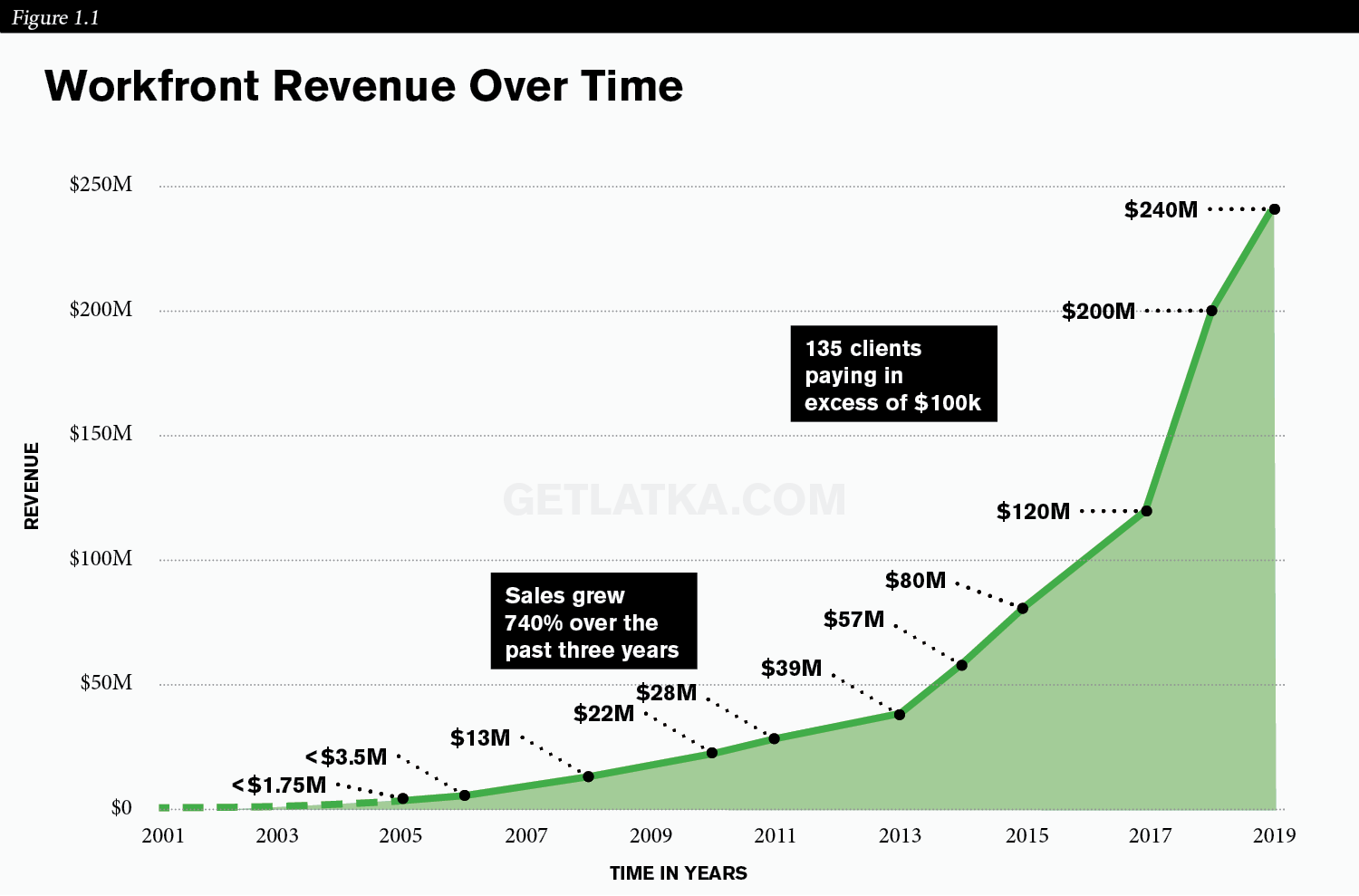

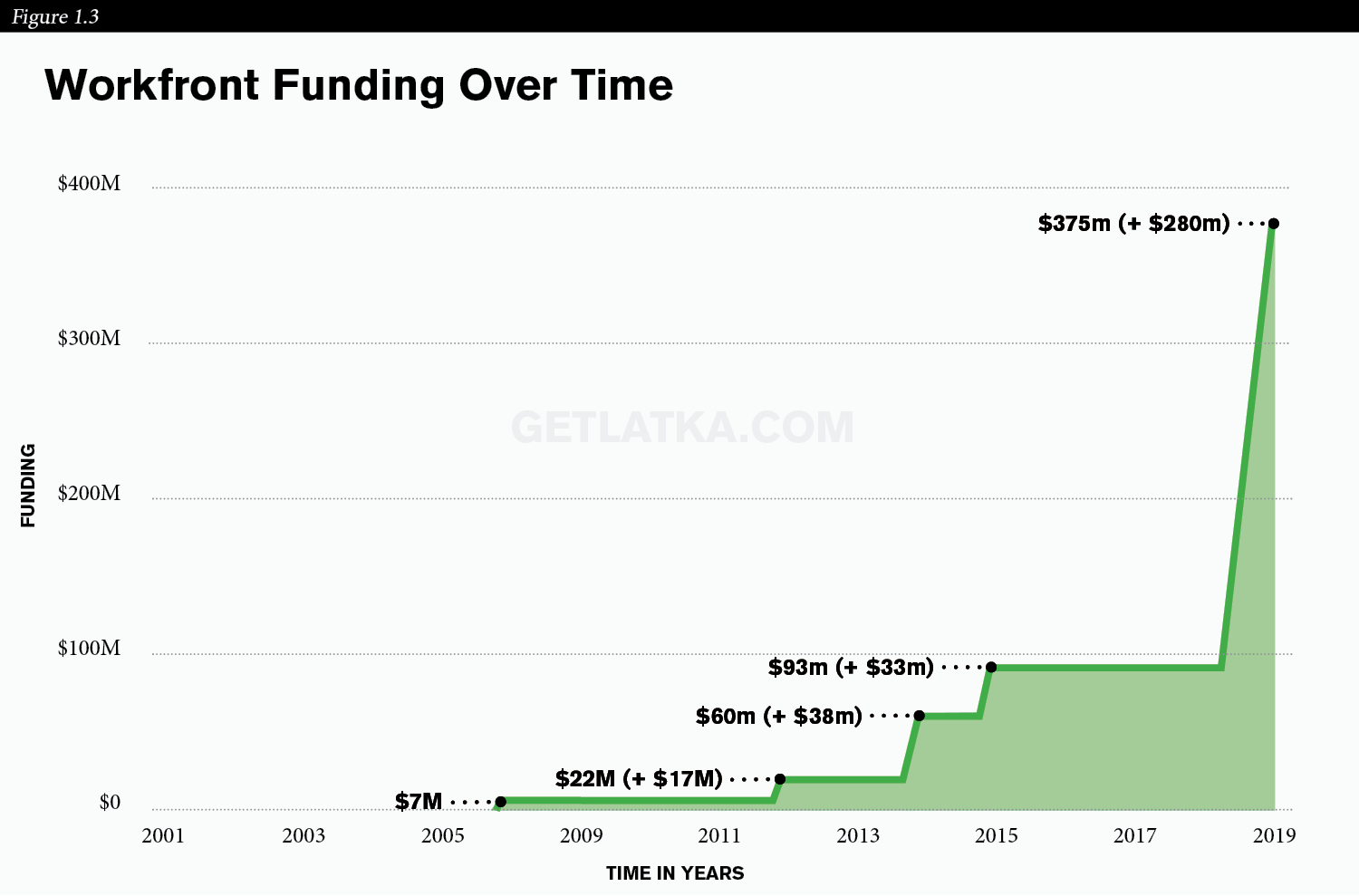

Workfront had only raised $100MM until 2019, when it agreed to a secondary investment of $280MM

-

Workfront’s annual revenue is $200MM

-

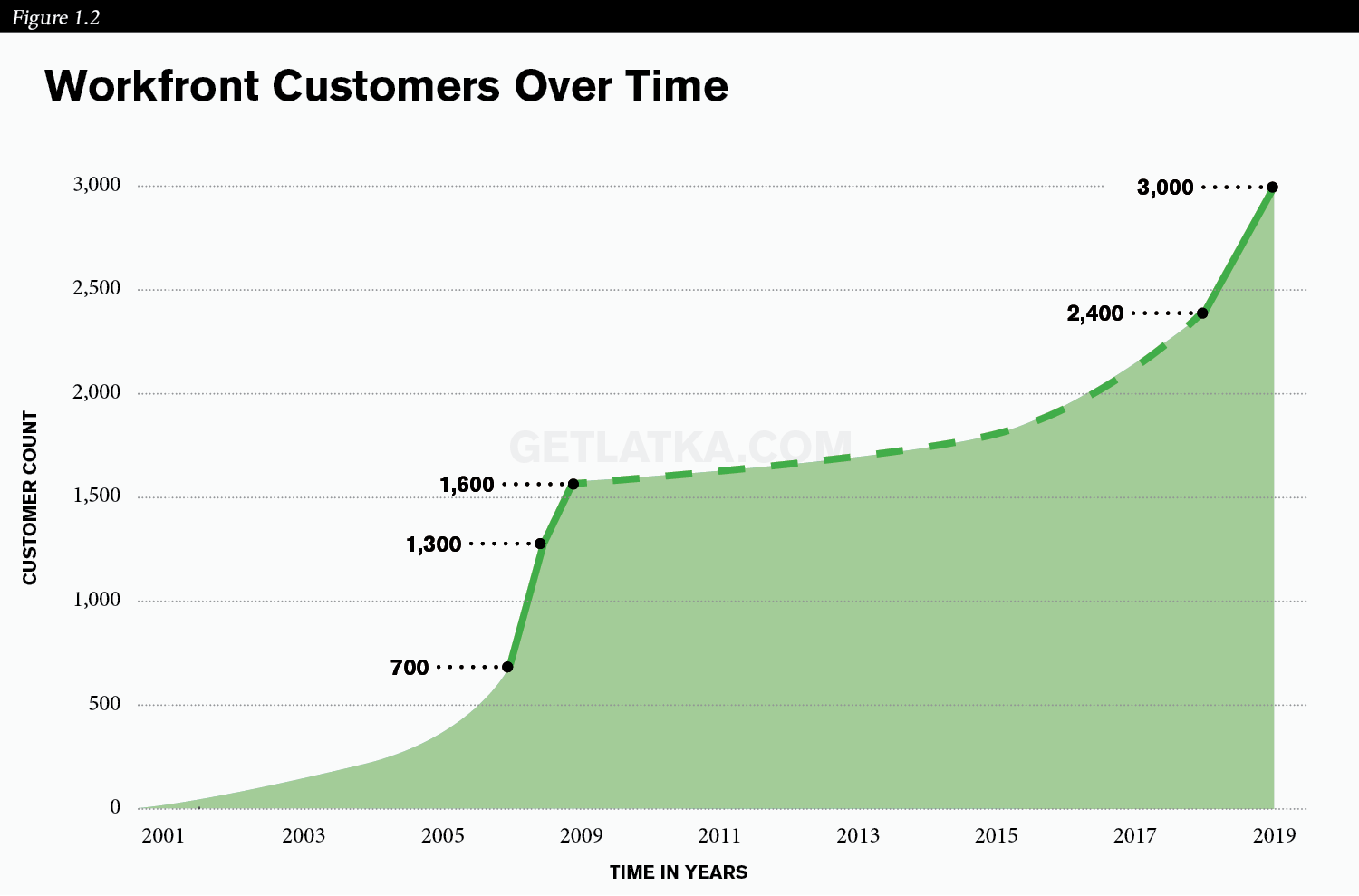

Workfront has 3,000 paying customers; among them 50 out of 100 Fortune 100 companies

Workfront was launched in 1999. Alex Shootman, who I’ve had the pleasure to interview last February, joined the company as CEO in 2016.

Up until recently, Workfront had only raised $100 million, with the last round of funding in 2015. “We’re very proud to be a company that’s raised less money than our annual revenue,” Shootman said.

In 2019, the company sold a minority stake for $280 million through a secondary process, with Blake Heston, managing director at W Capital, and Martin Angert, joining Workfront’s Board of Directors.

20 years into the game, Workfront is oriented at the long-term, sustainable growth, and not eager to IPO.

The Problem: Millennials Require a Different Kind of Workplace

Alex Shootman, the CEO of Workfront, does not shy away from comparing workplace digitization to the Netscape revolution or even the invention of an internal combustion engine. Millennials—or, Digital Natives, how he calls them—”just think differently,” he said in the 2017 LEAP conference.

How exactly do they think differently? Shootman outlines grand shifts in the younger, tech-savvy workplace.

“Digital Natives think egalitarian versus hierarchical,” the CEO explains. “They’re nomadic. [Millennials] do work wherever they’re gonna do the work. They are task-squishing and task-juggling—they’re not linear tasked. They work on just-in-time knowledge and just-in-time information. Finally, they are just super networked.”

The problem, Shootman claims, is that the digital tools are lagging behind the real needs of a highly mobile, knowledge-based work ecosystem. To evaluate how crucial is Workfront to the Digital Native, let’s break those claims down one by one.

Egalitarian vs. Hierarchical Workplaces

Last year, two Dutch professors conducted back-to-back studies to measure how employees react to strict hierarchies within organizations. In the first study, some groups would be given arbitrary job titles, such as ‘senior executive’ or ‘junior executive.’

The control groups would not be given these titles. They would also tell some teams they had to beat rival companies. In both cases, the researchers found that teams that faced no hierarchical or rivalry pressure cooperated and performed better.

In the second study, the professors surveyed 158 teams within an insurance firm. The teams were asked to rate how “egalitarian” they perceived their structure and the “level of conflict” with rivalry firms. Team managers were then asked to rate the performance of their teams. Both teams that were considered “hierarchical” or “in conflict” with their competitors were the ones underperforming.

Remote Workers Need the Right Tools to Make It Work

The other issue Workplace is tackling is the growing need for mobile access. The number of remote workers has grown by 140% since 2005 (Global Workplace Analytics), and this number is only expected to grow in the future. Right now, Millennials and Gen Z make up about 38% of all employees. By 2028, this number is going to be closer to 60% (Upwork). In fact, even today, 16% of companies hire exclusively full-time remote workers (Owl Labs). These tend to be smaller businesses.

Both employees and their employers seem to love the idea of spending more time away from their desk. Microsoft’s recent 4-day workweek experiment only fed to the hype. However, the tech to support a fully remote workforce seems to be lagging behind.

Besides the usual culprits—poor cell signal, frozen Skype screens—more subtle issues arise. “The only frustration I have around communication is when a coworker is unresponsive on those channels,” said Ciara Hautau, lead digital marketing strategist at Fueled, who works remotely full-time. “When I was in the office, I could simply visit that individual’s desk and see them in person. But it’s quite difficult to get those direct answers if they’re uncommunicative via digital channels.”

Indeed, the success of remote work technology is fully reliant on how comfortable the employees are using that technology. If they find it inconvenient, they’ll be unresponsive, which lowers productivity.

Workplace Digitization Is Highly Fragmented

In an information-overload economy, the ability to focus is tremendous value. The highly-fragmented digital space, however, does not provide a single solution.

An independent survey called The False Promise of The App Economy provides insight into the scope of the issue:

- The average employee today uses 9.39 apps

- 74% of the 900 respondents have at least 5 apps open at any one time, while 16% of them have more than 15 apps open simultaneously

- Almost half of those people (48%) use apps not distributed by their I.T. departments, such as WhatsApp or Dropbox

This digitization mess puts a serious bottleneck on productivity in a knowledge-based economy.

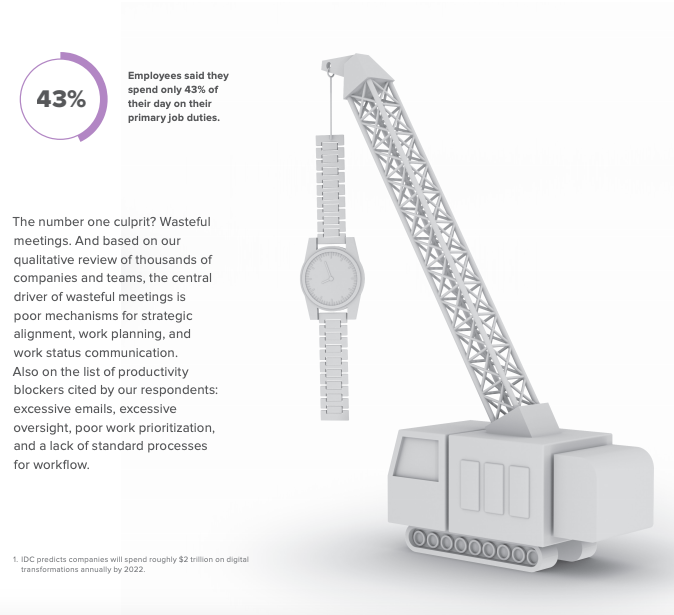

$3.4 Trillion in Lost Productivity

According to the data presented by Alex Shootman during the 2017 LEAP conference, there are 60 million knowledge workers in the U.S., which cost $92 thousand a year to employers. These costly employees, however only work 39% of the time. This loss of productivity, Alex claims, costs the global economy $3.4 trillion.

In The State of Work 2020, Workfront themselves have surveyed 500 knowledge workers. The report provides insight into information-age productivity:

- Employees said they spend only 43% of their day on their primary job duties

- 91% of workers surveyed say that they crave modern technology solutions

- 66% report their company has yet to have a “Chief Work Officer” in place

Whichever way you spin it, the workplace as we know it is quickly fading, and the only thing keeping it in place is the lack of proper technology to facilitate the shift. For SaaS companies, this spells huge opportunity.

The Solution: One Management Platform to Rule the Millennial Workplace

Workfront is a work management software that is designed to seamlessly connect all parties involved in a highly-remote, increasingly complex knowledge-based project.

Here’s how Workfront revolutionizes all stakeholder relations:

- Managers. The platform offers automated client query management, a clear view on available team resources customizable templates that make project automation a breeze. One of the features that stands out in particular is the Gant chart implementation, which allows managers to quickly estimate new project deadlines if any delays occur.

- Employees. They get prioritized task-lists that spell out which tasks need to be done first, and by when. All of the communication is stored inside the platform—so they don’t have to scroll 3 weeks back on their Messenger app for that link you’d sent them. Workfront eliminates the need for spreadsheet reports, as they can be generated automatically from a highly-structured interface. And, most importantly for remote workers, the cloud-based app works on mobile devices, which means your mobile talent can access all of this information anytime, anywhere.

- Shareholders and board members. Thanks to neatly structured, centralized project data, gathering digestible insights for decision makers is a 5-minute feat. Shareholders can log in and see exactly what’s going on with their projects. For general updates, Workfront can generate automatic progress reports. And, to soothe those CFOs, the platform offers features like planned vs. actual resource hours, budget spend, or contracted revenue.

Workfront Combines Three Elements of “Work DNA”

“The DNA of any kind of knowledge work that you do, it’s got three elements to it,” Shootman explains the purpose of Workfront. “It’s got the collaboration that’s occurring; it’s got the task itself that you’re trying to work on; and then it has the output of work done, which is increasingly digital content.”

Most competitors, Alex claims, tackle the management issue “from their point of view.” A collaboration system, for example, may offer a seamless communication platform. The other two components—task management and output access—will only be included as integrations.

In comparison, Workfront is a centralized work management system that combines all three areas.

“Workfront built the DNA of work into the product,” Shootman said. “You come in through the content—you see the task and the collaboration. You come in through the task—you see the collaboration and the content. And it’s that integration of those three things that you’d consider the DNA of work that allows us to be successful.”

The Business: $200m Revenue, 3,000 Paying Customers

The average customer, Shootman said, pays Workfront $40,000-$45,000 a year. As of the interview last February, the company had 2044 paying customers. Today, that number is closer to 3,000.

For companies with long-term contracts and lots of upsell/cross-sell opportunities, figuring out the customer’s lifetime value can be tricky. How does Workfront manage to estimate those numbers in a way that makes sense?

According to the CEO, estimating the lifetime value of a customer is not a priority right now. Instead, they try to analyze their success cases and get as many customers as possible to $100k annual revenue range:

“What we look at is companies who’ve had grown to over $100,000 in ARR,” Shootman explained. “And what has been the path that led them to $100,000? What are the things we’ve been able to solve for them? We’re focused on these larger customers that we tend to have success with.”

Workfront Goal: Maximize Number of $100,000 Clients

In most cases, a manager would implement Workfront for their department at first. Once the upper management notices the increase in productivity, they would foster implementation for other departments as well.

“You’re not gonna go at a customer,” Alex continues. “Unless you have people inside that customer looking at the department next to them, saying ‘hey, have you seen this software before? It’s super cool.’ That’s what we’re really focused on right now.”

However, can Alex say with confidence that a $50,000 ACV account will go up to $60,000 and $70,000?

“What we know is that if we sell to a customer that scores well in [certain predefined metrics],” the CEO answered. “[If they’re at] anywhere between $30,000-$40,000, within a couple of years they’re a customer that’s over $100,000 for us.”

What are those predefined metrics? To select A-tier clients, Workfront has developed a system of 22 attributes. They give certain weights to these attributes and derive a score for each client—an “Alexa score” for target clientele, if you will. Workfront will prioritize clients based on this score.

“We actually used a technology and we fed all the customers we ever sold into that technology,” Shootman explains the historical-data nature of their client selection process. “Coming out of that exercise, we said, here are the attributes that make a lot of sense.”

In essence, what Workfront did is a major analysis of their historical customer data. From that, they gathered 22 attributes that would predict best the average contract value, as well as 5 core reasons why their customers bought the software.

Joining Workfront as CEO in 2016

Alex Shootman was not a founding partner within Workfront. Instead, he was brought on as an external CEO. This is usually not the ideal scenario, but Alex seems to have made it work. How? Shootman praises the founder and the cultural fit.

“The thing with founder-run companies is that the DNA of the company never goes far away from the founder,” the CEO explains. “Scott’s (Scott Johnson – Workfront founder) a guy with super-high integrity, family values, customer focus, technology focus. And those things are still true about the company today. We just get along very well.”

On his last interview with the board members, Alex Shootman was asked to define what he believes in. His answer was, in the board members’ words, “what they wanted for this company”:

“I believe that you can do the right thing and win.”

So it was a deep cultural and integrity-based match between the new CEO and the board members that paved the way for a successful transition.

A Sustainable Growth Process

In 2018, Workfront employed 849 people. 300 are based in Utah, and the rest of them are scattered across locations in the US, UK, Poland and Armenia.

To expand their business, Workfront has a dedicated enterprise sales team. “We know the five problems that we solve really well,” Shootman continues. “And so we ask our account acquisitions team, ‘go find one of these problems.’ And then, we surround the customer with an account manager and a customer success team.”

On average, it takes Workfront “under 18 months” to recover their customer acquisition costs. The CEO did not give an exact customer acquisition cost figure.

What starts off as a routine account acquisition and onboarding process often branches out into unique use cases. In one such case, Alex told me, he sat down with one of their customers to ask them how they were utilizing the platform.

“He goes, Alex, you’re not gonna believe this,” the CEO recalls. “Sometimes, we run a local promotion and we’ll get the price wrong on the shelf. It used to be a really big work process for our associates to go fix that price. Today, they walk by the shelf with their smartphone, they take a picture, and that kicks off an entire work process where somebody else goes and checks on the price point.”

It makes sense—when you big a platform as ambitious as Workfront—people are either going to use it in the most unexpected ways, or not at all.

Workfront Not Eager to IPO

Is Workfront thinking about an IPO? The CEO gives a mature, long-term perspective answer.

“The way I think about going public is really just exchanging one set of owners for another set of owners,” Shootman said. “The next day you gotta wake up and acquire customers and serve them. In my mind, much of the decision whether we raise private equity is really getting into the conversation with current owners. ‘How long would you like to be owners?’”

“Our thing is,” Alex added. “As I’ve told the company—going public is fantastic. It’s great—you get the T-shirt, you get the cupcake. But the next day, you still gotta be a great company. And then, once you build a great company, when you go public—you just never disappoint. ‘Cause the worst thing is to go public and disappoint.”

Workfront CEO: Alex Shootman, Previously President of Apptio, Eloqua

Alex Shootman joined Workfront as a CEO in 2016.

Shootman has over 25 years of experience in growing businesses:

- He managed integrated sales and services functions globally for Apptio

- Alex led global sales, customer success, and field operations teams for Eloqua, which paved the way to a successful IPO and, later, acquisition by Oracle of approximately $871 million

- Shootman filled executive-level positions with Vignette, TeleTech, BMC Software and IBM

6 Questions with Workfront CEO Alex Shootman:

- Shootman’s two favorite books are: How Did That Happen by Roger Connors and Speed of Trust by Stephen Covey Jr.

- Is there a CEO Alex is currently studying? “There’s one that I like a lot—and it’s a weird one for you, but it’s Father Greg Boyle.”

- Alex’s favorite online tool for business: Slack

- How many hours of sleep does Alex get every night? “Five.”

- Married? Single? Kids? “I’ve been married to a woman I’ve been with for 32 years and we’ve never had a fight. We’ve got four kids: 21, 16, 13 and 11. I am 52.”

- What does Alex wish to a 20 year-old self? “Be versus do. I think we get so focused on ‘what am I getting done? What did I do? What did I accomplish?’ At the end of the day, I think what’s more important is ‘Who am I, and who am I becoming?’”

—

Workfront

Revenue

2001:

2002:

2003:

2004:

2005: <$1.75m (4, “more than doubled in 2006”)

2006: <$3.5m (3)

2007:

2008: $12.95m (10, “sales grew 740.4% over the past three years”)

2009:

2010: $21.6m (9)

2011: $28.2m (16, “31% year over year)

2012:

2013: $38.6 (15, “38 clients each paying more than $100,000 in annual recurring revenue”, “sales from existing customers grow 62 per cent year over year”)

2014: $57.5 (17) (“expansion plus renewal achieving over 110 percent”)

2015: $80.5 (18) (“135 clients paying in excess of $100,000 in annual recurring revenue”)

2016:

2017: $120m

2018: $200m (1)

2019: $240m (estimated) (2)

2020:

Customers

2001:

2002:

2003:

2004:

2005:

2006:

2007: >700 (5)

2008: 1,268 (7, “+568 customers including Boeing, Cisco, EA”)

2009: 1,600 (8)

2010:

2011:

2012:

2013:

2014:

2015:

2016:

2017:

2018: 2,044

2019: 3,000 (1)

2020:

Funding:

2001:

2002:

2003:

2004:

2005:

2006:

2007: $7m (2)

2008:

2009:

2010:

2011:

2012: $22m (+ $17m)

2013:

2014: $60m (+ $38m)

2015: $93m (+ $33m)

2016:

2017:

2018:

2019: $375m (+ $280m, secondary investment)

2020:

Notes:

2001: In July 2001, AtTask released @task, a project management tool designed for businesses

2002:

2003: Johnson, AtTask founder, decided to completely rewrite the company’s project management platform

2004:

2005:

2006:

2007: AtTask received $7 million in funding from OpenView Venture Partners.

2008: AtTask expansion to UK and China (6)

2009:

2010:

2011: Eric Morgan replaced founder Scott Johnson as president and CEO of AtTask.

2012: AtTask raised $17 million in venture capital in a funding round led by Greenspring Associates

2013:

2014: The company raised an additional $38 million

2015: AtTask was renamed to Workfront

2016: Alex Shootman joins as CEO

2017:

2018:

2019: Workfront secures $280 secondary investment

2020:

Sources:

- https://www.workfront.com/news/Workfront-280-Million-Strategic-Investment

- https://www.crunchbase.com/organization/workfront#section-interest-signals-by-bombora

3. Paul Beebe (2007-06-12). “Orem’s AtTask gets $7M infusion”. The Salt Lake Tribune.

4. https://www.workfront.com/news/attask-continues-aggressive-growth

5. https://www.workfront.com/news/attask-among-100-fastest-growing-companies-in-utah

6. https://www.workfront.com/news/attask-inc-announces-overseas-expansion-with-new-offices-in-the-uk-and-china-answering-the-hot

7. https://www.workfront.com/news/attask-announces-record-setting-second-quarter-with-uk-expansion-and-new-marquee-customers

8. https://www.workfront.com/news/attask-announces-record-q4-2008-revenues-with-141-year-over-year-increase

9. https://www.inc.com/profile/attask

10. https://www.workfront.com/news/attask-named-an-inc-500-company

11. https://www.workfront.com/news/attask-exceeds-projections-with-140-year-over-year-increase-in-bookings

12. https://www.workfront.com/news/attask-reports-record-earnings-for-q4-2009-by-enabling-project-visibility-accountability-and

13. https://www.workfront.com/news/attask-shows-continued-growth-adds-150-new-customers

14. https://www.workfront.com/news/attask-posts-record-year-widespread-recognition-in-2010

15. https://www.forbes.com/companies/attask/#1a8998c61f3a

16. https://www.workfront.com/news/attask-appoints-veteran-ceo-eric-morgan-to-accelerate-growth

17. https://www.workfront.com/news/workfront-experiences-49-cloud-subscription-year-over-year-growth-in-2014

18. https://www.workfront.com/news/workfront-ranked-in-utah-fast-50-for-8th-year-in-a-row