Austin Mac Nab, CEO and founder of VizyPay, shared profound reflections on the company’s impressive trajectory and strategic endeavors in the niche market of rural payment processing across the United States. VizyPay, through its innovative approaches and dedication to community-centric services, is redefining the payment technology landscape for small businesses in underserved areas.

- Launched in 2017

- $22 million ARR

- Funding: financed expansion through $1.5 billion in debt financing to avoid diluting equity

- Over 13,000 signed customers

- 95 full-time employees

A Comprehensive Overview of VizyPay’s Journey

Foundational Objectives and Growth

Launched in 2017 by Austin Mac Nab, VizyPay quickly established itself as a significant player in the payment technology sphere. The company primarily caters to rural small businesses, a sector often overlooked by larger corporations. By employing advanced Clover hardware, VizyPay has managed to support over 13,000 clients, with numerous point-of-sale (POS) systems facilitating an impressive annual transaction volume of approximately $1.85 billion across 35 million transactions.

Innovative Business Model

VizyPay’s unique business model integrates traditional W2 employees with 1099 contractors who retain 50% of the residual revenues from their sales. This hybrid structure not only incentivizes the workforce but also embeds them deeply within their communities, fostering robust local economies and sustained business engagement. “Our strategy is designed to empower local entrepreneurs, which in turn drives our own growth,” Mac Nab explained.

Analyzing VizyPay’s Financial Strategy and Economic Growth

Revenue Trends

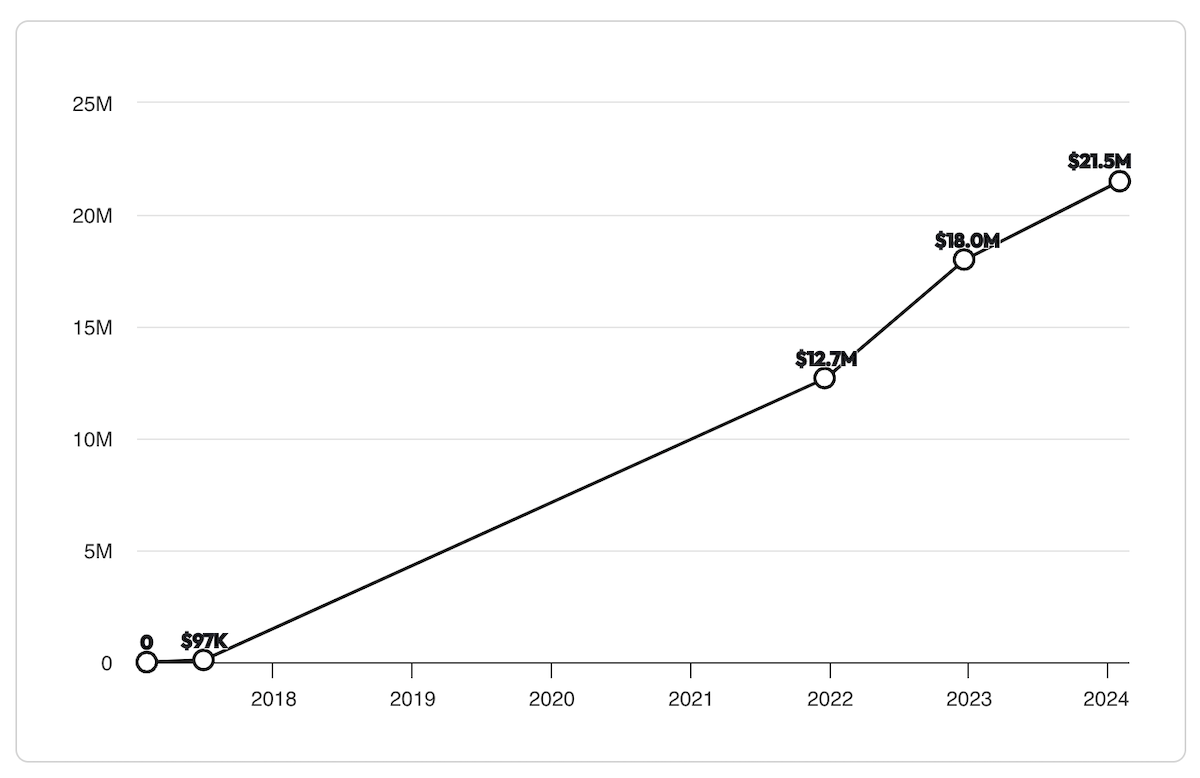

Despite its recent inception, VizyPay has shown remarkable revenue growth, generating approximately $22 million last year with a forecast to reach $25 million shortly. This increase is partly due to strategic reinvestments in essential technology and hardware, particularly in expanding their Clover device installations to enhance operational efficiency and transaction security.

Strategic Financial Management

Unique to VizyPay’s growth strategy is its approach to financing. Rather than diluting equity through external investors, the company has smartly navigated its expansion by securing $1.5 billion in debt financing from local banks, thus preserving its equity structure. This not only highlights VizyPay’s solid financial foundation but also illustrates Mac Nab’s astute financial acumen.

Addressing Challenges and Making Strategic Adjustments

Balancing Expansion with Efficiency

One of the core challenges faced by VizyPay was managing its rapid team expansion without diluting service quality. The initial strategy of aggressive hiring was soon recalibrated towards enhancing productivity within the existing workforce, which proved more sustainable and economically beneficial in the long run.

Technological Investments and Infrastructure

The commitment to technological enhancement is evident from Mac Nab’s decision to use his office as a storage space for the $1 million worth of Clover POS systems recently acquired. This investment significantly bolsters VizyPay’s capability to deliver superior service and reliability to its customers.

Future Prospects and Continued Innovations

Forward-Looking Initiatives

VizyPay is not resting on its laurels. The company is actively developing new applications for the Clover platform that promise to revolutionize rural payment processes by introducing more user-friendly features and versatile functionalities. These innovations aim to improve the overall customer experience and enhance operational efficiencies for rural businesses.

Expansion and Market Penetration

With ambitious plans to increase its transaction volume to $2.25 billion and significantly enlarge its customer base, VizyPay is poised for further growth. Mac Nab’s optimism about the company’s self-funded expansion strategy underscores his confidence in its ongoing financial health and strategic direction.

Famous Five

Favorite online tool: Linkedin

Favorite book: Can’t Hurt Me

Favorite CEO: N/A

Advice for 20 year old self: Have more empathy

Balance: 39 years old with 3 kids