Average Revenue Per User (ARPU) is one of the most misunderstood SaaS metrics.

Actually, some people even regard ARPU as a vanity metric – a metric that looks good on paper yet provides little value for your business.

However, this couldn’t be further from the truth.

In fact, if calculated correctly, ARPU can be one of the most valuable SaaS metrics for determining your business’ health and growth potential.

So, in this article, we will cover everything you need to know about calculating your company’s ARPU and extracting the most value from this metric, including:

- What is the Average Revenue Per User (ARPU)?

- Why is ARPU An Important SaaS Metric?

- ARPU Formula – How to Calculate ARPU?

- What to Include in ARPU

- How to Increase Your ARPU

- Examples of Bootstrapped SaaS Companies With Very High ARPU Compared to CAC

- Examples of SaaS Companies With Short Payback Periods

What is the Average Revenue Per User (ARPU)?

Average Revenue Per User (ARPU) measures the revenue your company receives per one user (or unit) over a specific period, which is typically one month.

In general, ARPU is one of the most important and useful SaaS metrics as it can help you to effectively analyze and model your business’ growth.

What is a Good ARPU?

If you have 10 customers with an ARPU of $100, that’s not so good. It comes down to $1000 in monthly revenue.

If, on the other hand, you have 50,000 customers with an ARPU of $100, that’s pretty good as it amounts to $5m in monthly revenue.

As you can tell, ARPU is relative. Here’s how to think about it:

If your goal is to build a profitable company, you need a customer to pay you a monthly amount that quickly makes up for any amount of money you spent to acquire the customer. We call this payback period.

By looking at the payback period, you can figure out if your current ARPU will allow you to make money or not as a business.

For example, if you spend $300 to get a customer that pays you $10/mo on average (their ARPU), your payback period will be 30 months, which is way too long. In fact, the more customers you get, the more money you lose in the short term.

Signing up 1,000 customers next month and spending $300 on each, means you spent $300,000 to get $10,000 in new monthly revenue. Unless you have a rich uncle, you’ll go out of business before you make your money back.

Why is ARPU An Important SaaS Metric?

As we already mentioned, measuring your company’s ARPU can give you valuable insight into your business’ growth and success.

Specifically, calculating your company’s ARPU is useful for:

#1. Determining Your Business’ Financial Health

ARPU can help you determine where your business stands financially and whether you should adjust your product pricing to increase your financial growth.

For example, a low ARPU (e.g. below $100) means that you need tons of customers to sustain your business’ growth. Often, this indicates that you’re selling your products too cheap and your market size is too small.

On the other hand, having a high ARPU in a big market shows that your business is profitable and thriving.

#2. Measuring Your Company’s Efficiency

Calculating your ARPU can also help you to measure your company’s efficiency, sales and marketing effectiveness, and overall business growth.

Generally, your company’s ARPU should be constantly increasing. That’s because a constantly growing ARPU indicates that your business is doing better each month and that your marketing and sales efforts are paying off.

If, however, your ARPU stays the same or decreases, you should reconsider your business, marketing, and sales strategies to promote business growth and efficiency.

#3. Aligning Your Product Price

Calculating your ARPU can give you great pointers on adjusting your product price to match the value you provide to your customers (or different customer groups, e.g. enterprise customers).

Basically, a low ARPU may signify that your product pricing is too low for the value your customers are getting in time, cost reduction, etc., so you might want to reconsider your pricing strategy.

Because of this, ARPU is a valuable metric to your product and sales teams that can help them to see whether your product price is adequate or should be adjusted to avoid underselling.

ARPU Formula – How to Calculate ARPU?

Calculating your company’s monthly ARPU is easy – however, you do need to calculate your total Monthly Recurring Revenue (MRR) first.

To find your total MRR, just take all of your active and paying customers’ MRRs and add them together.

Once you have that figured out, you can proceed to calculate your company’s ARPU with this simple formula:

Average Revenue Per User (ARPU) = total MRR / total number of paying customers per month.

So, for example, if your company’s total MRR is $100,000 and you have 100 customers, your ARPU will be $1,000.

Now, typically ARPU is calculated monthly, but it’s also possible to calculate your company’s ARPU annually – all you have to do is multiply your monthly ARPU by 12 months.

And, if you want to calculate your ARPU for a different time period, you can do so by using this formula:

ARPU = total revenue per period / total number of paying customers per period

What to Include in ARPU

To calculate your company’s ARPU, you have to divide all of the revenue you receive from active users by the total number of customers that you received the revenue from.

So, here’s exactly what you should calculate in your ARPU:

- Monthly recurring revenue (MRR). This refers to the total recurring revenue amount your business generated in a month.

- Account upgrades and downgrades. To accurately measure your ARPU, you should calculate the total amount of dollars gained from customers who upgraded their accounts as well as the total amount of dollars lost from those who downgraded.

- Lost MRR from customer churn. Along with account downgrades, you should also calculate the monthly recurring revenue you’ve lost from customers who churned.

- The total number of paying customers. You should only include the customers who generate revenue in your ARPU calculation.

What You Should NOT Include in ARPU

Calculating your company’s ARPU is only useful if your calculations are accurate.

As such, one thing to keep in mind is that you should only calculate your current active customer base and the money they’ve generated for your business during the month.

For this reason, you should not include the following items in your ARPU calculation:

- Free users

- Inactive users

- Free subscription plans

- Free items

This way, you can make sure that your ARPU calculation gives you a clear and accurate picture of the financial situation and growth of your business.

If you include any of the items listed above, however, your ARPU calculations will show a lower average revenue amount that doesn’t reflect your actual business situation and can be misleading.

How to Increase Your ARPU

It goes without saying that, to increase your ARPU, you first have to start tracking it – otherwise, you won’t have a clue whether your ARPU (and business) is consistently growing or not.

However, once you figure that out, you might want to start implementing business strategies to increase your company’s ARPU.

So, here are 5 tips that can help you increase your company’s ARPU and maximize your revenue growth:

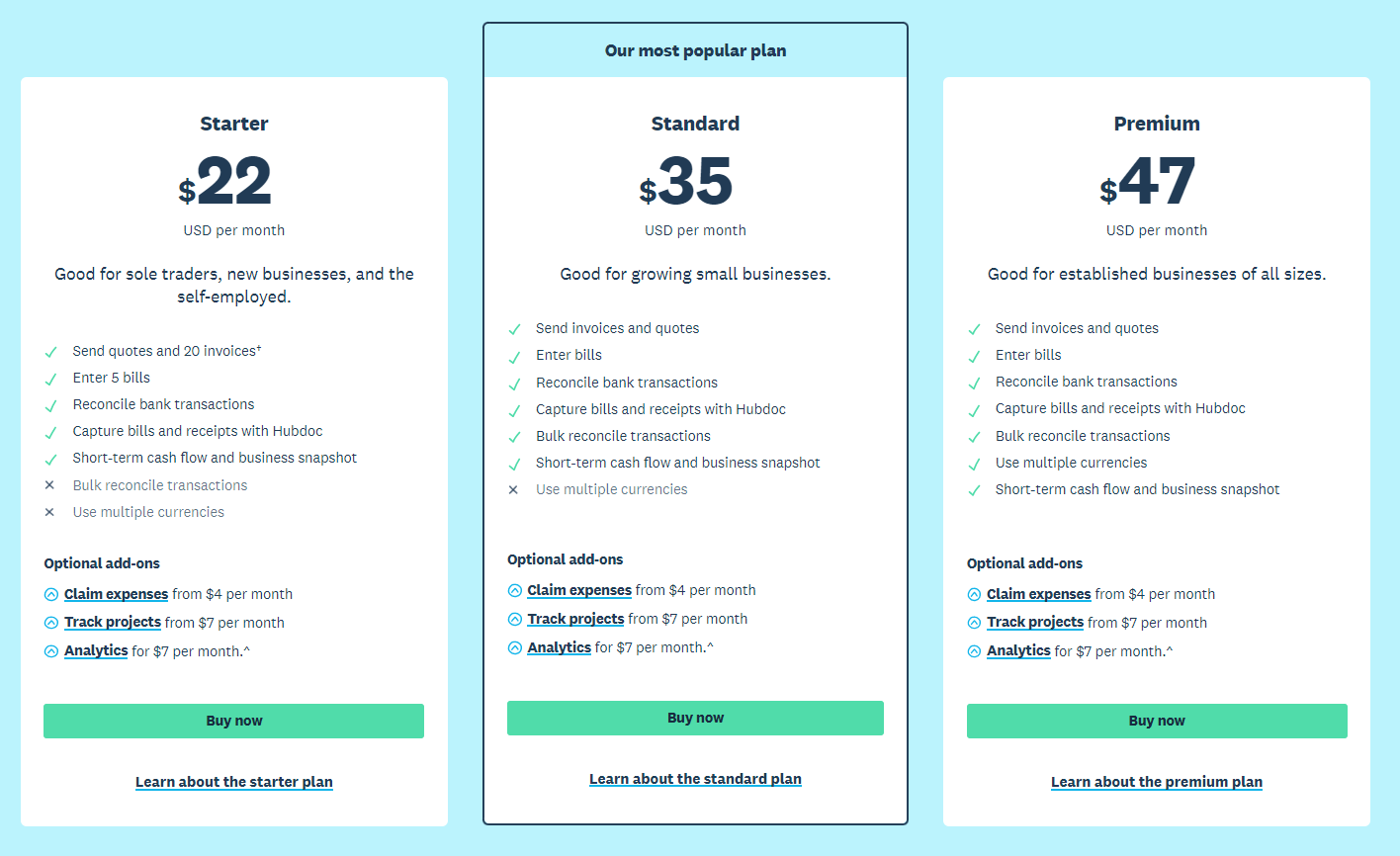

#1. Offer Multiple Subscription Plans

No matter what type of product you offer, it’s safe to say that your customers have different needs and budgets.

Thus, offering multiple subscription plans with different features and price points is a great way to increase your ARPU and drive your company’s revenue up.

That way, you can avoid losing potential customers with lower budgets or selling your products at a bargain price.

Even more, offering different pricing tiers allows you to add tags such as ‘Most popular’ and ‘Recommended’ that can entice customers on a budget to pick a more expensive (and better) subscription plan and ultimately help you to maximize your earnings.

Here’s how Xero does it:

#2. Offer Add-ons

Offering add-ons is another effective way of increasing your ARPU – essentially, the more additional paid features you offer to your customers, the more likely they are to buy them.

Besides, add-ons can lead to a win-win situation for both your company and your customers – after all, you won’t just be driving more revenue from your customers, but you will also be providing your customers with more options, features, and flexibility.

#3. Reconsider Your Free Subscription Plans

As we mentioned above, free subscription plans aren’t calculated in your company’s ARPU.

So, naturally, if you want to increase your ARPU, you might want to reconsider your free subscription plans.

Of course, you don’t necessarily have to eliminate them altogether – but you might want to check whether you are giving away too much value at zero cost.

Ultimately, the best way to go about this is by changing up the features you offer with your free plans.

Basically, if you’re planning to take something away, make sure to add something else to the free plan to balance it out – just don’t forget to inform your customers about the changes in advance.

#4. Target High-Paying Customers

As we mentioned above, ARPU is calculated by dividing your total recurring revenue by the total customer number.

This means that having tons of low-budget customers decreases your ARPU, so it’s only natural that one of the best ways to increase your ARPU is by targeting customers with larger budgets.

This way, you can focus your marketing and sales efforts on the right customers who can bring you more revenue, thus helping you to increase your company’s ARPU.

#5. Retain The Most Valuable Customers

There is no doubt that all of your customers are valuable – however, some are more valuable than others.

So, to maximize your earnings, make sure to focus more of your attention on the customers that bring you the most revenue to make sure they keep using your product.

You can, for example, provide high-paying customers with fast, top-quality customer support by adding VIP customer support as a feature in your most expensive subscription plans to attract and retain more customers.

Generally speaking, prioritizing high-paying customers over free users allows you to make better use of your resources, which can pay off in the long run and increase your ARPU.

Examples of Bootstrapped SaaS Companies With Very High ARPU Compared to CAC

For any company to grow its monthly recurring revenue (MRR), it has to be able to spend money to get new customers profitably. If you haven’t raised money and your preference is to stay bootstrapped, you can’t afford to spend more than 10x what a new customer pays you per month. You need to make that money back, fast.

Here are some examples of bootstrapped SaaS companies that have a higher ARPU relative to their CAC which enables them to grow a profitable customer base.

- JustCall did $2.4m in revenues in 2019 and spends $200 to get customers with a $150 ARPU. This means JustCall gets their money back in under 2 months.

- Refersion spends $25 in SaaS marketing to get customers that pay $83/mo on average, meaning that their payback period is under 1 month.

- Shipedge spends $500 to get customers who pay $750/mo, meaning that their payback period is in the first 30 days. The company is completely bootstrapped and broke $2m in revenue in 2019.

Examples of SaaS Companies With Short Payback Periods

- Moz is an SEO tool that spends $290 to acquire customers that pay $150/mo. They get their money back in under 2 months and broke revenues of $60m in 2019.

- GetOutlaw spends $2,000 to acquire get customers with an ARPU of $1,000. They get their money back in 2 months and broke $720,000 in revenues in 2019.

Examples of Funded SaaS Companies With Very Long Payback Periods

When a company raises funding, it can afford to invest in future growth. Many times this means they’ll pay more now to get a customer who will have a very long customer lifetime value (LTV). The time frame they have at their disposal to make money from customers can be much longer than bootstrapped CEOs.

Here are a few examples:

- Animoto pays $500 to get a customer who pays an average of $240 in the first year (ACV). They can afford to wait 2 years to get paid back because they’ve raised $30m.

- 247Office has raised $5m and spends $800 to get a customer who pays $400 per year. Today they have 40,000 customers and $16m in revenues.

- Centrify has raised $90m and spends $100,000 to get customers who pay $20,000 per year. They are playing a long game by spending a lot to get the customer and not making money until 5+ years out.

ARPU FAQ

#1. What’s the ARPU Formula?

Here’s the formula for calculating ARPU:

ARPU = total MRR / total number of paying customers per month.

Using this formula, you can calculate your monthly ARPU.

If you want to calculate ARPU for a different time period, simply adjust the formula for the specific time period.

#2. Is ARPU a Monthly Metric?

By definition, ARPU isn’t a monthly metric, however, it can be calculated for any specific time period (e.g. week, month, quarter, year, etc.).

Having said that, most commonly companies calculate their ARPU on a monthly basis.

#3. What’s the Difference Between ARPU and LTV?

Both ARPU and LTV measure the revenue generated from a customer, so it can be difficult to see the difference between them.

Let’s take a look at their definitions first:

- Lifetime Value (LTV) estimates the total revenue a customer will generate for your company over their entire relationship with your company.

- Average Revenue Per User (ARPU), calculates how much revenue, on average, your company makes per customer.

So, the key difference between ARPU and LTV is that LTV measures the overall profitability of one customer, while ARPU measures the average revenue your company generates from one customer.

For this reason, ARPU is useful for determining your business’ health as well as helping you make strategic business, pricing, and marketing decisions.

LTV, on the other hand, can help you determine which customers and customer groups are the most valuable to your company.

Used together, however, both of these metrics can give you great insight into how each customer will affect your company’s revenue over time.

#4. Does ARPU Include Churn?

To calculate your ARPU correctly, you need to know the exact amount of total revenue generated over a specific period.

Because of this, customer churn should be included in your ARPU calculation to ensure accuracy.

#5. What are Other Important SaaS Metrics?

Here are some of the most important SaaS metrics that you might want to consider tracking alongside your company’s ARPU:

- Annual Recurring Revenue (ARR). This metric calculates how much recurring revenue your company can expect to generate in a year.

- Total Contract Value (TCV). Calculating TCV allows you to see how much revenue a customer brings to your company in total.

- Revenue Run Rate. This SaaS metric helps you predict the amount of revenue you’re going to generate based on your previous earnings.

Key Takeaways

And that’s about all you need to know about calculating your company’s ARPU.

Before you go, though, let’s quickly go over some of the main points mentioned in this article:

- Average Revenue Per User (ARPU) refers to the total revenue your company generates per one user on average over a specific time period, which is typically one month.

- To calculate your company’s ARPU, you need to divide your total revenue by the total number of paying customers.

- The key to calculating your ARPU is to include your total revenue, such as MRR, customer churn, account downgrades, and upgrades in your calculation.

- However, to get accurate results, you should not include free customers and any free items you offer in the calculation.

- Calculating your company’s ARPU can help you to measure your business’s efficiency, determine your business’ health, and align your product price to match its value.

- You can increase your ARPU by offering multiple subscription tiers, add-ons, reconsidering your free subscription plans, as well as targeting and retaining high-paying customers.

![What is ARPU? Definition, Formula, and Optimization [in 2022]](https://blog.getlatka.com/wp-content/uploads/2020/04/apru_b2b_saas_nathan_latka-1140x641.png)