Longtime tech CEO Joe Payne saw the writing on the wall at Code42. While the company had been around for nearly 15 years when he joined in 2015, their core product, bringing in over $50m in ARR, was in decline. So, he and his team decided to build another company inside the company— one with upside growth opportunity. When that new product hit $50m ARR last year, Payne decided to let go of the legacy product to focus on the new growth opportunity. Payne recently visited with the GetLatka team to share how he discovered what to build, why mid-market deals are outperforming enterprises today, and what one piece of advice he’d give entrepreneurs who want to disrupt a space.

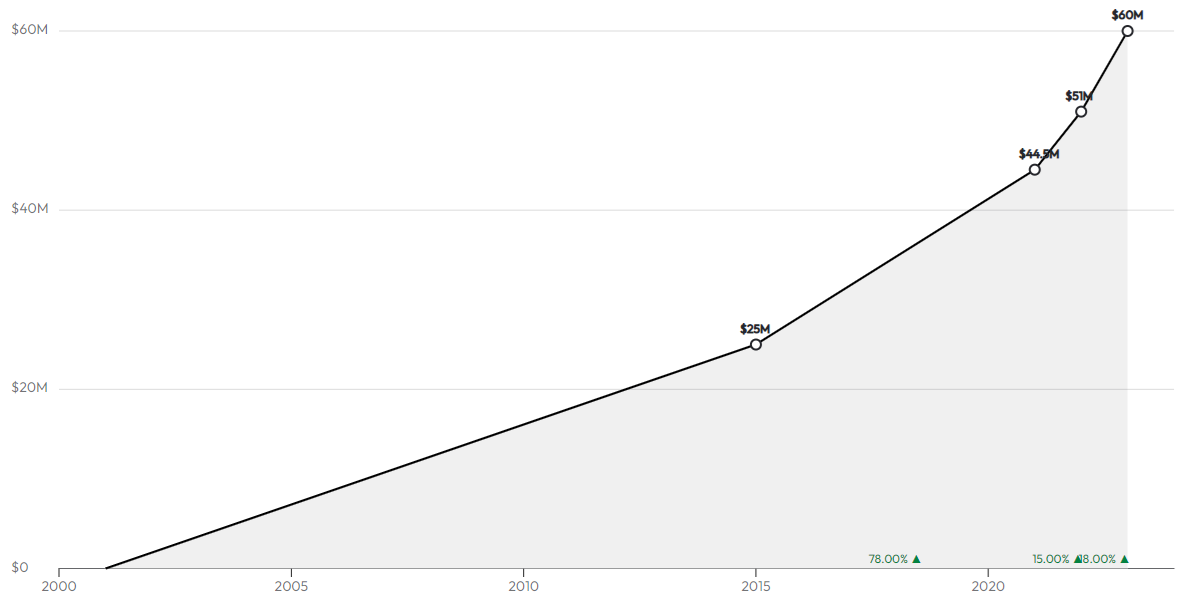

When Joe Payne, former CEO at Eloqua, iDefense, and eSecurity, joined Code42 in 2015, Crashplan was its core product offering. This endpoint cloud backup software was doing a respectable $50m ARR, which grew to $70m when Payne sold it to Mill Point Capital for $250m in 2022. Meanwhile, Code42 launched Incydr in 2017, growing it to $50mm ARR in just 4 years.

- Sold $70m ARR CrashPlan to PE for $250m in 2022

- $50m ARR from Incydr

- 800+ customers

- Team of 220 with 30 quota-carrying sales reps

- $120,000 ACV

Value creation focus leads to a $50m ARR product in a new category

“We knew in 2015 that CrashPlan would go away long term. That’s why the Board hired me: to decide what to do with it,” explained Payne. What happened next changed Code42’s future, “We spent a bunch of time on research to create value. That’s when we discovered that the DLP market (data loss prevention) was ripe for disruption. Everyone we talked to hated their DLP. They were spending money but not using the products they bought because it wasn’t solving their problem.” So, in 2017, Payne’s team began developing what would become Incydr, a leading data security product focused on reducing the risk of data leakage from insider threats, which brought in $50m in ARR in 2022.

Fixing a problem with nearly 100% of employees

According to Payne, “Many security products are focused on external threats. It’s easy to focus on what’s outside. However, when you look at data loss, most comes internally from employees and contractors.” He added that their own studies reveal that 60% of employees admit they took data from their last job to help with their current job, and in reality, nearly 100% of people take data with them when they leave a job. Incydr gives visibility to security people, like who’s moving stuff on Dropbox, putting data on a thumb drive, or even emailing themselves source codes or customer lists.

Incubated Incyder to $50m while CrashPlan grew to $70m

Over the next 4 years, Payne and his team incubated and grew Incyder to $50m ARR, which he saw as the magic number that would allow Code42 to spin off CrashPlan and its $70m ARR. “Once we sold CrashPlan to a private equity firm for $250m, we could completely focus on insider threats and DLP,” the CEO explained. He added that they now focus on an entirely different buyer (security), solving an entirely different problem. “That’s what I want to tell entrepreneurs: if you want to disrupt a market and win in that market, you better be very focused on it. You can’t have many different products doing many different things,” shared the CEO, adding, “You can do that when you become bigger, like CrowdStrike or GE.” Payne added the $250m to the balance sheet, as Code42 revenue adjusted from $120m to $50m ARR.

800 customers with 200 to 120,000 employees

When asked about ACV, Payne indicated that it varies wildly by customer employee count and feature choices. “A good rule of thumb is $80-120 per employee, depending on sophistication and features, such as connecting to Salesforce.com or OneDrive,” the CEO noted. He added that Code42 has over 800 customers and several multi-million-dollar customers. Organizations consider it money well-spent since the average breach costs an organization $16m. He added that, of the 800 customers using Incydr, he’s most proud of the 30+ big-name security companies that rely on it, like CrowdStrike, Okta, Ping, Splunk, and Cisco. “If the smartest people in security are using us to solve this problem, I think that’s a great validation for us,” observed the savvy CEO.

$120,000 ACV with substantial variances

Payne finally identified their ACV at $120,000 but bristled at Latka’s implication that mid-markets are their “sweet spot”. “The great thing about SaaS is that they’re democratized for everyone. From small to large organizations, everyone gets the same software and power,” proclaimed the CEO. He added, “The people buying fastest are mid-market 1000-5000 companies: they are making fast decisions in today’s markets economy, whereas big companies are taking forever to make decisions on new technology purchases.”

20% growth target with outbound and inbound

When Latka asked about their growth target, Payne indicated he was looking to hit 20% YoY growth and is still moving toward $60m ARR for the end of 2023. “You’re crazy if you don’t do inbound, but we also do outbound with tools like 6Sense to see intent data,” explained the CEO. “At Eloqua, I helped pioneer the separation of new business and customer success teams. We called them the hunters in the forest looking at new accounts vs. the hunters in the zoo growing installed base accounts,” revealed Payne. He added that Code24 currently manages a team of 220 with 30 quota-carrying sales reps.

Adjusting quotas based on macroeconomic conditions

When asked about adjusting quotas today, Payne indicated that they would relook at quotas and territories in 2024: “Over the last 10 years, security budgets were growing 30-35%, but this year they only grew 5%.” He added that he feels good about their current plan.

Aspiring for the Rule of 40

According to Payne, “Growth is out of style right now, but to me, long-term growth always trumps; grow at a high rate, and good things happen.” When asked about the Rule of 40, he added, “I still believe that growth trumps profitability, especially early in a market when there’s big grab. You want to be the market leader when it grows to be a couple of $100M+ players there. But yes, we all want to aspire to 40% growth plus EBITDA.”

Talk to everyone in your space

After mentioning Vista Capital, Latka queried Payne about being in talks. “No. I meet with people all the time,” adding, “You should always be talking to everyone in your market space, particularly strategics. Entrepreneurs worry that if you talk to big companies, they’re going to steal your ideas. My experience is that those big companies don’t have the capability to listen to us, steal our ideas, and execute them better than we do. So, get in there. Your partnerships will come. Private Equity, for instance, has great insights. Vista is the largest software company in the world. I want to hear about how they think about managing their companies.”

Famous 5

Favorite Book: Although President and CEO Joe Payne just finished Going Infinite by Michael Lewis, about the rise and fall of Sam Bankman-Fried, the book he highly recommended was The Covenant of Water by Abraham Verghese. “I highly recommend it to all in the tech industry, even though it has nothing to do with tech directly,” Payne shared.

CEO he’s following: “Because of current macroeconomic conditions, I’m following Jamie Dimon more than usual,” explained Payne, adding, “But I get the most value from a group I’m in with 40 CEO techs called Enterprise Software CEO council.”

Favorite online tool: Payne named 6Sense the most helpful tool. “But of course, my favorite tool is Eloqua,” quipped the former Eloqua CEO.

Balance: Payne gets 7 hours of sleep per night. He’s 58, married, with four children. He proudly added, “I’ve been with my wife for 40 years now.”

What does he wish he had known at 20? “I wish I had known sooner how important culture is to the CEO job,” replied Payne.