In the SaaS world, revenue growth and profitability are two of the most common measures.

Specifically, SaaS companies are continuously aiming to maximize their revenue growth rate and profitability margin while maintaining low costs and corporate social responsibility.

But how can a SaaS company know, exactly, that it is growing and generating profits at a sustainable rate?

This is where “The Rule of 40” comes in.

The Rule of 40 is a simple financial framework that balances your revenue growth and profit margin to determine the health and attractiveness of your SaaS company.

In this guide, we will be taking an in-depth look at the importance of the Rule of 40 is, including its key drivers and ways you can meet it, at all stages of your company’s life cycle.

Read along to learn about:

- What is the Rule of 40?

- Growth Rate & Profit – Key Drivers for the Rule of 40

- How to Calculate the Rule of 40

- Rule of 40 Examples

- How to Meet the Rule of 40?

What is the Rule of 40?

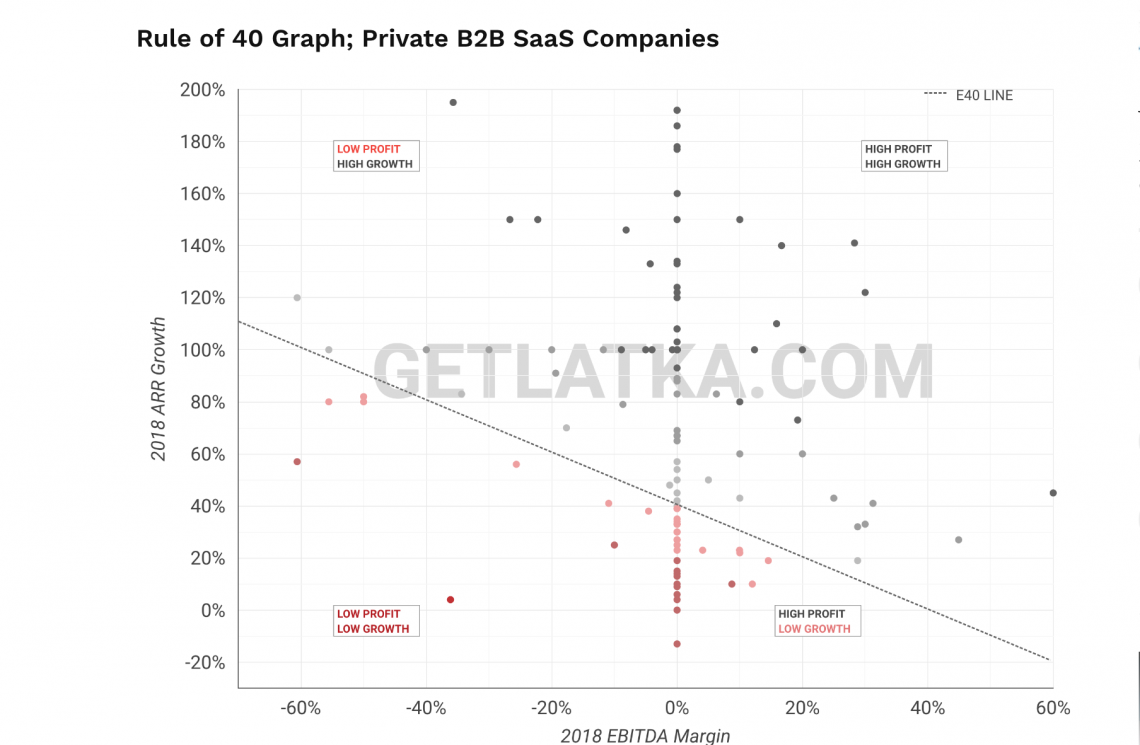

The Rule of 40 is defined as the idea that a SaaS company’s combined revenue growth rate and profit margin should be equal to or greater than 40%.

What does this metric mean for your SaaS business? When calculating the rule of 40, there are three potential outcomes:

- Your growth rate and profit margin add to greater than 40%. This means your SaaS company is generating profit at a sustainable rate, and you’re deemed healthy and attractive to investors. You have room to invest more into growth without worrying that it will affect your profits.

- Your growth rate and profit add up to exactly 40%. Again, this is a healthy balance between growth and profit. Reaching this benchmark will impress prospective investors and venture capitalists.

- Your growth rate and profit add up to less than 40%. You don’t have enough profit or growth to make up for the other. So, you’ll need to reanalyze and work towards optimizing your growth and profit efforts.

Want to know what other metrics your SaaS business can measure to determine its profitability and growth? Then head on over to our guide on 11 Important SaaS Metrics to Track in 2022.

Growth Rate & Profit – Key Drivers for the Rule of 40

As mentioned, the Rule of 40 simply sums up two of your numbers:

- Growth rate (as a percentage)

- Profitability margin (as a percentage)

Let’s take a closer look at what each one represents.

Growth Rate

A SaaS company can measure its growth rate using either ARR or MRR growth.

MRR stands for monthly recurring revenue, whereas ARR is the annual recurring revenue you expect to generate from subscribers each year. Usually, SaaS companies benefit more from measuring MRR, as they charge on a recurring monthly basis.

Profitability Margin

Profitability margin is a rather broad term that can refer to several different measures, such as your cash flow, net income, operating profit margin, cash from operations, return on assets, and more. For SaaS companies, however, the most well-known and frequently used profitability metric is EBITDA.

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, and it’s a measure of a company’s profitability of operating activities only, excluding any costs or expenses.

How to Calculate the Rule of 40

The Rule of 40 only requires two inputs: growth and profitability margin.

To calculate this metric, you simply add up your growth in percentage plus your profit margin, again, in percentage.

For example, if your revenue growth stands at 17%, and your profit margin stands at 20%, your Rule of 40 number is 37%, which is below the 40% target.

The formula goes as follows:

| Growth (%) + Profit (%) = Rule of 40 Total |

|---|

How to Meet the Rule of 40?

The key to meeting the Rule of 40 is understanding the key metrics that drive your profit and growth, and where your SaaS business might be lacking.

Here are our top 3 steps that can help you substantially boost your SaaS growth, and meet the Rule of 40:

#1: Reduce Churn

Churn, also known as the churn rate, is the rate at which customers stop using your services or products over a specific period of time. A reduced churn rate shows that your product is providing value to consumers, and contributes to overall higher revenue and profit growth for your SaaS company.

Concrete methods you can implement to reduce churn include communicating with users through multiple channels, requesting regular feedback, and implementing predictive analytics to identify when there’s a risk of losing a customer.

#2: Increase Average Revenue per User (ARPU)

One of the best ways to improve your sales, profit, and revenue growth is by boosting the Average Revenue per User (ARPU). ARPU measures how much you receive from one user, either over a month, quarter, year, or another time period.

Some business strategies you can implement to boost ARPU include offering multiple subscription plans and add-ons, targeting high-paying customers, and reconsidering your free subscription plans.

#3: Improve User Experience

User Experience (UX) is the set of behavior and actions your consumers and leads display when interacting with your website. These behaviors are influenced by several factors, such as website usefulness, credibility, design, format, look-and-feel, and accessibility.

The better the features, the higher the customer satisfaction, the lower the churn, and the closer you get to reaching the Rule of 40.

FAQ on the Rule of 40

Do you still have some questions left unanswered? Take a look at our answers to the most frequently asked questions on the topic:

#1: Who Should Follow The Rule of 40?

Generally speaking, the Rule of 40 is more reliable for mature companies than new SaaS businesses. Those who pioneered the rule recommend applying the measurement after reaching $1 million in recurring revenue.

Instead, startups should put their focus on product/market match, cash flow, and product-launching strategies.

#2: Why Use the Rule of 40?

The Rule of 40 helps you assess the ability your company has to invest, without sacrificing profit. If you can reach both profitability and growth rates of over 40%, this means there’s space and opportunity to pursue hypergrowth and retain more customers.

Additionally, the Rule of 40 serves as a guide to what tradeoffs your SaaS company can afford. So, for instance, the Rule of 40 assures you that you can afford to operate at a 10% loss if you achieve a 50% growth and profit rate. You are also on the right track if you reach a 40% growth rate, with 0% profit, and vice versa.

#3: Who Came Up with the Rule of 40?

The Rule of 40 was originally popularized by two venture capitalists: Brad Feld and Fred Wilson, who shared a blog post about the idea back in 2015. They were both in the same board meeting when a late-stage investor mentioned the rule to them for the first time.