Simply put, your company’s revenue model defines how your business will generate income.

For this reason, choosing the right revenue model for your business is key to running a successful business.

Many companies, however, struggle to find the revenue model that works for their business – and in some cases, using a revenue model that doesn’t work can even lead to bankruptcy.

So, if you’re after the best revenue model for your business, look no further.

In this article, we will cover everything you should know about revenue models, including:

- What is a Revenue Model?

- 10 Most Popular Revenue Models in 2022

- 5 Emerging Revenue Models (Starting to Get Traction)

- How to Choose the Right Revenue Model?

What is a Revenue Model?

As mentioned above, a revenue model is a framework that a company uses for generating revenue.

As such, your company’s revenue model identifies the strategy your business uses to generate income, which helps you to determine:

- Your revenue streams

- Your target customers

- Your product pricing

In general, using a revenue model can help your company to plan and manage your revenue as well as track and predict your business growth.

You should also keep in mind that, although revenue models are often confused with business models, these terms shouldn’t be used interchangeably – in fact, revenue models are a core component of your company’s business model.

10 Most Popular Revenue Models in 2022

Many founders stick to the same pricing model for many years without stepping back to consider if they’re leaving money on the table.

Here are some additional revenue models you should consider to increase cash in your bank account.

#1. Recurring Subscription Revenue Model

The recurring subscription revenue model works for physical products like Harry Razors and digital software products like Slack.

Actually, many analysts say that the recurring subscription model is the best revenue model.

That’s because the customer pays every month and, as long as you’re delivering value, keeps paying for a very long time – in fact, many SaaS companies have customers who have paid every month for 3+ years.

To make the most out of the recurring subscription revenue model, consider making your cheapest plan one that is easy for new users to get started on.

Your middle plan and the most expensive plan should have obvious additional features or usage-based milestones (6 razors per month instead of 3) that drive customers to upgrade to a higher price.

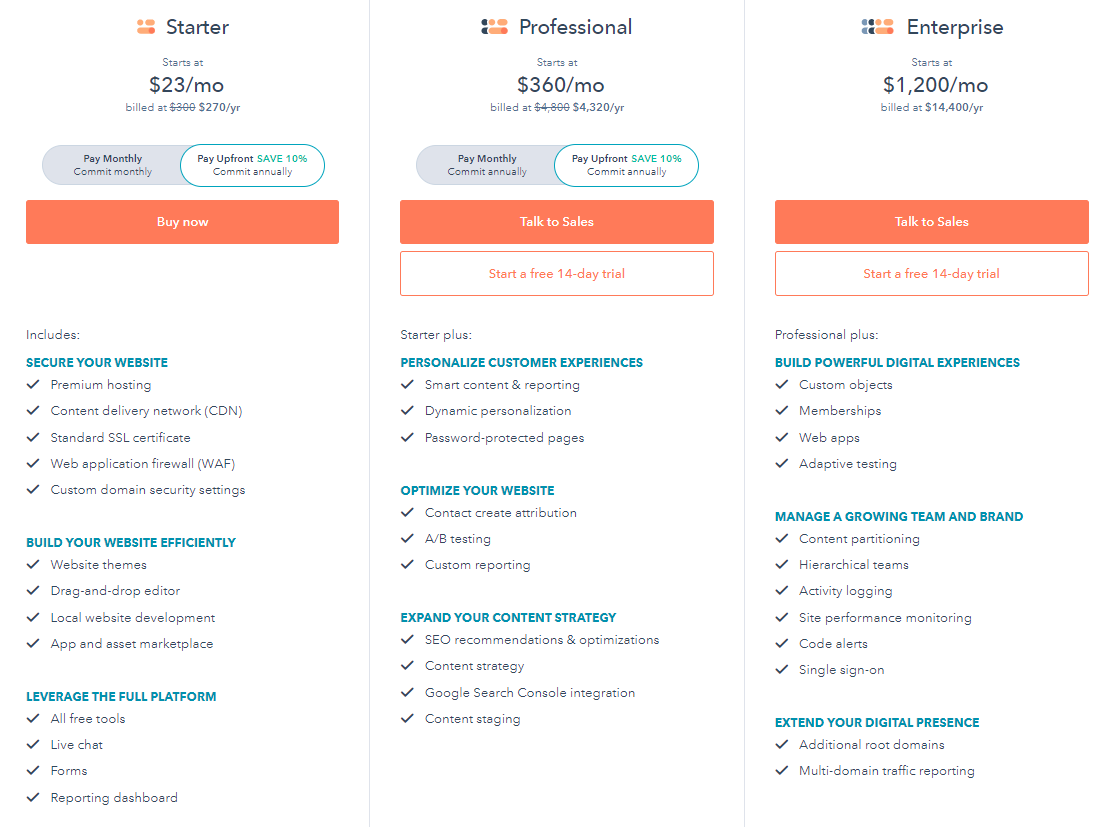

Here’s an example of HubSpot’s CMS subscription plans that offer more features with each tier:

By offering multiple subscription plans at different price points and with distinct features, HubSpot’s customers can see exactly what they’re getting – and missing out on – with each plan.

Here are some other examples of companies that use the recurring subscription model:

Example 1:

SEMRush broke $100m in revenues in 2019 selling subscription plans to 47,000 customers who pay on average $130+/mo. Customers use them to do search engine marketing and optimization research.

Example 2:

Wistia hit $40m in revenues in 2019 and almost $6m in free cash flow by helping over 50,000 customers host and manage video content. They build their plans around the number of videos, channels, and certain features.

Example 3:

Jivochat hit $8m in revenues without raising money by selling customers a live chat solution for their websites. Over 37,000 customers pay $18/mo to use the tool.

#2. Transactional (take a %) Type of Revenue Model

If you’re processing payments for your subscribers or helping them manage money in any way, consider the transactional revenue model.

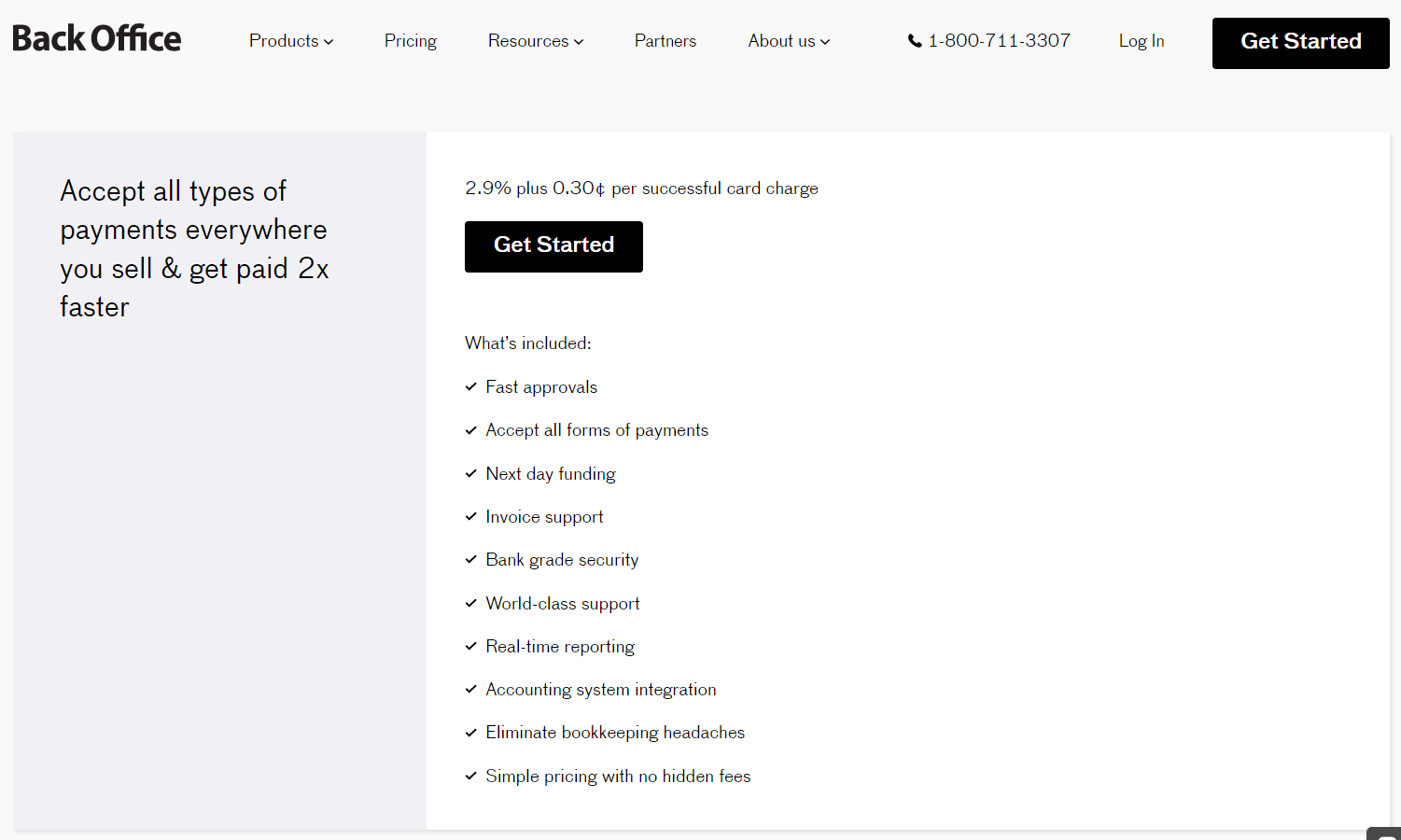

Back Office, for example, helps businesses manage their finances and payroll.

They started by selling a recurring subscription model and hit $80,000 per month in revenue in under 18 months.

Then they realized they were helping customers bill their customers millions of dollars each month.

Using this transaction model, Back Office now takes a small percentage (<3%) of each sale to help its customers with payment processing:

If Back Office hits $10m/mo in processing, they’d be making an additional $300k/mo if they charged a 3% transaction fee.

Here are two more companies that use the transactional revenue model:

- Printful was founded in 2014 and has helped creators sell over $540m in gross merchandise volume (GMV) through its platform in total. In 2019 the company made $100m in revenues on about $300m in total GMV. The company takes an average of 30% on each order.

- Argentina-based PopMyAds makes money by charging 8% of total ads placed through its system. This transaction fee – sometimes called the “ad tax” in the advertising world – is very popular among SaaS companies that help brands place ad spend.

#3. Usage-based Revenue Model

With the usage-based revenue model, your company only charges customers based on how much they use your products.

However, many founders mess up their business plans because they think customers use them for one thing when actually their customers value something different.

So, when you charge customers based on usage, make sure you are tracking real usage metrics from your tool and price against the usage metric customers value most.

For example, if you sell customer relationship management (CRM) software, you might price against the number of contacts.

If you help customers write proposals, on the other hand, your usage-based metric might be the number of proposals sent each month.

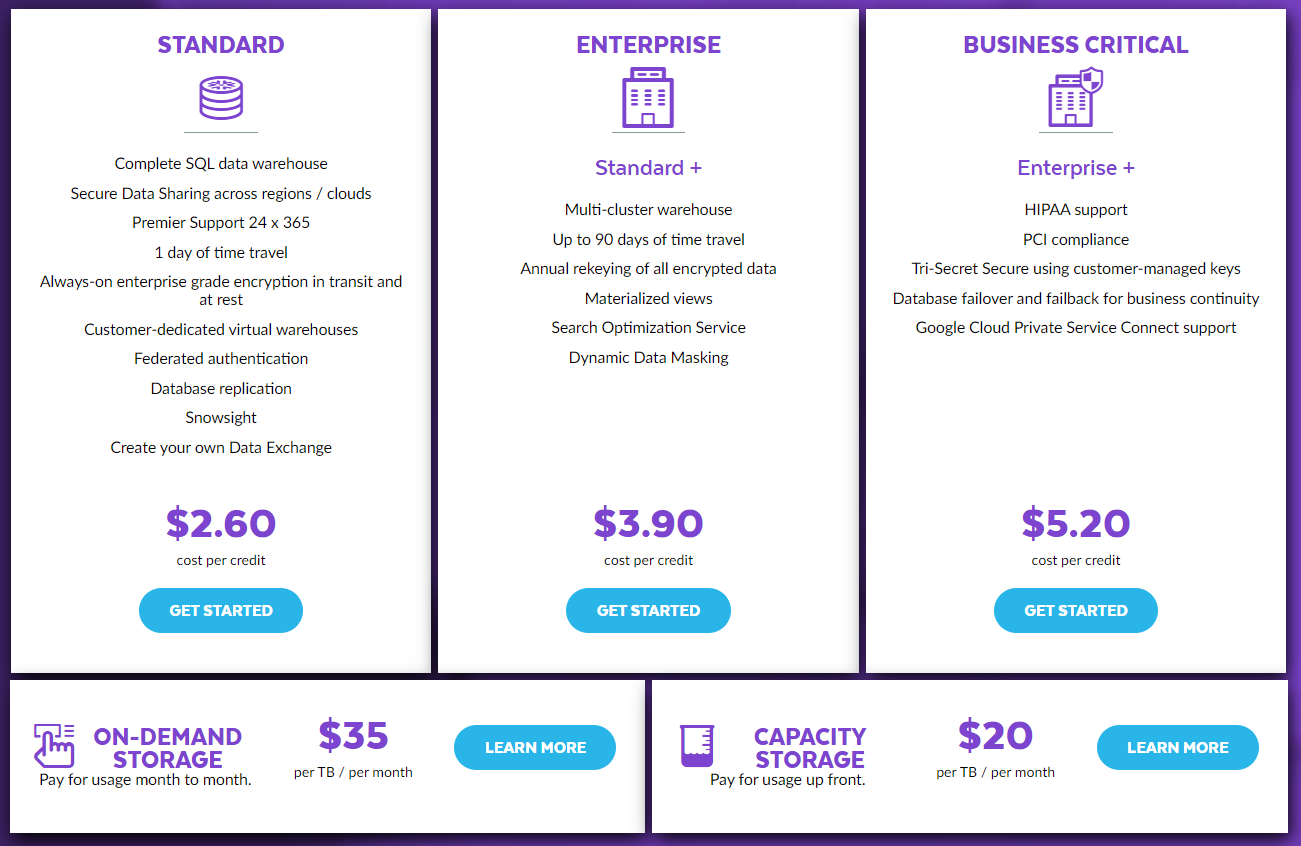

One of the companies that effectively use the usage-based revenue model is Snowflake.

Here’s an example of Snowflake’s pricing:

Basically, Snowflake’s pricing includes two elements:

- Cost of storage. Customers can choose either on-demand storage (paid for monthly) or capacity storage (paid for upfront). Whichever option they choose, the customers are only charged for the terabytes they use.

- Cost of computing resources. Snowflake measures the compute resources used to perform services (e.g. data loading) by credits. Customers are charged based on their actual usage of computing resources per second.

Here are some other companies that use the usage-based revenue model:

- Proposify charges based on the number of contracts per month.

- CloudCheckr charges based on the percentage of cloud spend.

- SEMRush charges based on the number of keyword searches you do per month.

#4. Pay Per-Seat

When a customer recommends your product to one of their co-workers, it means you’re doing a great job delivering value.

So, when you see this sort of pattern, consider a pay per-seat model.

With this revenue model, customers pay you based on how many seats they’re using.

Most commonly, the pay per-seat revenue model works best for B2B companies.

If you have 3 people from a company using your product, for example, use LinkedIn to check the company’s total number of employees so that you can see if it’s worth it to try and get their entire team signed up.

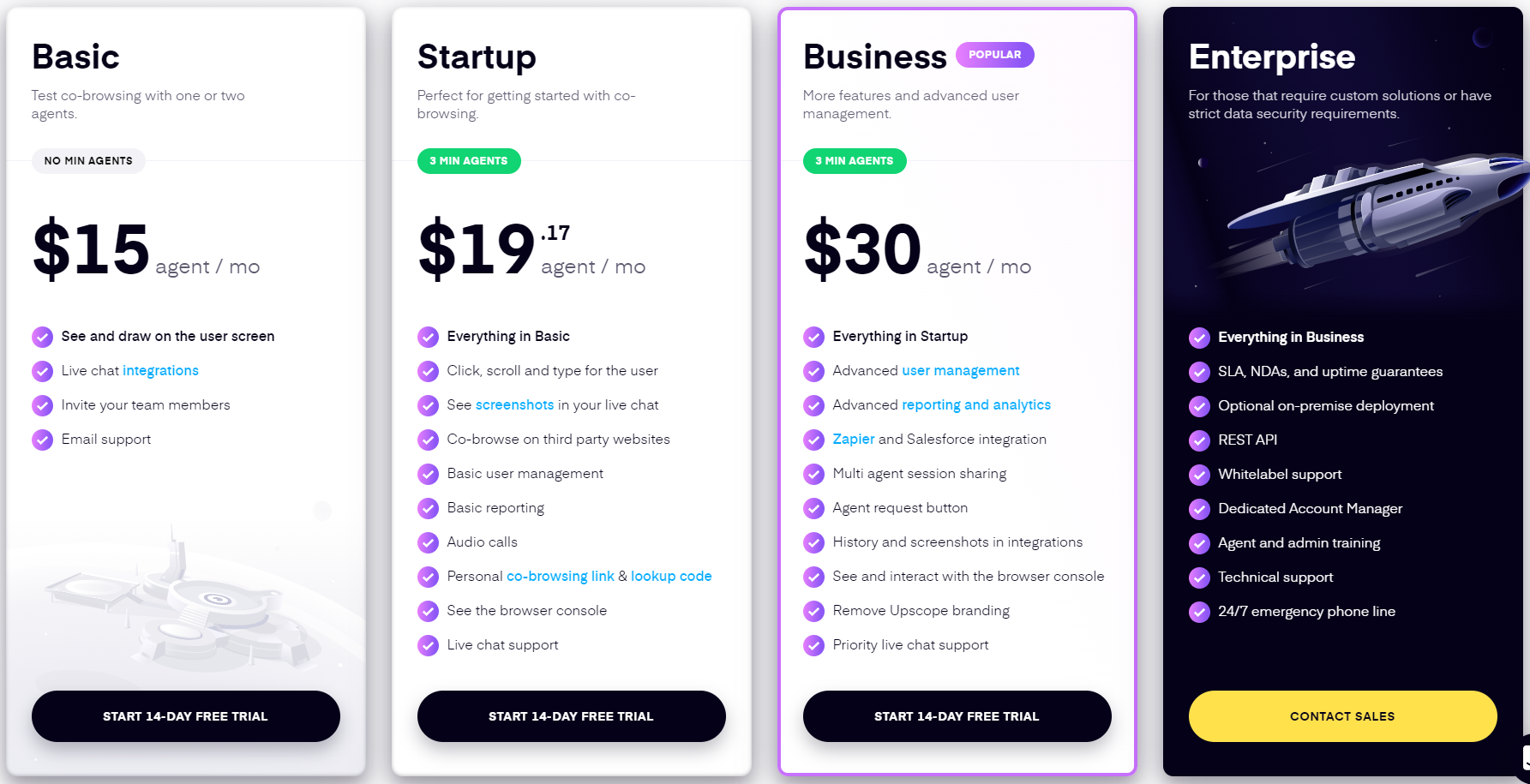

Upscope, for example, tried 7 revenue models before sticking with the pay-per-seat model that doubled their revenue.

Here’s what their pay per-seat pricing looks like:

#5. Ad-based Revenue Model

Ad-based revenue models are becoming less popular because users can easily spot ads and find them annoying, which is why the best ads are the ones that don’t look like ads at all.

That being said, if you’ve built a blog, podcast, or email list and attracted a large following, monetizing with ads is a great idea.

If you’ve built a large audience and can’t seem to attract advertisers, however, one revenue model you should consider is the affiliate model. Check if the products you already use and love have an affiliate program where they’d pay you to mention their goods or services.

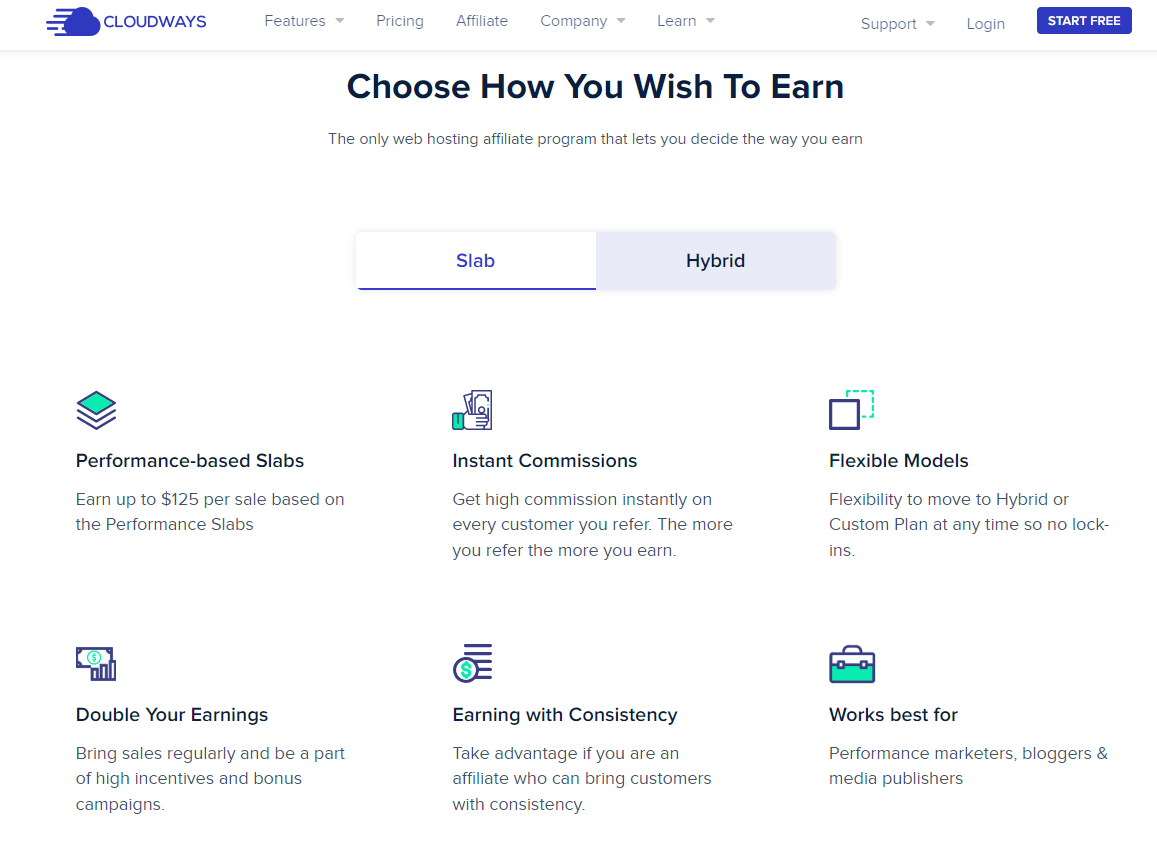

Clowdways, for example, has an affiliate program with multiple commission payout models that you can choose from:

Here are some other ad-based revenue model examples:

- Email newsletters like Morning Brew generate over $18m/year by sending one email per day and selling ads in that email. They’ve been at it for many years and now have over 1,600,000 readers of their Morning Brew newsletter.

- Podcast hosts like Tim Ferriss are able to charge $56,000 for a 60-second message at the beginning of their podcast episode because they’ve built a massive audience of listeners.

- Web properties like Forbes and Entrepreneur sell ads on their websites using Google Adsense and other marketplaces which bring in $10m+ in revenue annually.

If you’re an E-Commerce company that spends a lot on ads to generate new customers, though, finding the right outlets that already serve your desired customers can be tricky.

What might help you is running small tests under $5k and then doubling down once you find an email list, website, podcast, or other property that helps you get customers at a low customer acquisition cost (CAC).

#6. Freemium Model

To acquire more customers, companies often offer some of their products with basic or limited features for free, whereas advanced features come at a price – and that’s what the freemium model essentially is.

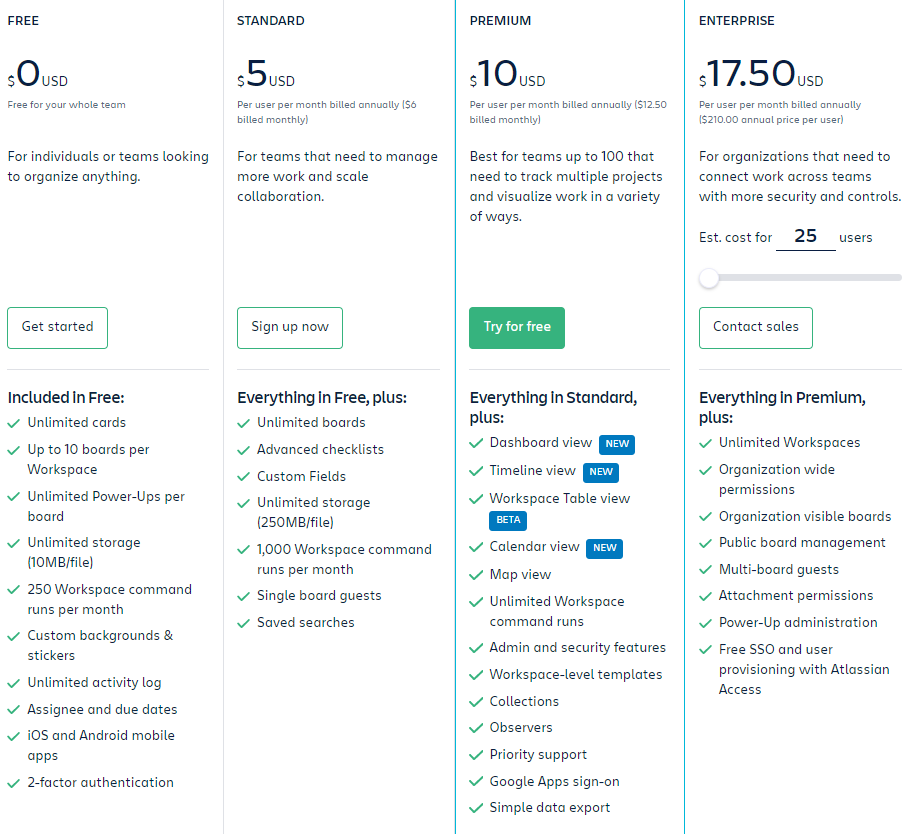

Here’s an example of Trello’s freemium model:

As you see, Trello offers a wide array of features for free, while additional features cost $5 and more per month.

The goal of using the freemium model is, of course, to convert free users into paying customers by offering advanced features for a price.

Nonetheless, you should keep in mind that this model typically works well in very specific situations.

When you’re buying groceries and a server has a “free sample” booth set up in front of a Hamburger brand, for example, they give you a free bite of the hamburger because they know if they do that 10 times, 1 person will buy the $15.99 pack of 12 hamburger patties.

The 10 samples they gave out cost them a total of $1 (marketing) and the product cost of goods sold (COGS) is $4, generating a profit of $10.99.

Having said that, freemium models can be dangerous if you don’t know how much “free” you have to give out to convert 1 new customer, which is why it’s important to know your conversion metrics.

After all, if you give away products or tools for free and these free ideas cost you a lot of money, freemium models can drive your business bankrupt.

#7. Marketplaces

To put it simply, marketplaces connect buyers and sellers and make money by sitting in the middle.

However, the sales cycle in marketplaces can be tricky because you have to sell 2 people at once: the buyer and the seller.

So, who should you focus on getting on your marketplace first – the buyers or the sellers?

If you want to start generating cash flow, you have to go after both target customers at once.

A key piece of your intellectual property then becomes your network of buyers and sellers.

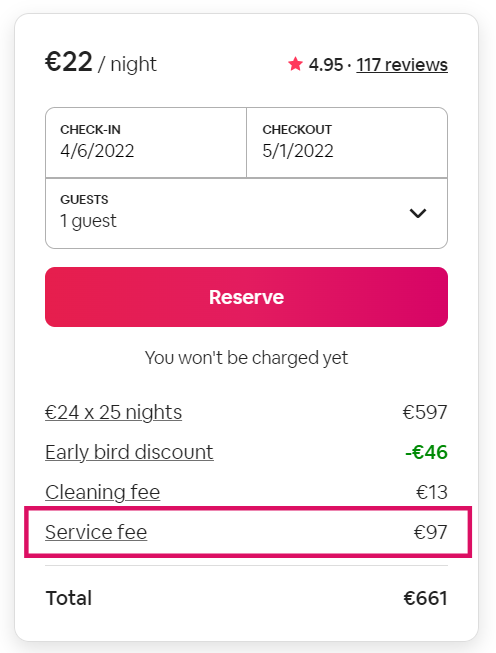

Airbnb, for example, connects travelers who are looking for accommodation with hosts and typically split their service fees between hosts and guests:

Airbnb’s service fees can vary – in this case, for example, the guest service fee is just over 17% of their booking subtotal (nightly price – early bird discount + cleaning fee). Hosts, on the other hand, are usually charged a 3% fee.

Here are some more examples of businesses that use the marketplace revenue model:

- Google helps publishers connect with brands that want to reach those publisher audiences. With $50b+ in annual revenues, Google is the best model.

- Amazon connects the maker of a widget to a buyer who just searched for that widget and takes 30% in between.

- Apple’s app store connects gamers with game app developers and takes 30% on each $4.99 sale.

- Fiverr connects a writer in Europe to someone who needs blog content in California and takes a small cut in between.

Other examples of marketplaces include Uber, TopTal, and the car-buying marketplace Shift.

#8. Data Sales

Using the data sales revenue model, your company is selling data directly to customers.

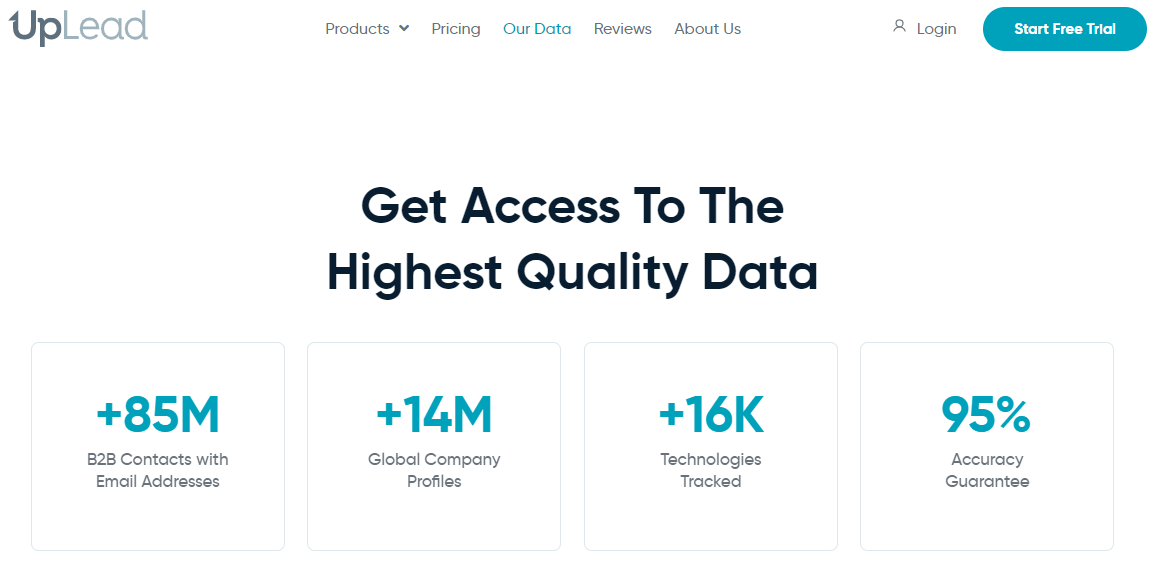

While most companies use this revenue model as an additional revenue stream, some businesses, such as UpLead, use data sales as their company’s primary revenue model:

Although selling data can be tricky, it can also be highly lucrative when done right.

Second Measure, for example, has built relationships with many firms that touch transactional credit card data.

Those firms anonymize the data and share it back to Second Measure.

Second Measure then cleans and organizes the data and enables customers to sort, filter, and pull insights from this credit card data.

Other firms that sell data include ZoomInfo, Crunchbase, and Gartner.

#9. Markup Revenue Model

The markup revenue model is one of the most common revenue models across companies today.

The idea is simple: buy or create a product, increase its price by X% and sell it to make a profit.

For example, you may decide that every time you sell a product, you want to make a 50% markup. Meaning if it cost you $10 to buy or create, you want to sell it for a minimum of $15 so you pocket $5 per sale in gross profit.

While some small businesses that use the markup revenue model make direct sales to customers through social media and search engines, others use dropshipping, middlemen like eBay, Shopify, or retail stores like Walmart to sell their products.

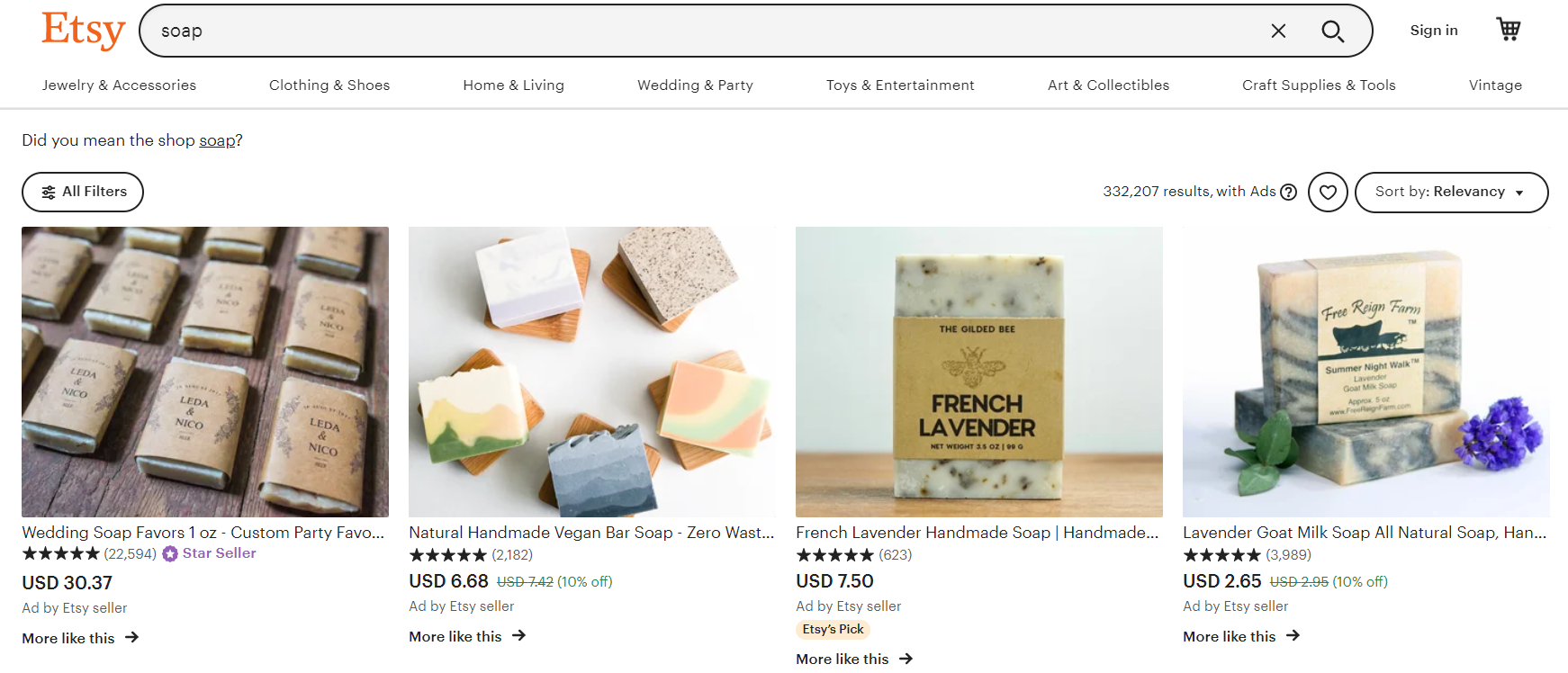

For example, many independent sellers and small businesses use Etsy to sell their handmade goods:

Nonetheless, regardless of how you sell your product, make sure you’re making enough margin on the sale to make it worth your energy.

Using the markup revenue model makes calculating profits very simple, which is why this revenue model is so popular among businesses.

#10. Service-based Revenue Model

If you have plenty of time and specific skills or expertise, the service-based revenue model is one of the easiest startup revenue models to start your business with, especially if you don’t have a lot of money.

With the service-based revenue model, you’re essentially selling your time, labor, and/or expertise to deliver services to your clients.

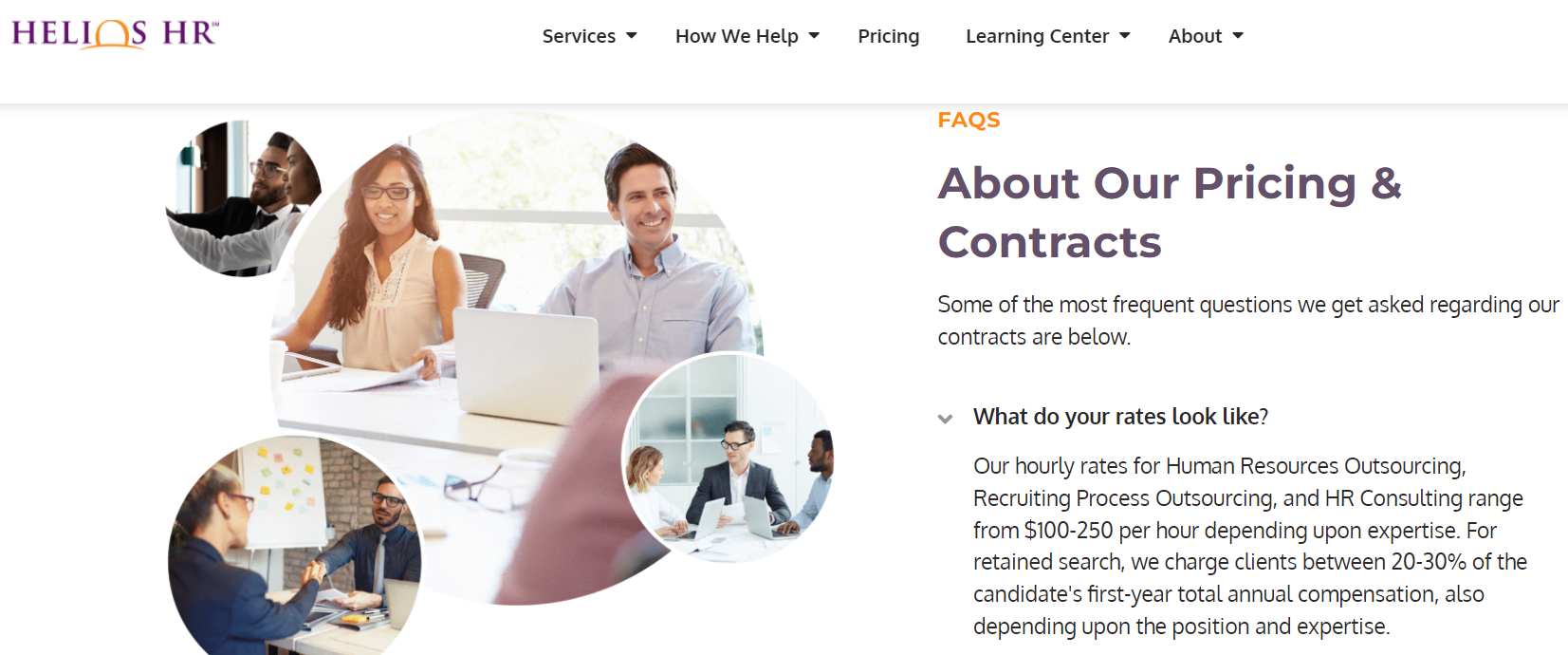

Helios HR, for example, offers HR services and charge their customers an hourly rate based on expertise:

One thing to keep in mind, however, is that most founders that start off selling services realize that it’s very hard to scale past $1m in annual revenue because you only have so much time.

So, they often start to build an agency where they sell other people’s time and then realize that it’s also hard to scale – once you get new customers, you always have to go hire more people to service those customers.

At this point, most agencies start to look at more profitable revenue models, such as the recurring subscriptions revenue model, or invent their own products and use their agencies to sell the product.

5 Emerging Revenue Models (Starting to Get Traction)

#1. Markup + Subscription

Many brands that sell to consumers are starting to do this, after only using the markup model selling razors to consumers.

It cost them $1 to make the razor and they sold each for $5 for a $4 gross profit. They got sick of paying Walmart for shelf space and of paying Amazon a 30% cut, so they launched their own website and sold directly to consumers.

They started seeing many customers come back and buy every other month, so they launched a subscription plan: 3 razors per month for just $12.

This is the path DollarShaveClub took before it sold to Unilever for $1b in cash in July of 2016. I expect you’ll see many more brands go down this path combining the markup revenue model with subscriptions over the next few years.

#2. Marketplace + % of GMV

You really want to help stay-at-home moms find flexible work, so you launch a site where they can list their talents.

In the first year, you sign up 1,000 moms who list things like “I write blog posts” or “I’ll edit your podcast.”

In your second year, you finally see companies hiring these moms to do tasks. You charge companies $50/mo to use your platform to find moms ready to work.

By year 3, you’re processing 10,000 jobs per month equalling over $5m in total jobs completed (gross merchandise volume, GMV). You’re making $50/mo from 2,500 companies paying to get access to your mom network, a total of $125,000 per month.

You start to realize you could charge a small percentage of each job to keep for yourself. You launch new pricing stating you’ll keep 3% of each job. 3% of $5m/mo is approximately $150k/mo in new revenue. You just doubled your business.

Many marketplaces are going through this change right now. I expect you’ll see this combination of business models continue to become popular over the next 5 years.

Example 1:

SimpliShip helps freight forwarders sell ocean and air transportation space to brands like Adidas who need to ship products. The company makes money by taking 2% of space booked on the ocean side and 5% on the airside. In 2019, the company processed $15m in total freight spend (75% ocean, 25% air), making about $1m in revenues. They plan to do $300m in volume in 2020 and make $10m in revenues.

Example 2:

Freightos is another example of this same model in the transportation space. The company passed $18m in revenues in 2019.

Example 3:

New brands like LeafLink help cannabis brands like Dixie in Colorado connect with retailers who can sell their products like Medicine Man in Denver. LeafLink has 1300 brands like Dixie on the platform and 3400 retailers like Medicine Mane. In April of 2019, the platform processed $123m in gross merchandise volume (GMV).

Leaflink has 3 revenue models. They made $6m in 2019. 60% came from charging 1300 brands like Dixie for $399-1500/mo subscription plans. 5% came from transaction fees where LeafLink charged 3% on total bought through their platform of $2.25m. The last 15% came from letting brands like Dixie buy ad space in their marketplace. This is a great example of using multiple revenue streams to scale.

#3. Hardware (IoT) + Software

Many companies build hardware that enables their software to work. They’ve realized that once a customer installs the hardware, they will be way more likely to keep paying the subscription fee for long periods of time.

SensaNetworks helps companies like Walmart manage their waste. SensaNetworks ships hardware devices to brick and mortar shops to install on their dumpsters. These devices tell trash pickup when the dumpster is full.

It costs SensaNetworks $900 to build each piece of hardware. They sell this to customers for $2400 one time, or $90/mo rental. 60% of customers buy and 40% rent. They then upsell the software package for $34/location.

#4. Subscription + Services

These are like two twins that can’t seem to get along. Many entrepreneurs start off selling their time by selling services. They get tired of selling their time, morph into an agency, and then that agency develops a subscription software product.

This is where the conflict begins. How many of your agency members should you have focused on building the software? When should you shut down the agency and focus only on the higher-margin software?

In some cases, the software takes off and the company goes on to raise venture capital. The investors hate the services revenue because it “doesn’t scale” and “has low margins.” Most software margins are above 75% while services margins tend to be around 40%.

After the subscription company reaches $5m or so in revenues and 1,000 customers, the founders start thinking: “Wow, we could upsell services to some of these customers and get them more addicted to our software.” Typically, you see these companies focus on launching a services plan again, going back to their roots.

Ultimately, the most successful software companies sell software and upsell significant services to get customers onboarded, activated, and sticky. Do both!

Clucth.io, for example, started as an agency in 2007, when the founder was 19. The agency grew to 40-50 people in 2019 and revenues hit $5m, but the work was exhausting. The founders tried to sell the agency and got an offer for 1x revenues of about $5m.

One of the founders wanted to spin out a valuable piece of code that allows companies to drag and drop together applications and websites without having to code. That founder was paid 50% from the sale of the agency, or $2.5m, and then used $600k to buy out the code from his old agency. Today, that subscription software company has launched named Clutch.io.

#5. Subscription + % of GMV

Companies like Workaxle help businesses easily schedule paid meetings. Companies pay a fixed fee of $1000 each month to use the software on a subscription basis and Workaxle takes 1.5% of the total value of appointments booked through their platform. This tool is for industries that charge for appointments (salons, coaches, etc).

How to Choose the Right Revenue Model?

With so many revenue models out there, it can be difficult to choose the right revenue model for your business.

However, having a good understanding of your product, your market, and staying flexible can help you make the right decision for your company.

Understand Your Product

If you want to make sure you are choosing the right revenue model for your business, you need to first consider your product.

In some cases, your product can give you a clue about the revenue model that would work best for your business.

For example, if you have a set of products that come with different features, chances are you’d be best off choosing the recurring subscription revenue model. This way, you can make sure you’ll get a consistent stream of revenue each month, which can promote your business growth.

Now, if your product doesn’t dictate the revenue model by itself, you might want to consider different options, such as joining affiliate programs to get an additional revenue source.

Understand Your Market

Having a clear understanding of your market can help you choose the best revenue model.

As such, you need to consider the following:

- Your target customers. Knowing your customers and what their needs are can help you define your revenue model. For example, if your customers are large businesses, your business might do well using the pay-per-seat revenue model.

- Your competitors. Analyzing your direct competitors can help you to evaluate your product and its value, which can in turn help you choose the right pricing. Also, you can get an idea of which revenue model would work for your business by examining what works for your competitors, which revenue models they’ve tried in the past, etc.

Moreover, you can reach out to other similar companies for networking, advertising, and other business opportunities that could potentially help you generate more income.

Stay Flexible

Perhaps the most important part of choosing your revenue model is to stay flexible.

As your business grows, chances are your revenue model will change as well.

Sometimes, choosing the right revenue model can be a matter of trial-and-error – it’s important, however, to quickly note when a revenue model doesn’t work and make the necessary changes.

You may, for example, think that your business would do best with the recurring subscription revenue model only to find out that, in fact, your business does much better with the usage-based revenue model.

Or, you might eventually add advertising or data sales as an additional revenue stream to your primary revenue model.

Whatever the case may be, it’s important that you stay open and flexible to changes – this way, you will eventually figure out a unique revenue model that works best for your company.

Key Takeaways

And there you have it – now you should be ready to choose the right revenue model for your business.

Before you do so, though, let’s go over some of the key points of this article:

- Revenue models help companies to figure out their target customers, product pricing, and revenue streams by outlining their income generation process.

- There are many different revenue models businesses can choose from, including markup, recurring subscription, and usage-based revenue models. Many businesses, however, have a primary revenue model and look for additional revenue streams.

- Tracking your conversion metrics is vital if you’re planning to use the freemium model.

- Service-based revenue models are one of the easiest to start with, yet often they don’t have much room for business growth.

- The key to choosing the best revenue model for your business is to consider your product, market, and stay flexible since your revenue model will likely change over time.