What do you do for an encore after transforming the digital content industry and selling your 3rd startup to Google? Seven years into startup #4, serial entrepreneur Ben Barokas, CEO and Co-founder of Data Privacy solution Sourcepoint, shared his latest journey with the GetLatka team. In this interview, discover why Barokas chose VC funding while sitting on cash from his last sale to Google. He also shares what makes him confident that he will pass $50m in ARR by 2024, and how he successfully managed his first sales hire.

- 500 large-scale digital enterprise customers

- $100,000 ACV

- 40% YoY growth

- $17m Series C in 2020

- Team of 60, evenly distributed between engineering, product, sales, marketing

Startup #3: Admail acquired by Google for $400m in 2011

Barokas described the Google acquisition of Admail before launching Sourcepoint in 2015. “We launched Admail in 2007, raised $40m in VC funding, and sold to Google in 2011,” explained the Co-founder. When Latka asked him to confirm the $400m sale price, the CEO replied, “It’s all about how you do your fancy accounting. It was significantly above that in terms of price when considering the bonuses given to employees on top of the cap price.”

40% YoY growth with data privacy solution

According to Barokas, “We created the best solution in the world for large-scale digital enterprises to evaluate what their data privacy risk is and provide a series of tools to mitigate that risk and act ethically and in a good way.” That solution is paying off, with 40% YoY growth.

Why data protection is worth $100,000 ACV

“Data is the lifeblood, the oil of what runs the digital enterprise today. From a user’s perspective, most don’t understand the value exchange by giving their data away. More and more, it can be stolen or utilized in ways that the individual user doesn’t want,” he continued. “Digital marketing made a lot of this data available. Many brokers don’t act responsibly, ethically or keep data secure like good digital citizens. We knew the digital ecosystem needed to clean up its act, and we wanted to provide a solution.” That solution, available in 3 forms from Sourcepoint, is worth an average ACV of $100,000 to their customer base.

3-tier pricing, 500 customers on board with Sourcepoint

Unlike some SaaS models, Sourcepoint offers a trio of different products to mitigate data privacy risks for its roughly 500 enterprise customers. “Our clients are the biggest media companies in the world. We price based on implementation and volume,” explained CEO Barokas. Their three products with varying pricing include:

- Volume of API calls: how many times your website or app with an SDK pings up

- Pure SaaS: traditional seats plus feature upsells

- Protection of spend: basis points (under 1%) to protect your media spend and data purchases

Expansion to other enterprise verticals to hit $50m ARR

When asked how he plans to continue the company’s 40-50% YoY growth, the CEO answered, “We’ve had success in the digital marketing ecosystem. We realized we can translate that into other verticals, like the more generalized enterprise system.” He continued, “We are spending a lot of time making sure we are the easy button for data privacy. Everyone in the Fortune 1000 needs to have a series of tools and a platform to execute a privacy program.” The Co-founder added that while reaching $50m ARR is a stretch for 2023, he’s confident they will cross that threshold in 2024.

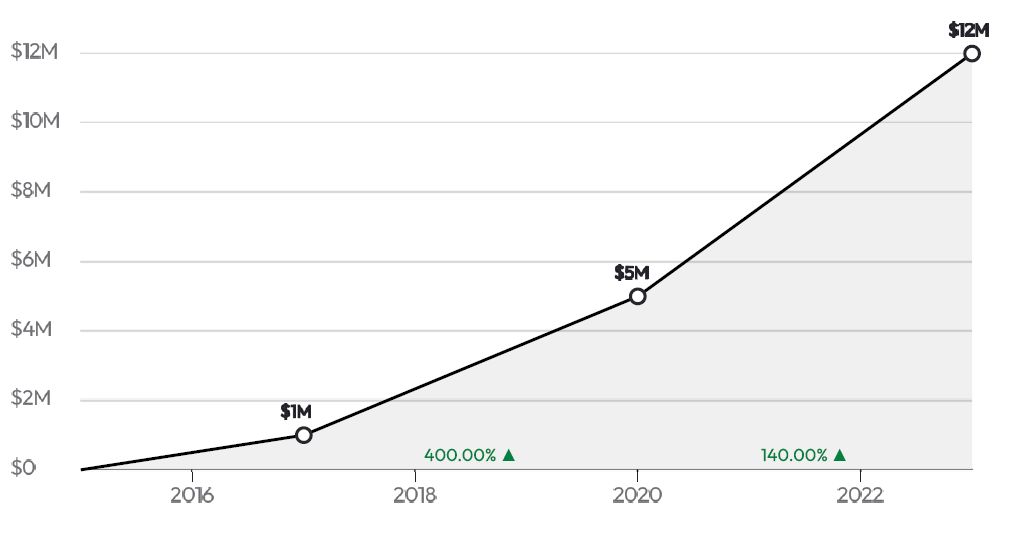

First line of code in 2015 with $10m Series A funding

Barokas shared that the company closed its $10m Series A round of funding in 2015, the same year they wrote their first line of code. He confirmed that he and his Co-founder gave up the standard 10-15% equity in this round.

Why raise $10m with VCs?

Latka queried the serial entrepreneur on why he sought VC money pre-revenue instead of tapping into his revenue from his last venture. The CEO thoughtfully replied, “Because it makes every difference to have smart VC partners. It’s a great accelerator for anything you want to do. The best bet to change the world is to partner with those who have seen and invested in changing the world.” He paused and added, “I wouldn’t raise VC for a lifestyle or something that has been done before, but in all the cases when I founded companies, we are doing something that hasn’t been done before. No man is an island. You want to increase your success rate.”

Aligning expectations with VCs

Seemingly dissatisfied with his answer, Latka continued to press the CEO by asking how he deals with the ongoing expectation of accelerated growth by VCs, which can influence business decisions. “You find other investors more aligned with your particular investors at your particular stage,” noted Barokas. He then revealed, “Data privacy in the US moved very slowly, more slowly than expected, which accounts for how 60-70% of revenue is from Europe. But now that 5 states have passed legislation, tailwinds are now blowing very hard, and we’re seeing an exciting opportunity to grow much more quickly in North America.”

First client in 2017, closed Series B of $16m for 5-10% equity

According to Barokas, the company closed its Series B round of $16m in 2017. This was around the same time they landed their first paying customer. “We had few customers in 2017, but because they were large enterprise customers, there was a proof point there,” noted the Co-founder.

$17m operating capital Series C round in 2020

Sourcepoint’s last round of funding came in 2020 when they secured $17m in Series C. When asked if any of that funding was directed to liquidity for early employees, Barokas vehemently replied no. He bluntly explained, “I don’t see secondary funding for employees as being a primary drive of a sales event. We’re not hiring people with a focus on the incentive of cashing out options.”

Team of 60 evenly distributed

Barokas oversees a team of 60 employees, evenly split between engineering, product, sales, and marketing. They maintain offices in New York, London, and Berlin and supplement their hires with some outside contractors. When asked about his first sales hire experience, he gushed, “It’s spectacular to have worked with great people in the past. My former VP of Sales became my CRO. It was a wonderful way to found a company by bringing in someone we can trust.”

$1m quarterly team sales quota

The sales team (the CRO and 2 sales reps) initially managed a sales quota of $1m per quarter. “We had some bumps in the road where we reevaluated the technology and use cases. Then we course-corrected and evolved,” shared the CEO, adding, “None of the opportunities are straight-line. Everyone zigs and zags.”

Famous 5

Favorite Book: CEO and Co-Founder Ben Barokas immediately chose The Hard Thing About Hard Things by Ben Horowitz as his favorite book.

CEO he’s following: Ben revealed that he follows many CEOs but is particularly interested in ones in the finance sector. Examples inlcude Jamie Dimond. He notes, “We all need to be aware of what people like Jamie Dimond are doing and how they navigate the current pressure in the finance sector.”

Favorite online tool: The Google Suite of work products is what Ben’s team relies on most today.

Balance: Ben gets at least 6-1/2 hours of sleep per night. He’s 49 years old and has been happily married for 21 years.

What does he wish he had known at 20? “It’s all going to be alright,” Ben declared.