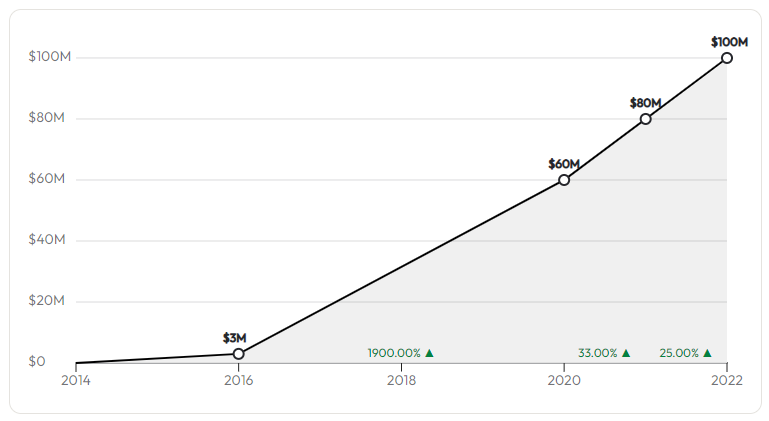

After 6 years as the CEO of QCC, Zong Peng left the SaaS he grew from $3m to $100m ARR. Peng, an early investor in QCC, recently sat down with the GetLatka team to detail his journey. QCC (Quality Check Companies) is a leading B2B data intelligence tool in China.

Peng loves SaaS, AI, ML, and data-driven businesses. In 2017, after 14 years in the US, the CEO and early-stage investor moved to China. He became part of a 4-person founding team at QCC. Discover what prompted Peng to leave the “ZoomInfo of Asia,” how Android helped QCC explode, and why he chose a bottom-up sales strategy.

- $100m in ARR in 2022, up from $80m in 2021

- Team of 200 full-time employees

- 50m MAUs on 300m unique app downloads

- Over 1m paying customers

CEO joins QCC as part of $5m pre-A investment round

How did Peng’s journey start with QCC? He tells Latka, “When I was at SMP Capital IQ, I was a student of the data company market. I have lots of friends in China and at Columbia. One friend asked, do you want to be the CEO of this company?” He knew QCC had a business model like Cap IQ and ZoomInfo, so he joined the early-stage company in 2016, two years after it launched. He was part of an early $5 pre-A investment round, adding that “QCC is still basically bootstrapped today.”

$3m ARR grows to $100m with bottom-up approach

According to Peng, QCC strategically diverged from ZoomInfo because of the market in China. Whereas ZoomInfo focuses on enterprise sales, “We push customers directly to the app store and direct channels.” He added, “In China, top-down sales have a very long sales cycle of 6-12 months. Instead, we sold through the Android and Apple app stores.”

2017-2018 Android adoption drove explosive sales growth to 3B downloads

When Peng arrived to run QCC in 2016, Apple was the only app channel to sell through. Then, he explained, in 2017 and 2018, Android exploded on the market in all other mobile phones. “That was the opportunity. We really drove adoption through the Android channels,” revealed the CEO. To date, QCC boasts over 3 billion total downloads.

Freemium model offers Chinese consumers access for $52 annually

“The Chinese consumer downloads QCC from the app store. They check out companies, employers, bosses,” clarified the co-founder. He added that consumers use it to get hired or for sales leads. Thus, the usage mimics ZoomInfo and Cap IQ, but the execution aligns with the Chinese consumer.

300m unique downloads, 50m MAUs

Latka queried Peng about the number of active users when he left QCC. Peng explained they have about 20% monthly active users, or 50m, in the last 30 days.

1m paying customers in freemium model aligns with 2% gaming industry norms

QCC boasts 1m paying customers in their freemium model, which includes tiered pricing based on a 1-3 year commitment. According to Peng, taking QCC to a world-class level of 5% paying would be “very doable.” He had a vision of growth and product improvement for the data intelligence company that would have easily doubled the conversion rate.

Secret of QCC growth from $60m to $100m in 2 years

Between 2020 and 2022, QCC grew from $60m to $100m. Peng surprisingly attributed the growth solely to organic channels, which added $20m ARR to the company for two straight years, with a profit margin of 20%. Peng reiterated that the bottom-up model better aligns with the market in China.

CEO’s vision diverges from other 3 founders

Latka pressed Peng on why he left, especially after QCC showed no signs of slowing down. The former CEO explained that it again related to the market differences. “In the US, most founders want to progress to IPO. In China, many founders grew up under a different regime. You must understand the regime,” Peng carefully explained. “If you are a founder and you have a very profitable company, you want to keep the company.”

Spend and compete or stay and keep the profits?

Peng revealed that he and the other QCC leaders disagreed about how to tackle competition. “When you are faced with intense competition, do you raise money to compete or know you are very profitable and keep the money?” Peng wanted to spend to compete, noting that they even launched a very profitable campaign across social and paid media channels. “Our founders didn’t want to do any of that,” he lamented, finally adding, “I wanted to grow faster and more aggressive, and the other founders didn’t.”

What’s next for Peng?

“I’m going to keep on doing things in AI and ML. The data company space is so interesting,” answered the ex-CEO. Peng added that he’s looking at companies that are influencing Snowflake, ZoomInfo, and CrowdStrike.

Famous 5

Favorite Book: Former QCC CEO Zong Peng identified the novel The Three-Body Problem by Cixin Liu as his favorite book. The science fiction novel is part 1 of a three-part series.

CEO he’s following: “It’s cliché, but I follow Elon Musk.”

Favorite online tool: Zong chose Wind as his favorite online tool, calling it the “Bloomberg of China”.

Balance: Zong sleeps 6 hours per night. He is currently single and identified his age as “under 40.”

What does he wish he had known at 20? “I wish I knew at 20 not to be so kind. But that’s a conversation for another day.”