When your board includes leading global authorities in your space, such as Peppers & Rogers Group founders Don Peppers and Martha Rodgers, you carry an air of confidence in your product. Such is the case with seasoned Co-founder and CEO of SuiteCX360, Valerie Peck. She joined the GetLatka team for a second time to share the intriguing details and key learnings from her company’s recent $3m acquisition.

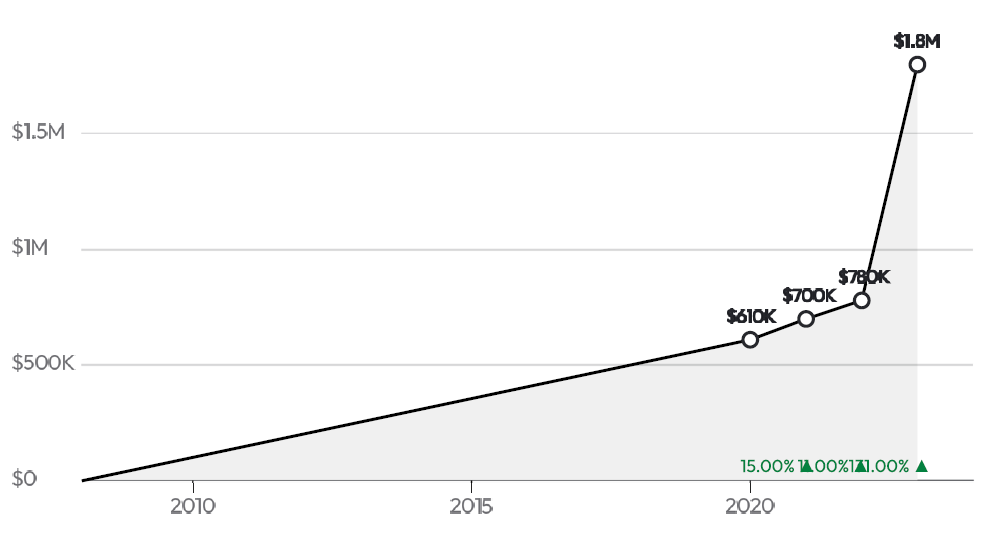

After co-founding the customer experience and diagnostics company 15 years ago as a blend of consultancy and professional services, CEO Peck added SaaS products, all while bootstrapping. Even with 10-20% YoY growth, she decided to sell. Discover why she decided to sell for $3m with an $800 ARR, what challenging obstacles she faced to close the sale, why her network played such a significant role, and how she negotiated to meet her most critical priorities.

- Founded 15 years ago

- $800k ARR, expect to grow to $1.8m in 2023

- Bootstrapped, sold for $3m in 3-year deal in October 2022

Mutual connection introduction led to $3m deal for SuiteCX360

According to Peck, Marc Mandel introduced her to Vivek Bhaskaran, CEO and Co-founder of QuestionPro. That spark ultimately led to SuiteCX360’s $3m acquisition. The SuiteCX360 CEO spoke to several interested parties. “Fit was critical,” explained the Co-founder.

“We found a number of common opportunities. We plugged a hole for them, as they didn’t have a tool to pull their products and tools together. And they have a lot of tools for us for our consulting service,” Peck elaborated.

4 months of negotiations

“The who you know becomes important when you’re doing networking and acquisitions,” shared CEO Peck, adding, “It comes down to people and numbers. We had 4 months of up and back with a couple halts in the middle,” she revealed. Eventually, after ironing out a pair of significant points, Peck sold the IP on consulting to SuiteCX. Then QuestionPro purchased SuiteCX in October 2022.

2 critical sticking points

“First, we had to agree on fit, as in how we work with different departments in QuestionPro,” explained the Co-founder. The second challenge was around deal terms. According to Peck, “Our tax code is not conducive to M&A,” so she advised all founders to have a great tax person, accountant, and M&A expert when considering a merger or acquisition.

$3m deal: asset purchase vs. stock sale holds up negotiations

Peck shared that because SuiteCX360 was a qualified SB102 company for over 5 years, they were eligible for the QSBS (Qualified Small Business Stock) program that lets investors exempt up to 100% of their capital gains on a stock sale. However, buyers are more interested in asset purchases, as that allows them to write 100% of the deal down in year one. However, such a purchase would result in a 50% cap gains cost for the sellers.

M&A consultant offers solutions, gets deal over the hump

“So what was Vivek going to do?” Peck queried. “Gross us up to make us whole, or find an alternate way of buying stock but not being able to write off as much but letting us end up in a better position? It was most difficult for everyone to deal with,” the CEO revealed. However, her M&A consultant identified workable solutions to get the deal over the finish line.

“He identified some ways to allocate resources and figured out which R&D fees could be written off,” Peck explained, adding, “A couple of my shareholders waived their shares, so the two founders that did the most got a share bump with helped with a lower selling price, so we all came out with a win-win.”

$3m over 3 years, not straight cash

Although Latka queried Peck about the terms of the deal, the CEO only revealed, “We did an installment sale. It allows the buyer to ensure the company keeps building something that continues to make money over time; it is a mix of cash, salary, benefits, perks, and spiffs over 3 years.” The seasoned CEO added, “If I was 28, I might have done a different deal.”

4 reasons why the Co-founder was ready to sell

Latka asked Peck, “Why not keep doing what you’re doing? You’re already at over $1m per year and still growing.” The CEO responded with 4 major reasons the opportunity was right for her:

- “This is an opportunity for me to grow and get back into my consulting roots to do more of what I love and less of software sales, which I don’t love.”

- “This is where Mark Mandel fits in. He loves doing software sales. I hate it. I do global consulting, which is a capstone for my career and a big lifestyle choice win, and now the software side is taken care of because he’s now the SuiteCX360 VP of Sales for North America.”

- “A couple of other people wanted to step out. The sale let me do that and let new people in.”

- “I’ve done a lot of work at KPMG and PWC. Money in hand is worth a lot. I would have had to triple in size personally to make the money. Having this investment is far better with cash flow.”

Targeting 50% increase this year while ramping up at QuestionPro

Since the acquisition, Peck and her team have worked to ramp up and start understanding the integrations with QuestionPro. “Meanwhile, we landed a whale of a client,” shared the CEO, explaining, “An existing client doubled what they had been doing with us.”

She added, “We are on the precipice of taking an integrated approach. Our marketing tools and tactics like editorial and webinars are starting to fold things in.” Peck expects SuiteCX360 to enjoy a 50% revenue increase from last year, hitting $1.8-2m ARR.

Famous 5

Favorite Book: CEO and Co-founder Valerie Peck again chose Managing Customer Experience and Relationships 4th Edition by Don Peppers and Martha Rogers as her favorite book: “Mine is all dog-eared now, and I give it to everybody,” she quipped.

CEO she’s following: “Right now, I’m following the First Republic; I think the CEO and team are managing the situation quite well,” Peck shared.

Favorite online tool: Peck shared that she’s currently “having fun experimenting with ChatGPT.”

Balance: Peck is “back to getting 6 hours of sleep per night.” She’s been “happily not married, with my CTO for 17 years” and has 6 children. The 68-year-old quipped, “I’m still on the right side of the turf.”

What does she wish she had known at 20? “I wish I knew how difficult it is to actually start up and run a business beyond knowing the thing you know so that I could have gotten smart about it sooner.”