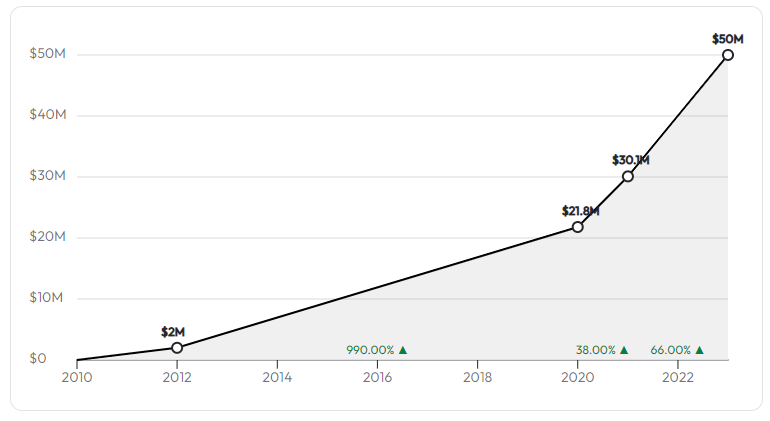

After a decade of growing MoxiWorks from 1 to 3500 customers and $50m ARR, CEO York Baur imparted his wisdom to the GetLatka team. His unique background of GM, sales, and marketing skills stems from various roles, from enterprise leader at Microsoft to startup founder. That background led Baur to be recruited to scale this one-customer spin-off company. And scale he did. With support from PE firm Vector Capital, the ‘Salesforce of Real Estate Brokerages’, continues to grow toward $100m ARR rapidly.

During his interview, Baur revealed why he focused on enterprise brokerages and not individual agents, what made him choose to work as a 1-10 CEO instead of a founder, and why he prefers private equity to VC funding.

- $50m ARR

- 3500 customers, 400,000 agents

- 150 partners in platform ecosystem

MoxiWorks launched in 2011 with one 7-figure customer

Baur joined MoxiWorks in 2012, a year after they spun off from their parent, Windemere Real Estate. The company was funded initially by the parent company plus two other existing customers who helped shape the direction of the SaaS. “We are Salesforce for residential real estate. Not just CRM. We also offer a full suite of products like website builders, presentation software, management tools, and recruiting tools,” Baur explained, adding, “It’s everything a brokerage needs to give an agent to be successful.”

Enterprise focus: 6 customers paying 7 figures

Baur initially toyed with selling to real estate agents; he quickly doubled down on the enterprise sale. “Lesson learned. Consumers and SMBs are hard. As a SaaS, you have to be concerned about churn. You can’t avoid it at the low end of the market, so we decided a decade ago to focus on enterprise.” Today, MoxiWorks boasts a half-dozen 7-figure customers in its mix of 3500 brokerages. He confirmed that their first customer was a large enterprise customer they still serve. “It gave us the experience of having a large enterprise customer from day 1. If you are customer focused and can interact, refine, and use as a reference, it’s a luxury,” revealed the CEO.

Multi-year deals outperform “onesie-twosie deals”

The CEO continued his stumping for enterprise by sharing, “With enterprise, the customers are full-service brokerages. They are better run, more profitable, and don’t rely on ‘experimental’ funding that can dry up in uncertain times.” Baur admitted to preferring upfront multi-year deals with enterprises to ‘onesie-twosie deals’, adding, “If I could give one piece of advice, it would be to generate something for enterprise. It’s harder to sell initially, but it’s much more durable and stable over time.”

Brokerage ARR ranges from $50k to single-digit millions

When Latka queried Baur on the average amount a brokerage pays per year, the CEO noted that it varies wildly, from small firms paying $50k ARR to middle markets paying $100-500k ARR to the half-dozen customers hitting 7-figure per year. Baur shared that their largest customer is Anywhere. He explained, “They are the largest real estate entity in the US, with 200,000 agents across the 7 franchise brands like Coldwell Banker, Sotheby’s, and Century 21.”

3500 brokerage entities, 400,000 agents with platform access

MoxiWorks touches 400,000 real estate agents across 3500 brokerages with some combination of its cloud platform solutions. Baur again reiterated his stance, “I have an enterprise and B2C background, so I was tempted to go after agents. But that’s really a consumer business. It masquerades as a business, but agents act like consumers: CAC is high, support burden is high, and they churn like crazy. I learned that quickly.”

$50m ARR, heading to $100m

Because the pricing volume is more stratified than a typical B2B, Latka discovered that calculating MoxiWork’ ARR wasn’t as easy as multiplying 3500 by $50k. Instead, Baur indicated that the company is at around $50m ARR but expects to break $100m in 2-3 years. The CEO attributes the rapid growth to healthy expansion revenue from ARPU expansion and COLA on multi-year deals.

Managing accelerators in multi-year deals

The CEO revealed that they’ve integrated accelerators many times into their multi-year deals, admitting that “Sometimes they’re hard to get over the finish line.” He shared that most deals feature COLA or cost of living accelerator. “We phrase it so it sounds reasonable.” He indicated that they occasionally include performance accelerators in some instances, where the company is paid incrementally for driving specific results.

System supports upsells, includes 150 partners in ecosystem

Baur explained that they do deals for entire enterprises, typically by offering a single or subset of a product family. Subsequent growth comes from customers adding products, as well as the portion they’re paid from the 150 product partners who support the MoxiCloud ecosystem. “It’s about selling more of the product family,” clarified the CEO.

CEO recruited to join 10 years ago, 1 year after spin-off

Latka queried Baur on why he chose to come in as a CEO instead of building his own company. “The entrepreneur’s journey is a lonely one. I’ve developed an expertise in multiplying family businesses. I turned an embryonic thing into a pretty good mature business for them,” Baur thoughtfully explained. He confirmed that he enjoys a decent cash package plus equity-based incentives. The CEO further noted, “When you can come into something with some traction, it accelerates your ability to grow from there. I prefer a smaller piece of a bigger pie.”

0 to 1 vs. 1 to 10

“Some people love 0 to 1. Some prefer 1 to 10. I wonder about the 1 to 10,” mused Latka. The interviewer added, “Most CEOS comps in this situation are making $250-350K and an equity slug in the 5-20% range.” Baur responded, “I’ve done 0-1. It’s harder. The fail rate is really high. Been there, done that. My career has spanned from Microsoft to startups.” He advised, “Do what you prefer, and know it can vary throughout your career.”

PE Vector Capital joins in 2019

In a majority buyout, private equity firm Vector Capital became MoxiWorks’ capital partner in 2019. Three previous customer investors remained customers and investors of significance. Baur confirmed that this trio represents half of the six 7-figure customers served today.

Working with a PE with $4B+ AUM

“What’s it like working with private equity?” asked Latka, pointing out that Vector Capital’s $4B+ AUM would appear to open the door for acquisitions. “We’ve done 3 so far in 3 years. But Vector and I are very disciplined,” responded the CEO. “There’s a difference in approach between PE and VC. PE is more disciplined and better in market slowdowns,” Baur shared. He added that Vector Capital is the oldest tech-only private equity in the country, still run by the same founder.

Board of 7 delivers expertise and perspective

Baur shared that he prefers small boards, like their 7. “We have Vector’s expertise, plus customers who sit on the board. It’s good for me as CEO to draw on that expertise and get alternate perspectives. It’s a collaborative approach,” the CEO revealed.

Famous 5

Favorite Book: CEO York Baur went “way back” to select his favorite book, Well Made in America by Peter C. Reid. “I’m a big motorcycle guy, and the book covers interesting lessons about Harley-Davidson,” he explained.

CEO he’s following: “It’s controversial, but I do watch what Musk does. I don’t agree with all, but (Musk) challenges us to think outside the box. It’s a trite phrase, but he actually does it, and I find it helpful to spur thought,” the CEO thoughtfully shared.

Favorite online tool: “I’m not sure there’s just one. I will say that having immediate access to PE and VC information is helpful. I find it important to have a multitude of perspectives,” York shared.

Balance: York quipped, “I’m old, so I get 6 or 7 hours of sleep per night.” The 58-year-old added that he’s been married for over 3 decades with two kids. “One is a data scientist at 31. And my daughter was working at MoxiWorks but is now trying to be an entrepreneur with her Olympian influencer husband.”

What does he wish he had known at 20? “It’s the same thing you hear a lot. Go ahead and take the entrepreneurial route. Start early with entrepreneurship. It doesn’t get any easier when you have a family.”