Bootstrapped entrepreneur Austin Mac Nab’s entire adult life has focused on learning payment processing. His dedication has led to the creation of Vizy Pay, a payment processing software that makes it easy for rural businesses to implement POS systems.

Mac Nab sits down with Nathan Latka to discuss how Vizy Pay achieved millions without venture-backed capital.

- $1.5M a month with 130 employees

- In payment processing for over 18 years

- Processes over 16M transactions a month and over $2B processing volume

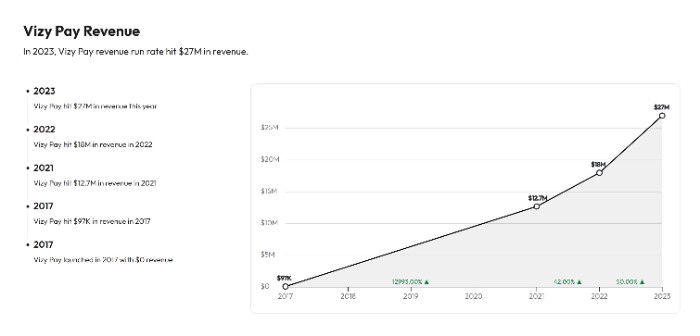

How Vizy Pay grew to $18M a year revenue

When Vizy Pay started, Founder Austin Mac Nab found himself using traditional sales methods to expose local businesses to the software.

“I actually went door to door, like any sales individual would, to sign deals up,” explains Mac Nab. His efforts helped the company grow from $97k in 2017 to $18M in 2022

Processes over 16M transactions a month

Vizy Pay’s software works with multiple types of businesses including restaurants, retailers, and small business operations.

“These small rural towns in America are being underserved. When they want to level up, the technology is way too robust and way too costly, therefore they resist,” Mac Nab illustrates.

As the primary payment system, the company generates 16M transitions every month.

Giving away equipment worth $2,000 – $3,000 for free

Vizy Pay wants to make its offer appealing to smaller businesses that make up most of rural America. In doing so, they’ve created a payment option that allows retailers to receive $2,000 – $3,000 worth of equipment for free.

In exchange, the retailers must sign a term with Vizy Pay for 36 months. The exchange gives retailers more payment options to please customers and process more payments.

Forecasting $27M with 3 pillars of growth

To raise revenue from $18M a year to $27M, Vizy Pay believes there are three main pillars of growth. Their account manager channel will improve lifetime value, their 1099 independent contractors will close leads, and social media marketing will attract new customers.

The small team allows them to pivot easily compared to competitors like Toast.

Vizy Pay offers 3 payment options to over 10,000 clients

To fit mom-and-pop shops in America, Vizy Pay has adjusted its pricing structure over time. They now offer three payment solutions: customers can buy the equipment upfront and then pay month to month, pay month to month for the service, or they can opt for a 36-month term for free equipment installment.

Charging additional 1%-3% card fees for revenue growth

The bulk of revenue Vizy Pay earns is not from monthly payment plans or software equipment purchases.

Instead, it comes from charging additional fees when processing interchange costs. If AMEX charges a 3% fee, Vizy pay will add an additional 1% to the business as the total cost. In total, Vizy Pay processes over 57M credit card swipes a year.

Processing over $2B transactions in a single year

Vizy Pay ends up processing over $2B through its millions of transactions. Most companies even have multiple pieces of software included in their brick-and-mortar. Averaging 2 systems for every customer, Vizy Pay has over 20,000 pieces of software installed in rural SMBs.

Companies have the option to pay for the equipment upfront or pay monthly for access.

Launched Vizy Pay in 2017 but has been in financing for 17 years

The success of Vizy Pay isn’t without merit. Mac Nab has been in the payment processing industry for over 18 years. “I’ve been in this space my whole adult life. I’m 38 now, so I’ve been doing it for a while.

Probably one of the best industries to be in” The experience has led Mac Nab to understand his target audience and pivot quickly when needed.

Austin Mac Nab has net worth of $18M

To this point, Vizy Pay hasn’t received a single dollar from venture capital, angel investors, or other forms of outside investment. Mac Nab has bootstrapped the entire company’s revenue.

While bigger competitors are able to leverage more resources, Vizy Pay has the advantage of speed. “What we do have is we’re like a speed boat, we can pivot at any moment. These guys are like the Titanic, if they have to pivot they can’t move quickly.”

Company culture key to 40% forecasted revenue growth

Mac Nab believes the primary reason for Vizy Pay’s success is the culture the company has cultivated. “Our clients aren’t number one,” Mac Nab clarifies, “our number one person we focus on is company culture in our organization.”

The company focuses on diversity when hiring, minorities and women make up a majority of employees within the business.

Famous 5

Favorite book: Mac Nab gets asked this question a lot but doesn’t have a favorite book. Their favorite book is the one they write every day.

CEO they follow: No specific CEO but they follow several in the industry. “I wouldn’t say there is one specific one that stands out, but I follow a lot in our industry.”

Favorite Tool: LinkedIn. “The most underused tool in the world I think and we use it to the till.”

Situation: The 38-year-old entrepreneur manages to fit in 7 hours of sleep a night even though he has three kids and has been married for almost 20 years.

Something he wish he knew when he was 20: Mac Nab wishes he understood what empathy really meant. “I’ve learned a lot more now growing this organization.”