We recently sat down with Ariel Assaraf, CEO at Coralogix, to discuss the company’s remarkable journey and ascent. Coralogix Software as a Service (SaaS) core product is a stateful streaming analytics platform for observability data to produce real-time insights and trend analysis for logs, metrics, and security without the need to index and store data.

Today, Coralogix generates impressive financials, overcoming its early struggles:

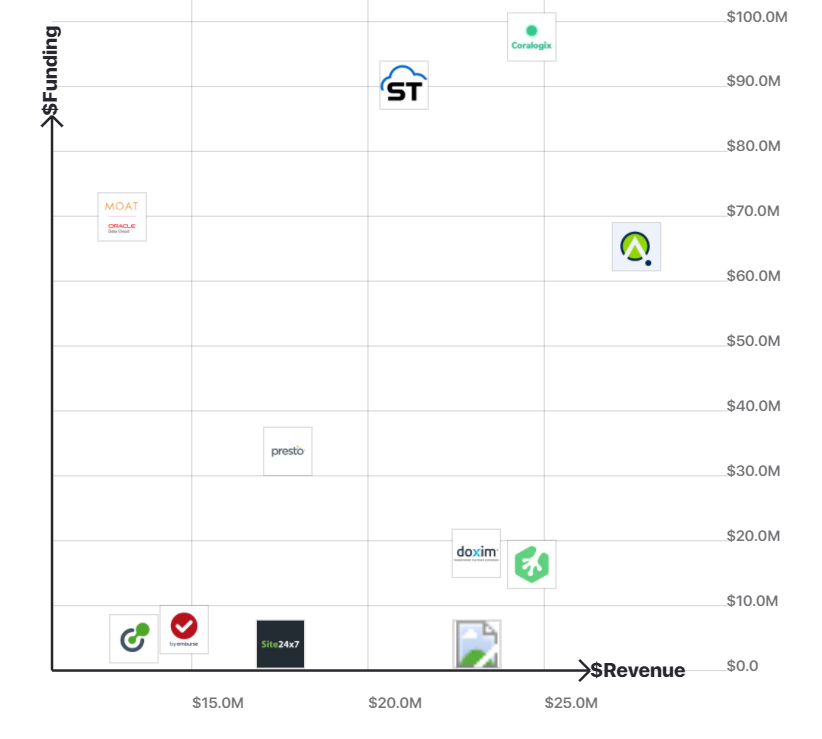

- $24 Million Annual Recurring Revenue (ARR)

- 32% in expansion revenue annually

- Remarkably low gross churn annually of just 2%

- Turned down a $40 million acquisition offer in 2019; now valued at $400 million

Data Needs Grow 510X Faster Than Revenue

The observability, logging, metrics, security, and tracing space have evolved over time. It started more than 20 years ago and moved from appliance to software and then to SaaS. The concept was to ingest all of your data, index it and store it. In essence, create a platform to become the Google for your organization, operations, and security.

“It worked great at the time,” said Assaraf. “Because the amount of data 20 years ago was something that could be handled like that.” Over time, though, data has grown exponentially. In 2020, more than 2.5 quintillion bytes of data were created every day. That’s 2.5 followed by 17 zeros.

While individual companies produce far less than that, the amount of data has simply become unwieldy for most organizations. As much as 73% of all the existing data within organizations goes untapped and unanalyzed. There’s simply too much data being generated and the amount gets bigger every day.

“We told our customers and our investors in the previous round, data grows faster than revenue,” he said.

When you talk to a company about their performance, they’ll give you some insane KPI of growth, Assaraf said. But when you ask how much their data grew during that time, you get an answer like 510X.

“As data grows faster than revenue, it becomes hard to manage, super expensive, and hard to scale,” he said. “Performance issues start to rise.”

Humble Beginning: Zero Revenue, Zero Customers

In 2014, Coralogix jumped into the data observability market with a lighter version of Splunk, a popular data platform for searching, monitoring, and analyzing machine-generated data. Coralogix launched a less-expensive, cloud version and began its evolutionary journey.

“We saw that customers weren’t looking just for a solution that can do whatever the others can because their model started to break,” Assaraf said. “Cost containment was impossible. Performance was an issue.”

But that didn’t break instant success. The first three or four years were difficult. “The company was zero revenue, zero customers,” Assaraf said. “It was almost shut down.”

It’s a common story with tech startups with exceptionally high failure rates. Over a 10-year period, some 90% of startups fail. 70% fail in the period between years 2 and 5. Out of the 5,000 startups that are founded each year, slightly more than 20% are able to raise a Series A round. Yet, of those that can get Series A funding, less than 10% ever reach the next stage of investment.

For Coralogix, the first dollar didn’t come until October 2017.

Meantime, the company’s board started to question whether it was time to shut the doors and give money back to the early investors. The CEO had left, the CTO left, and the company was at the breaking point.

The company needed restructuring and a new plan.

Generating $25,000 of Monthly Recurring Revenue

There comes a point in every startup’s lifecycle where they either die a painful death or they turn the corner. Just as the Board was on the verge of pulling the plug, customer acquisition took off. Within five months of the first dollar coming in and the restructuring, revenue started to build.

Revenue built rapidly, reaching $25,000 of monthly recurring revenue by early 2018. The Board gave Coralogix another $2.5 million. The additional investment round accelerated growth even further. Success begat success. The evaluation jumped to $10 million.

And then something really interesting happened.

Turning Down a $40m Acquisition Offer in 2019

Coralogix received an acquisition offer for $40 million. It was tempting to say the least.

“We had so much trouble getting this off the ground,” Assaraf said. “People on the Board and in the company started to get tired.” The company was still only 8 people at this point and the offer was serious money on the table. It got all the way to the signature stage.

“We were really fortunate to get the stage,” he said. “You know, everyone says ‘I want to grow a big company, I don’t want to sell.’ Then an acquisition offer comes in and now you’re sitting in front of something that is real.”

All you have to do is sign your name and walk away with millions of dollars in your pocket and live a good life or start another venture. The easy play is to take the money. For most startups and VCs, it’s living the dream. Founders cash out. Investors get repaid at a premium. Everybody’s happy.

Well, not everyone.

By now, ARR had grown to $1.4 million. There’s been $10 million raised at a $30 to $40 million valuation, a significantly high multiple for a company that was struggling just a few years ago.

In the week before the Board was ready to agree to sell, the founders decided they wanted to keep the company going. They found another investor. The Board rejected the acquisition offer and agreed to stay the course.

By December of 2019, growth continued. ARR had doubled to around $2.8 million.

Then COVID hit.

Despite COVID, a $25 Million Investment

The company had hired its first New York-based sales team. Assaraf went to meet with them on the 10th of March 2020 for training and onboarding when everything changed. As news of COVID spread, everything started to get locked down in the US and Israel.

“Everyone was shocked,” he said. “New York became hell. No one would take our calls, no one was answering our emails. It was a mess.”

Like much of the world, everything literally stopped. Customer acquisition stalled. Growth plateaued. It was starting to look like rejecting the acquisition offer was the wrong move.

However, Coralogix had a game-changing product in development: Streama©.

Streama flipped the ingestion pipeline using a stateful stream without the need to store or index data.

At the time, everyone had to gather the data, store it, index it, and then analyze it. “They run period queries on the data, run aggregation of the storage, and run dashboard from the storage,” Assaraf said. “It’s expensive, slow, and limits the level of analytics you can do. Streama analyzes everything in real-time, including stateful things without storing the data.”

Cloud adoption has become ubiquitous in business. As much as 92% of companies’ IT environments are now dependent on cloud resources and technology and analysts expect that number to grow even larger in the future. Average cloud spending has grown by 59% in the past two years and accounted for $73.8 million in 2020.

The rapid adoption of cloud resources has provided significant business benefits, not the least of which is greater mobility. However, the cost of cloud resources, and specifically data storage, is also taking a larger part of company budgets.

Streama provided a way to reduce storage costs at the same time improving performance.

“We started with 3 very big international clients spending half a million dollars a year for our services, and we reduced that to less than $200,000. So, we created massive savings, and that allowed them to scale,” Assaraf explained. “Because they already had that budget, they could stop thinking about whether or not to connect new data. They just pour in a lot more data and get better observability.”

For Coralogix, Streama was a new play that broadened the company’s use cases from logs to metrics, security, traces, and soon business intelligence.

Still, it’s a hard thing to explain to an investor, Assaraf said, especially at a time when you’re not growing. But they did it. Another investment round came in and the company was poised for even greater growth. VCs pitched in another $25 million.

By 2020, the valuation had grown to roughly $100 million.

$90 Million Series A, Series B, Series C Funding

With the launch of Streama, the company announced a $25 million Series B round, led by Red Dot Capital Partners and O.G. Tech Ventures. The round also included existing investors Aleph VC, Stage One Ventures, JanVest Capital Partners, and 2B Angels.

This followed a $10 million Series A round from November 2019 led by Aleph with participation from StageOne Ventures, Janvest Capital Partners, and 2B Angels

Most recently, Coralogix added $55 million in Series C funding. This round was led by Greenfield Partners, with Red Dot Capital Partners, StageOne Ventures, Eyal Ofer’s O.G. Tech, Janvest Capital Partners, Maor Investments, and 2B Angels also participating.

The dramatic shift in digital transformation is generating an explosion of data, which until now has forced enterprises to decide between cost and coverage,” said Shay Grinfeld, managing partner at Greenfield Partners in announcing the Series C funding. “Coralogix’s real-time streaming analytics pipeline employs proprietary algorithms to break this tradeoff and generate significant cost savings. Coralogix has built a customer roster that comprises some of the largest and most innovative companies in the world. We’re thrilled to partner with Ariel and the Coralogix team on their journey to reinvent the future of data observability.”

Moving forward, Coralogix sees Streama as the foundation for what it calls the data-less data platform.

Analytics pipelines provide all of the real-time and long-term insights you need to monitor applications and systems without needing to store the data. At the same time, Streama allows power query capability for archived data without having been indexed.

This allows companies to send all of their data for analysis without worrying about quotas, retention, or throttling.

Generating Net Revenue Retention of 130%

Saying Streama was a success is an understatement. Today, Coralogix is generating some $2 million in MRR and $24 million in annual recurring revenue. More than two dozen accounts are billing more than $100k, four accounts have an annual contract value (ACV) at half a million dollars, and one account is valued at $1m ACV.

The team has grown to 70 engineers and 100 total employees.

Most remarkably, the company has an exceptionally low churn rate among customers. In SaaS, the average churn rate is around 5%, although some startups see substantially higher churn. At Coralogix, the annual gross churn is just 2%.

When you’re expanding revenue by 32% annually — with minimal churn — you’re setting the stage for explosive growth. The median net revenue retention rate for SaaS companies is 100%. Even with expanding staff and re-investment, net revenue retention at Coralogix is 130%.

Consulting Services: $5M to $10M Secondary on Top of $55M

“We’re at a point where we’re starting to really broaden the opportunity and the offering,” Assaraf explained. “We have this technology that can analyze in real-time without storage. Why stop with observability?”

The tech seemed like a logical fit for security.

“When we asked people how much they increased their spend in the past two years on security products, we heard answers between 4X and 10X,” he said. “And then, we asked how much more secure they feel in the organization and how did their security posture improve? The most common answer is a bit more or none.”

There had to be a better way.

Most security tools on the market produce a lot of insights, but companies often don’t know what to do with them or how to defend themselves. “There’s a huge gap of information and knowledge,” Assaraf said.

In July 2021, Coralogix launched a consulting service with a $5-$10 million secondary on top of a $55 million revenue round.

“We launched a security offering that was very powerful, including professional consulting,” Assaraf explained. Consulting helps companies optimize their use of the data that goes beyond observability and logging.

VCs typically hate the word consulting, but some of the highest net retention companies add consulting to the product offerings and create sticky customers. With Coralogix, adding on consulting led to a significant increase in revenue.

For example, DevOps and platform engineers know data, but now, as everyone adds in a security component, there aren’t as many DevSecOps engineers. Many are highly skilled in DevOps, but they now have new responsibilities around securing resources. They need help.

Growing to 2,000 Customers, ACV of $12,000

By adding product lines and finding additional use cases, Coralogix continues to expand its customer base and increase revenue. The company has more than 2,000 customers with an annual contract value (ACV) of $12,000.

“We have so many ways for customers to reduce cost because we help customers prioritize data by use and then find ways to eliminate these costs,” Assaraf said. “And we have multiple offerings that the customers buy. They start with log, and then they’ll buy metrics, and then they will buy security.”

In the near future, he said, customers will also buy tracing.

“It gives the customer a sense of unification of data,” he said. “People want to see everything in the same place in the same dashboard.”

This strategy helps drive both gross retention and net retention and solves two important industry concerns.

Solving Industry Problems

It also solves two significant industry problems. Even as cloud adoption has proliferated, it hasn’t reduced the amount of data living in siloes and the high costs of acquiring and preparing data.

The average company is now using 110 different SaaS applications. It’s pretty easy to build silos of data and make accurate analysis nearly impossible.

The sheer volume of data available and the prep work required for use also make things challenging. As much as 80% of the workload for data scientists and IT teams is spent cleaning the data to make it usable. The data pipeline continues to grow as well. 93% of data professionals say they expect their data pipelines to increase by the end of 2021. An even higher number (96%) said they are already at or over capacity.

Coralogix solves many of these challenges by providing real-time data without the need for storage.

“It’s about high-volume, but low-value data,” Assaraf said. “Customers don’t want to store the data [or index it] but want to view it live and visualize it. We are starting to see a use case where business information and our analytics come together for sentiment analysis and other areas.”

Real-Time Analysis, Monitoring, Visualization, and Alerting, Resulting in Savings of Up To 70%

The Coralogix platform provides real-time analysis, monitoring, visualization, and alerting. Coralogix turns cluttered log data into a meaningful set of templates and flows, allowing users to quickly analyze and solve production problems.

Many companies deploying the Coralogix platform also report savings of up to 70% using data prioritization.

Coralogix describes its solutions for businesses across several use cases, including:

- Log monitoring: Proactive analysis and monitoring of log data without the need to index with no overage or cost limitations.

- CI/CD acceleration: Full system visibility and correlation of real-time insights with specific releases without the restrictive costs of other solutions.

- Cost optimization: Significant reductions to Total Cost of Ownership (TCO) with data prioritization before storing and indexing data in your observability stack.

- AWS observability: full observability and alerting for AWS cloud-native applications.

- Alternative to homegrown observability stacks: A fully-managed analytics and observability platform that scales effortlessly so you can stop stressing about maintaining your homegrown observability stack.

- Contextual data analysis: Adding context and deeper system observability by ingesting small pockets of data that can be correlated to system health and errors with AI/ML-powered contextual alerting.

Also, the Coralogix platform provides robust cloud security. You can secure your cloud environment in minutes by deploying Security as a Code to provide automated coverage for security and compliance.

Average Annual Revenue per Employee 44% Higher Than Average SaaS Firm

SaaS firms typically see an average revenue per employee of $166,000. At Coralogix, it’s more like $240,000 in revenue per employee. It’s 44% higher than the industry average. It’s also nearly triple what the average private VC-based SaaS company procures, according to Assaraf.

The number will go down as you start hiring more employees, but will rise again assuming growth continues on a similar track. Coralogix is growing fast. Two and a half years ago, there were 8 employees. “A year from now, we’ll cross the 200 people mark,” Assaraf predicts.

Anticipating the Competition

When you are successful, competitors start to creep into your space. It happens in every industry and every product category. Assaraf expects some of the big-name platforms to jump into the space. “It just makes no sense for companies that control a lot of data and charge for that data not to get into that space,” he said.

One major difference between Coralogix and many of its potential competitors is that the Coralogix platform reduces storage costs. For companies that generate significant revenue from data storage, however, launching a streaming data platform can undercut their core product.

Cleaning the Cap Table at 25X Return

Having already rejected one acquisition attempt, Assaraf said the company is not thinking about an acquisition. “There’s no real urge to go ahead and sell the company.” In fact, Coralogix has been cleaning up a lot of the cap table from early investors by offering pre-emptive deals.

Many investors that signed on early felt like they were going to lose everything just a few short years ago, so when they found out they could cash out at a significant profit of 20X to 25X, many sold, Assaraf said, and that made the cap table a lot cleaner.

“Our goal now is to grow the company,” Assaraf said. “We have a pretty decent runway and a lot of freedom to grow and expand, build more products and more offerings.”

From Military Intelligence to Entrepreneur

Israel produces more startups per capita than any other country globally and an astounding number of entrepreneurs have emerged from Israel’s elite military and cyber intelligence agencies. Cyberspies, it turns out, make good entrepreneurs.

Unlike the US and many other countries, military conscription is compulsory in Israel. Although only half of the conscripts eventually serve, intelligence units attract some of the top talent in the country. Getting chosen to a unit such as the 8200, for example, is incredibly challenging. With a size of roughly 5,000, getting selected is much harder than getting into the Silicon Valley feeder schools such as Harvard, Princeton, MIT, or Stanford.

New recruits also have access to some of the best training in the world. The unit takes on some of the biggest security challenges in the world and runs in many ways similar to the way startups work. It’s become a launching pad for entrepreneurs.

Assaraf started his career in the Israeli intelligence unit of 8200 and learned the lessons which have served him well throughout his career. The Coralogix team has a mix of team members from the 8200 unit, unit 81, and pilots. Nearly 80% of the board members were pilots in the past.

He later joined Verint Systems to work on Homeland Security before cofounding Coralogix in 2015.

Advice for the 20-Year-Old You: Ambition Never Ends

“If you would have asked me at 20 years old, you can take $5 million, or you can take $10 million home,” Assaraf said. “I would have said I’d retire. But it seems like the more you have, the bigger your company is, the more assets you have, it only accelerates your passion and your willingness to sacrifice.”

The 20-year-old would think you can chill and have more time with family and friends and relax, but for many, it’s actually the opposite. With many of the CEOs and other execs that Assaraf meets, he said it seems the higher they go, the harder they work.

For most people, the thought of becoming a millionaire at age 30 and retiring would be a dream come true. Given the chance, most people would jump at that opportunity. Assaraf had the option at age 29 when buyers were calling. He and his partners turned it down.

“Ambition,” he said, “never reaches an end for entrepreneurs.”