Machiavelli once stated, “Entrepreneurs are simply those who understand that there is little difference between obstacle and opportunity and are able to turn both to their advantage.” Such is the case with musician-turned-serial-entrepreneur Darren Gallop, CEO and Co-founder of Carbide Security.

When he sat down with the GetLatka team, the CEO revealed how his second SaaS, a VC-backed cybersecurity platform, resulted from the challenges he faced doing business at bootstrapped Marcato, a backend platform for live events and his first SaaS venture. Discover from Gallop how he compares bootstrapping to VC funding, which he would choose for his next venture, and why he takes a contrarian stand to closing funding when the market is compressed.

- $2m+ ARR, targeting $4m+ ARR by year’s end

- 190 customers, SMBs

- $7500-$30,000 ACV

- Team of 34, up from 16 a year ago

Solving cybersecurity and privacy for 190 SMBs serving government and enterprise

“The majority of our 190 customers are selling a SaaS type product and handling some degree of confidential information, like healthcare or financial. They’re selling to government or enterprise and are being required to comply with a variety of cybersecurity best practices, standards, and frameworks like SOC2 or a 27001 audit, and various data privacy like GDPR in Europe and now state-based privacy acts,” explained Co-founder Gallop.

He continued, saying “They come in, they don’t have a sophisticated enterprise-grade system in their SMB. They’re using our platform and resources to build, manage, and effectively report that back to their customers.”

$7500-$30K ACV for enterprise version of Vanta

According to Gallop, Carbide is an enterprise version of Vanta. “We compete with them in the SOC2 example, but we are more of an enterprise-grade version of Vanta. We come in not when they need a fast and dirty SOC2 audit, but more when they have more complex needs and multi-compliant environments or are required to do more.”

The CEO added that their ACV ranges from $7500 to $30,000. He added that their smaller SMBs have 20-30 employees, while their average customer employs 150-250 people.

Launched Marcato, first SaaS, in 2007, exited in 2018

Gallop turned his pro musician career in his 20s into his first SaaS in 2007. Marcato is a backend logistic management platform for music festivals and cultural events. “By 2014, we were doing massive events like Bonnaroo, Coachella, Burning Man, and X-Games.”

He continued, “We were doing $2m in ARR and profitable with a team of 14 and 300 worldwide events. We exited in 2018 in a PE rollup with a 5-10x multiple. I was pretty stoked to get out of events when we did (before the pandemic).”

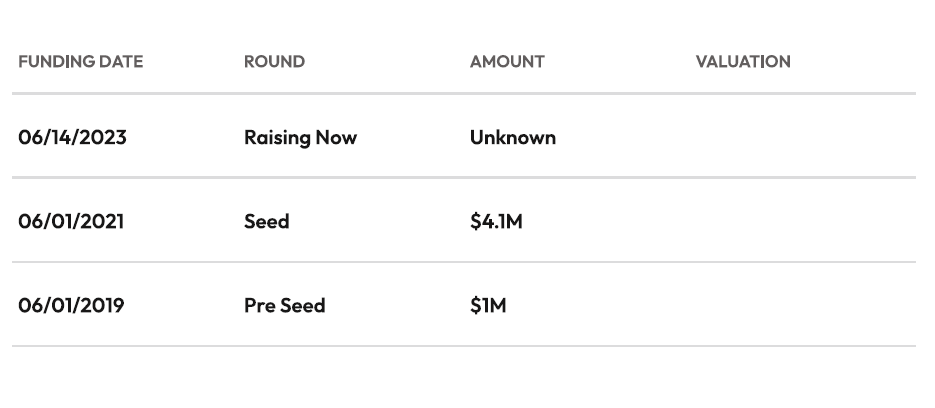

Carbide launches in 2019 with $1m preseed round

“I was frustrated by all the security protocols we had to do at Marcato. As we worked with corporate-owned events, we got put through rigorous cybersecurity assessments. Keeping the company trustworthy on the security front became my focus.

That forced me to get pretty knowledgeable on the topic,” explained CEO Gallop. He and his Co-founder began working on Carbide as Marcato was being sold. They closed a $1m preseed round in 2019 and a $4.1m seed round in 2021, with $500,000 in ARR. “We used the funds to double down on sales and leadership teams to formalize business. We put more energy behind sales and marketing.”

$2m bootstrap vs. VC-backed

Latka paused to help Gallop appreciate his efforts: “I think that’s the new American Dream. $2m bootstrapped, a profitable software company with 14 employees. People don’t celebrate that enough. I think that’s fantastic,” adding, “How do you compare bootstrapping do what you want vs. VC, answering to a board?”

The Co-founder replied, “Your small exit could be just as good as a much larger exit when you have classes of shares and some venture debt piled on. There’s a lot of BS associated with it.”

Managing the unpredictability

“It’s hard to predict how your board members and investors will react to things in the macro environment, your business, their world, and their fund. It becomes another thing to manage. I like to build products, solve problems, and talk to customers.

Everything else you pile onto your business atop that is just extra.” He concluded that “next time,” he would probably bootstrap and look at capital later. Latka added, “I know way more broke VC founders than broke bootstrapped founders.”

3 feature tiers of pricing plus expertise services

Currently, Carbide offers 3 tiers of pricing based on feature tiers, as well as a layer of what Gallop calls “A heightened degree of expertise: experts who can run workshops and upskill your team.” When Latka asked if he had any per-unit pricing, the CEO replied, “Now that we’re launching more stuff with AI, we have thresholds in those tiers. I expect per quota costs to come.”

$2m ARR today, target $4m by end of 2023 with 34 FTEs

Gallop confirmed that their current ARR is over $2m, and he expects to hit $4m by the end of the year. He has more than doubled his workforce from 16 in 2021 to 34 today. The CEO is considering a Series A if the offer is right. Latka asked why he would do a deal with a compressed market, to which the CEO replied, “When everyone says it’s a bad time to do something, sometimes it’s a surprisingly good time to do something. There’s a lot of venture companies out there right now. A lot of dry powder. Many companies are flatlining right now, struggling to hit their targets, but we are closing a lot of business month over month.”

Defining a good Series A deal? 12-18%

Latka asked Gallop why raise when you’re 105% of target this year and could be cash flow positive by the end of the year. The CEO replied, “We’ve got different actions that are working, and we want to put more velocity behind it because it’s working. The time to raise capital is when you have the ability to spend money and know that it’s going to result in revenue growth.” As he and Latka discussed dilution as a function of valuation and money raised, the Co-founder concluded, “I think most good deals fall between 12-18% in a Series A-style round.”

Famous 5

Favorite Book: CEO and Co-founder Gallop shared that he currently spends his time on blogs and new cyberstandards. Therefore, he doesn’t have a favorite book right now.

CEO he’s following: “No one,” Gallop succinctly replied.

Favorite online tool: Gallop chose Asana as his favorite tool, stating, “It’s pretty important to us.”

Balance: He gets 7-9 hours of sleep per night. He’s 48, married with no children.

What does he wish he had known at 20? “I could do a whole podcast on that,” he said, adding, “Take more time to focus on the customers and less time on a lot of other things that become distracting.”