COO and Co-Founder Dan Zavorotny lamented that he didn’t take the risk of starting his own company in his 20s. But he’s quickly made up for lost time, as his DTC metabolic health SaaS Nutrisense exploded on the scene in 2019 and is now one of the fastest-growing startups in America. Zavorotny recently chatted with the GetLatka team about his accelerated journey, including how he extended average churn from 3 weeks to 8 months, how he got revenue before building product or raising capital, and why he segments his view of CAC/LTV into 3.

- $3.2m MRR, up 3X from a year ago

- Team of 170, with 25 engineers, 25 marketing

- 50,000 total customers to date

- 15-16,000 average customers per month

DTC healthcare SaaS monitors glucose for $2200 per year, $225 ARPU

Nutrisense is a direct-to-consumer metabolic healthcare SaaS that specifically monitors glucose levels in real time, according to Co-founder Zavorotny. When asked if they’re purely DTC, he replied, “In healthcare, it’s hard to go B2B. The trend is to go D to C, show folks what’s possible, then push the industry into a B2B.” Their glucose monitoring kit includes a pair of monthly hardware units, analytics, and access to a dietician to coach you through the data, at a cost of $189-$225 per month, depending on the subscription plan length.

Monthly disposable monitoring hardware costs $80-$120

While subscribers pay $189-$225 per month for Nutrisense, $80-$120 of that revenue is consumed by the cost of the disposable hardware sensors from third-party manufacturers like Medtronic and Eversense. “The hardware is still pretty innovative; it’s at the cutting edge of technology. As it continues to become more effective, the medical community expands the codes for what it can do. Tracking started at 4 hours, and now it can track 14 days at a time,” explained the COO. As a result, Nutrisense customers receive two monitors per month.

Variable subscription plans, targeting 3:1 contribution margin LTV to CAC

Currently, the average Nutrisense customer stays on plan for 7-8 months. “When we started, customers stayed 3 weeks. Now we’ve iterated, and people are staying 8 months on average. Now, once we have someone in the funnel, we have the ability to convince them to stay longer. We connect with them monthly to discuss the next health problem they want to solve,” the Co-founder noted, explaining that although anything over 1:1 covers fixed costs, they strive for a 3:1 contribution margin of LTV to CAC.

CAC averages $200, varies by channel from free to $300

When asked about their average CAC, Zavorotny indicated that it varies depending on the channel. “It’s a mix based on Instagram, Twitter, Quora, Pinterest, YouTube, and Influencers. All the channels you can think of,” he clarified. New customers are offered subscription plans for 1, 3, 6, and 12 months. The COO added that in the early days, they asked customers to prepay to help fund the company, but now they offer monthly payments, making the product more affordable and accessible for some customers.

Complex medical system limits competition

Navigating the complexity of consumer medical devices has mitigated the number of competitors. “Many don’t want to tackle it: medical, hardware devices, software, and the human component. It’s a hard problem to solve,” shared the COO. He explained that to onboard a new customer, he must pay a 3rd party for an online consultation. They write the prescription if they believe the device is right for the individual. Then it’s routed to a pharmacy partner to fulfill. “We take all the risk up to this point,” Zavorotny added, noting that they also pay for a dietician who coaches the customers through their data.

Gross margin reaches 40-50% as company scales with 15-16,000 monthly customers.

Unit economics, reduced churn, and extended LTV to 8 months have helped Nutrisense scale to a 40-50% margin. According to Zavorotny, over 50,000 have paid for at least one month of service, with 15-16,000 customers currently on the monthly plan.

$500 deposits drove revenue before product build or capital raise

Before building Nutrisense, Zavorotny and his partner tested their idea by posting on multiple health-related Facebook groups. They asked if people would be interested in a wearable glucose monitor with real-time data analytics. “We put up a landing page, went to some Facebook groups, and said, pay us $500 if you’re interested, and we will let you know when we are ready.” The response excited the partners. “It took my Co-founder 3 weeks to launch the first version. He drank a lot of coffee,” shared the Co-founder. He added that the Ketogenic diet and Oura ring groups were most responsive to the offer.

$32m raised over 3 rounds

After launching in 2019, Nutrisense received $250,000 from Techstars and an angel investor weeks before the pandemic shutdown, selling about 10% of the company. Next, their Seed Round in early 2021 netted $1.2m for another 15-20%. They added another $5m in funding in late 2021 and $25m in August 2022, selling another standard 10-15%. As Latka accurately guessed the equity sold in each round, Zavorotny quipped, “Wow, you’re really good at this!”

3 customer subgroups

When asked how he calculates churn for customers who drop off but come back, the COO responded that he looks at customers in 3 distinct subgroups:

- 1X users

- Continuous users

- Health check users

“We look at CAC/LTV differently for each. We now know some people use us almost as an annual health check like you would a physical. They’ve come back every year for 3 years so far,” explained Zavorotny.

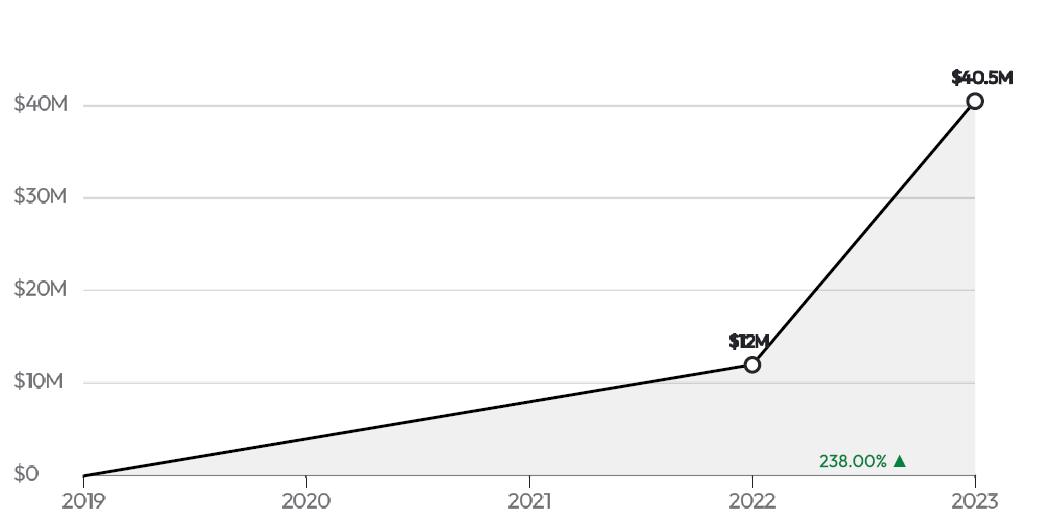

$3.2m MRR, up from $1m MRR one year ago

Zavorotny shared that MRR tripled in the last 12 months, from $1m MRR to $3.2m MRR. Latka queried the COO about the source of the growth. “In the first 2 years, I did all the marketing myself. Now we have a team of 18 doing everything from SEO to paid ads on Facebook, Google, Quora, Pinterest, Twitter, plus influencers and more. We are on all the channels at the same time,” exclaimed the Co-Founder, adding, “We finally made some money so we could buy our .com domain (for tens of thousands of dollars).”

Famous 5

Favorite Book: COO and Co-founder Zavorotny selected The Lean Startup by Eric Ries as his favorite book.

CEO he’s following: Zavorotny chose his own CEO as the one he follows: “My CEO CO-founder is the one I am following most closely, so I can make sure I am complementing his work.”

Favorite online tool: Airtable was Zavorotny’s definitive choice for favorite online tool, noting, “We used it for everything in our first three years.”

Balance: Zavorotny admits he was only getting 5-6 hours of sleep when they started the business. “Now I get 9. I realized that sleep is so critical. Even more critical than the gym and nutrition,” he revealed.

What does he wish he had known at 20? “Having the mindset that failure is part of the process. It’s great not to fail, but worse comes to worst, you learn a bunch, and there’s no risk early, right? What’s the worst that happens? You get a job. That was a fear I always had, and I never took that chance early on, but finally took it as an adult.”