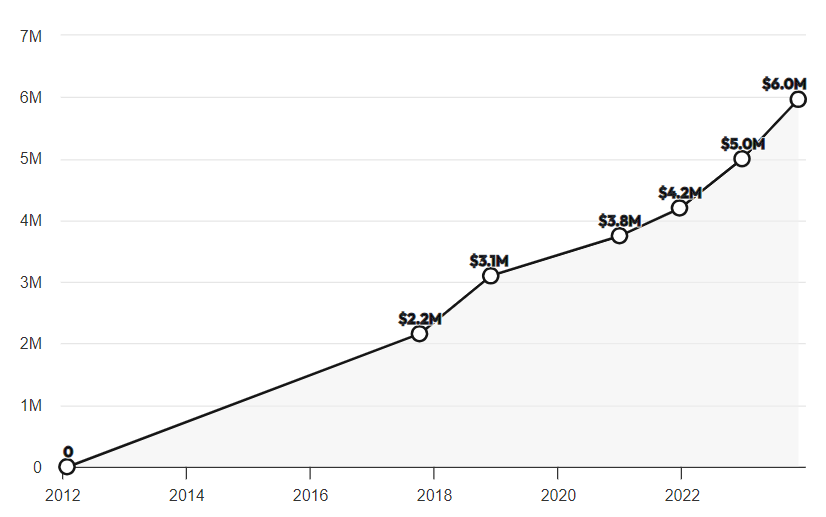

In the competitive and dynamic world of the SaaS industry, the story of BadgerMaps is both unique and inspiring. Based in San Francisco, this innovative software company has carved out a niche for itself by providing a solution that combines Google Maps, CRM data, route optimization, scheduling, and lead generation. Under the leadership of CEO Steve Benson, BadgerMaps has achieved an impressive $6M while maintaining 100% equity, a feat rarely seen in the startup world.

- Launched in 2012, and hit $2m ARR in 2017

- $6m ARR in 2023

- $123 ARPU

- 4100 customers

Bootstrapping the Route to Success

BadgerMaps was founded in 2011, born out of a clear and unmet need within the field sales industry. Recognizing that field sales teams required a more efficient and integrated way to manage their territories, Benson developed a solution that combines the functionalities of Google Maps with crucial CRM data. This innovation allows sales professionals to optimize their travel routes, plan their schedules more effectively, and uncover new leads, thereby increasing efficiency and productivity.

Choosing to bootstrap, BadgerMaps took a path less traveled in the SaaS sector. This decision to self-fund has allowed the company to maintain complete control over its equity. This approach has not only fostered a culture of financial prudence and efficiency but has also enabled BadgerMaps to grow steadily, focusing on generating revenue directly from sales. The company’s use of strategic debt instruments, such as those offered by Founderpath, further highlights its sophisticated understanding of finance within the tech industry.

Leveraging Technology for Field Sales

At the heart of BadgerMaps’ success is its innovative software that revolutionizes how field sales teams operate. By integrating Google Maps with CRM data, the software provides sales teams with a powerful tool to manage their territories. This integration enables route optimization, efficient schedule planning, and proactive lead generation, addressing significant challenges faced by sales professionals in the field.

Mastering Niche Marketing and Customer Engagement

In addition to its technological prowess, BadgerMaps has mastered the art of niche marketing. One notable example is the “Outside Sales Talk” podcast, initiated by Benson. This podcast specifically targets field sales professionals, providing them with valuable insights and information while simultaneously serving as an effective lead-generation tool for BadgerMaps. This approach to niche marketing, focusing on quality engagement rather than sheer numbers, has been pivotal in building a loyal and active customer base.

Strategic Growth and Financial Acumen

The evolution of BadgerMaps is a story marked by consistent growth and strategic financial management. Reflecting on the company’s journey, CEO Steve Benson highlighted key milestones that have defined its path. Starting in 2012, the company broke the million-dollar mark, achieving $1.6 million in revenue. By 2017, BadgerMaps had scaled to $3 million, and in the following years, it further increased its revenue to approximately $4 to $5 million.

In 2023, BadgerMaps reached an impressive $6 million in ARR. This growth has been underpinned by a combination of customer-funded operations and strategic financial maneuvers. Initially, the company secured a modest amount of funding through a friends and family round about a decade ago. Since then, BadgerMaps has primarily relied on bootstrapping, reinvesting revenue generated from product sales back into the business.

An integral part of this journey has been the company’s adept use of debt financing. Over the years, BadgerMaps has worked with several debt providers, adapting its financial strategy to its evolving needs. Currently, the company utilizes Founderpath as its primary debt provider. This capitalization approach, focusing on customer funding and judicious use of debt, has allowed BadgerMaps to grow sustainably while maintaining control over its operations and equity.

Why Debt Financing is Important to Maintain Equity

Steve Benson has been an early and vocal advocate of debt financing in the SaaS industry, a stance that reflects a deep understanding of the sector’s unique financial dynamics. His perspective on equity and venture capital is both pragmatic and insightful, recognizing that SaaS companies don’t always align well with the traditional venture capital model. Benson points out that many SaaS businesses address smaller, niche problems that don’t necessarily exhibit the explosive growth required by venture capitalists to meet their investment criteria.

This understanding has shaped BadgerMaps’ approach to growth and financing. Benson emphasizes that for many SaaS businesses, including BadgerMaps, the combination of debt financing and bootstrapping presents a more suitable path. This strategy allows these companies to grow at a sustainable pace without the pressure to meet the aggressive growth targets often imposed by venture capital funding.

Benson’s approach acknowledges the reality that while some SaaS businesses might start small and find unexpected avenues for significant expansion, many others operate in specialized or crowded markets. These markets might not be attractive to venture capitalists due to perceived limitations in growth potential or market size. However, these businesses can still be highly successful and profitable with strong economics that benefits founders and employees.

BadgerMaps’ Resilience During the COVID-19

Despite the challenges posed by the COVID-19 pandemic, BadgerMaps managed to sustain its growth trajectory, a remarkable feat considering the nature of its business. The pandemic, which severely limited face-to-face interactions, particularly impacted industries reliant on physical routes and in-person meetings, such as those served by BadgerMaps. However, the company demonstrated resilience and adaptability during this period.

In 2020, BadgerMaps did experience a contraction, shrinking by about 8%, as the pandemic disrupted the usual operations of its primary client base – field sales professionals who typically meet customers face-to-face. Despite this setback, the company quickly regained much of its lost revenue. A key factor in this recovery was the diversification of its client base to include field service professionals. This segment, encompassing industries like utilities, HVAC, pool cleaning, and pest control, proved more resilient during the pandemic. These professionals still needed to visit homes and businesses, albeit under new safety protocols, maintaining demand for BadgerMaps’ route planning and territory management solutions.

Moreover, the flexible and adaptive nature of BadgerMaps’ software played a crucial role. The platform’s ability to handle complex scheduling and routing problems proved invaluable, not just for sales teams but also for service providers who had to make real-time decisions about customer visits. By catering to both field sales and service professionals, BadgerMaps was able to navigate through the pandemic’s challenges, underscoring the versatility and essential nature of its offering even in times of crisis.

Marketing Innovation and Customer Service Excellence

An integral part of BadgerMaps’ success is its innovative marketing strategies, such as its engaging homepage animation that succinctly communicates the app’s value proposition. Moreover, the company’s commitment to exceptional customer service, with a capable team managing a high volume of leads, ensures a smooth experience for its users. This commitment extends to compatibility with major CRMs like Salesforce, ensuring seamless integration and user satisfaction.

Scalability Through Partnerships and Operations

BadgerMaps’ scalability is significantly enhanced through strategic partnerships, particularly with Salesforce, which acts as a vital lead-generation channel. The company’s blend of direct sales and customer success efforts has proven effective in catering to a diverse range of clients, from small businesses to large enterprises. This scalability is a testament to the company’s operational efficiency and strategic planning.

Famous 5

Favorite Book: “Impossible to Inevitable”

CEO he’s following: Nathan Latka

Favorite online tool: Google Suite, crucial for productivity.

Balance: Benson prioritizes a balance between work and personal life, ensuring adequate rest even with family commitments.

What does he wish he had known at 20? “How fun being a founder is”