In a world increasingly shaped by innovation and entrepreneurship, the journey from an idea to a successful business venture is fraught with challenges, decisions, and invaluable lessons. This narrative weaves through the experiences of Joe DiPasquale who has navigated both the venture capital (VC) and bootstrapping paths, offering insights into the multifaceted landscape of startup growth, fundraising strategies, and market dynamics.

Starting Journey and Venture into Entrepreneurship

The chronological recount of ventures begins in the late 2000s, detailing the launch of College Wikis in 2006. This venture, born in the heart of Silicon Valley and incubated in the entrepreneurial ecosystem of Stanford’s business school, aimed to create Wikipedia-like sites for colleges. It was a time when digital platforms like Wikipedia and Facebook were gaining unprecedented traction, signaling a ripe moment for advertising-driven business models. Despite raising a Series A, the entrepreneur candidly shares the challenges encountered as the economic landscape shifted dramatically.

Early Ventures and Lessons Learned

The journey continued with the inception of StartOut, a non-profit supporting LGBT entrepreneurs, and Regroup, a company specializing in mass notifications and emergency messaging. Each venture offered unique funding experiences and lessons, from securing grants to navigating the complexities of a SaaS business model. The entrepreneur emphasizes the diverse funding mechanisms employed, including Series A for College Wikis and revenue-based funding for Bitville Capital, a fintech and crypto fund launched in 2017.

With the foundation of Bitville Capital, the narrative shifts towards the fintech and crypto landscape, showcasing the entrepreneur’s adaptability and foresight in recognizing emerging market opportunities. This transition underscores the critical importance of staying attuned to industry trends and leveraging personal expertise to venture into new, uncharted territories.

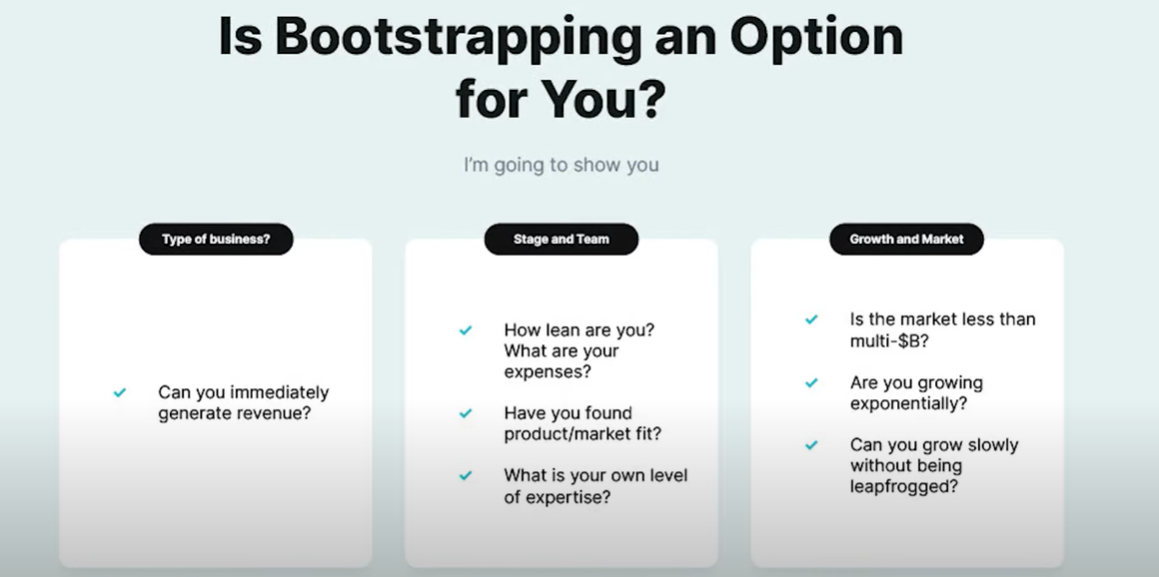

Bootstrapping vs. Venture Capital

In the intricate landscape of startup financing, entrepreneurs grapple with the decision between bootstrapping and venture capital, each offering distinct advantages.

Bootstrapping: This approach emphasizes financial independence and control, allowing entrepreneurs to steer their startup without external influence. Key benefits include full equity retention and the ability to pivot without investor constraints. However, it often results in a slower growth pace, challenging founders to balance patience with ambition.

Venture Capital: Venture capital accelerates growth, providing startups with the resources to scale quickly, enter new markets, and refine their offerings. Beyond financial support, VC brings access to invaluable networks and mentorship. The trade-off includes equity dilution and the necessity to align with investor expectations and timelines.

Market Timing: The decision between bootstrapping and venture capital is significantly influenced by market conditions. Economic optimism can heighten the appeal of VC due to potentially higher valuations and more abundant funding opportunities. Conversely, in times of economic uncertainty, the prudent, self-sustained growth afforded by bootstrapping becomes more attractive.

Strategies for Fundraising and Growth

Joe’s practical roadmap for entrepreneurs seeking to secure financing and scale their ventures is outlined through the following steps:

- Evaluate the Business and Market Positioning: Understand where your business stands in its lifecycle and its positioning within the market. This involves a thorough analysis of the product-market fit, competitive landscape, and your unique value proposition.

- Consider Timing and Industry Trends: Align your fundraising efforts with current market conditions and industry trends. This includes assessing the economic climate and investor sentiment to determine the most opportune moment for seeking financing.

- Adapt Fundraising Strategy According to Market Conditions: Choose between venture capital and bootstrapping based on which is more favorable under current market conditions. This decision should be influenced by your growth objectives and how quickly you need to scale.

- Engage with Angel Investors and Venture Capitalists: Prepare to reach out to potential investors by crafting a compelling pitch that clearly articulates your startup’s potential for growth, innovation, and profitability.

- Communicate the Startup’s Value Proposition: Ensure that your pitch and presentations to investors succinctly convey the unique benefits and advantages of your product or service, why it meets a critical market need, and how it stands out from competitors.

Strategies for Bootstrapping Your Startup

In the dynamic world of startups, bootstrapping emerges as a preferred path for founders keen on maintaining control and minimizing external funding dependency. At the heart of bootstrapping lies creative financing, leveraging personal networks, and innovative product development to fuel growth from the ground up.

Bootstrapping your startup requires a strategic approach to financing. Founders often turn to revenue-based factoring, friends and family contributions, and convertible debt as initial funding sources. The landscape of startup financing has evolved, with platforms offering more founder-friendly terms, enabling early-stage ventures to secure capital without diluting equity prematurely.

Leveraging Networks and Technology

In the dynamic world of startups, bootstrapping emerges as a preferred path for founders keen on maintaining control and minimizing external funding dependency. At the heart of bootstrapping lies creative financing, leveraging personal networks, and innovative product development to fuel growth from the ground up.

Bootstrapping your startup requires a strategic approach to financing. Founders often turn to revenue-based factoring, friends and family contributions, and convertible debt as initial funding sources. The landscape of startup financing has evolved, with platforms offering more founder-friendly terms, enabling early-stage ventures to secure capital without diluting equity prematurely.

Navigating Friends and Family Funding

While friends and family rounds can provide vital early-stage capital, they come with their own set of challenges. The pressure to succeed and the potential strain on personal relationships underscore the importance of pursuing this funding route with caution. Founders are encouraged to balance the immediate benefits of such rounds with the long-term goal of achieving revenue independence as swiftly as possible.

The Entrepreneurial Ecosystem: Angels and Advisors

Engaging with angel investors who have a track record of success in your industry can significantly enhance your startup’s chances of success. These individuals not only bring capital but also valuable insights and networks that can propel your business forward. Founders should seek advisors and investors who understand the unique challenges of entrepreneurship and can provide strategic guidance.

The Grey Areas: Equity, Debt, and Strategic Pivots

Startups often face decisions that don’t have clear-cut answers, particularly when it comes to financing. Some founders may opt for equity financing to accelerate growth, while others might explore debt as a way to retain ownership. Strategic pivots, such as buying out investors or launching new product directions, require careful consideration and a deep understanding of the market and your business model.

The Long Haul: Commitment and Adaptability

Bootstrapping is not just a financing choice but a testament to a founder’s commitment to their vision. It requires adaptability, resilience, and a willingness to make tough decisions for the sake of long-term success. Whether it’s through bootstrapping, angel investment, or venture capital, the journey of a startup is marked by continuous learning and iteration.

Conclusion: Charting Your Own Course

Bootstrapping offers a unique set of challenges and rewards, providing founders with the opportunity to build their startups on their own terms. By leveraging networks, choosing the right financing strategies, and remaining adaptable, entrepreneurs can navigate the complexities of startup growth. The key is to remain open to learning, iterating, and making strategic decisions that align with your business goals and values.