Chris Marentis, CEO of Surefire Local, is on a mission. Over the last dozen years, he has transformed his business from a managed services agency to a software company. Surefire local builds robust marketing solutions that give local SMBs cost-effective, easy-to-use tools previously only accessible by enterprise companies. The capital-efficient Marentis recently sat down with the GetLatka team to chat about the two most significant pitfalls of VC funding, the one thing never to do when negotiating for funding, and how he thinks about using debt in his business.

- Launched in 2010

- $30m ARR

- Using $10m in debt to drive growth

10 years of capital efficiency: Surefire Local

Marentis strongly believes in capital efficiency. He vehemently implores founders to retain control of their own company. “When you raise a lot of money early, you lose operational control of your business.” He cautions, “the VC game is fail fast or put more money in, which continues to dilute what you own.” According to the CEO, VCs are not in the same operational place as entrepreneurs, as they don’t have the same objectives. “I want to serve a market and make money for my family,” noted Marentis.

Raised $6m in cash, acquired 3 companies along the way

Surefire Local CEO Marentis revealed that they raised $6m in cash and now have a capital stack of $10m preferred against an ARR of $30m. Marentis is using the cash to accelerate its growth, spending the cash nearly exclusively on GTM and scaling.

Using $10m debt to accelerate GTM motion

At Surefire Local, Marentis and his team worked on getting the local market product to the point where it is the best option in the space. That’s when he believed it was time to make a bet on the product and go to market. For him, that meant opening an office in Austin. His goal was to use debt to get the GTM motion right. He wanted to accelerate growth and get to breakeven. Surefire local focuses specifically on customers that generate their new business within a specific localized geography.

Now at breakeven, at 70% growth to $30m

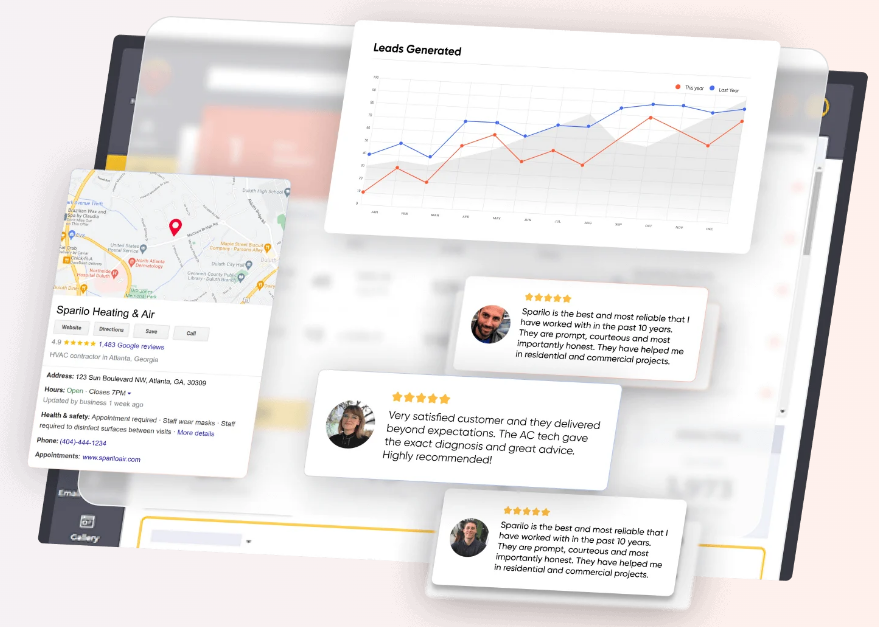

Today, Surefire Local is growing at 50% with no additional capital needed, with support from the board. They are at breakeven, having grown to $30m ARR. Marentis shared that they are working with great partners at Bridge Bank and Recurring Capital Partners. The CEO explained that Surefire Local is an all-in-one platform where all channels and tools communicate with existing and new customers in in one place, eliminating data silos. Marentis noted that data provides powerful insights from existing customers on how to get new customers.

How do capital-efficient founders negotiate for debt?

Latka asked Marentis for advice on how founders can negotiate for debt. “When you’re super capital efficient and don’t have a VC sponsor, it’s tricky. Traditional banks like Bridge Bank, Silicon Valley Bank, and Signature, their GTM plan is to get a company that just raised a bunch of VC funds and give them a revolver,” Marentis explains, adding, “They know that the VC will back up that debt play, so they won’t ask for a personal guarantee.” Latka added, “If they ask for a personal guarantee, you should run.”

$3m VC simulation

According to Marentis, the best strategy for founders is to simulate a VC using debt capital. “Get a good story and show growth traction. Show you have a good product-market fit and can grow, then you can go to a venture debt provider and get some kind of multiple on your debt,” the CEO explained. “You can show you are using your debt wisely and continuing to expand, then other banks feel comfortable,” he noted. Marentis shared that he first secured recurring capital, then brought in VC debt. He worked with Tamia for $3m, then settled, allowing the company to then close a deal with Bridge Bank.

Extended payback period

Latka queried Marentis about his thoughts on long or short payback periods. “Move it back as far as you can. You want predictability for as long as you can get it,” he advised.

Lower interest rates with warrants or higher with none?

Latka continued his “would you rather” series of questioning with Marentis, this time asking if he’d rather pay a higher interest rate with no warrants or a lower interest rate with none. At first, Marentis chose no warrants but then backed off that position by saying, “It wouldn’t be off the table, depending on the partner and the warrants, and if it’s reasonable.” The CEO advised founders to “think about how your business will mature over the next couple of years. You could optimize the cost to where you think that will be.”

$2m at a 15% flat rate, no covenant or 12%, and $1m in the bank at all times?

As Latka queried about an even more complex scenario, Marentis shifted gears to share his overall philosophy of using debt to fund growth. “When you’re doing venture debt, it’s going to be expensive. You must believe that the debt will accelerate sales. You must believe in the value creation,” noted the philosophical CEO.

2 points won’t make or break you

When discussing deal points, Marentis shared, “People said to me, you’re crazy. I can’t believe you’re paying that much for your debt. But, I quadrupled the value of my company for me and my investors.” He added, “Was it expensive? Yes. But look at the value. Two points here or there won’t make or break you.”

How to spend the debt to drive growth

Latka asked Marentis to explain how he knew the extra capital would drive growth. The CEO explained that he worked in phases. First, Marentis used managed services to build and test the product. Then, he demonstrated that Surefire Local could drive super high growth. Next, he worked on onboarding and customer success. Their change to “elite customer support” enabled their next phase of upselling and net retention revenue.

Changed GTM model to 70% outbound for magical growth

Marentis revealed that he proved high growth by building a team with a leader and 6 salespeople in Austin. “I had a predictable revenue model from inbound and SDRs. When we changed the GTM from inbound to 70% outbound, we quadrupled monthly bookings in 4 months. It was magical,” gushed the CEO.

$1,100 per month revenue, net retention revenue just under 100%

As the CEO revealed their average price point at $1,100 per month, Latka noted that the revenue better reflects lower mid-market than SMBs. As for net retention, Marentis shared that getting over 100% is a challenge in their space. “Part of net retention is understanding who the customers are, where they are in their adoption cycle, and serving them new ideas at the right time.”

Famous 5

Surefire Local CEO Chris Marentis shared that his favorite current business book is Trillion Dollar Coach: The Leadership Playbook of Silicon Valley’s Bill Campbell by Eric Schmidt. Chris’ favorite CEO to follow is Elon Musk. “I think he’s super transparent and visionary, with good people around to clean up the mess,” Chris explained. His favorite tool for building Surefire Local is Chargebee, which gives them micro visibility into customers. Chris gets 6 hours of sleep per night and raves about his Sleep Number bed. He’s married with a daughter, a SaaS salesperson in New York City. At 20, Chris wishes he had known to “Take a long view of life’s progression. Don’t be impatient, so you don’t make short-term decisions that might not be in your best interest.”