In today’s startup world, “slow and steady” is not how most founders would describe their growth style. But to Olin Hyde, CEO and co-founder of LeadCrunch, “slow and steady” is the perfect way to describe his growth strategy.

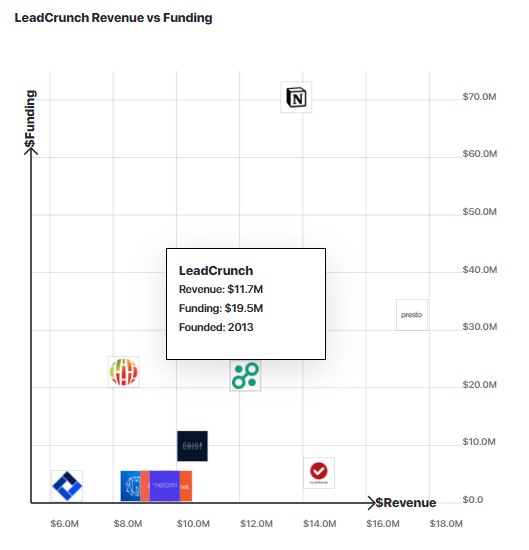

That’s not to say LeadCrunch — an AI-powered B2B demand generation tool — isn’t growing quickly. The company ballooned to $20 million in revenue in 2019 from an initial $2.4 million in 2017, and the martech company is now earning a steady $2 million a month.

Hyde, a serial entrepreneur with two exits under his belt, knows LeadCrunch is doing well. “Our company has raised a total of about $20 million, and we have revenues that are similar to companies that have raised $100 million,” he says in an interview with Latka.

But unlike many startup giants today, LeadCrunch isn’t running at a deficit. The company has been profitable since October 2020, with a $400,000 EBITDA (20% of its monthly revenue).

Source: GetLatka

Despite wanting to raise another round before going public, Hyde isn’t reinvesting all of the company’s profits immediately into growth. He prefers a slower approach.

“We will spend money aggressively when we know we can get growth that is responsible and sustainable,” Hyde says. “What we’re using our capital now for is what I call small bets. Let’s go out and see what channels work for us — and when we start to see one work well, we’ll spend a lot of money on it. It will pay for itself. And then we know what we’ll do with our series C.”

That’s an approach he’s extended to his workforce, as well. LeadCrunch had 75 employees in 2019, but by late 2020, the startup had halved its workforce to 35 full-time staff. “We wanted to really pare our team down, so we could have a smaller team where we were a lot more efficient and could go a lot faster in one direction,” Hyde explains. “That’s something that we were successful in doing — and now it’s time to start building the team back up.”

With a 24-month run rate ahead of it and a lithe team on board, LeadCrunch is in a good position to figure out its next steps before laying on the gas. Once the startup unlocks the secret to its next stage of growth, Hyde expects LeadCrunch to raise between $30 million and $60 million in its Series C.

“I know that’s a big range, but that’s the ballpark we expect the valuation to justify,” Hyde says. “It’s got to be a big enough round for us to take the company all the way to an IPO.”

What is LeadCrunch’s annual revenue?

In 2019, LeadCrunch generated $20 million in ARR.

What is LeadCrunch’s monthly revenue?

In 2021, LeadCrunch generated $2 million in MRR.

Who is the CEO of LeadCrunch?

Olin Hyde, age 55, is the CEO of LeadCrunch.

What is LeadCrunch’s valuation?

In 2018, LeadCrunch had a valuation of $56 million.

Transcript Excerpts

Why startups should focus on cash management

“Our philosophy is we’ve really been inspired by John Singleton and the theory of cash management. I really am a big fan of managing expenses. There’s such a thing as raising too much money. I’ve seen a lot of companies raise a too high evaluation or raise too much money and they can afford to be stupid or make more mistakes. I think there’s a real value in capital efficiency. We’re not seeing that in the market right now, simply because there’s so much money on the street. But I think in a couple years from now likely the business cycle will be at the stage where people will pay a premium for capital efficiency.”

Taking a lower valuation for smarter capital

“From our perspective, we really want to deliver remarkable returns to our investors. And we want to raise the right amount of money to capture the market. I think that the good VCs add a tremendous amount of value and add a lot to your exit value, because they’ve done it many times. They bring a lot of experience. And so I think that it’s more important to get the right team than the ideal valuation.”

When things get tough, roll with the punches

“When we went into Q1 2020, things were not looking great. In Q2, the floor fell out from underneath us. We really had a tough second quarter — we basically lost the quarter. So this year [2020], we’re going to end the year about exactly where we were last year. So a joking way to say it is, ‘Flat is the new up.’ The second half of this year has just been amazing growth for us, but the first half was the other direction.”

Calculate the rate of return on each of your employees

“Unfortunately, I think the skills that get you to $10 million are very different than the skills that get you to $20, $30, $40 million. We had some amazing team members that we’d outgrown or they had outgrown us. One of the key metrics that I use is I think of valuation per employee — what’s your gross margin per employee? We wanted to increase that a lot.”

Full Transcript Nathan: Hello everyone, my guest today is Olin Hyde. He’s the CEO and Co-Founder at LeadCrunch AI, one of the fastest growing MarTechs in history. They’re ranked number two in the marketing industry, number 35 overall in the 2020 Inc. 5000. He was a finalist for EY Entrepreneur of 2020 in San Diego. He’s an 8x serial entrepreneur with two exits. Olin are you ready to take us to the top? Olin Hyde: I am. Thank you so much, Nate. Nathan: All right. So first off you have a very interesting billing model before we get to that, because I think it’s the future, I want to talk about what LeadCrunch is for those that missed the first one. What do you do for B2B SaaS companies? Olin Hyde: So LeadCrunch is a B2B marketing platform that finds the ideal targets and then delivers the ideal audiences based on buying signals. So we find your ideal customer profile and then detect the buying signals that indicate those ideal prospects need your product or service. Nathan: So we might track the clicks of that person through the web and notice they’re looking at your competitor pages. This is reminds you a lot of what Erica Bombora is doing. Is it similar? Olin Hyde: We are complimentary to Bombora. Bombora is doing what’s really called intent. And it’s around looking for things on the web. What we’re looking for is we look at about 40 billion data points on about 10 million companies. And you can think of our technology as modeling out how companies fit into each others supply chain. So we’re actually looking at things like, is your company an early adopter? Is your company have a high need for communication services? Is your company have a high cyber security threat? These are the things you can’t look up on a database. And they’re the things that would augment what Bombora is doing. Nathan: Yeah. Now you’re not charging a lot of SaaS companies. They have churn issues because they charge a flat fee per month and then whatever the utility is doesn’t actually get used. And then people churn. You said, “Screw that, we’re going to bill on a CPL, Cost Per Lead model.” Tell me about that. Olin Hyde: Yeah. We really believe in billing on actionable intelligence and when you’re generating demand for your company, it’s not a commodity. People are not commodities, they have different values. And so when we first started, we thought, well, we should really charge a percentage of customer lifetime value or a percentage of customer acquisition cost. And we found early in our history that we couldn’t get that data in [crosstalk 00:02:23]. Nathan: Hard to track. Olin Hyde: Hard to track. So what we decided to do is charge on a cost per lead basis, where we can estimate the general cost of customer acquisition, the general value of that lead across a campaign. And so the good news is that our net revenue retention, which is a metric a lot of SaaS companies track, it’s about 138% quarter to quarter. So that, and it started off much lower than that. I think the last time we spoke, we didn’t want to reveal it because it was probably below 100% and it crept up. Nathan: Yeah. You said in 2017, 100%. And then in 2019, 130%. Peel that onion back for me though today. So 138% quarter over quarter, two components make that up, gross dollar churn on gross spaces and then expansion on a dollar basis. What are those two metrics? Olin Hyde: Most of it is expansion. Our gross revenue retention, which would be, you can think of that as the logos from prior quarter spending in this quarter is only at about 80%. And that’s because we had a big dip in the first half of the year. Nathan: What do you mean by that? Only 80% churn. Olin Hyde: No, that would be, if you can have 100 customers in the first quarter and they spend a $100 each, the next quarter $100 still spent each but only 80 of them are buying. So we lose about 20% of our existing logo revenue per month while the other side’s growing at almost 40%. So same customer revenue increases dramatically whereas the overall customer base is shifting. As we move from SMB into the enterprise we’re dropping off some of our less than ideal customers right now. Nathan: So let’s move away from logo churn because of that trend. That’s why I want to dig onto dollar churn. So I’m going to use your same exact example, 100 customers today paying 100 bucks a month, next month 80 churn. But the ones that are left are not, hopefully still only paying 100 bucks a month. Ideally they’ve expanded. That’s what I want to know. Olin Hyde: It’s not an 80 churn, it would be a 20% churn. Nathan: Sorry. That’s what I meant but you get my point. Olin Hyde: Yeah. And the others are paying in some cases, six, seven times x. Nathan: But what is it? I mean, when you take the total revenue amount from those 100 in one month, and then the next month, a portion of them churn cancel revenue, and then they expand by x dollars. What’s the churn on a revenue basis, and the expansion on a revenue basis? Olin Hyde: We don’t track it like that. And I could certainly pull those numbers. I don’t have them off the top of my head. Nathan: Okay. All right. Got it. So basically what you’re telling me is net a cohort from a year ago or a quarter ago is paying 138% more because they’re using more, they’re using you more or more leads. Olin Hyde: Correct. That’s on a net basis. Nathan: Yeah. Okay. Interesting. Last time we spoke, you were testing some different customer generation inbound methods. Talk to me today. How are you getting new customers and how many customers do you have? Olin Hyde: We were going to do $2 million of revenue this month, which is our best month ever. And almost all of it is from customers that were here in October and November. Unfortunately we have not been able to do a lot of marketing because we’ve been so busy, just keeping up with demand from current customers, we track our inbound leads through a multi-touch attribution method. And of our current, we will run about 150 campaigns this month, rather 150 different companies will be running campaigns for this month. 74 of them are new customers in the past six months. And of those 74, about 40 of them are from inbound marketing. Nathan: Interesting. Okay. So 40 new inbound. And what’s the general size of the initial contract folks spend with you? The first month they pay you x Olin Hyde: Yeah. We don’t like to do anything less than 10,000 and that’s really going away. The average right now for first time order is around 50,000. Nathan: Okay. And how many leads would you deliver them if this is a tool like monday.com or ClickUp? A team productivity tool. Olin Hyde: Yeah. I love ClickUp, their San Diego company just raised a $100 million in their series B. Nathan: Awesome. Well, not just that. It was one of the fastest rounds I’ve seen from, they just literally two months ago did the $33 million round at a half a billion valuation then 100 million at a billion valuation. It was the fastest I’d ever seen that happen. Olin Hyde: Yeah. Well, I’m going to buy your report just to see if there’s a plug for you. I think your question was what is our price per lead? Nathan: Yeah. Olin Hyde: It depends upon the specification. So it can be as low as say 50 and our most expensive that we’ve ever sold is 1,200. Nathan: Per lead? Olin Hyde: Per lead. So you can think of an average of around 75 is a number that most[crosstalk 00:07:27]

Nathan: What was the low end? Olin Hyde: The low end is around 50. Nathan: Okay. So 50 to 1200 average, 75. Interesting. Okay. What’s a $1,200 lead. What is it? Like a hedge fund or something? Olin Hyde: Yeah. Nathan: What is a hedge fund? Olin Hyde: Well, it’s somebody is selling very, very expensive things, maybe like airplanes or financial packages to large corporations, those types of things. They’re not big lead packages. They take a lot of work to go through. And so that package may only include say 100 leads, but they’re very expensive. Nathan: Well listen, congrats on the growth. I mean, last time you were on in 2019, you were doing about 20 million in terms of 1.6, 1.7 million a month. You’re now up to two million a month or 24 run rate. So congrats on the growth at a tough year for everybody. Have you raised additional capital? Olin Hyde: We have not. With the last raise we did was about two years ago. I think we still have plenty of dry powder in the bank. We are profitable for the past three months. Nathan: Oh, wow. Can I ask how much? Olin Hyde: Yeah. This month we’ll have about 400,000 EBITDA on about 2 million of revenue. Nathan: And how on earth does your board, who wants you reinvesting in growth let you sit on a 40, well, not 40%, a little over 20% EBITDA margin. Olin Hyde: 20% EBITDA. So I think that our philosophy is we’ve really been inspired by John Singleton and the theory of cash management. So we will spend money aggressively when we know we can get growth that is responsible and sustainable. I really am a big fan of managing expenses. We’ve been very capital efficient. Our company’s raised a total of about $20 million and have revenues that are similar to companies that have raised a $100 million. So I think there’s such a thing. And this applies to me, I’m not saying this is true for everybody. There’s such a thing as raising too much money. It creates problems for founders where you can’t clear preferences. There’s a problem with raising money at too high, a valuation. Olin Hyde: So from our perspective, we really want to deliver remarkable returns to our investors. And we want to raise the right amount of money to capture the market. And you can expect us to do a round in another year that would be a large series C. And what we’re using our capital now for is what I call small bets. Let’s go out and see what channels work for us. And when we start to see one work a lot, we’ll spend a lot of money on it. It will pay for itself. And then we know what we’ll do with our series C. Nathan: Your last one I believe it was an $11 million round in 2018. Is that right? Olin Hyde: Yeah. It was about, I think a little bit more than that, but that’s the ballpark. Nathan: And sold what you see most companies sell, something like 10 to 15% of the business. Olin Hyde: Yeah. It was a little bit more than that. I think that we raised 12.5. I mean, I don’t think there’s any secret, our post-money valuation was 56 million. Nathan: Okay. And if you go out in 2021 and try and raise, what valuation do you think you can command? Obviously the combination of metrics, plus your ability to storytell. Olin Hyde: Yeah. Well, I think that’s the job of the VCs. I can tell you in general, I’m not interested in raising a round that’s not, it’s got to be a big enough round for us to take the company all the way to an IPO. And I think in our world, that’s number North of 30 million and less than say 60 million. I know that’s a big range, but that’s the ballpark that we expect the valuation to justify. Nathan: Yeah. So what you’re saying is you want to get a cheque size in of 30 to 60 million without selling more than call it 15% of the business. So you really need an angle to figure out, can you get a 15 to 20x multiple on a 24 million run rate or something like a 300 to $400 million post-money evaluation? Olin Hyde: Maybe. Yeah. I think we’d be willing to take a little bit more dilution than what you just outlined. 10 to 15% is pretty aggressive. VCs, we [crosstalk 00:11:27]

Nathan: Aggressive or conservative? You’d sell more than 15% for 30 million? Olin Hyde: Yeah. Nathan: Okay. Got it. Olin Hyde: Yeah. Sorry if I reversed those, it depends upon the perspective of which side you’re on the table and what’s conservative. I think that the good VCs add a tremendous amount of value and add a lot to your exit value because they’ve done it a lot of times. They bring a lot of experience. And so I think that it’s more important to get the right team, then the ideal valuation. And I’ve seen a lot of companies again, raise a too high evaluation or raise too much money and they can afford to be stupid or make more mistakes. I think there’s a real value in capital efficiency. We’re not seeing that in the market right now, simply because there’s so much money on the street. But I think in a couple years from now likely the business cycle will be at the stage where capital efficiency is people pay a premium for it. Nathan: Yep. And talk to me about team today. How many folks on the team? Olin Hyde: 35. Nathan: Olin Hyde: Well, we separate our product engineering, our code engineering and our data science. So let’s treat all of them the same, 12. Nathan: Olin Hyde: Five. Nathan: Interesting. Okay. So these are down since 2019 and maybe you were, so you had told me 72 in 2019, you’re down to 35 now. You cut your engineering staff in half and you kept the same number of sales reps it sounds like. Olin Hyde: Yeah, actually we were at 75 and then I did three layoffs. Nathan: Okay. Tell me about those. Those are tough. Olin Hyde: It’s painful. So we went into Q1 things were looking not great, Q1 2020, Q2 the floor fell out from underneath us. And we were in the wrong place in the market. And we had already started the migration into the enterprise accounts and we really had a tough second quarter. We basically lost the quarter. So this year we’re going to end the year about exactly where we were last year. So a jokingly way to say it is flat is the new up. The second half of this year has just been amazing growth for us, but the first half was the other direction. Olin Hyde: And so what happened is unfortunately I think the skills that get you to 10 million are a lot different than the skills that get you to 20, 30, 40 million. And we had some amazing team members that we’d outgrown or they had outgrown us and we really wanted to pare our team down. And one of the key metrics that I use is I think of valuation per employee. So you can think of that as how much gross, how much revenue per employee, what’s your gross margin per employee. And so we wanted to increase that a lot and really pare our team down to have a smaller team where we were a lot more efficient and we could go a lot faster in one direction. And that’s something that we were successful in doing. And now it’s time to start building the team back up. Nathan: $24 million run rate, 35 employees puts you at again, way above average, $685,000 in revenue per employee average in public companies, you see about 195,000 in revenue per employee in the SaaS space. So it makes sense there. Where will your next hires be, you think? Olin Hyde: Well, we’ve got nine open positions right now. We’re going to expand our sales team. We’re going to expand our engineering team and we’re going to expand our product team. So it’s really the old mantra that Peter Drucker said, “A company has two functions, marketing and engineering.” I would say the company has two functions, sales and product engineering. And that’s where we want to focus on right now. Nathan: All right Olin, let’s wrap up here with the famous five. Number one, favorite business book. Olin Hyde: The Outsiders. Nathan: Yeah. It does not surprise me you would say that book with how you talk about capital efficiency and Singleton. Number two, is there a CEO you’re following or studying? Olin Hyde: Many, everyone should be following Reed Hastings and Jeff Bezos. They’re two of the smartest guys ever, but there’s many, there’s a few local ones here that I love a lot too. So, I think Doug Winter over at Seismic is doing a remarkably good job. Nathan: Number three. What’s your favorite online tool for building LeadCrunch besides your own? Olin Hyde: Wow. There’s a lot of those too. I’m really in love with, it sounds so simple, but we couldn’t live without the Google OfficeSuite, Google Docs and so forth. It’s amazing what you can get done with that and Slack. Nathan: Number four. How many hours of sleep are you getting every night? Olin Hyde: I get at least eight and I measure my sleep with a WHOOP tracker. Fortunately during this pandemic, I lost 25 pounds and got in shape. And if it could be measured, I like to measure it. And I measure my sleep and really pay attention to make sure I get eight hours of sleep at night. Nathan: And Olin what’s your situation? Married? Single? Kiddos? Olin Hyde: I’m married with adopted kids. Nathan: How many kids? Olin Hyde: Three nieces and one nephew. A lot of them have started to grow out of the house now. We’ve got one that’s graduating from college. Two that are in college. And then we’ve got an eight year old. Nathan: Okay. So you’ve adopted four kids. Olin Hyde: Yeah. We’re guardians. So they [inaudible 00:16:49] time between us and their parents. So it takes a village to raise these kids. Nathan: I love that. Okay. And how old are you? Olin Hyde: I am 55 years of age. Nathan: Last question. What do you wish you knew when you were 20? Olin Hyde: I wish someone at 20 would have said, it’s not enough to be smart, the only thing that really matters is hard work and don’t misinterpret your luck with skill. Nathan: Guys there you have it, Olin Hyde LeadCrunch.ai. They did 2.4 million in revenue back in 2017, have since scaled in 2019 up to about 20 million in revenue, in 2020 this year they’re now doing $2 million a month. So healthy growth rate year over year. They’re also profitable. $400,000 per month for about a 20% EBITDA margin. They’re also scaling their team size down. So they’re more capital efficient generating almost $700,000 in revenue per employee before they look to scale next year, targeting a $30 million round at somewhere around a 200 or $300 million valuation. Olin, thanks for taking us to the top. Olin Hyde: Thanks so much, Nathan, have a great day. Nathan: One more thing before you go. We have a brand new show every Thursday at 1:00 PM Central it’s called Sharktank for SaaS. We call it deal or bust. One founder comes on, three hungry buyers. They try and do a deal live and the founder shares backend dashboards, their expenses, their revenue, ARPU, CAC, LTV, you name it. They share it. And the buyers try and make a deal alive. It is fun to watch every Thursday, 1:00 PM Central. Additionally, remember these recorded founder interviews go live. We release them here on YouTube every day at 2:00 PM Central, to make sure you don’t miss any of that. Make sure you click the subscribe button below here on YouTube. The big red button and then click the little bell notification to make sure you get notifications when we do go live. I wouldn’t want you to miss breaking news in the SaaS world, whether it’s an acquisition, a big fundraise, a big sale, a big profitability statement or something else. I don’t want you to miss it. Nathan: Additionally, if you want to take this conversation deeper and further, we have by far the largest private Slack community for B2B SaaS founders, you want to get in there. We’ve probably talked about your tool if you’re running a company or your firm, if you’re investing. You can go in there and quickly search and see what people are saying. Sign up for that at nathanlatka.com/slack. In the meantime I’m hanging out with you here on YouTube, I’ll be in the comments for the next 30 minutes. Feel free to let me know what you thought about this episode. And if you enjoyed it, click the thumbs up. We get a lot of haters that are mad at how aggressive I am on these shows, but I do it so that we can all learn. We have to counter those people. We got to push them away. Click the thumbs up below to counter them and know that I appreciate your guys’ support. All right, I’ll be in the comments. See ya.