Revenue churn simply measures how much recurring revenue your business loses in a month from customers that cancel, downgrade, or fail to renew their subscription plans.

As such, there’s no surprise that revenue churn is one of the most important metrics for SaaS businesses. If you don’t track and keep your revenue churn under control, it can be difficult, if at all possible, to grow your business.

So, if you’re looking to learn how to calculate and effectively reduce your revenue churn to improve your company’s financial health, you’ve come to the right place.

In this article, we will cover:

- What Is Revenue Churn?

- How to Calculate Revenue Churn?

- Why Is Calculating Revenue Churn Important?

- What Revenue Churn is Acceptable?

- How to Reduce Revenue Churn

- Revenue Churn FAQ

What Is Revenue Churn?

Revenue churn, also known as MRR churn rate, is a SaaS finance metric that measures the percentage of monthly recurring revenue your company loses from subscription cancellations and downgrades.

Typically, companies calculate their revenue churn rate on a monthly basis.

There are two types of revenue churn you should calculate:

- Gross revenue churn refers to the percentage of revenue lost from subscription cancellations and downgrades.

- Net revenue churn measures the percentage of revenue lost from canceled and downgraded subscriptions as well as factors in new revenue you’ve generated from existing customers.

In other words, net revenue churn takes into account your expansion MRR. If your expansion MRR is greater than your gross revenue churn, you’ll have a negative revenue churn. This essentially shows that despite losing customers and revenue, you are still managing to grow your business.

However, negative revenue churn is difficult to achieve and maintain, and even more so for startups that don’t have a loyal customer base they can upsell just yet.

How to Calculate Revenue Churn?

Although there are several ways you can calculate your revenue churn, as with all SaaS metrics, it’s best to keep your revenue churn calculations simple.

That said, it’s important that businesses using the recurring subscription revenue model calculate both their gross revenue churn and their net revenue churn every month.

This way, you can consistently track your company’s performance.

So, let’s take a look at two simple formulas that will help you correctly calculate your monthly gross and net revenue churn rates.

Revenue Churn Formula

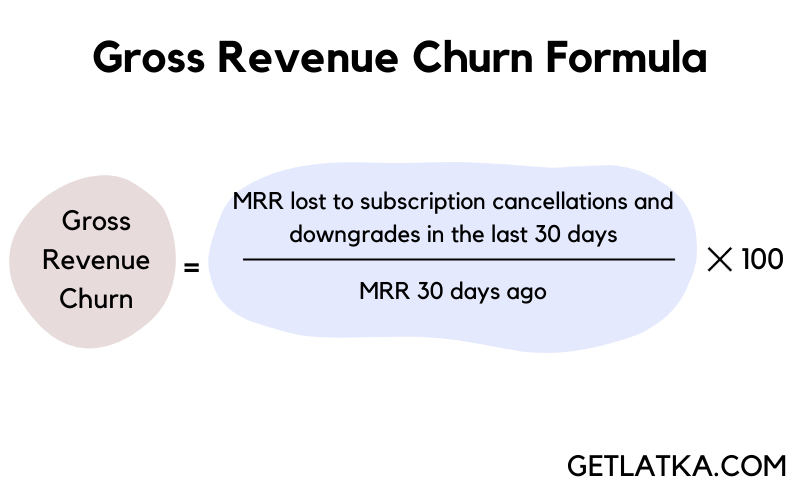

Here’s a simple formula for calculating your monthly gross revenue churn:

Gross Revenue Churn = (MRR lost to subscription cancellations and downgrades in the last 30 days / MRR 30 days ago) x 100

Now, let’s see how you could calculate your gross revenue churn using this formula.

Let’s say your MRR at the beginning of the month was $10,000. In the last 30 days, you’ve lost $2,000 MRR to subscription downgrades and $1,000 to cancellations.

In this case, your gross revenue churn would be ($2,000 + $1,000) / $10,000 x 100 = 30%.

Now, it’s likely you might gain some additional revenue from your existing customers through upsells, cross-sells, and add-ons, which is known as expansion MRR.

Although expansion MRR can impact your revenue churn, gross revenue churn doesn’t take it into account. For this reason, you want to calculate your net revenue churn.

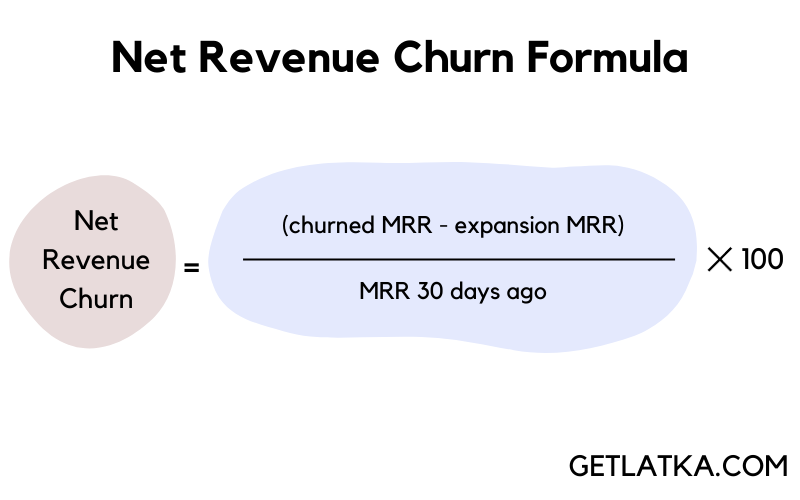

So, here’s a formula for calculating monthly net revenue churn:

Net Revenue Churn = ((churned MRR – expansion MRR) / MRR 30 days ago) x 100

So, if your MRR at the beginning of the month was $10,000 and you’ve lost $3,000 MRR to subscription downgrades and cancellations, your gross revenue churn would be 30%.

Now, let’s say you’ve also gained $2,500 MRR from upselling your existing customers.

In this case, your net revenue churn would be ($3,000 – $2,500) / $10,000 x 100 = 5%.

As you can tell, your gross revenue churn can be extremely different from your net revenue churn.

That’s because your gross revenue churn shows how much MRR you’ve lost, while your net revenue churn shows how much of the lost MRR you’ve recovered through your existing customers.

One more thing you should also note is that while it’s generally recommended to calculate your revenue churn monthly, you can also calculate it for any given period by modifying the formulas above.

Why Is Calculating Revenue Churn Important?

Now that you know how to calculate your revenue churn, let’s see why it’s important to calculate your gross and net revenue churn rates.

So, here are the three main reasons why calculating your revenue churn is important:

#1. Estimate Cash Runway

Alongside your burn rate, revenue churn can help you determine how long your business can operate until it runs out of cash, or your cash runway.

Not to mention, consistently tracking revenue churn allows you to forecast how much revenue you can expect to lose in the future.

In turn, revenue churn allows you to estimate how much cash you’ll have a few months down the road, which can help you determine your funding needs and manage your budget.

#2. Optimize Your Pricing

If you offer several subscription plans, calculating your revenue churn can help you optimize your product pricing.

Essentially, tracking your revenue churn rate allows you to see where most of the revenue churn comes from. From there, you can take action to optimize your pricing and thus reduce revenue churn.

For example, if you’re mostly losing revenue because your customers are downgrading from your most expensive subscription plan to less expensive plans, you might want to reduce the plan’s price. Alternatively, you can improve your product so that its value justifies the price.

#3. Boost Business Growth

Growing your business is nearly impossible if you keep losing revenue. Essentially, if you don’t take control of your revenue churn, you might eventually go out of business.

Luckily, reducing revenue churn improves revenue retention, which is vital for your business growth.

For this reason, it’s important that you calculate and track your revenue churn. Otherwise, you may not be able to spot an increase in revenue churn and take appropriate action to reduce it.

Generally speaking, tracking your revenue churn can help you outline the steps that you need to take to promote your business growth.

If, for example, most of your revenue churn comes from subscription cancellations, you might want to work on improving customer retention.

On the other hand, if you’re losing revenue because of subscription downgrades, you should consider optimizing your product pricing or enhancing your product.

What Revenue Churn is Acceptable?

As a general rule, you want your revenue churn rate to be as close to 0% as possible. The lower your churn rate, the less revenue you’re losing.

That said, it’s important that you compare your revenue churn against your own benchmarks to evaluate your company’s performance. If your churn rate is far from 0%, for example, yet it decreases month-over-month, that means you’re on the right track.

Comparing your revenue churn against that of other companies, on the other hand, can be tricky. That’s because there are many variables, such as the revenue model used and the company’s maturity, that can impact revenue churn and thus make it difficult to draw a fair revenue churn comparison between different businesses.

What Does My Revenue Churn Mean?

After calculating your revenue churn, you may wonder what it means for your business.

As we mentioned above, the closer your revenue churn rate is to 0%, the better your financial performance is.

In other words, a low revenue churn rate indicates sustainable business growth and profitability. It also typically means that your business effectively retains its customers, and that your products and services meet your customers’ needs.

If you’ve calculated your net revenue churn, you might’ve noticed a negative figure. In fact, this is a huge achievement – a net negative revenue churn rate essentially means that your expansion MRR is greater than the MRR you’ve lost from subscription downgrades and cancellations.

Now, if your revenue churn is on the higher side, it’s very likely that you’re losing customers and money. In this case, it’s important that you improve your products and services, as well as your sales, marketing, customer acquisition, and other business strategies.

How to Reduce Revenue Churn

Although decreasing revenue churn isn’t always easy, it’s necessary for your business growth.

So, here are some ways how you can effectively reduce revenue churn:

- Analyze customer feedback. Simply put, your revenue comes from your customers. For this reason, it’s important that you prioritize decreasing customer churn, and the best way to do it is to collect feedback from churned customers. This way, you can learn which areas you need to improve to retain your customers and increase your revenue.

- Optimize your pricing. If most of your revenue churn comes from customers canceling your most expensive plan or subscription plan downgrades, it might indicate that your product prices don’t match their value. In this case, consider adjusting your prices.

- Increase your expansion MRR. Revenue churn won’t take as big of a toll on your business if you generate enough revenue from your existing customers to cover your losses. As such, you might want to focus on upselling, cross-selling, and offering add-ons to your current customers to improve your net revenue churn.

- Improve customer onboarding. If most of your revenue churn comes from new customers canceling their subscriptions soon after purchasing them, you want to optimize your onboarding process. One way to do it is by offering plenty of learning materials, tutorials, FAQs, and other resources to help new users learn to use your product.

- Attract the right customer. Do subscription cancellations play a major role in your revenue churn? Well, you may be targeting the wrong customer. Essentially, you want to attract customers that need your product as this can minimize customer churn. For this reason, it’s important that you tailor your sales and marketing strategies to your target audience.

Revenue Churn FAQ

#1. Should I Calculate Revenue Churn or Customer Churn?

In short, you should calculate both your revenue churn and your customer churn.

Essentially, customer churn measures how many customers cancel their subscriptions. As such, it can be a great measure for evaluating your customer retention.

Revenue churn, on the other hand, measures how much revenue you’re losing from churned customers, as well as from customers that downgrade their subscription plans.

In most cases, your revenue churn is closely linked to your customer churn. High customer churn can lead to a high revenue churn.

Ultimately, tracking your revenue churn alongside your customer churn can help you determine the type of customers you have the most trouble retaining, and how much it costs you.

This allows you to optimize your customer retention efforts, which can positively affect both your customer churn and your revenue churn rates.

#2. What Is the Difference Between Gross Revenue Churn and Net Revenue Churn?

The difference between gross revenue churn and net revenue churn is that gross revenue churn only calculates how much revenue you’ve lost from customers that cancel or downgrade their subscription plans.

Net revenue churn, on the other hand, also takes into account any additional revenue that you gained from your existing customer base over the month.