- 3-4M ARR in 2012-2013

- 254M ARR in 2023

- 300M ARR in 2024

- 1,500+ Full-Time Employees

- 100k+ Paying Customers

Semrush Revenue is $330 Million as of March 2024

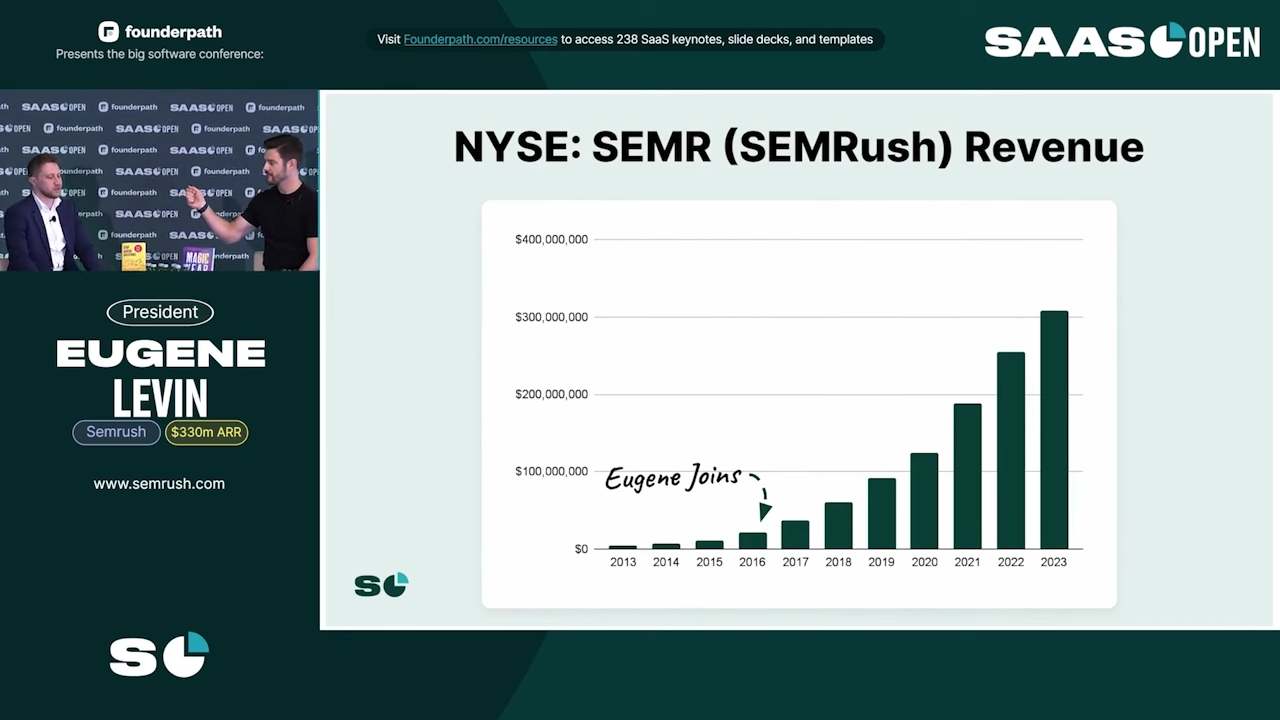

From its modest beginnings in 2012, with an ARR of only $3-4 million, Semrush has undergone a transformative journey, reaching a remarkable $330 million in ARR by March 2024. This is with only $40 million in outside funding in 2018.

This impressive growth trajectory is not confined to small and medium-sized businesses, Semrush has expanded its reach to include over 30% of Fortune 500 companies, boasting at least 5,000 accounts from organizations with more than 500 employees.

Such a diversified customer base reflects Semrush’s capability to scale solutions across varying business needs, a testament to its robust platform and strategic market positioning.

Foundation & Rapid Growth

In the early 2010s, Semrush was yet another contender in the crowded field of SEO and marketing tools. However, what set it apart was its visionary approach to not only addressing but anticipating the needs of digital marketers. This foresight was driven by a deep understanding of the challenges marketers faced, translating into features that provided real solutions rather than just data.

As Semrush grew, its customer base diversified significantly. By 2023, the company had secured over 100,000 paying customers, ranging from freelancers and small businesses to large enterprises, including more than 5,000 accounts with companies boasting over 500 employees. This diverse clientele highlighted the platform’s scalability and flexibility, making it a favorite not just among SMBs but also within the halls of the Fortune 500.

How Eugene Levin Turned 40% Profitability into Massive Growth

When Eugene Levin first encountered Semrush in 2014, he sought to invest, but the founders initially declined his offer. However, they instead proposed an alternative—offering him a pivotal role within the organization.

In 2016, Levin joined Semrush as President, bringing with him a wealth of experience and a vision to amplify the company’s growth.

Upon his arrival, Levin discovered that Semrush was operating with an impressive 40% profit margin. The company was generating significant cash flow, but there was a palpable uncertainty about how best to utilize these funds to fuel further growth. Levin proposed a bold strategy: reinvesting the profits into aggressive expansion efforts rather than resting on their laurels. His approach was to use the capital to accelerate development and market penetration. In exchange for his strategic leadership, Levin was awarded 2% of the company, aligning his interests closely with the success of Semrush.

“People don’t want to buy tools, they want to buy solutions to their problems.”

This simple yet profound mindset shift led to a reevaluation of how Semrush communicated its value to customers. Instead of merely talking about features, Levin pushed for a focus on demonstrating how Semrush solved specific marketing challenges—effectively showing more and talking less.

Another crucial area of focus for Levin was the company’s affiliate program, which had been a significant growth driver during the early stages. With a 40% recurring affiliate commission, it contributed to one third of the business’s revenue at its peak. Today, Levin recommends other companies use an affiliate strategy, but advises against perpetual or recurring commission models. He suggested a limited-term commission model, spanning only 2-3 years, to maintain the benefits of affiliate marketing without incurring endless costs.

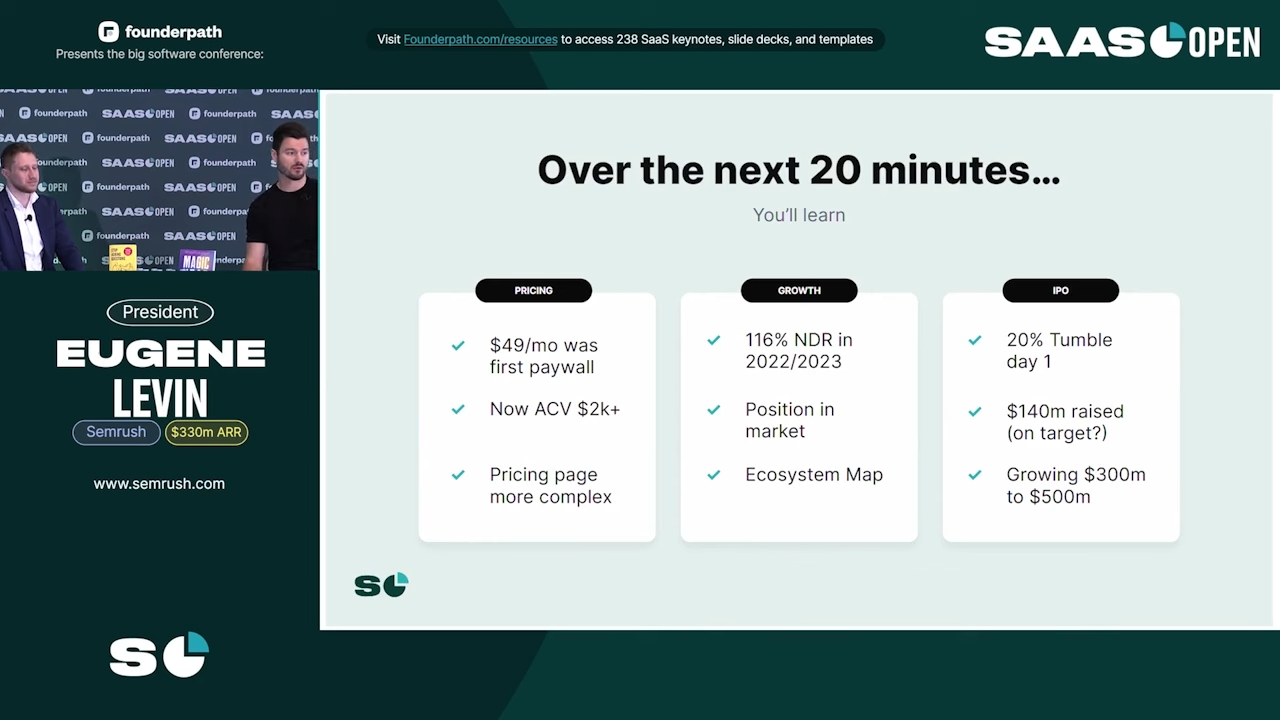

Levin also spearheaded a transformative approach to Semrush’s pricing strategy. In 2010, Semrush offered its services at a flat rate of $49 per month. However, to better capture the value provided and to cater to a broader range of customers, Levin experimented with price adjustments. After a series of tests revealed that higher price points did not significantly deter new customers but rather increased the average revenue per customer, Semrush revamped its pricing structure to include tiers ranging from $99 to $399+ per month, significantly lifting the annual contract value (ACV) to over $2,000.

To further refine this approach, Levin collaborated with pricing strategy firms like Profit Well and conducted extensive market surveys, not just within Semrush’s customer base but across the industry. This comprehensive research helped Semrush develop a more nuanced understanding of what customers were willing to pay, leading to a pricing model that aligned closely with customer value perception.

Under Levin’s guidance, Semrush also restructured its service packages to cater specifically to different segments of its audience. Packages were tailored for various user groups—from freelancers and startups to large enterprises—ensuring that each could find a plan that fit their specific needs and budget. This segmentation allowed Semrush to address the unique challenges and opportunities within each market segment effectively.

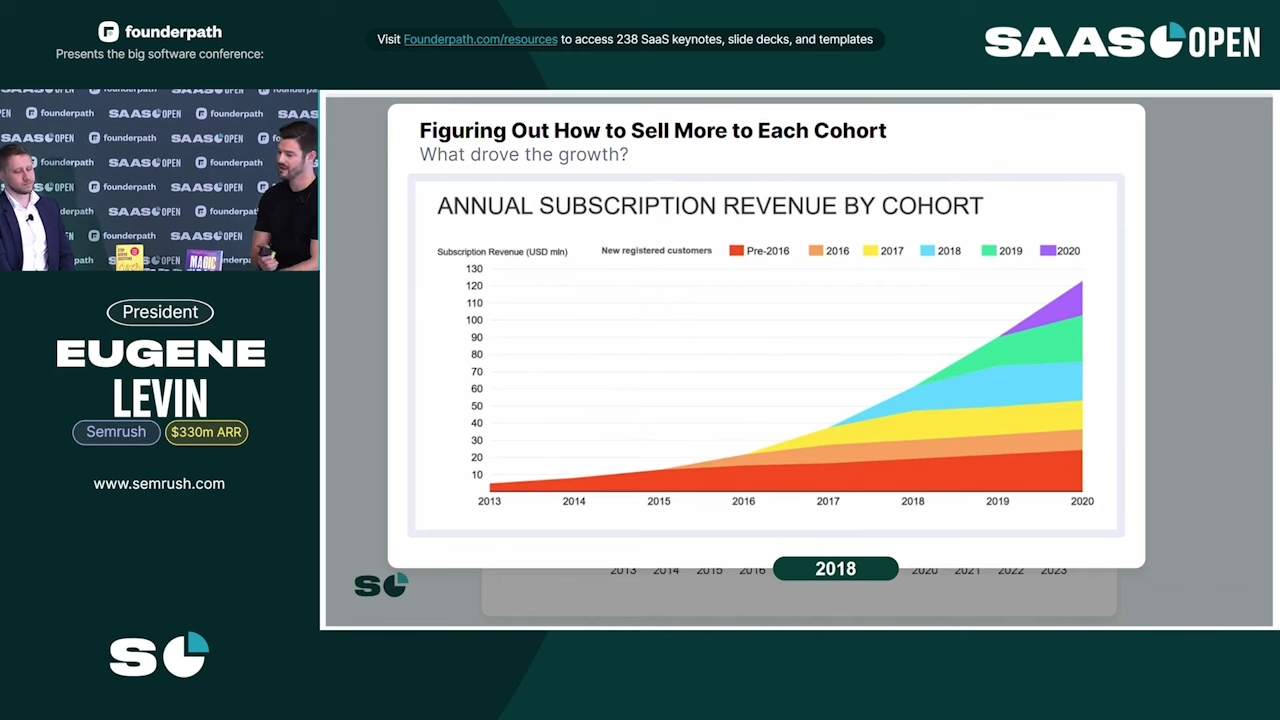

In addition to revising pricing and packaging, Levin and the COO designed a three-axis expansion model to drive the company’s growth:

- Encouraging users to migrate between core plans based on usage, ensuring they always had the right tools as their business needs evolved.

- Increasing the number of users per account by making it easier and more beneficial for customers to invite colleagues to collaborate on the platform.

- Developing and promoting specific add-on products, like local listing services, which were not necessary for all customers but provided significant value to others.

This strategic model not only diversified Semrush’s revenue streams but also deepened user engagement and retention, contributing approximately $800 in ARR per paying customer across each axis.

Levin’s strategic initiatives transformed Semrush from a tool provider into a comprehensive platform solving real-world marketing problems, setting the stage for sustained growth and market leadership.

Launching an IPO Peak Pandemic (20% Slip on Day 1)

In March 2021, amidst the global turmoil caused by the COVID-19 pandemic, Semrush made a bold move to go public. This decision came at a time when the financial markets were fraught with uncertainty, and very few companies dared to initiate public offerings. Semrush, however, with its strong fundamentals and a solid base of 67,000 paying customers, decided to take the plunge.

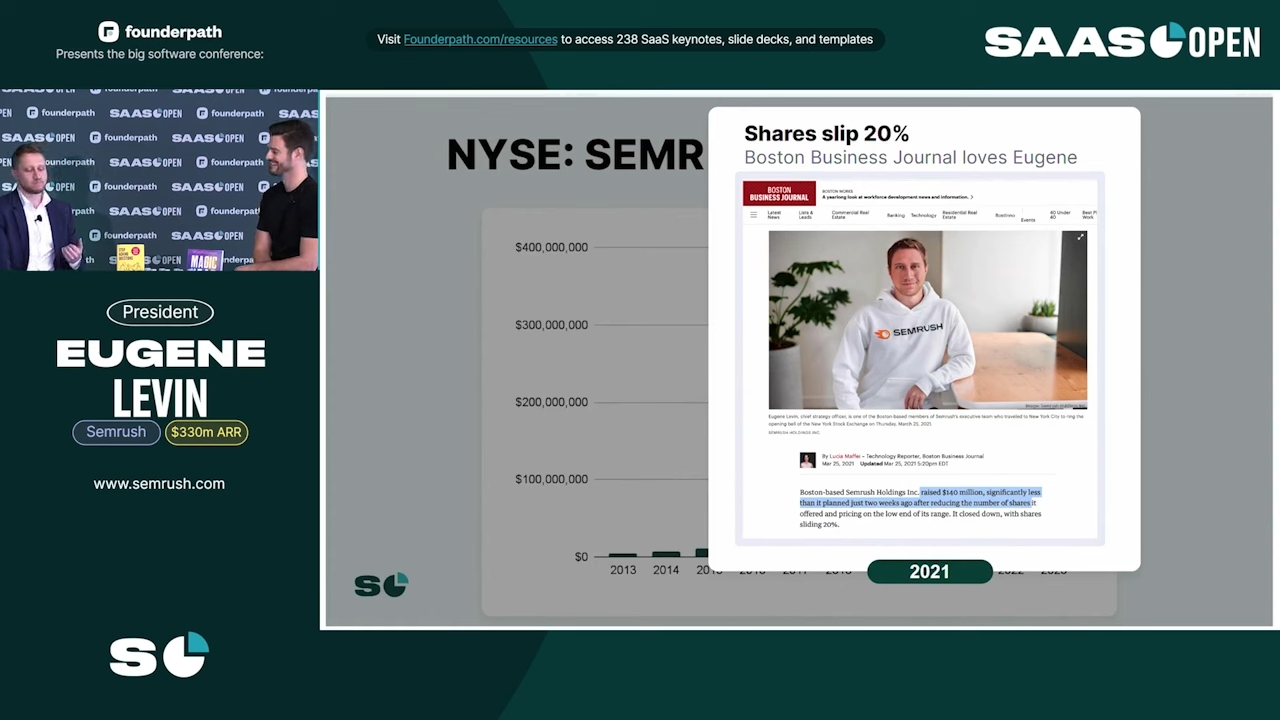

The initial public offering (IPO) was met with considerable skepticism from the market, resulting in a 20% slip in share price on the first day. This drop was a significant blow to the company’s morale, especially for the CEO, who was affected by the market’s initial reaction. The timing of the IPO, coinciding with peak pandemic conditions, contributed to the adverse response, compounded by a generally negative press atmosphere around new IPOs during such an unstable period.

Despite these initial challenges, Semrush’s fundamentals were sound, and the company quickly began to regain its footing. The resilience of Semrush’s business model and its strong customer base allowed it to recover from the initial dip in share prices. Remarkably, within just a few months, Semrush’s stock not only rebounded but also started trading above the initial offering price.

Strategic Decision Against Acquiring Moz

In the same year, another significant strategic decision was made by Semrush’s leadership regarding the potential acquisition of Moz, a well-known competitor in the SEO space.

Eugene Levin, reflecting on the situation, noted the challenges associated with integrating small-cap companies. He pointed out that small-cap investors typically seek high-growth companies, and acquiring a company like Moz did not align with this investment philosophy.

Levin emphasized that in the competitive landscape of digital marketing tools, it was crucial for acquisitions to complement or enhance Semrush’s existing growth rate, rather than dilute it.

Semrush Today: ARR Growth Up 23% & NRR Rate 107%

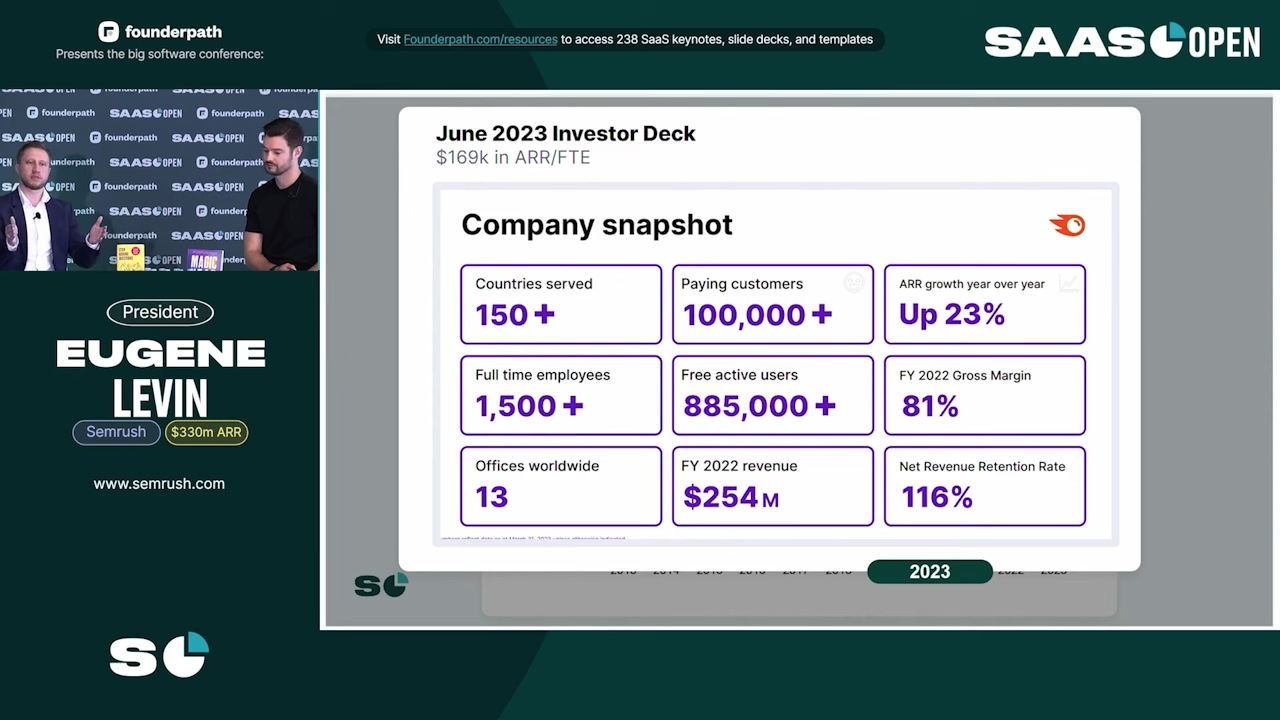

Today, Semrush stands as a paragon of steady growth and innovation in the digital marketing industry. Despite the volatile market conditions, Semrush has maintained a stable stock price, equivalent to its IPO level, while continuing to increase its revenue significantly (+$100M).

The company reported an impressive 23% year-over-year growth in Annual Recurring Revenue (ARR), underpinned by a robust Net Revenue Retention (NRR) rate of 107%.

One of the key strategies driving Semrush’s success is its focus on leveraging AI to address and solve real customer problems more effectively.

A prime example of this innovative approach is the “Reply to Review AI” solution, designed specifically for local businesses. This tool automates responses to customer reviews, significantly reducing the manual effort required and enhancing the quality of customer interactions. Additionally, Semrush has been proactive in automating many of its reporting features, streamlining processes for users and improving overall efficiency.

The company’s strategic focus in 2022 was centered around deepening existing relationships and enhancing customer satisfaction. Semrush has actively promoted additional products and add-ons to its loyal customer base, ensuring that users have access to a comprehensive suite of tools that evolve with their growing needs. This approach has not only contributed to the high net revenue retention rate but also reinforced customer loyalty and expanded the utility of Semrush’s offerings. The company reported a gross margin of 81% in 2022, with total revenues reaching $254 million, and an impressive net revenue retention rate of 116%.

As highlighted in the June 2023 investor deck, Semrush’s operational metrics further illustrate its growth trajectory and operational success. The company boasts over 100,000 paying customers and 855,000 free active users, reflecting its broad appeal and effective conversion strategies. With 1,500 full-time employees spread across 13 global offices, Semrush has established a substantial presence in the digital marketing space.

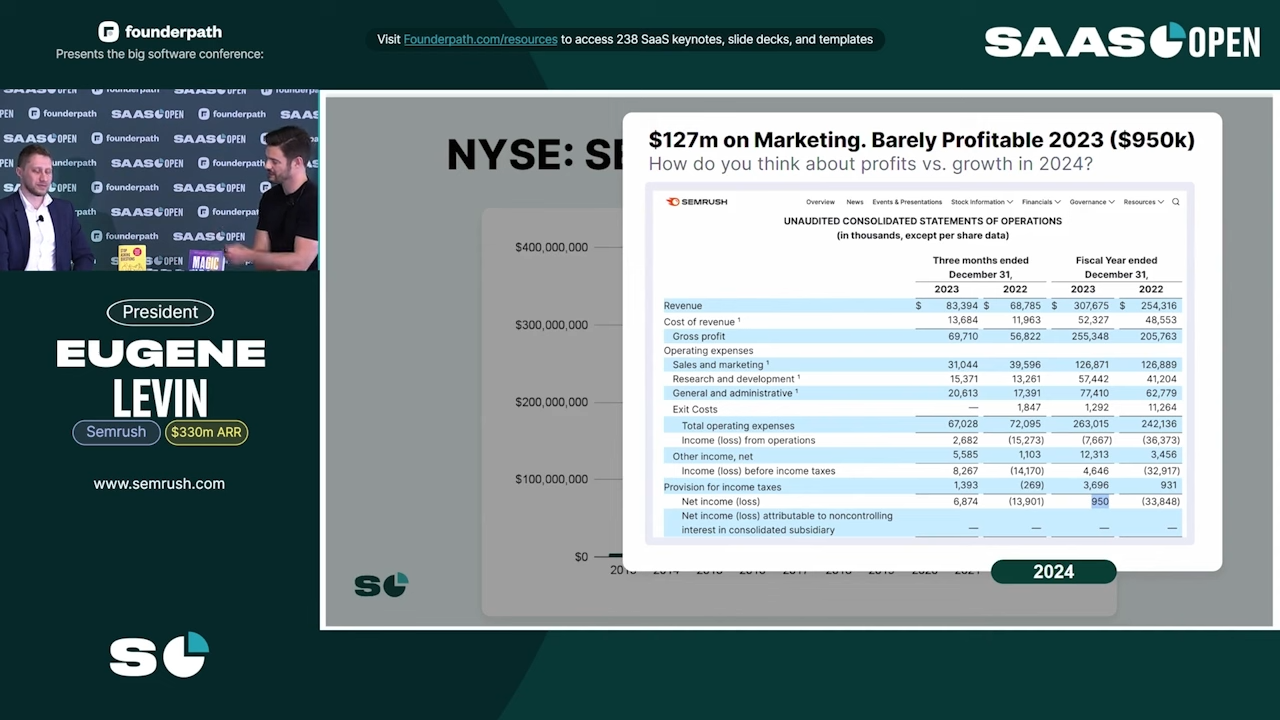

Despite these advancements, 2023 marked Semrush’s first profitable year, with the company posting a modest profit of $950,000. This was achieved after significant investment in marketing, with expenditures totaling $127 million for the year.

Eugene Levin, embodying the principle of “eating their own dog food,” has championed the efficient use of marketing resources. Applying the same strategies and tools that Semrush sells, the company demonstrated their effectiveness in practice, not just in theory.

Semrush’s ability to maintain high growth rates while expanding its product offerings and improving customer satisfaction illustrates its strategic acumen and operational efficiency. As Semrush continues to innovate and adapt to the evolving needs of the digital marketing industry, it remains poised for continued success and leadership in the field.

Watch the full interview with Eugene Levin below.