-

$65,000 of Verblio’s $465,000 monthly revenue is on pause due to Covid-19

-

CEO switches new full-time hires to contractors and expects $500,000 in payroll relief funds

-

The company is 100% bootstrapped and is not looking to raise cash

We don’t need to tell you about all the caveats of working with freelance writers. You’ll spend hours investing into a potential partner only to wait weeks for that email saying ‘hey, I’m just not that interested in the job anymore.’

Verblio’s goal is to systemize the transactions between writers and businesses, but they take a more strict approach than popular freelancing platforms. Whereas Upwork acts more like a job board and an interface, Verblio actively screens their writers and micromanages the contracts.

The middleman acts more like a manager here, and they get $6 million reasons a year to do so. With marketing budgets taking a hit due to the Covid-19 crisis, our host Nathan Latka went to investigate how Steve Pockross, CEO of Verblio, plans to survive the downswing.

100 of Verblio’s 1,000 Customers Pause Contracts

Verblio serves just over 1,000 clients as of April 2020. Their largest clients—agencies and publishers—are happy to produce as much content as they can during the times of social distancing, Pockross says. The bulk of smaller agencies in Verblio’s clientele, however, is “bleeding down,” the CEO says.

“We’ve seen a drop about 10% of them so far,” Pockross explains. “We reach out to all of them and the stories are pretty crushing.”

By 10%, the CEO means that about 10% of small businesses have paused their subscriptions with Verblio. While the consumption of digital content has gone up dramatically, businesses that are not primarily content producers are not eager to increase their content spending. Pockross speculates that it will take “one or two” weeks for Verblio’s clients to “reset” and start thinking about more aggressive content campaigns.

As of April 2020, $65,000 out of Verblio’s $465,000 monthly recurring revenue is in paused contracts. The company has taken proactive steps such as expanding the number of months a client could put a contract on pause. “It used to be 3 months, and now we’re up to 4, looking at all options,” Pockross explains.

Verblio CEO Switches Full-time Hires to Contractors, Applies for $500,000 Stimulus Loan

Verblio was planning to grow their team from 12 to 24 in 2019—an aggressive expansion. Covid-19, of course, got in the way.

“We moved a lot of those to contract hires,” Pockross says. “3 of the key hires got moved to contractors, but we still brought on everybody.”

Today Verblio employs 23 people—not counting additional contractors—6 of whom are engineers. The company doesn’t have outbound sales teams at the moment.

The freelance writing startup is fully bootstrapped, and not looking to change that anytime soon. Pockross argues that crises are a “particularly good time to be bootstrapped” due to months of runway, enabled by lean existence.

The CEO does, however, plan on taking advantage of the Payroll Protection Program. During the interview, Pockross was peeking at the phone, waiting for his banker to announce the $500,000 relief package.

For now, Verblio’s CEO expects to use the funds exactly what they’re intended for: to keep his team on the payroll and avoid making dramatic changes. Should his company weather the storm unscathed, he is open to explore investment opportunities. The current guidelines—which change day to day—say that money not spent on payroll and other fixed costs will need to be repaid back to the government.

Nathan Latka’s 5 Questions with Verblio CEO Steve Pockross

- Favorite business book? “The Power of Little Ideas by David Robertson.”

- Is there a CEO Steve is following or studying? “I’m learning a lot from Mark Organ right now.”

- Favorite online tool to grow Verblio? “Slack.”

- How many hours of sleep does Steve get? Married, single, kids? Age? “9 terrible hours. Married with two boys. I am 47.”

- What does Steve wish his 20 year old self knew? “Move to San Francisco and join a startup.”

Funding:

2010:

2011:

2012:

2013:

2014:

2015:

2016:

2017:

2018:

2019:

2020: 0 (interview)

Revenue:

2010:

2011:

2012:

2013:

2014:

2015:

2016:

2017:

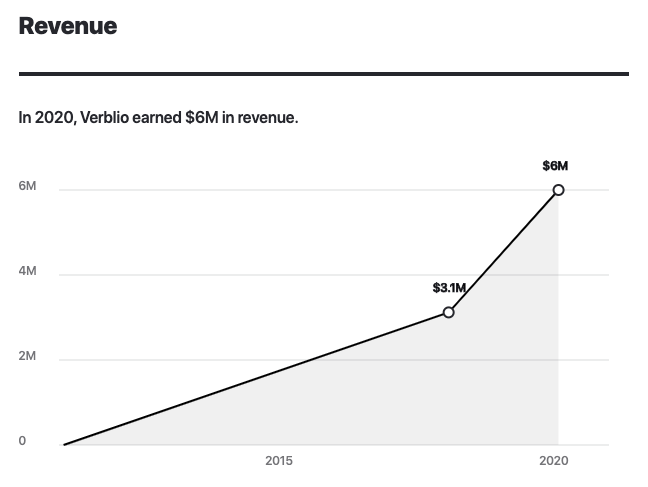

2018: $3.2M (old interview)

2019: $6M (interview)

2020: $5.5M (prediction—contracts on pause, no signs of increase in demand)

Customers:

2010:

2011:

2012:

2013:

2014:

2015:

2016:

2017:

2018: 1,500 (old interview)

2019: 1,000 (interview)

2020: