Serial entrepreneur Vivek Bhaskaran didn’t find overnight success with QuestionPro. Instead, he earned it through 18 years of building his customer experience SaaS company. What started as a simple way to gain insights into customer interactions became an all-in-one platform for complex research, customer experience, and employee engagement.

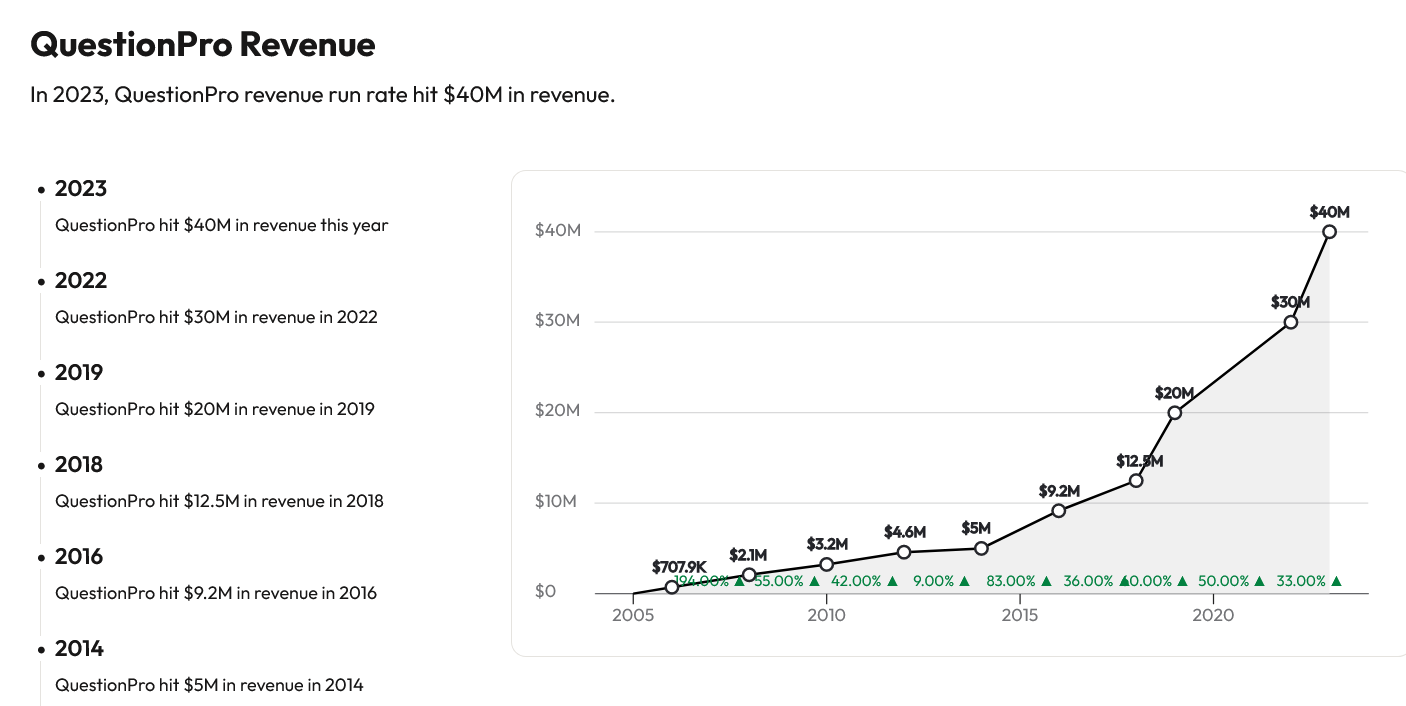

Bhaskaran’s company hit over $30M in revenue in 2022 with a current run rate of $40M in 2023, and they’ve served over 4,800 customers. More surprising than QuestionPro‘s success is what got them there: mergers and acquisitions.

Bhaskaran shared with Latka what strategic acquisitions led to their record-breaking revenue year and the pitfalls all SaaS companies need to be aware of during an M&A.

- 50% Revenue increase in one year

- Purchased 5-7 companies since 2005

- Served over 4,800 customers

How QuestionPro Grew to $30M Revenue

Since its inception in 2005, QuestionPro has successfully merged with 5-7 companies, transforming its services and widening its market share. “I have three deals in the pipeline right now,” adds Bhaskaran, “from an M&A perspective, the kind of deals we do, there are still deals to be made.”

The strategy has taken QuestionPro from a customer feedback survey company making under $10M a year to expanding into employee feedback and a data-rich research suite with a run rate of $40M in 2023.

It has no plans of expanding beyond its three main buyers that use QuestionPro. “We double down on the current niches we are in. Any product or services that sell to each of these buyers (marketing, customer experience, HR), we are interested in.”

Managing 20% Attrition With Each Merger

QuestionPro cracked the growth code with mergers, but it wasn’t without risks. The first acquisition they attempted resulted in 20% of the current employees leaving the company. “The first time, it was kind of a shock,” Bhaskaran explains, “but the next time and third time, I’m expecting 20%-30% attrition.” The SaaS founder looks at the transition as a part of the process.

“20% of the people of the selling company will leave no matter what you do, it’s a breakpoint. That’s the way I look at it.”

Bhaskaran highlights culture, tech, and business operations as being the biggest obstacles to any merger.

QuestionPro Has 4,800 Customers Paying $1,200 A Year On Average

QuestionPro’s pricing structure has evolved over the years and includes three separate services aimed at three different ideal users. The initial Advanced service is for smaller businesses that only require one account for management. It starts at $99/mo but is billed annually.

The Team Edition service includes the functionality of the Advanced service but includes additional features for integrations and collaborations. The Research Edition service is an enterprise-ready survey software that includes actionable insights for large amounts of data.

QuestionPro Pays 2X Revenue for SuiteCX

The experience of merging or acquiring five different companies has led QuestionPro to clear insights on how to structure payment terms. “We want to conserve cash like, frankly, everybody,” Bhaskaran explains. “Everyone has a minimum cash requirement in their head, can I be comfortable dropping this much cash upfront? That’s what it comes down to.”

With their most recent acquisition with SuiteCX, Bhaskaran was able to convince CEO Valerie Peck to take 1X cash upfront while structuring the addition 1X in options, earnouts, and kickers. This strategy helped QuestionPro conserve cash while incentivizing SuiteCX to complete the acquisition.

QuestionPro Uses 80% Organic 20% M&A to Grow Revenue

The concentration on M&A distracts from how QuestionPro makes the bulk of its revenue. “M&A will be small, maybe one or two deals for a million. My expectation is 80% will be organic, maybe 20% M&A.”

Although the mergers have helped QuestionPro remain relevant in highly competitive markets like marketing and customer experience, they continue to focus on their primary user base. All future mergers will strengthen their core services like customer experience, the workforce, survey technology, and research tools aimed at enterprise-level operations.

Vivek Bhaskaran has a Net Worth of $120 Million

Even without a public valuation placed on the company, QuestionPro is still large enough that public perception helps establish trust during the merger and acquisition process. “There’s enough public conversation that has happened in my business. [QuestionPro is] not publicly valued, but we are big enough right now we are doing $30M in revenue.”

The company has put an internal valuation at 5X the current revenue, making them worth roughly $120M. With no co-owners and no funding rounds raised, Vivek Bhaskaran’s personal net worth is also estimated to be about $120M.

Famous 5

Favorite book: He hasn’t read a book in a long time, but Ray Dahlio’s Principles still has a lot of influence over his business philosophy.

CEO he’s following: Bhaskaran used to follow Jeff Bezos, but doesn’t believe he is still the same person and doesn’t like the new direction.

Favorite online tool: He loves Balsamiq because it creates architecture fast, and you don’t get caught up in the UI elements.

Situation: 46-year-old Bhaskaran typically gets 6 hours of sleep a night, even with two teenagers at home and a Wife who recently graduated from Grad school.

What he wishes he knew when he was younger: Vivek Bhaskaran wishes he hustled harder when he was younger. He started his company at 24 but would have started right out of college if he had a second chance.