Concentric started as a tech-enabled consultancy in 2010 and made the shift to a SaaS model in 2015. Sitting high on the Marketing Tech stack, Concentric’s simulation software allows CMO’s to understand the effectiveness of a campaign or the traction of a product before deploying a marketing strategy.

From predicting box office sales for blockbuster films to how well a car will sell two years in advance, Concentric runs hundreds of market simulations to answer the most critical go-to-market questions.

After over nine years of operating, Greg Silverman (CEO) and his team have started to hit their stride.

Nathan Latka caught up with Greg for the second time this past August to discuss a major strategy shift.

What Is Product Market Fit?

Getting to product market fit is essential to every SaaS business. 80% don’t ever make it. But for how much weight is put on the term its measurement remains largely undefined.

How do you know when you have built the right product, marketed it through the right channel, and are selling it to the right companies or people?

There are both qualitative and quantitative signals for achieving product market fit.

A qualitative signal could be a high Net Promoter Score. A flattening churn curve is a quantitative indicator talked about a lot. However, there are no generally accepted metrics that define product market fit.

Additionally, the road map an entrepreneur takes to get to the coveted, yet theoretical status is even less cut and dry.

Let’s look at the changes Greg implemented between interview #1 and #2 that resulted in significant growth and efficiency.

If Your Target Market Moves Upstream So Should Your Acquisition Channel

One critical component of achieving product market fit is making sure product, customer cohort, and acquisition channels align.

Seeing the strongest demand from enterprise customers Greg molded the product to better serve that cohort. This included adding several features specific to their needs with built in upsell components. Accordingly, his CAC increased by 10x in 18 months.

In 2018, CAC was about $13K and ACV was $144K. When Nathan interviewed Greg in August CAC shot up to $130K and ACV will go up to $555K by the end of the year. In the first interview Greg mentions CAC mainly derives from trade shows and traditional lower budget marketing tactics.

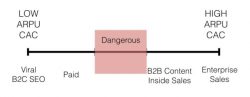

As you can see in the diagram, for the low CAC / lower ARPU cohort the common sales channels are SEO and word of mouth marketing. In the high CAC / high ARPU cohort the more common route is an enterprise sales team. You have to match your sales channel and CAC with the end user.

Don’t Get Stuck In The Danger Zone

If Concentric kept the same marketing strategy and acquisition channel while shifting towards an enterprise focused product they likely wouldn’t have seen the same level of growth.

Instead, Greg and his team aligned acquisition channel and target customer by adding an outbound sales team to go after enterprise deals. This strategy shift led to Concentric growing 250% YoY and increased ACV by almost 4x.

The Key Equation for $100M ARR

Model market fit is also crucial and involves making assumptions on ACV, total customers in your market, and % of the market you think can capture.

For most venture backed companies the goal is to get to $100M in ARR. When VC’s advise on model market fit the product of ACV x total customers x % of market captured will likely equal $100M.

Many over capitalized start-ups have eventually faltered because incorrect assumptions around model and market.

Possible reasons include:

- AVC ended up being less than projected

- There are less customers for the product

- The company was only able to gain a portion of expected market share

These points of friction lead to less efficient unit economics in order to grow – increased CAC, longer pay-back periods, etc. Or maybe the company decides to spend the extra money on engineers to build additional features to eat up more market share.

Either way, because of the lack of model market fit the company’s revenue and valuation are likely not close to what they should be to justify the amount of funding.

How Did Concentric Grow ARR 250% While Decreasing Customer Count By 400%?

Bootstrapped founders have more flexibility with model market fit because they don’t need to strategize for $100M ARR or bust. Greg did an excellent job finding the sweet spot.

He gladly let low ACV customers churn off while focusing on wallet penetration of existing enterprise accounts and adding new enterprise accounts. Total customer count from 2018 to 2019 went from 130 to 35 – a 400% decrease!

What’s so impressive is even with that amount of logo churn Concentric’s revenue churn was only 4%. Net revenue retention skyrocketed and they were able to add new accounts with 4x the ACV with roughly the same effort as SMB accounts.

ARR increased from $2M in August 2018 $2M to over $5M in August 2019. Based on the MRR size of new contracts being $45K Concentric, only needs to add three new customers and upsell a few clients to be at a $7M run rate by December.

What Does Product Market Fit Feel Like?

Greg credits Concentric’s newfound traction to their “golden formula” – some would call that product market fit. Interestingly, when entrepreneurs describe product market fit they rarely discuss metrics, but rather a gut feeling.

Peter Reindhardt, CEO of Segment, describes the feeling below:

“Product market fit doesn’t feel like vague idle interest. It doesn’t feel like a glimmer of hope from some earlier conversation. It doesn’t feel like a trickle of people signing up. It really feels like everything in your business has gone totally haywire. There’s a big rush of adrenaline from customers starting to adopt it and ripping it out of your hands.”

Key Takeaways

There are a few important takeaways from Concentric’s

- Product market fit isn’t binary and it doesn’t happen overnight

- Product market fit doesn’t always, and often doesn’t start with product – understanding your market / problem first or iteratively is just as likely to lead to success

- Make sure your acquisition channels align with your target market

- Making accurate assumptions on ACV, # of customers, and % of market share capture is key to ensuring model market fit

- Product market fit is a gut feeling, not a metric

Check out Brian Balfour’s blog series on how product, market, model, and channel all need to fit together like puzzle pieces. He expands on many of the topics above and provides contextual decisions made at Reforge and Hubspot. Also check out Nathan’s post on pricing strategy to get to $100M ARR.