-

Exponea CEO Peter Irikovsky wants to raise big to buy out early investor due to diverging views

-

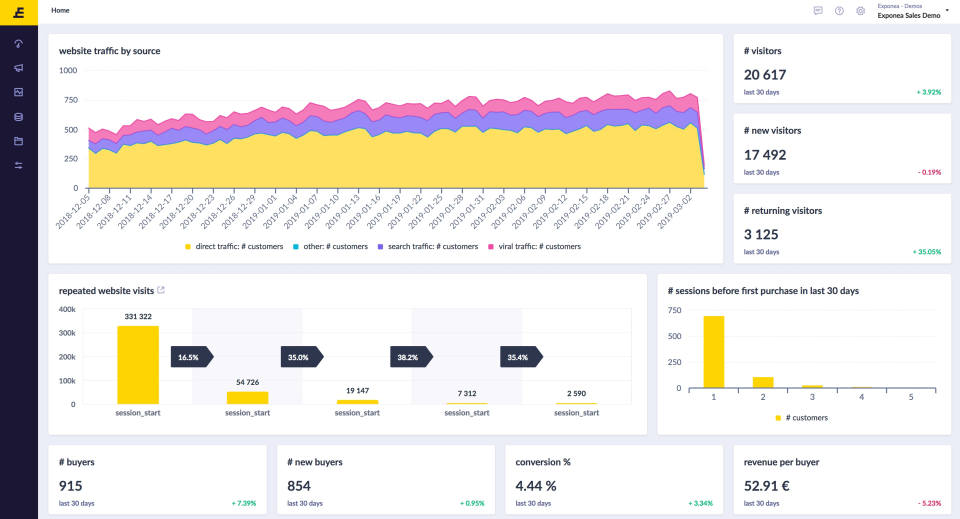

195 online retailers pay Exponea $100,000 a year for unified buyer persona data

-

No drastic cost-cutting measures until summertime, Irikovsky promises employees

CDPs, or Customer Data Platforms, are the emerging buzzword for marketers. With customer data scattered across dozens of platforms and channels, CDPs help companies create a unified view of the customer—something that the likes of Amazon and Google have taken full advantage of.

Peter Irikovsky’s Exponea takes it a step further. Instead of just visualizing a unified customer persona, his platform integrates existing marketing tools with the customer data. Our host Nathan Latka had the chance to sit down with the CEO and capture both his success story and plans to survive the Covid-19 downswing.

Online retailers are Exponea’s prime customers, Irikovsky says. Being more than just a CDP, the CEO says his platform’s time to the market is unrivaled. G2 agrees, rating Exponea a top CDP partner.

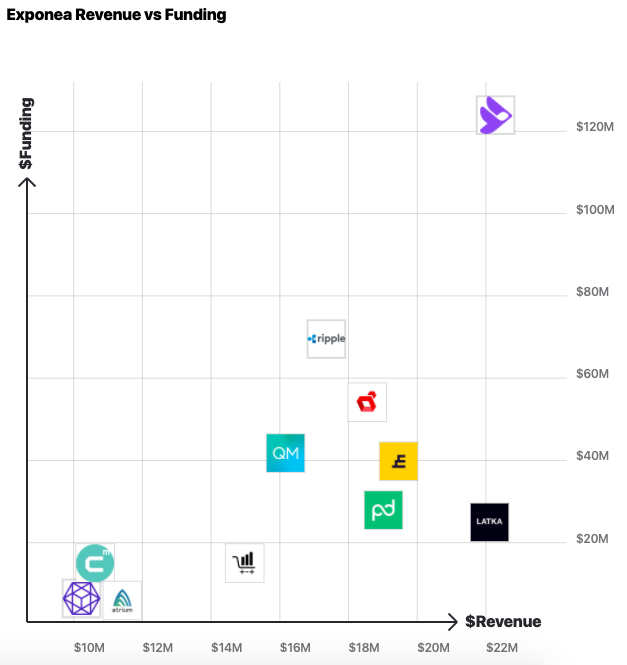

Back in September 2017, the company had raised $3 million in total. As of April 2020, Exponea has over $35 million in funding. Irikovsky used the money to build US and Germany product and sales teams, for the most part. Today, Exponea employs more than 220 employees, 60 of whom are engineers. The company has 20 quota-carrying sales representatives.

195 Customers Pay Exponea $100,000 a Year, CEO Wants to Raise $100M+ to Buy Out Investor

The average customer pays Exponea $100,000 a year. That’s almost 3 times more than the ACV Irikovsky gave our host in 2017. The company enjoys healthy 121% net revenue retention with the focus on larger retailers. To break that down even further, Exponea’s gross revenue churn is at 12%, while expansion revenue is at about 30%.

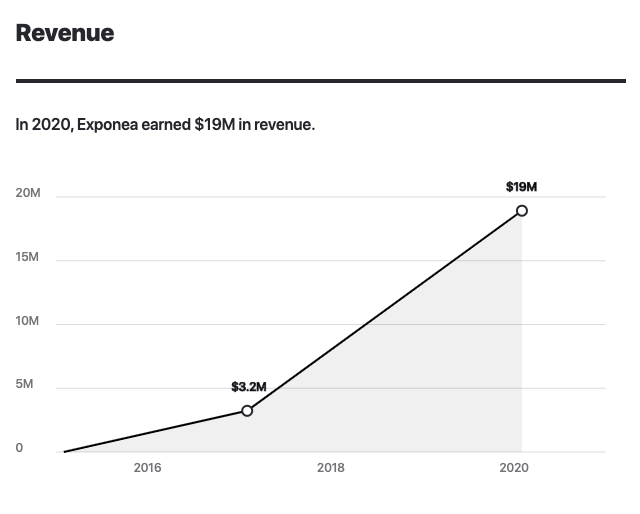

Exponea’s 195 customers bring around $19 million in annual recurring revenue to the company’s top line.

With healthy numbers, Exponea is actively looking at raising capital. The company valuation, Irikovsky says, didn’t take a huge hit due to the Covid-19 pandemic, compared to a 19% valuation downswing in the SaaS market. “There are quite a few funds who are fortunate significant new funds during 2019,” the CEO adds. “Many of them are actively looking at who will actually win and who will benefit from what is happening.”

Exponea, Irikovsky says, meets these criteria. He wants to buy out Exponea’s early investors, so the company’s next raise would mean at least a 50% dilution. “We see that our existing investor has a different view than we have and we don’t believe that is beneficial to us,” the CEO explains. “He wants us to focus on Europe, and we actually see a significant opportunity in the US and want to keep driving that.”

For now, Irikovsky is less interested in big valuations than finding a strategic partner in the US who could share his vision for growth.

Source: https://getlatka.com/companies/exponea

Source: https://getlatka.com/companies/exponea

New Bookings Down 50%, but Deals “Frozen”, Not Lost, CEO Says

Irikovsky expected Exponea to break even in mid-2020. With the Covid-19 pandemic raging, he is less certain that is going to happen. “It’s slowing down the sales cycles, so I don’t know how well we will be able to get there and how long this would last,” he explains.

For now, Irikovsky is not too worried about the coronavirus. However, should the situation not get better come summertime, the CEO thinks aggressive cost cutting measures will be unavoidable. Exponea has about $5 million left from their $16.3 million Series C round, and is burning just above $500,000 a month.

Source: https://getlatka.com/companies/exponea

Source: https://getlatka.com/companies/exponea

It costs Exponea between $110,000 and $150,000 to acquire a new customer, depending on the market maturity. This number is significantly higher than the $38,000 CAC figure Irikovsky gave us in 2017, which indicates they’re aggressively switching to larger companies. Most of that money goes to digital advertising.

Exponea grew its revenues by 101% in 2019, but the CEO expects a new contract to add $700,000 to the company’s top line in the nearest future—not exactly the $1.5 million in new revenue he was expecting in March. Most of these deals, Irikovsky says, are not lost, but “frozen.”

Nathan Latka’s 5 Questions with Exponea Co-founder and CEO Peter Irikovsky

- Favorite business book? “Blueprint to a Billion by David G. Thomson.”

- Is there a CEO Peter is following or studying? “Not really.”

- Favorite tool to build Exponea? “Currently, Zoom.”

- How many hours of sleep does Peter get? Married, single? Kids? “7+ hours. Happily married with 2 amazing kids. I am 35 still.”

- What does Peter wish his 20 year old self knew? “To be more patient, but I wouldn’t have listened back then.”

Funding:

2015:

2016: $2.5M (Seed Round, 1)

2017: $7.5M (Series A, 1)

2018:

2019: $25M (Series B + Series C, 1)

2020:

Revenue:

2015: $180k (NathanLatka.com)

2016: $940k (NathanLatka.com)

2017: $4M (NathanLatka.com)

2018: $19M (CEO said 101% YoY growth in 2019, interview)

2019: $19M (Getlatka)

2020: $21M? (prediction)

Customers:

2015:

2016:

2017:

2018:

2019: 195 (interview)

2020:

Sources: