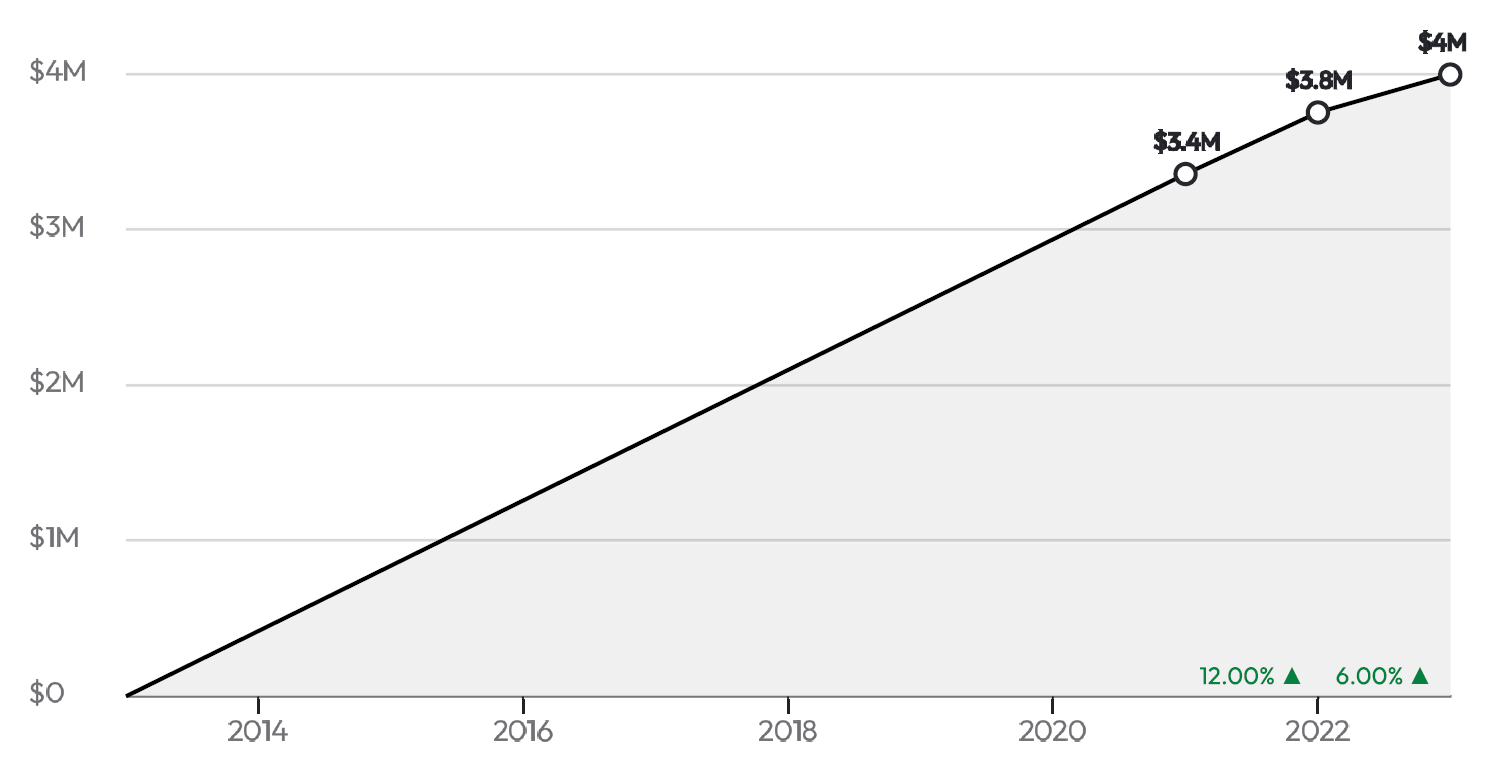

Meet Alex Samant, the CEO and Co-founder of TitleCapture, a B2B SaaS Nathan Latka describes as “The definition of a healthy bootstrapped company.” Samant founded the real estate cost estimator app in 2013 after spending several years developing software projects for a variety of clients.

The CEO discussed with the GetLatka team why he chose the real estate market, where he allocates the company’s growing 33% monthly profit capital, and how he approaches growth strategies for TitleCapture, in anticipation of a future product sales plateau.

- $330,000 MRR with 33% profit margin

- 5-10% annual growth

- 1000 active customers with $4,000 ACV

- Team of 35, with 10 engineers

Dev shop pivots to building its own product in 2013

Samant shared TitleCapture’s origin story, which involves a customer they still serve today. The CEO explained how he and two co-founding partners worked together on software development projects for several years.

Then, in 2013, “We got fed up with the business model. So we decided to build something we could own and sell subscriptions for,” he explained.

First customer from 2013 still pays $1,000 per month after 10 years and being acquired

When a large company asked them to build a rate calculator app, they realized it represented the opportunity they sought.

They researched and concluded that this app could serve the whole real estate community, so they offered to build it and charged the company only $1,000 per month instead of the hundreds of thousands it would have cost in development.

“We capped the price for them in a lifetime deal, and they said yes.” Even after the company was acquired by First American, who had their own solution, their customer activists lobbied to get them to keep using TitleCapture.

3rd partner drops out before trade show, designer develops V1

In the beginning, Samant, the designer, worked with a programmer and a salesperson. When he dropped out, Samant was left to create V1.0 of TitleCapture for a trade show they committed to 3-4 weeks later. “It wasn’t very functional, but it looked great, and we got lucky at that trade show,” shared the CEO.

He continued, “A national sales rep for a large title insurance company loved it and wanted to put it in front of all of his title agency agents.” This early boost helped launch the company.

Ease of use, aesthetics help it grow to 1000 active customers

Latka queried Samant about how their solution was different, to which he explained, “This was 10 years ago. We delivered a solution for a slow, non-tech-savvy industry. The solutions that existed looked like they were from the 90s.

Ours was responsive and delivered a superior experience. Plus, we white-labeled it for every customer. We won with ease of use and aesthetics.” Those qualities continue to resonate as TitleCapture grows to 1000 active customers.

1500 title agency customers

With a market total of 13,000, Samant shared that 1500 title agencies have used TitleCapture. “Given the competitors and market size, we are pretty satisfied with where we are,” he shared. He added that with their churn, the total number of active customers sits at 1000, with an ACV of $4000.

“Our base month-over-month churn is 0.6%, but for a few months at the end of last year, it doubled to 1.2%,” the CEO noted, adding, “We had a few months of net-new negative as agents got scared because of the real estate slowdown so they preemptively cut costs, but now the numbers are back to 0.6%.”

5-10% YoY growth expected to taper

Samant recognizes that his growth rate will taper in the coming future. “We are getting higher in market share, and we have competitors. We’ve already signed up all the tech-savvy companies. It’s becoming increasingly more difficult to grow through new customers,” he lamented.

The CEO and his Co-founder are exploring ways to build more products to increase ACV or acquire other assets to grow the business.

Missed opportunity with 2016 category disruptor

The CEO lamented that the company missed an opportunity to create a settlement product to offer their existing customers. “It’s the next step, and a competitor came in and disrupted the market in 2016.”

When Latka asked why they didn’t acquire the company early on, Samant shared, “We didn’t get around to buying in time. We were slow with our internal decision-making. And that product offers an ACV 10 times higher than what we have, at $40,000 ACV.”

33% profit margin of $90,000 per month

The Co-founder shared that he and his partner each own half of the business. Each month, they put roughly half of the profit into the bank to maintain cash reserves of roughly 5 months or $500-600,000. Each partner then takes about $20-30,000 per month, which is what they pay themselves in total.

Capital allocation options

Latka asked Samant how he plans on allocating capital going forward. He indicated that he wants to either add value to TitleCapture or add new assets. “. The sky’s the limit. No matter how small the niche is, if you dive deep, you will find opportunities everywhere.

We’ve actually discussed buying a distressed insurance underwriter with an investor. And use our technology to position it as a competitor in the market. That’s a different model altogether.”

Best advice for founders

Samant offered this sage piece of advice on capital allocation: “Owners and founders must get on the same page and make these calls about capital allocation. You don’t always have the same values and wants. Making decisions is lightning quick when there’s little revenue.

Moving forward is slower when there’s a bigger pie to split.”

$10m offer: sell or stay?

When Latka asked the CEO if he would take a $10m all-cash buyout or stay, he noted, “It’s tough to say. I’m open to exit, but we know there’s an opportunity here to build and grow based on conversations with our customers.

When comparing that financial offer vs. the value of existing customers, their value is much higher than what a financial buyer would offer. We did the math and realized a $60-80m buyout would be fair. We haven’t been proactively networking in front of the strategic acquirers to get that deal so far.”

Famous 5

Favorite Book: CEO Alex Samant chose Dan Martell’s Buy Back Your Time as his favorite book.

CEO he’s following: Alex pondered the question, indicating that he follows several CEOs, and finally chose Elon Musk, noting, “He’s funny to follow on Twitter.”

Favorite online tool: HubSpot is Alex’s favorite online tool for building TitleCapture.

Balance: Alex is 39, almost 40, and is married with 2 daughters. He sleeps an average of 6 hours per night.

What does he wish he had known at 20? Alex struggled to articulate what he called “a lot of ideas and complex answers” to the question, so Nathan let him skip a final answer.